2 Factor Authentication Compulsory (AATO>100 Cr) w.e.f. 15 July

Two Factor Authentication compulsory from 15/07/2023 for all the taxpayers with AATO above 100 Crore

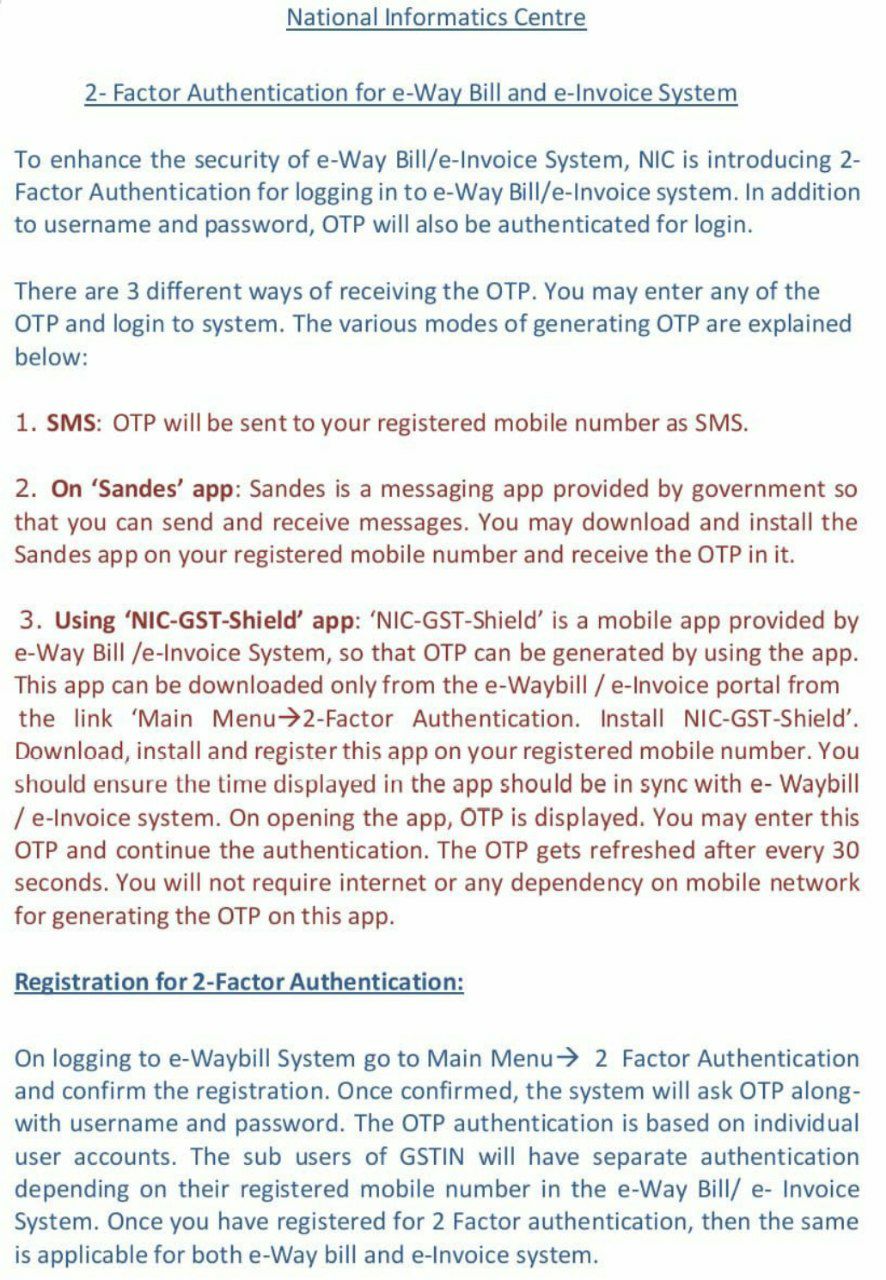

- NIC is implementing two-factor authentication for logging into the e-Way Bill/e-Invoice system to increase the security of the system. OTP will be used in addition to the username and password for login authentication.

- Two-Factor Authentication will be made compulsory from 15/07/2023 for all the income tax taxpayers with (Aggregate Annual Turnover) AATO above 100 Crore

- The system will then request an OTP along with a username and password after confirmation. User accounts provide the basis of the OTP authentication. The registered cellphone number for each sub-user of the GSTIN will be used for independent authentication in the e-Way Bill/e-Invoice System.

- 2 factor Using a mix of two separate identity-verification techniques, authentication allows you to confirm a user’s identity. Even if the password has been compromised, it adds an extra degree of security to ensure that only authorised users can access an account.

- A key step towards enhancing the security of the e-Way Bill and e-Invoice System is the installation of required 2-factor authentication for taxpayers with AATO above 100cr as of 15/07/2023.

- Three methods exist for getting the One Time passwords. You can log in to the system by entering any OTP. The different ways to issue One Time passwords (OTP) are described below:

-

- Using ‘National Informatics Centre -(NIC-GST-Shield)’ app: ‘NIC-GST-Shield’ is a mobile app given by e-Way Bill or e-Invoice System, so that OTP can be issue by using app.

-

- On ‘Sandes’ app: Sandes is a messaging app provided by govt so that you can send & receive messages. GST Taxpayer may download and install the Sandes app on your mobile No & receive the One Time passwords in it.

-

- SMS: One Time passwords will be sent to GST Taxpayer registered mobile No as SMS.

- The National Informatics Centre seeks to protect private taxpayer information by demanding an extra layer of authentication via OTP. GST Taxpayers are urged to sign up as soon as possible for 2-factor authentication and select the most practical OTP technique for their requirements. The e-Way Bill and e-Invoice ecosystem will become safer and more resilient as a result of this improved security mechanism.

India Financial Consultancy Corporation Pvt Ltd provide experienced CFO Service & Corporate advisory, financial solution & affordable business Solutions to , SMEs, business owners and Entrepreneurs, Companies, to address their all business requirements without expense & challenges of having a full time CFO on your company’s payroll. To know more kindly contact us on: +91 9555-555-480 or singh@caindelhiindia.com

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.