CORPORATE AND PROFESSIONAL UPDATE NOV 1, 2016

CORPORATE AND PROFESSIONAL UPDATE NOV 1, 2016

Direct Tax:-

- Eligibility of deduction u/s 80G – it is not open to the Authorities to refuse approval by imposing conditions which are not mentioned in Section 80G of the Act – Bombay High Court in case of [DIT (Exemptions), Mumbai Vs. Shri Sai Baba Charitable Trust]

- New revised double taxation avoidance agreement (DTAA) between India and republic of korea has been signed to avoid the burden of double taxation for taxpayers of two countries.Action of the AO in not giving reasons for not processing the refund application is “most disturbing” and stating …Group M. [Media India Pvt. Ltd vs. UOI (Bombay High Court)].

- Accrual of interest income – There is nothing on record to indicate that the borrower had refused to pay either the interest or return the loan. Therefore, on facts, there has been an accrual of interest and following the mercantile system of accounting, the same is real income, liable to tax – Bombay High Court in case of [M/s. S. Raj & Co. Vs. The ITO]

- CBDT had proactively released in April, 2016 time-series data relating to direct tax collections, number of taxpayers, cost of collection, etc., data of number of PAN allotted and data relating to distribution of income and tax payable in the returns for AY 2012-13.

- Ministry of finance issued Notification No. 99/2016 on 25th October, 2016 of the powers conferred by section 68 of the Prohibition of Benami Property Transactions Act, 1988.

- New revised double taxation avoidance agreement (DTAA) between India and republic of korea has been signed to avoid the burden of double taxation for taxpayers of two countries.Action of the AO in not giving reasons for not processing the refund application is “most disturbing” and stating …Group M. [Media India Pvt. Ltd vs. UOI (Bombay High Court)].

- IT: Transfer fees received from members of co-operative society – the concept of mutuality cannot be applied – Vithalnagar Co-operative Housing Society Ltd. Vs. ITO-21(2), Mum. (2016 (10) TMI 964 – ITAT Mumbai)

- IT: These are two different causes of action leading to addition against the income of two different persons u/s 68 & 69. There is as such no question of any double taxation. – Sorry to say that the tribunal (ITAT) has mixed up the matters – CIT, Kol.a-II Vs. Trinetra Commerce & Trade Pvt. Ltd. (2016 (10) TMI 974 – Calcutta High Court)

- CBDT signs 5 unilateral advance pricing agreements (APAs) with Indian taxpayers covering a range of international transactions, including sale of finished goods, purchase of raw materials, software development services, IT enabled services, exports and interest payment.

- CBDT had proactively released in April, 2016 time-series data relating to direct tax collections, number of taxpayers, cost of collection, etc., data of number of PAN allotted and data relating to distribution of income and tax payable in the returns for AY 2012-13.

- High Court disallows travel exp. of wife who went with director on business tour

Commissioner of Income-tax (Central), Ludhiana v.Hero Cycles Ltd. [2016] 74 taxmann.com 254 (Punjab & Haryana) - Sec. 80P relief available if society provides credit to its members alone and it doesn’t receive deposits from public Commissioner of Income-tax, Circle-I, Vellore v.Kalpadi Co-operative Township Ltd. [2016] 74 taxmann.com 226 (Madras)

- SC to decide whether ‘Ansal Housing’ is liable to pay tax on flats lying unsold; SLP admitted Ansal Housing & Construction Ltd. v. Commissioner of Income-tax-1

[2016] 74 taxmann.com 245 (SC) - 3 Trust promoting Jain Community entitled to registration if it was also working for benefit of general public Commissioner of Income-tax (Exemptions) v. Bayath Kutchhi Dasha Oswal Jain Mahajan Trust [2016] 74 taxmann.com 199 (Gujarat)

- Where AO erred in determining status of assessee, CIT(A) had jurisdiction to go into such issue: HC Megatrends Inc v. Commissioner of Income-tax, Chennai

[2016] 74 taxmann.com 197 (Madras)

NCLT directs company to convene AGM to discuss financials Pradip Kumar Bajaj v. Doloo Tea Co.(India) Ltd. [2016] 74 taxmann.com 192 (NCLT-Guwahati) - Eligibility of deduction u/s 80G – it is not open to the Authorities to refuse approval by imposing conditions which are not mentioned in Section 80G of the Act – Bombay High Court in case of [DIT (Exemptions), Mumbai Vs. Shri Sai Baba Charitable Trust]

- Accrual of interest income – There is nothing on record to indicate that the borrower had refused to pay either the interest or return the loan. Therefore, on facts, there has been an accrual of interest and following the mercantile system of accounting, the same is real income, liable to tax – Bombay High Court in case of [M/s. S. Raj & Co. Vs. The ITO]

Indirect Tax:-

- Activity of toll collection on commission basis would not fall under the category of business auxiliary services so as to make the same liable to service tax – service not liable to tax – Prakash Asphal Ting & Toll Highways (India) Ltd. Vs CCE, Jaipur-II (2016 (10) TMI 746 – CESTAT New Delhi)

- Taxability of a Car Stereo System – electronic goods falling under Entry 75 or motor vehicle falling under Entry 18 – It cannot be gainsaid that a car stereo does add to the comfort for the use of a motor vehicle – car stereo held as accessory – to be taxed accordingly – Sony India Pvt. Ltd. Vs CIT & Anr. (2016 (10) TMI 720 – Allahabad High Court)

- Electric bikes assembled from parts procured from China held as manufacturing for sec. 80-IC relief Assistant Commissioner of Income-tax, Circle Palanpur v. Accura Bikes (P.) Ltd.

[2016] 74 taxmann.com 200 (Ahmedabad – Trib.)

GST UPDATE:

Under GST no physical documents for enrolment. Soft copy in jpeg or pdf format, upto 1 mb acceptable. Photos can be in jpeg format, upto 100 kb.

FAQ on Company Law:

- Query : We have a query as to if in a board meeting discussing inter corporate loan, 5 directors were present, 3 voted in favour, while 2 directors remain silent and did not vote, whether the unanimous board resolution is passed?

- Answer: Section 186(5) requires the consent of all the directors present at the meeting, therefore if two directors present at the meeting did not give their consent and remained silent, the Unanimous Board Resolution is not passed.

- Activity of toll collection on commission basis would not fall under the category of business auxiliary services so as to make the same liable to service tax – service not liable to tax – Prakash Asphal Ting & Toll Highways (India) Ltd. Vs CCE, Jaipur-II (2016 (10) TMI 746 – CESTAT New Delhi)

- Taxability of a Car Stereo System – electronic goods falling under Entry 75 or motor vehicle falling under Entry 18 – It cannot be gainsaid that a car stereo does add to the comfort for the use of a motor vehicle – car stereo held as accessory – to be taxed accordingly – Sony India Pvt. Ltd. Vs CIT & Anr. (2016 (10) TMI 720 – Allahabad High Court)

- ST: Reimbursement of expenses – Just because the Nepalese suppliers had billed the appellants separately for transportation from Nepal border to factory premises alongwith other expenses they do not become the agents of the appellants – Radha Mohan Textiles Pvt. Ltd. & Ors. Ltd. Vs. C.C.E. Jaipur-II (2016 (10) TMI 962 – CESTAT New Delhi)

- VAT: Withholding of Refund claim which is already crystallised – since prima facie requirements to invoke the power to withhold the amount of refund are not available on record such action is not possible to be confirmed -Rajnikant Lavjibhai Bhesdadiya & 1 Vs. State of Gujarat & Anr (2016 (10) TMI 941 – Gujarat High Court)

- couldn’t deny rebate on export of Pan Masala just because Waste Management Rules were notified later on P.R. Chemicals v. Union of India [2016] 74 taxmann.com 196 (Delhi)

- Date of filing of DVAT Return in Form 16, 17 & 48 for Q2, 2016-17 has been extended upto 14.11.2016. Circular No. 17 dated 28.10.2016.

- Query: We have a query regarding the incorporation of LLP as can I comply with the requirement of two designated partner by appointing myself as a designated partner in individual capacity as well as a nominee of body corporate?

- Answer: No, Appointment of at least two “Designated Partners” shall be mandatory for all LLPs. Every LLP shall be required to have atleast two Designated Partners who shall be individuals and at least one of the Designated Partner shall be a resident of India. In case of a LLP in which all the partners are bodies corporate or in which one or more partners are individuals and bodies corporate, at least two individuals who are partners of such LLP or nominees of such bodies corporate shall act as designated partners.

- Query : We have a query as to if in a board meeting discussing inter corporate loan, 5 directors were present, 3 voted in favour, while 2 directors remain silent and did not vote, whether the unanimous board resolution is passed?

- Answer: Section 186(5) requires the consent of all the directors present at the meeting, therefore if two directors present at the meeting did not give their consent and remained silent, the Unanimous Board Resolution is not passed.

- Query: We have a query as whether the consolidated financial statement of a listed holding company alone is required to be filed in XBRL or the subsidiaries also need to file their financials in XBRL?

- Answer: The listed holding company has to file its standalone and consolidated financial statement, if applicable, in XBRL. Additionally, its Indian subsidiaries are also required to file their financial statements in XBRL.

MCA UPDATE:

MCA has notified that revised Form MGT – 7 and Form GNL-4 are likely to be revised on MCA21 w.e.f 3rd November, 2016.

RBI UPDATE:

The amended bilateral tax treaty between India and Japan, which provides for strengthened exchange of information to help reduce tax comes into force.

RBI has directed banks to put entire banking areas under the CCTV surveillance and keep all the recordings.

OTHER UPDATE:

Senior Indian Revenue Service (IRS) officer Shri Sushil Chandra today took over as chairman of the Central Board of Direct Taxes (CBDT).

Attn CA Firms. EOI invited for internal audit of NBCFDC, to be submitted by 14.11.2016 (visit www.nbcfdc.gov.in).

PNB invites applications from practicing firms of CA as Concurrent Auditors in the Bank for conducting concurrent audit of branches.

Key Dates:

- Extension to 29.11.2016 of last date of filing of e-forms AOC-4,AOC (CFS),AOC-4 XBRL & MGT-7,without additional fee. MCA Circular No.12/2016 Dated 27.10.16.

- MCA has revised Form AOC-4 with effect from 27th October 2016.

- E-payment of service tax for the month of October by companies-06-11-2016

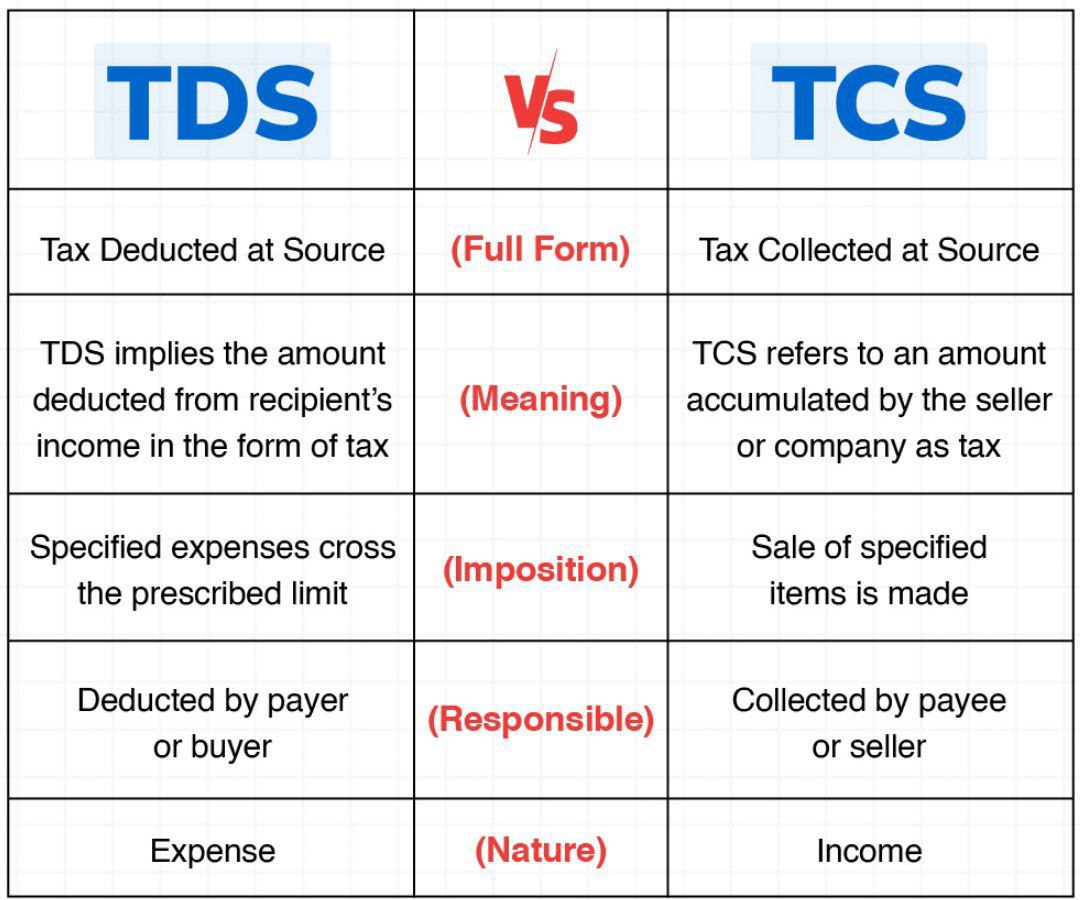

- Payment of TDS/TCS deducted and collected in the month of October-07-11-2016

- Submission of form No. 27C(TCS) received in October to IT Commissioner-07-11-2016

The biggest enemy of success is fear of failure. So when fear knocks at your door, send courage to open the door and success will wait for you.

Life can be happier and stress less If we remember the fact that We can’t have all that we desire, but the time will give us all that we deserve.

Right things are not possible always, Possible things are not right always. Be true to your heart. you will never go wrong…!!!

We look forward for your valuable comments. www.caindelhiindia.com

FOR FURTHER QUERIES CONTACT US:

W: www.caindelhiindia.com E: info@caindelhiindia.com T:011-233-4-3333 , 9-555-555-480

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.