GST DRAFT RULES AND FORMATS RELEASED

Table of Contents

GST DRAFT RULES AND FORMATS RELEASED

The last major development on GST was the approval of Union Cabinet for the formation of GST council and enforcement of all sections of the 101st Constitutional Amendment Act.

the Goods and Services Tax Network (GSTN) indeed plays a crucial role in India’s indirect taxation system. It serves as the technology backbone for the implementation of GST, which is a unified taxation system that subsumes various indirect taxes under one umbrella. GSTN’s platform enables taxpayers to register, file their tax returns, make payments, and comply with other regulatory requirements seamlessly. By providing a user-friendly interface and robust backend infrastructure, GSTN aims to simplify tax compliance for businesses and promote transparency in the taxation system.

When draft rules and formats for the Goods and Services Tax (GST) are released, it indicates progress toward implementing or refining the tax system. These drafts typically provide detailed guidelines on various aspects of GST compliance, such as registration, invoicing, return filing, and input tax credit.

The GST Council has fixed the annual turnover threshold of Rs. 10 Lakh for North eastern states and Rs 20 Lakh for the other regions. Latest in the row is the government has released following rules and formats:

-

Draft Rules and Formats on Registration

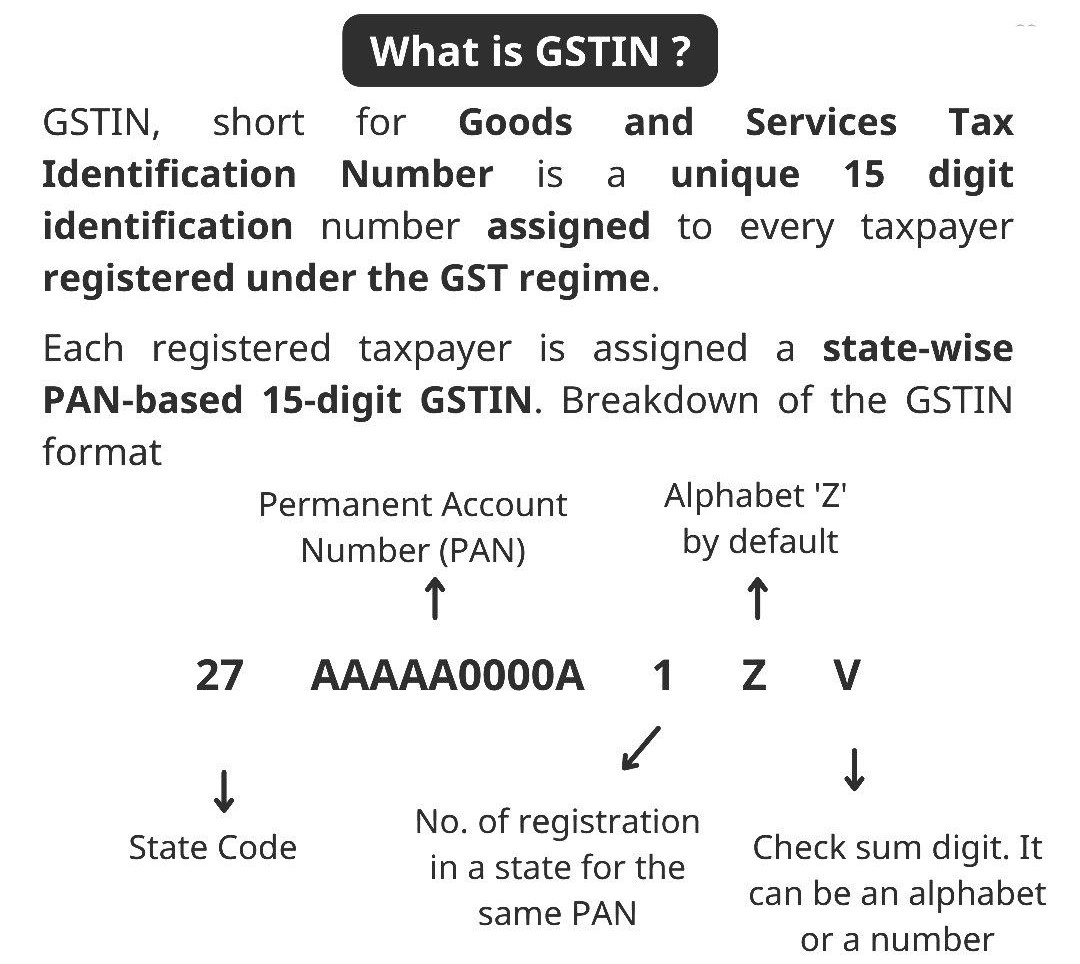

There are 26 forms for registration from GST REG-01 to GST REG-26. Before applying for registration, the taxable person needs to declare his PAN, mobile number and e-mail address in PART A of FORM GST REG-01 on common portal and then submit application in PART B of FORM GST REG-01 duly signed along with Documents specified. There are different forms for the registration of casual taxable person, Non-resident taxable person etc. There are forms for cancellation and amendment as well.

-

Draft Rules and Formats on payment

Seven forms from GST PMT-1 to GST PMT-6 released for payment of tax.

-

Draft Rules and Formats on return

Eighteen forms (Form GSTR-1 to GSTR-11) and Seven separate forms for Tax Return Preparer (Form GST-TRP-1 to GST-TRP-7) are released for returns. A Reconciliation Statement to be certified under Section 42 of Model GST Law in Form GSTR 9B. There are three Forms (Form GST ITC-1A, 1B and 1C) for GST Input Tax Credit Mismatch report.

-

Draft Rules and Formats on refund

Ten Forms (Form GST RFD-01 to GST RFD-10) pertain to refund are released.

-

Draft Rules and Formats on invoice

Invoice Rules prescribes for the requirements on the tax invoice issued by the supplier. The invoice shall be issued in triplicate in case of supply of Goods and in duplicate in case of supply of services. Special requirements on Invoice are provided in case of ISD, composition tax payer etc.

FOR FURTHER QUERIES CONTACT US:

W: www.caindelhiindia.com E: info@caindelhiindia.com T: 9-555-555-480

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.