CORPORATE AND PROFESSIONAL UPDATE OCT 5, 2016

TODAY UPDATE:

Direct Tax:-

HC dismisses assessee’s (a sub-licencee) appeal for AY 2002-03, holds that maintenance charges paid by sub-sub-licensee directly to the builder forms part of sub-licencee assessee’s rent for the purpose of computing property’s annual letting value u/s 23.[TS-539-HC-2016(P & H)]

Supreme Court of India in the below case held that The appellant University is neither directly nor even substantially financed by the Government so as to be entitled to exemption from payment of tax under the Act –(Visvesvaraya Technological University Versus Assistant Commissioner Of Income Tax)

IT: Exemption u/s 10(23C)(iiiab) – The appellant University is neither directly nor even substantially financed by the Government so as to be entitled to exemption from payment of tax under the Act – Visvesvaraya Technological University Versus Assistant Commissioner Of Income Tax (2016 (10) TMI 61 – Supreme Court Of India)

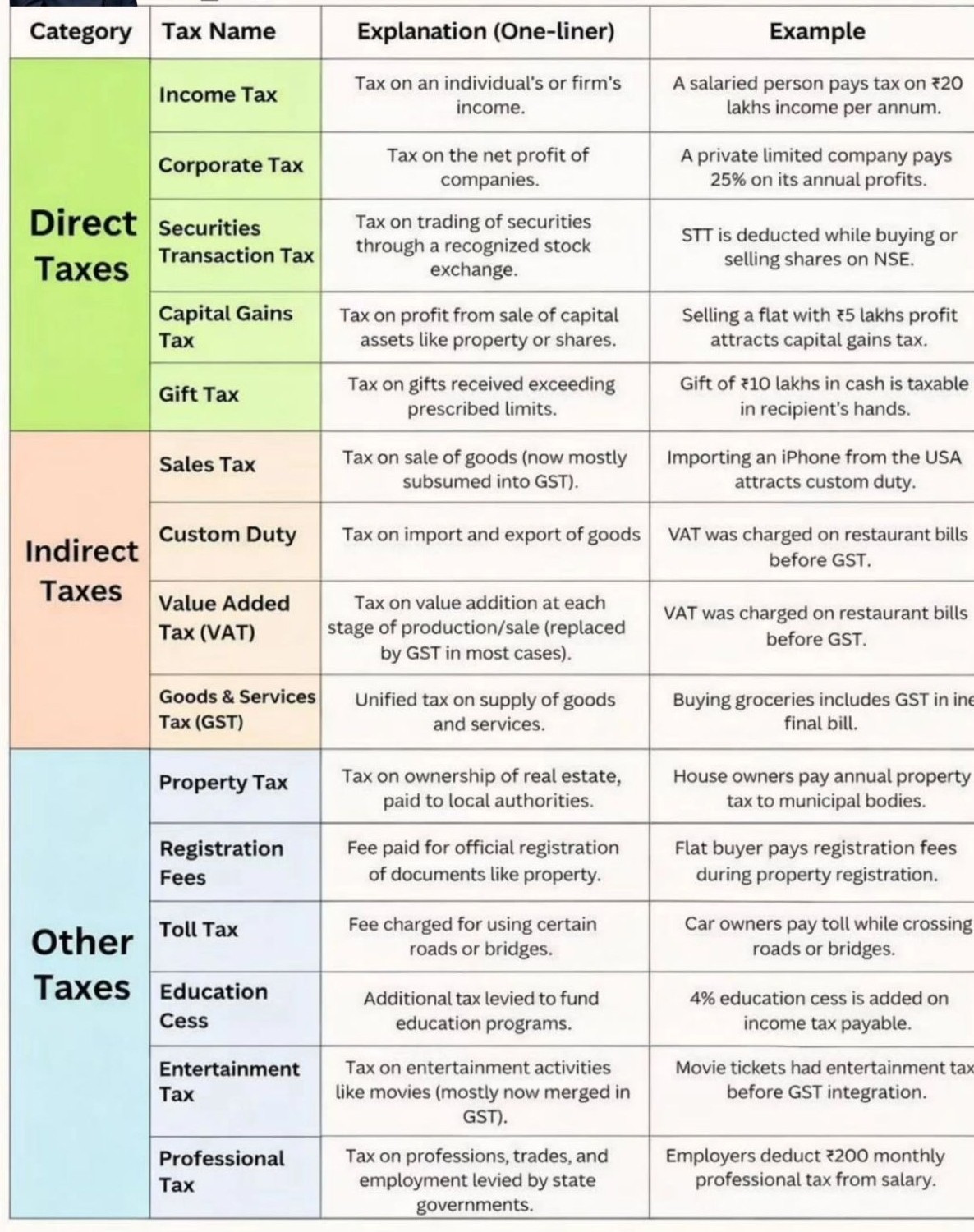

Kind of Tax

Indirect Tax:-

The Karnataka High Court in the below-cited case held that Fee u/s 234E can not be levied on TDS deducted prior to 01.06.2015. (Sri Fatheraj Singhvi & Ors vs. Union of India & Ors)

CESTAT Banglore in the below-cited case, held that a penalty can not be levied on the basis of mere allegation of suppression the Department did not bring any material on record to prove that there was suppression and concealment of facts to evade payment of tax.(M/s Toyota Boshoku Automotive India Pvt. Ltd. Vs CCE&ST, LTU, Bangalore)

ST: Except mere allegation of suppression, the Department did not bring any material on record to prove that there was suppression and concealment of facts to evade payment of tax – No Penalty—M/s Toyota Boshoku Automotive India Pvt. Ltd. Vs CCE&ST, LTU, Bangalore (2016 (10) TMI 82 – CESTAT Bangalore)

VAT & ST: Use of pesticides and chemicals was wholly incidental for providing cleaning services—no transfer of property in goods involved – State of Gujarat Vs Bharat Pest Control (2016 (10) TMI 85 – Gujarat High Court)

MCA UPDATE:-

MCA prescribes (i) Simplified Proforma for Incorporating Company (ii) Conversion of a Co. limited by guarantee into a Co. limited by shares

MCA constitutes Expert Group to look into issues related to Audit firms.

FAQ on Company Law:

Query: Kindly advice on the procedure of obtaining registration as an investment adviser from SEBI?

Answer: Application shall be made in Form A as specified in First Schedule of IA Regulations with necessary supporting documents. The procedure for obtaining registration as an investment adviser is available on the SEBI website under “Info for > Investment Advisers > How to get registered as an Investment Adviser.”

Query: As per Companies Act 2014, there is a provision that all the contestants contesting for the post of a director have to deposit Rs.1.00 lacs as security deposit. Is this provision also applicable to Section-8 companies?

Answer: As per section 160 of the Companies Act person who is not a retiring director in terms of Section 152 shall, subject to provisions of the Act, be eligible for appointment to the office of director at any general meeting if he or some member intending to propose him as a director has, not less than fourteen days before the meeting, left at the registered office of the company a notice in writing under his handsignifying his candidature and proposing himself as a director and the intention of such member to propose him as a candidate for that office, along with the deposit of one lakh rupees or such higher amount as may be prescribed in this behalf.

Thus it can be said that any person contesting for the post of Director shall deposit a sum of Rs. 1 lac as a security deposit with the Company. Further, these provisions are applicable to all companies.

FEMA Updates:

RBI issued a circular regarding Investment by Foreign Portfolio Investors (FPI) in Government Securities vide Circular No. 4/2016 dated 30/09/2016. (Click here to view)

ICAI Updates:-

The Auditing and Assurance Standards Board issued a Guidance Note on Reports or Certificates for Special Purposes (Revised 2016) dated on 01/10/2016. (Click here to view.)

Punjab National Bank invites applications from practicing firms of chartered accountants in India who fulfill the eligibility criteria for conducting concurrent audits of branches.

Key Dates:

Excise payment for Non SSI for the month of September by G.A.R.- 7 challan-06/10/2016

Service tax payment for company for the month of September by G.A.R.- 7 challan-06/10/2016

Service tax payment for Individuals/Proprietory/ Partnership Firms for the quarter ended by G.A.R.- 7 challan-06/10/2016

Submission of TCS forms (27C) received in sep to IT Commissioner- 07/10/2016

Payment of TDS/TCS challan No. 281-07/10/2016

We look forward for your valuable comments. www.caindelhiindia.com

FOR FURTHER QUERIES CONTACT US:

W: www.caindelhiindia.com E: info@caindelhiindia.com T: 9-555-555-480

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.