Union Budget 2026 – Direct Tax Changes Explained

Table of Contents

Union Budget 2026—Direct Tax Changes Explained

Capital Markets – STT Hike on F&O

What changed

| Instrument | Old STT | New STT |

|---|---|---|

| Futures | 0.02% | 0.05% |

| Options (premium) | 0.10% | 0.15% |

| Options (exercise) | 0.125% | 0.15% |

Policy intent

-

Discourage excessive speculative trading

-

Increase non-distortionary revenue (STT is simple to collect)

-

Push traders towards longer-term instruments

Practical impact : High-frequency traders & intraday F&O traders take a direct hit, Algo trading margins shrink materially & Retail traders will see higher breakeven costs

CA takeaway : Expect lower volumes, higher churn costs, and more disputes on business vs capital gains classification.

Return Filing & Compliance – Timeline Rationalisation

Changes

-

Staggered due dates

-

ITR-1 & ITR-2 → 31 July

-

Non-audit business & trusts → 31 August

-

-

Revised return allowed till 31 March

-

Updated return allowed even after reassessment (with +10% tax)

Why this matters: Portal load management, More realistic compliance windows & Encourages voluntary correction instead of litigation

Hidden implication : Updated return is now a post-assessment escape route, but costlier

Action point : Advisable to revise early rather than rely on updated return (tax cost escalates).

MAT Regime – Structural Overhaul (Big One)

What’s new

-

MAT becomes final tax from 1 April 2026

-

Rate reduced: 15% → 14%

-

MAT credit: Restricted & Usable only under new tax regime

-

Non-residents under presumptive taxation exempt from MAT

Why government did this

-

MAT was meant as a backstop, not a parallel tax system

-

Huge MAT credit balances were distorting tax certainty

Who wins : New-regime companies & Foreign presumptive taxpayers

Who loses : Companies sitting on large MAT credit & Old-regime corporates

CA strategy : Recompute long-term effective tax rate now & MAT credit planning becomes critical before FY 2026-27

Buyback of Shares – Tax Shift to Capital Gains

Old system

-

Company paid buyback tax

-

Shareholders exempt

New system

-

Buyback taxed as capital gains in shareholders’ hands

-

Additional tax on promoters:

-

22% (corporate)

-

30% (non-corporate)

-

Rationale

-

Prevent tax-free exit for promoters

-

Align with dividend / capital gains symmetry

Real impact : Promoter-led buybacks become expensive, Listed companies may prefer dividends over buybacks

Advisory note : Revisit capital structure & exit planning, especially PE-backed entities.

Foreign Asset Disclosure – One-Time Compliance Window (6 Months)

One-time 6-month Foreign Asset Disclosure Scheme (for small taxpayers like students, young pros, NRIs)

🔸 Category A (undisclosed income/assets ≤ ₹1 Cr): Pay 30% tax + 30% penalty → full immunity from prosecution

🔸 Category B (disclosed but not reported ≤ ₹5 Cr): Flat ₹1 lakh fee → full immunity

🔸 Retrospective immunity for small undisclosed foreign assets (< ₹20 lakh)

Category A – Serious but Small

-

Undisclosed asset/income ≤ ₹1 Cr

-

Tax: 30% + 30% additional tax

-

Immunity from prosecution

Category B – Reporting Lapse

-

Asset disclosed but not reported ≤ ₹5 Cr

-

Pay ₹1 lakh

-

Full immunity

Big signal

-

The government wants clean-up, not punishment

-

Last opportunity before stricter enforcement

CA responsibility : Strong due diligence for NRI/HNI clients; miss this window → criminal exposure later

Reliefs & Exemptions—Quiet but Impactful

Key reliefs

-

MACT interest fully exempt, no TDS

-

TCS rationalized:

-

Overseas tour → 5% → 2%

-

Education & medical (LRS) → 2%

-

Liquor, scrap, minerals, tendu leaves → 2%

-

Impact

-

Reduces cash-flow blockage

-

Simplifies reconciliation

TDS & Procedural Changes—Compliance Friendly

Highlights

-

Manpower services treated as contract: TDS @ 1% / 2%

-

No TAN required for TDS on NRI property purchase

-

Automated lower/nil TDS certificates for small taxpayers

-

Single Form 15G / 15H for multiple companies

Why this matters

-

Removes long-standing practical pain points

-

Huge relief for individuals buying NRI property

CA impact : Less paperwork, faster onboarding, fewer defaults

Litigation & Penalty Reforms—Pro-Taxpayer Tilt

Key reforms

-

Single combined order for assessment + penalty

-

No interest on penalty during appeal

-

Pre-deposit for appeal → 20% to 10%

-

Immunity extended to misreporting (with 100% additional tax)

Net effect: Faster closure, Lower litigation pressure & More predictable outcomes

Decriminalisation – Cultural Shift

Changes

-

Minor offences decriminalised:

-

Non-production of books

-

TDS in kind

-

-

Max imprisonment capped at 2 years

-

Courts can levy fine instead

-

Retrospective immunity for small foreign assets (< ₹20 lakh)

Signal : Compliance > Criminalisation

Sector-Specific Incentives—Growth Focused

Major incentives

-

Tax holiday till 2047 for foreign cloud companies

-

Deduction for cattle feed & cotton seed

-

Inter-cooperative dividends deductible if passed to members

-

3-year dividend exemption for notified national co-ops

-

Safe harbour margins:

-

Data centre services → 15%

-

Bonded warehouse storage → 2%

-

-

5-year exemption:

-

Tools supplied to toll manufacturers

-

Foreign income of non-resident experts

-

Macro intent: Push manufacturing, infra, agri, and digital infrastructure

Union Budget 2026 – Revised Due Dates for Filing of ITR

Category-wise compliance calendar for AY 2026–27: ITR Due Dates – Category Wise

- Individuals (ITR-1 & ITR-2) : 31 July 2026

- Non-audit business cases & Trusts : 31 August 2026

- Businesses requiring a tax audit: 31 October 2026

- Cases requiring a transfer pricing report: 30 November 2026

- Belated / Revised / Updated Returns : Revised / Belated Return : 31 March 2026 (subject to nominal late fee)

- Updated Return (ITR-U) : 31 March 2031

Late Fee for Belated/Revised Returns

- Total Income up to ₹5,00,000 : ₹1,000

- Total Income exceeding ₹5,00,000 : ₹5,000

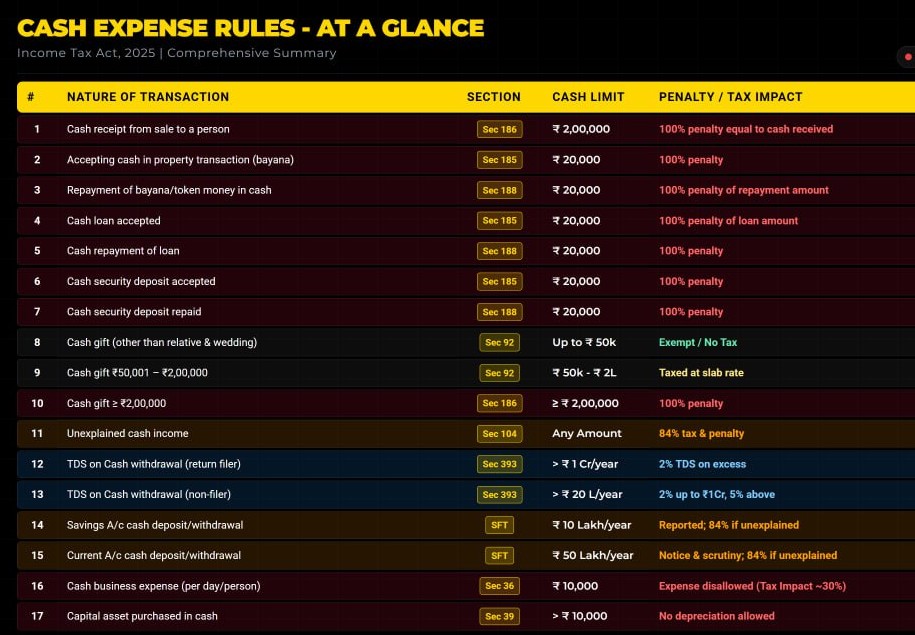

Cash Transaction Limit as per New Income Tax Act, 2025, to be effective from 1st April 2026

Rationalisation and Alignment of Select Provisions

Income Tax Act, 2025, vis-à-vis Income Tax Act, 1961 :

The proposed amendments aim to remove drafting ambiguities, prevent interpretational disputes, and ensure continuity with settled law under the 1961 Act. None of these changes introduce a new levy; they clarify the scope and mechanics of existing provisions.

Annual Value of Property Held as Stock-in-Trade

Section 21(5): Existing position under IT Act, 2025 : Section 21(5) provides relief for unsold property held as stock-in-trade by real estate developers. However, the provision does not clearly specify the starting point of the period for which annual value shall be taken as nil.

Position under IT Act, 1961 : Section 23(5) of the 1961 Act clearly provides that: Annual value shall be taken as nil for two years from the end of the financial year in which the completion certificate is obtained. This clarity has avoided litigation and ensured uniform application.

Proposed amendment : Section 21(5) is proposed to be amended to explicitly state that The annual value of property held as stock-in-trade shall be taken as nil for a period of two years from the end of the financial year in which the certificate of completion of construction is obtained from the competent authority.

Practical impact

- Removes ambiguity on the commencement of the two-year period

- Prevents premature taxation of notional rental income

- Aligns treatment across both Acts

This is a clarificatory amendment, reinforcing the legislative intent already recognised under the 1961 Act.

Deduction for Interest on Borrowed Capital – Self-Occupied Property

- Section 22(2) : Existing position under IT Act, 2025 : Section 22(2) allows a deduction of interest on borrowed capital, subject to a ceiling of ₹2,00,000 for self-occupied property. and The provision, however, does not expressly state whether Pre-construction / prior-period interest is included within this ceiling.

- Position under IT Act, 1961 : Section 24(b) of the 1961 Act clearly provides that Prior-period interest (aggregated and spread over five years) forms part of the overall ₹2 lakh limit. This position is well-settled through circulars and judicial interpretation.

- Proposed amendment : Section 22(2) is proposed to be amended to clarify that: The aggregate deduction for interest on borrowed capital shall be inclusive of prior-period interest payable.

Practical impact

- Removes scope for dual interpretation

- Prevents excessive claims beyond ₹2 lakh

- Aligns computation mechanics with settled law

The amendment does not reduce the deduction—it merely codifies the existing interpretation under the 1961 Act.

Power to Prescribe PAN Quoting Requirements

Section 262(10)(c) : Existing position under IT Act, 2025 : Section 262(10)(c) empowers the CBDT to prescribe PAN quoting for Documents pertaining to business or profession only. This creates a narrow and artificial restriction.

Position under IT Act, 1961 : Section 139A(5)(c) empowers the CBDT to prescribe PAN quoting for Any transaction or document, as may be specified in the interest of revenue. The power is transaction-based, not activity-based.

Proposed amendment : Section 262(10)(c) is proposed to be amended to Enable the CBDT to prescribe PAN quoting requirements for documents relating to transactions not connected with business or profession.

Practical impact

- Enables PAN reporting for high-value personal transactions

- Strengthens information trail and data analytics

- Prevents revenue leakage outside business activities

Examples of likely coverage

-

High-value property purchases by individuals

-

Luxury asset transactions

-

Certain financial instruments held in personal capacity

This amendment expands regulatory reach, not tax liability—aimed purely at information reporting and compliance.

| Aspect | Nature |

|---|---|

| Type of amendments | Clarificatory & alignment-based |

| Revenue impact | Neutral |

| Litigation risk | Reduced |

| Compliance certainty | Increased |

These amendments signal that the Income-tax Act, 2025 is not meant to reinvent settled law but to carry forward judicially tested principles. The approach reduces interpretational gaps during the transition phase and preempts avoidable disputes.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.