MANDATORY COMPLIANCE BEFORE ANNUAL FILLING

Table of Contents

Mandatory Compliance before Annual Filling

As per Companies Act, 2013 following are the mandatory compliance:

- Preparation of MBP-1(Disclosure of interest of Director), DIR-8(Disqualification of director) as per Section-184 & 164 respectively of the Companies Act, 2013.

- Adoption of Memorandum & Articles as per Companies Act-2013.

- Recording of minutes as per Secretarial Standard-1(Board Meeting Minutes) & Secretarial Standard-2(General Meeting Minutes.) w.e.f 01stJuly, 2015.

- Stamping of share certificate since incorporation and also on further allotment of shares if any.

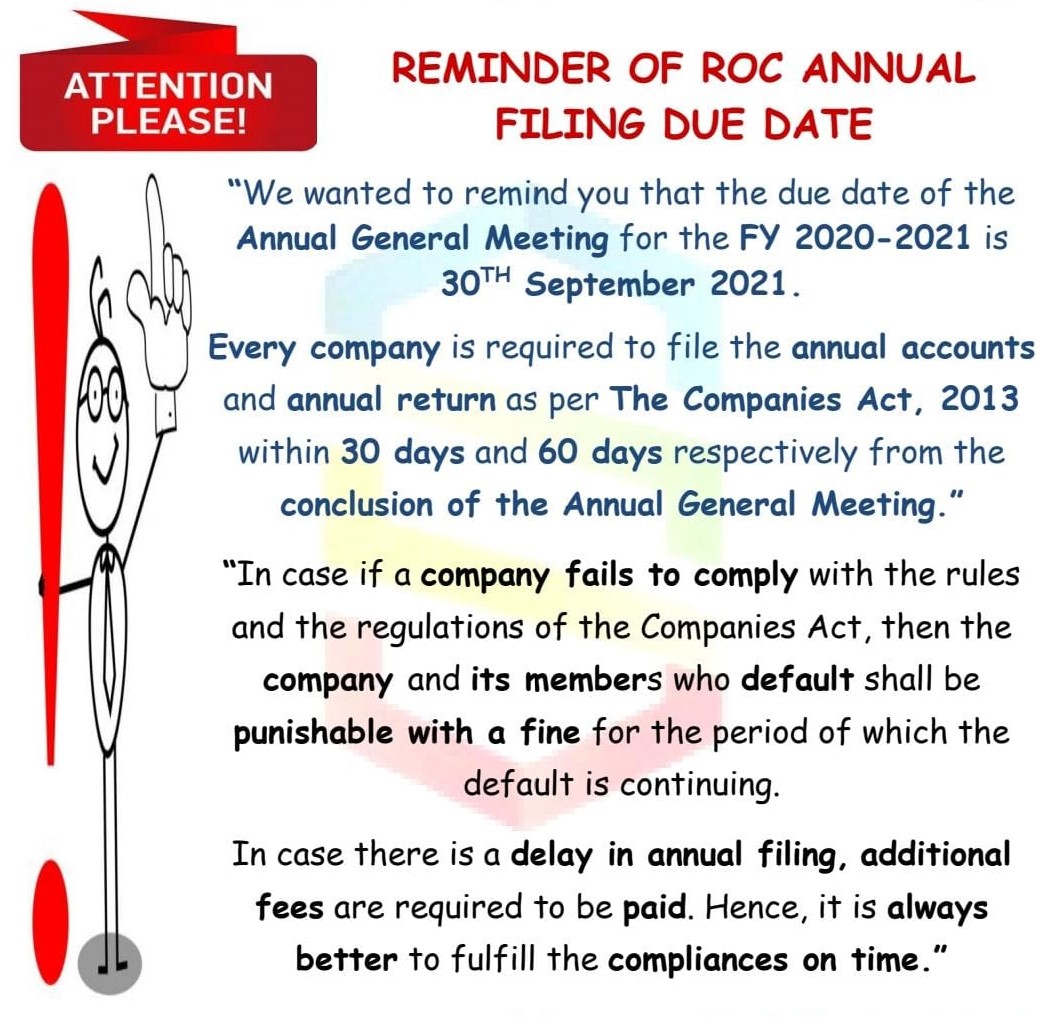

So comply above mentioned provisions before Annual Filling so that we have the necessary ROC Records for annual filling.

MCA

MCA has issued Clarification with regard to circulation and filing of Financial Statement under the provisions Section 101 & 136 of the Companies Act, 2013. Accordingly, if Companies calling their AGM at shorter meeting in compliance to the provisions of Section 101, can circulate Annual financial statements to be laid/considered at said AGM, at such shorter notice. Further, it is clarified that in case of a foreign subsidiary, which is not required to get its accounts audited as per legal requirements prevalent in their country, the holding Indian company may place/file such unaudited accounts to comply with requirements of Section 136(1) and 137(1) as applicable. These, however, would need to be translated in English, if the original accounts are not in English.

MCA

The Companies Law Committee set up by the Government to make recommendations on issues arising from the implementation of the Companies Act, 2013 invites comments/suggestions to assist its deliberations. Suggestions/ comments may kindly be sent only through the Ministry of Corporate Affairs’ online portal www.mca.gov.in in the prescribed format available on the website. The Committee requests that companies should route their comments/suggestions through their respective Industry Chambers, and professionals [Chartered Accountants, Company Secretaries, Cost Accountants, Lawyers etc.] should route their comments/suggestions through their respective Institute or representative body, whichever is applicable. The last date for submission of suggestions/ comments to Company Law Committee extended upto 31st July, 2015.

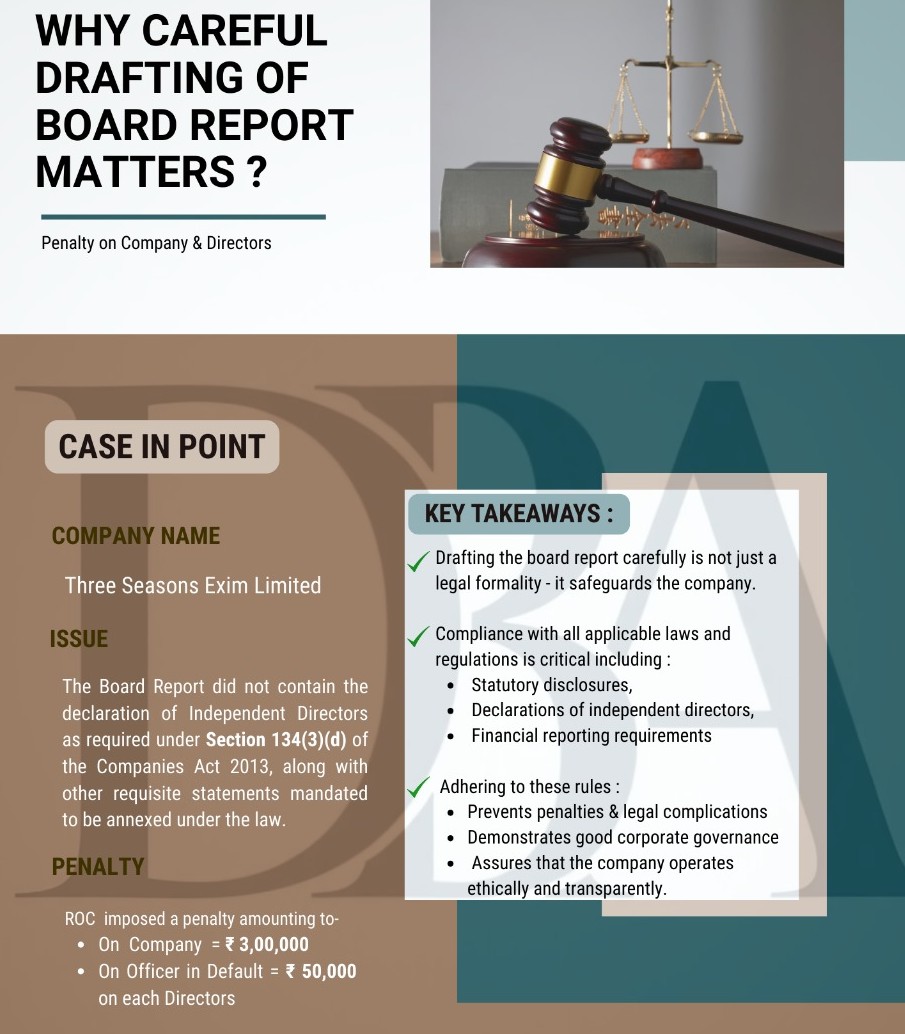

Why do Careful Drafting of Board Report Matters—Otherwise Penalty on Company & Director

Case Example: Three Seasons Exim Limited

Issue: Board Report lacked Declaration of Independent Directors (as per Section 134(3)(d), Companies Act 2013) & Other mandatory statements required by law

Board report drafting is not just a formality—it’s a legal safeguard. Ensure inclusion of Statutory disclosures, Independent director declarations, Financial reporting compliance Benefits of proper compliance Avoids penalties and legal issues, Promotes good corporate governance, & Reflects ethical and transparent operations. Company or Director will face Penalty Imposed by ROC:

- INR 3,00,000 on the Company

- INR 50,000 on each Director (Officer in Default)

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances; Hope the information will assist you in your Professional endeavors. For query or help, contact: info@caindelhiindia.com or call at 011-233 433 33

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.