Summarization of ITR Forms Under Income Tax Act

Summarization of ITR Forms Under Income Tax Act

| ITR

FORMS |

ELIGIBLE ASSESSEE | INCOME FROM SALARY | EXEMPT INCOME | CAPITAL GAIN | INCOME FROM HOUSE PROPERTY | BUSINESS INCOME | INCOME FROM OTHER SOURCES |

| ITR-1 | RESIDENT INDIVIDUAL AND HUF | YES | YES, PROVIDED AGRICULTURE INCOME IS UP TO RS. 5000. | NO | YES, FROM ONLY ONE HOUSE PROPERTY. | NO | NO |

| ITR-2 | HUF AND INDIVIDUALS. | YES | YES | NO | YES | NO | YES |

| ITR-3 | INDIVIDUALS AND PARTNERS OF FIRMS AND HUFS | YES | YES | NO | YES | YES | YES |

| ITR-4 | FIRM, HUF AND INDIVIDUALS | YES | YES, PROVIDED AGRICULTURE INCOME IS UP TO RS. 5000. | YES | YES, FROM ONLY ONE HOUSE PROPERTY. | YES, PROVIDED INCOME DECLARED UNDER PRESUMTIVE TAXATION | YES |

| ITR-5 | LLPS, PARTNERSHIP FIRMS, AOP AND BOI. | NO | YES | NO | YES | YES | YES |

| ITR-6 | COMPANIES | NO | YES | NO | YES | YES | YES |

| ITR-7 | TRUSTS | NO | YES | NO | YES | YES | YES |

PROCEDURE

Once the taxpayer identifies the applicable ITR form, they are required to furnish the details asked in the form. Once the details are furnished, follow the following steps –

-

- Download the TDS certificate in Form 26AS and match the amount of TDS deducted, with the amount filled in the ITR form. In case of any mismatch, validate the same accordingly.

- Once all the details are furnished and tallied, the taxpayer can calculate their total income for the particular Financial Year.

- In the last step, the software will calculate the Tax Liabilities of the assessee, based on the inputs provided by them.

17 updates in the latest ITR Forms for FY 2023-24!

Here’s a detailed breakdown of the key changes:

1. Filing Deadlines: Taxpayers now have a new column in Forms ITR 3, 5 and 6 where they specify the deadline for filing returns.

2. Online Gaming Winnings Taxation: Schedule OS has been amended to include reporting of income from online gaming in form ITR 2, 3, 5 and 6.

3. Adjustment of Unabsorbed Depreciation: The new provisions allow for the adjustment of unabsorbed depreciation in Form ITR 3 and 5.

4. LEI Details: Legal Entity Identifier (LEI) disclosure is now mandatory for refunds exceeding INR 50 crores in Form ITR 2, 3, 5 and 6.

5. Political Party Contributions: Schedule 80GGC will require detailed disclosure of political party contributions in Form ITR 2, 3, 5 and 6.

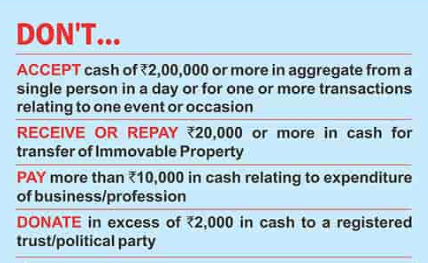

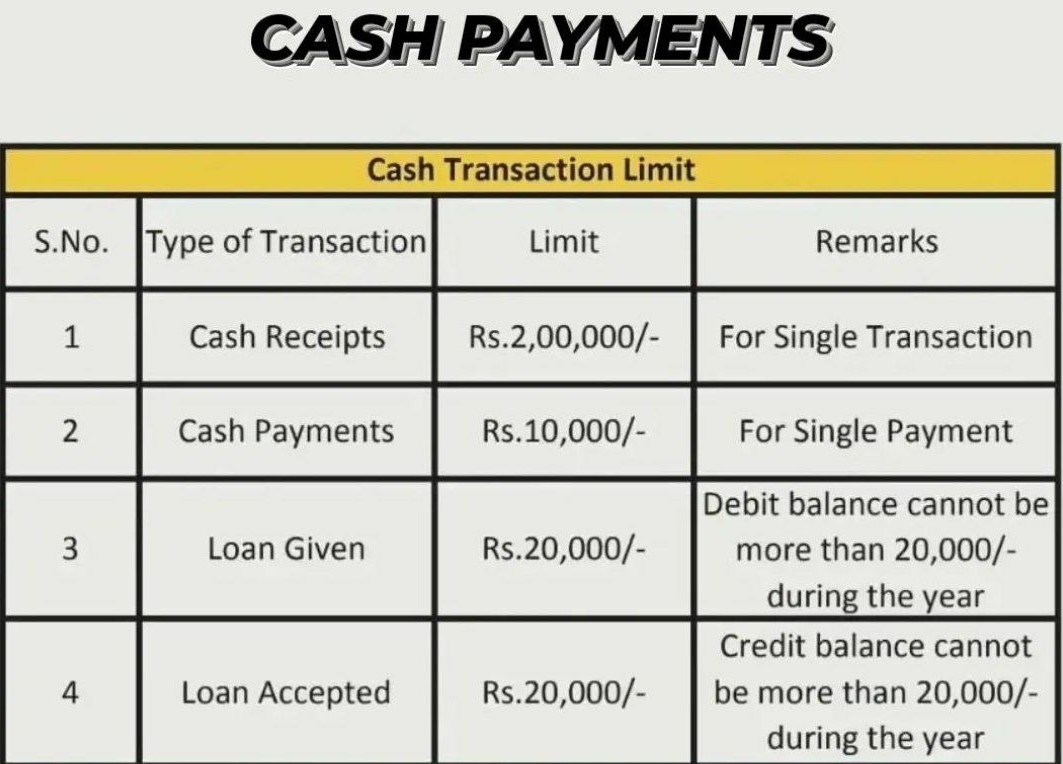

6. Cash Receipts Reporting: A new column for cash receipts reporting has been added to claim an enhanced turnover limit in Form ITR 3, 4 and 5.

7. Start-up Deduction Details: New Schedules for claiming deductions under Sections 80-IAC and 80LA have been introduced in Form ITR 5 and 6.

8. Dividend Income Reporting: dividend income received from a unit in an International Financial Service Centre shall be taxed at a reduced tax rate of 10% instead of 20%. Schedule OS has been amended in new ITR forms to incorporate such change in Form ITR 2, 3, 5 and 6

9. ESOP Tax Benefits: Enhanced reporting requirements for Employee Stock Option Plans (ESOPs) needs disclosure of PAN and DPIIT Registration Numbers in Form ITR 2and 3.

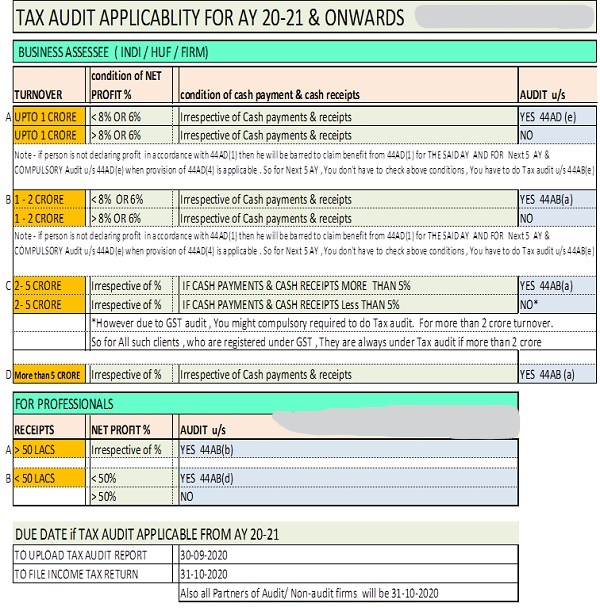

10. EVC for Tax Audits: Individuals and HUFs under tax audits (ITR 3) can now verify returns using Electronic Verification Code (EVC). This simplifies the verification process and enhances ease of compliance.

11. Reasons for Tax Audit: Additional details are required from audited companies in Form ITR 3, 5 and 6 regarding the circumstances necessitating tax audits. This change enhances transparency and accountability in tax reporting.

12. Business Trust Sums Reporting: A new column under Schedule OS allows for reporting sums received by unitholders distributed by business trust to avoid non-taxation in Form ITR 2, 3 and 5.

13. Bank Account Disclosure: Taxpayers must now disclose all bank accounts held, except dormant accounts in Form ITR 2, 3 and 5.

14. CGAS Reporting: Detailed disclosure of deposits in the Capital Gains Accounts Scheme is now required in Form ITR 2, 3, 5 and 6.

15. Deduction under Section 80CCH: A new column is introduced to claim deductions under Section 80CCH for Agniveer Corpus Fund in Form ITR 1, 2, 3 and 4.

16. New Schedule 80U: Schedule 80U is added for claiming deductions for persons with disabilities, seeking detailed information in Form ITR 3.

17. Schedule 80DD: Similar to Schedule 80U, Schedule 80DD is added to claim deductions for maintenance and medical treatment of dependents with disabilities in Form ITR 2 and 3.

These updates aim to simplify reporting, enhance transparency, and align with evolving tax regulations. Save this comprehensive overview for future reference and share it with your peers to help them navigate the tax filing process effectively.

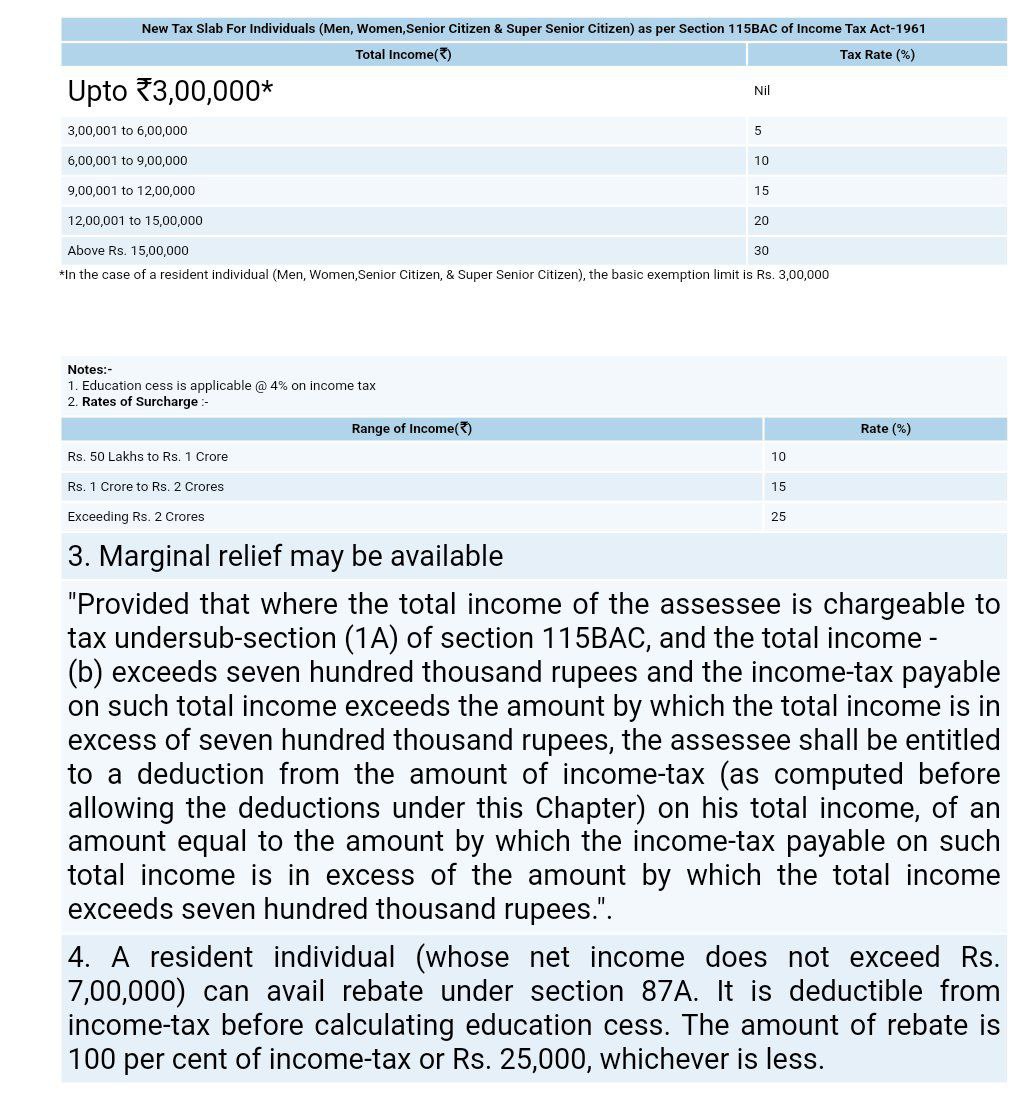

Income Tax Slab Rates for Residents for Financial Year 2023-2024 for Salary Income under Section 192 & Pension Income under Section 194P

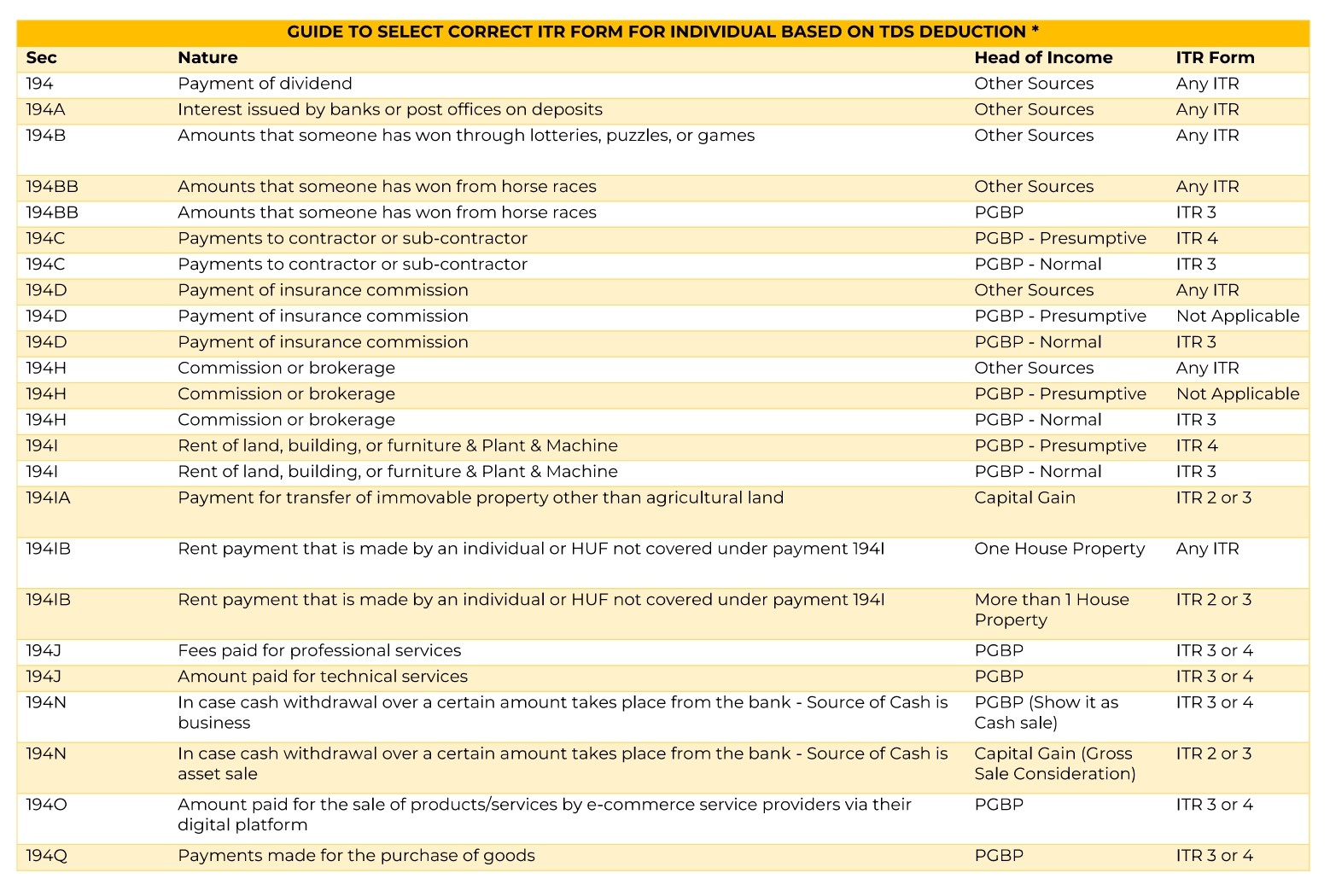

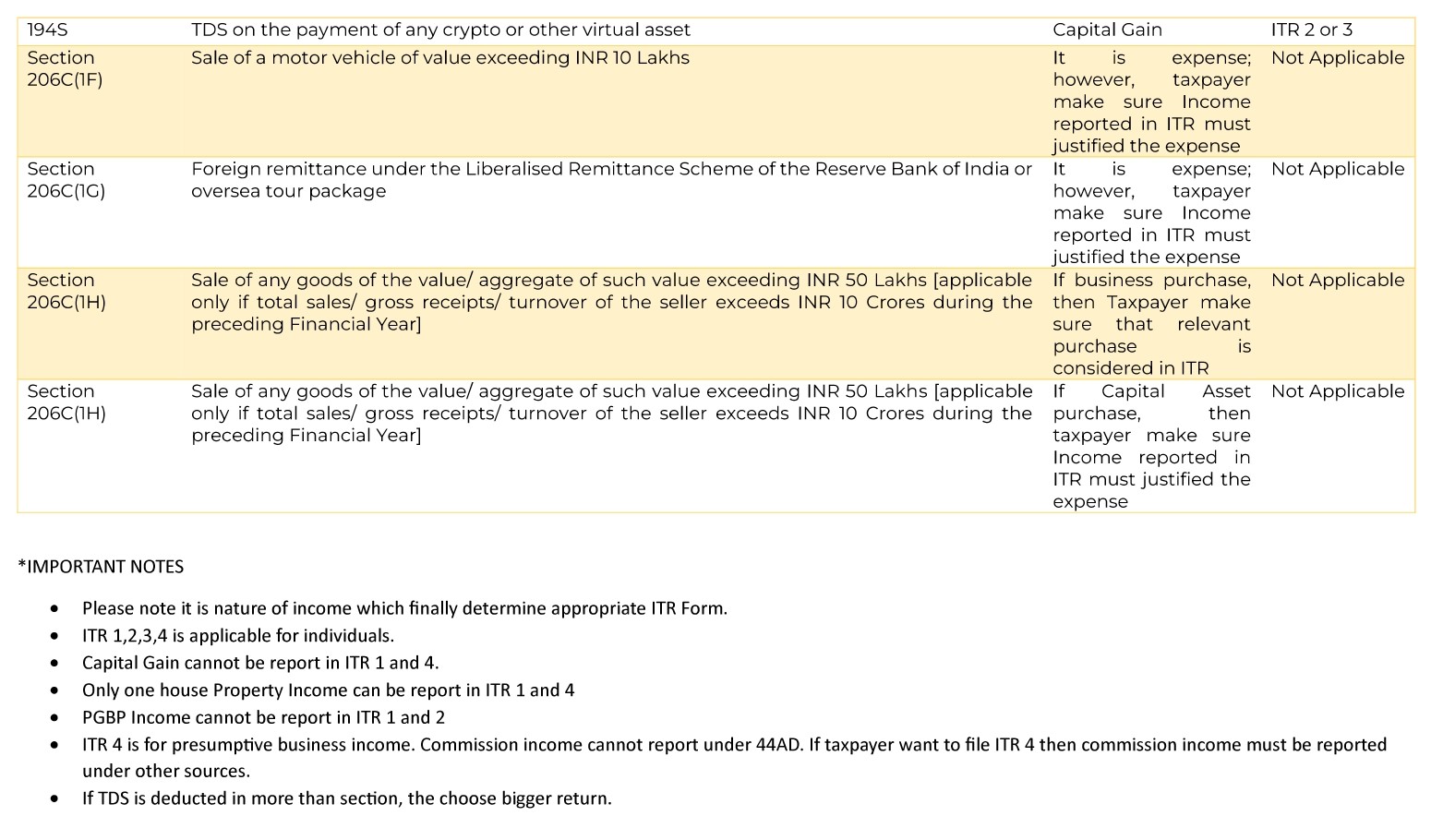

Guide to select correct Income Tax Return.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances; Hope the information will assist you in your Professional endeavors. For query or help, contact: singh@caindelhiindia.com or call at 9555555480

Read more for related blogs are ;