Trust Registration in India – Documents, Process, Benefits

Table of Contents

Trust Registration – An overview

The meaning of trust registration is legalizing the trust deed ((a legal contract between Trustee & settlor) from the registrar of the respective judistriction. The trust works as a legal medium that is used for the lawful distribution of the settlor’s assets among the concerned beneficiaries. The trust becomes valid as soon as the registrar provides its authorization to the trust deed.

In Indian context, what is meant by trust?

- All the registered deeds in India are governed by Indian trust Act 1882. It facilitates the legal provisions for the same. The Trust is basically a legal arrangement where the Trust’s owner transfers the property to the concerned Trustee. The motive of the firm is smooth transfer between the parties as stated in the deed.

- A trustee, selected by the grantor, is liable for administering the Trust and also distributing his/her assets to the beneficiaries selected by the grantor when the Trust is set up. To name a few , some common beneficiaries in trust of India can be Heir, family members, or charity. Registering a trust comes with various benefits that is less tax rates, safeguard of assets etc

There are various kinds of trusts in India, including

-

- Asset protection

- Spendthrift

- Charitable

- Revocable;

- Irrevocable

- Special needs

- Testamentary

Merits of a Indian trust Registration

To Do charitable work

- A charitable trust basically provides a way to set up assets to benefit ourselves, beneficiaries involved and a charity simultaneously. People who want to help the society by way of non-essential assets including stocks or real estate.

Benefit Accessibility from tax exemptions

- There are various exemptions offered by income tax department. since the main aim of a trust is not making profit , many tax relaxations are enjoyed by a trust. A trust deed shall be available to avail these benefits. Trust are helpful when it comes to tax relaxation on capital and income.

Provide help to those who need financial aid.

- It gives all the help to deprived people through charitable activities.

To avoid much legal obstacles

- It is ensure by the Act governing trusts that legal protection is given to trusts. It makes sure that no other party make any unnecessary claim that may act as a harm for trusts.

Avail legal coverage of family wealth

- Without trust it would not be possible for a trustor to split between individuals. However trust allows us to do so.

To Avoid Probate Court

- Trust registration can be used as a method for transferring an asset to the heir in the case the will is not present. As the legal title of the assets transfers from the settlor to the Trustee. when they are “settled”, no change of ownership after settlor demise, thus evading the requirement for probate of a will on account of trust assets.

- the trust is a Kind of agreement that does not require for additional registration. economic adversity can be avoided which the surviving spouse earlier had to face while waiting for grant of probate.

Emigration/ Immigration of Family

- To bring flexibility and safeguarding the assets of an organization , an individual can establish the trust to get better benefits of tax exemptions when the individual or his/her heir move to another country.

What are the Kind of Trusts in India?

There are 3 types of trusts Namely in India:

- Public Cum-Private Trust

- Private Trust

- Public Trust

Private trusts work according to the Indian trusts Act 1882. But, Public trusts are divided into religious and charitable trusts. For the enforcement of public trusts in India various acts such as the Religious Endowments Act, 1863, Charitable and Religious Trust Act, 1920, the Bombay Public Trust Act, 1950.

Public Trust

- Public trusts work not only for the purpose of the specific beneficiaries but public at large. This doesn’t work as per Indian trusts act. It works for the charitable and religious purposes. It works as per the law which is in effect for time being.

Private Trust

- Private trust is legal arrangement in the form of a trust that is created to help individuals other than public or charitable purposes. It. It works for the financial benefits for more than one beneficiaries. private trusts follow the provisions of Indian trusts act,1882. It doesn’t involve in charitable purpose and only benefit to the designated beneficiaries.

Public-Cum-Private Trusts

- This trusts works for both public at large as well as designated beneficiaries. Both public and private can benefit from this trusts.

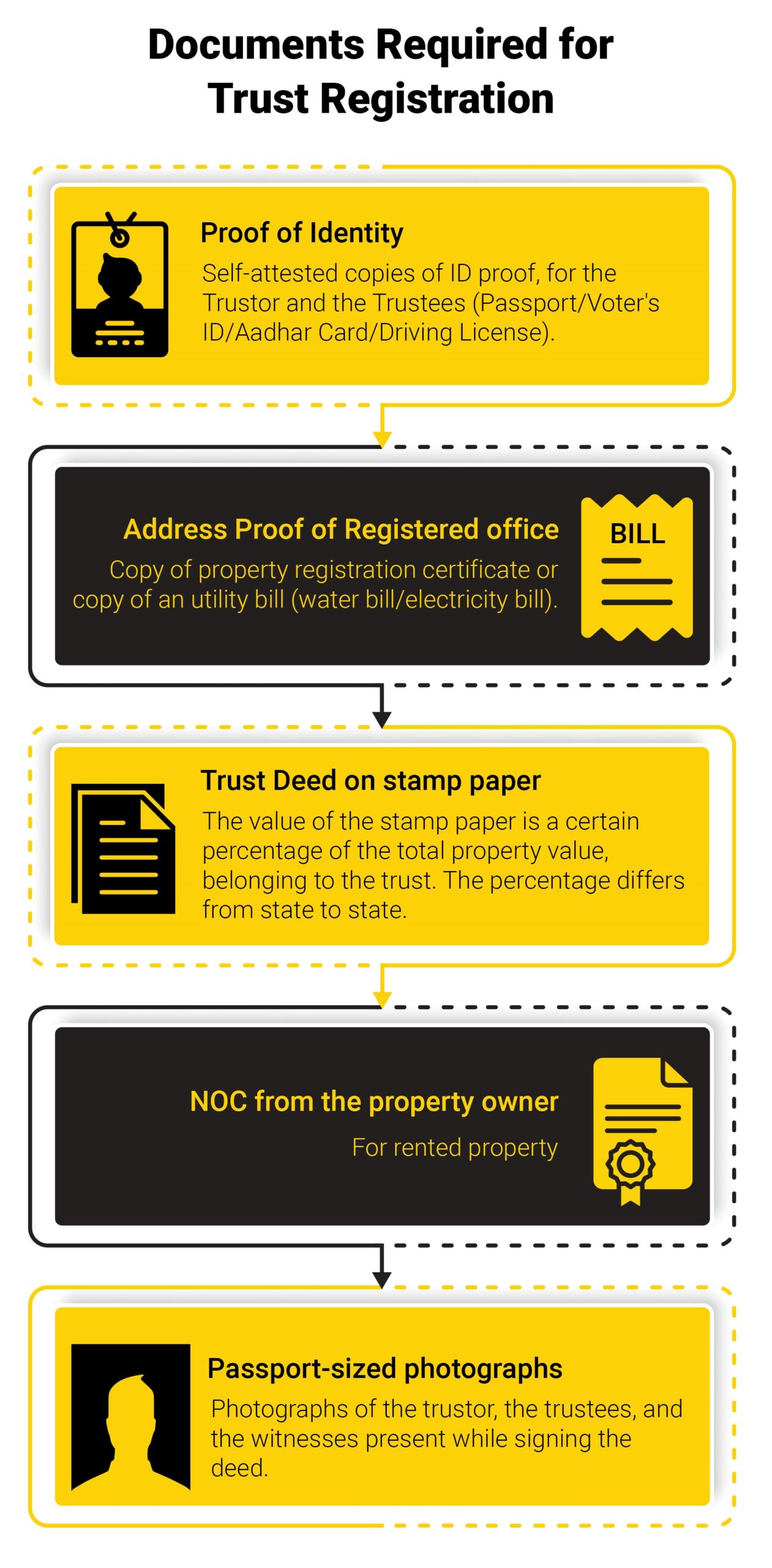

Basic Documents required by registration of a Trust in India.

Trust deed must reflect the following information:

-

- Number of trustees, Trust registered address , Proposed name of trust , Proposed Rules that will govern the trust, Presence of settlor , two witnesses at the time of registration of Trust

- PAN details

- Trustee and settlor Details such as Self-attested copy Id & Address Proof and occupation

- Identity proof of Trustor & Trustee such as Aadhaar Card, Voter ID, Passport.

- Trustee & settlor

- Address Proof of Registered Office. Eg: Copy of Certificate of Property/Utility Bills

- Trust Deed on Proper Stamp Value

- No objection certification from the Landlord if the property is rented .

- Trustee & settlor Photos

- Objective of Trust deed.

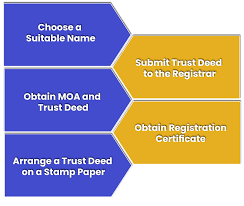

What is the Step-by-Step procedure for registering a trust in India ?

Following are the steps that are to be done for registration of trusts in India

STEP NO.1: Selecting a Apt Name of the trust

The selection of a name for the proposed Trust is the first and most important stage in the Trust registration procedure. The trust shall have a name and the name must be appropriate. Following are some points that are to be kept in mind while selecting the name of the trust.

- Trust Name shall be as per the Emblems and Names Act, 1950

- Trademark act shall not be violated whatsoever when it comes to Trademark Act.

- Name shall not be copied from somewhere and it must have originality.

STEP NO. 2 : DRAFTING OF A TRUST DEED

Drafting of Trust Deed makes the right & duties enforceable under the court of law. The trust deed consolidates the following clauses:

Trust Objective

- The objective behind the formation of trust shall be well defined in the deed.

Trust Acceptance of funds

- This clause includes the provisions regarding acceptance of donation, contribution and subscription from outside person, charitable avenue or from government either in form of cash, immovable assets without charge. Moreover the trust shall not accept any acceptance that may hamper the objective of the trust.

Investment:

- The investment clause states that prescribed conditions for lawful & effective administration of the trust’s fund. Moreover, this section outlined the parameters for the effective allocation of excess funds that are not in use and might be used to generate additional income through investment.

The trustee Power

This specific clause talks All the power and responsibility of trustees shall be specified here. This clause confer the following powers to the trustees includes :

- Investing additional funding in securities

- Accepting any gift, donation via legitimate individuals or sources

- Suing defaulters in case of legal dispute on behalf of the Trust

- Appointing employee(s)

- Alienating the trust properties

- Opening the bank account in the Trust’s name

Statutory Audit & Books of Account maintains

- This clause mandates the trustees states that the book of accounts of the trust shall be maintained on a regular basis. Also, the accounts shall be audited by a certified Chartered Accounts

WINDING UP OF TRUST

- A Trust is set to wound up when all the trust Assets & Immovable Properties are lawfully distributed in the beneficiaries or to a similar entity, either directly or via resettlement. The parties shall also consider any tax liability involved. The clause also tells the requirements of conducting any legal undertaking with the approval of court/ charity commissioner/Any law to reduce the mitigate of legal dispute.

Civil & Criminal Penalties on Violating Compliances of Trust Registration Result

- Both civil and criminal penalties are imposed for non adherence to trust deed. Section 405 to Section 409 of The Indian Penal Code (IPC), 1860 states the provisions when there is a criminal breach of trust.

Applicability of Tax Deduction Account Number (TAN)

- An official request shall be made to AO (Assessing officer) for the allotment of tax deduction number after the registration is done. Form 49B shall be facilitated by Income tax Department. On all challans for payment of Amount Under section 200 of Income tax and TDS certificate as well as TDS Returns u/s 206 , 206A and 206 to be file and required to mention TAN No quoted in all of the certificate and return.

- Under Section 272BB of Income Tax Act states that Penalty will be levied if the Trust fails to obtain a Tax Deduction Account Number. In the aforementioned situations, the aforementioned provision imposes a penalty of Rs 10,000.

Failure to furnish the Income tax Return

- This offense can lead to huge penalties under the Act. Income return shall be consider valid even in case Tax deducted Certificate has not been provided along with return. But This certificate shall be produced within 2 years from the end of assessment year.

What is Role under section 12AB on the Trust registered?

- To Ensuring continual exemption u/s 10 of income tax act, All the active existing institution or charitable trust are compulsory to registered under section 12AB that were under section:-

- Section 80G

- Under Section 12AA

- Section 10(23C)

- It is to be Noted that New Registration Under Section 12AB shall be taken where the registration was under Section 12AA or section 10(23C). Section 12AA shall no longer be valid and the new section 12AB shall be effected for process of registration for the trusts or institutions with effect from grant date of registration u/s 12AB or the last date for application or granting permission whichever is earlier.

- As per current scenario the Central Board of Direct Taxes has again extended the timeline for the application u/s 12AB, 10(23C), 80G & 35(1)(ii)/(iia)/(iii) of the income tax Act in Form No.10AB or Form No. 10A, for provisional registration or registration or intimation or provisional approval or approval of Research Associations or Trusts or Institutions etc.

- The application for registration or intimation or approval U/s 12A, or 80G, 10(23C), 35(1)(ii)/(iia)/(iii) of the Income Tax Act in Form No. 10A required to be submit on or before 30 June, 2021, which is extended to 31 August, 2021 via Circular No.12 of 2021 dated on 25.06.2021, may be filed on or before 31st March, 2022.

Contact us India Financial Consultancy Corporation Pvt Ltd, a team of professionals and expert CA CS in Delhi.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.