Key Changes wrt 47th GSTC meetings have been notified

Table of Contents

Main Changes wrt 47th GSTC meetings have been notified : GSTN

the GST Council altered the GST rates for several commodities, which may have an impact on average people’s wallets. The new Goods and Services Tax rates will be in w e. f starting on July 18, 2022. The modifications were made at the 47th GST council meeting, which was presided over by Miss N Sitharaman, finance minister. In a statement, she claimed that the GST Council had agreed with the government’s recommendations about exemptions and adjustments to GST rates.

Now Revised GST Rates Costlier

Pumps and Machines

- Power-driven pumps designed for handling water such as centrifugal pumps, submersible pumps, along with machines for cleaning, air-based flour mills, deep tube-well turbine pumps etc. have been placed under 18 % up from 12 %.

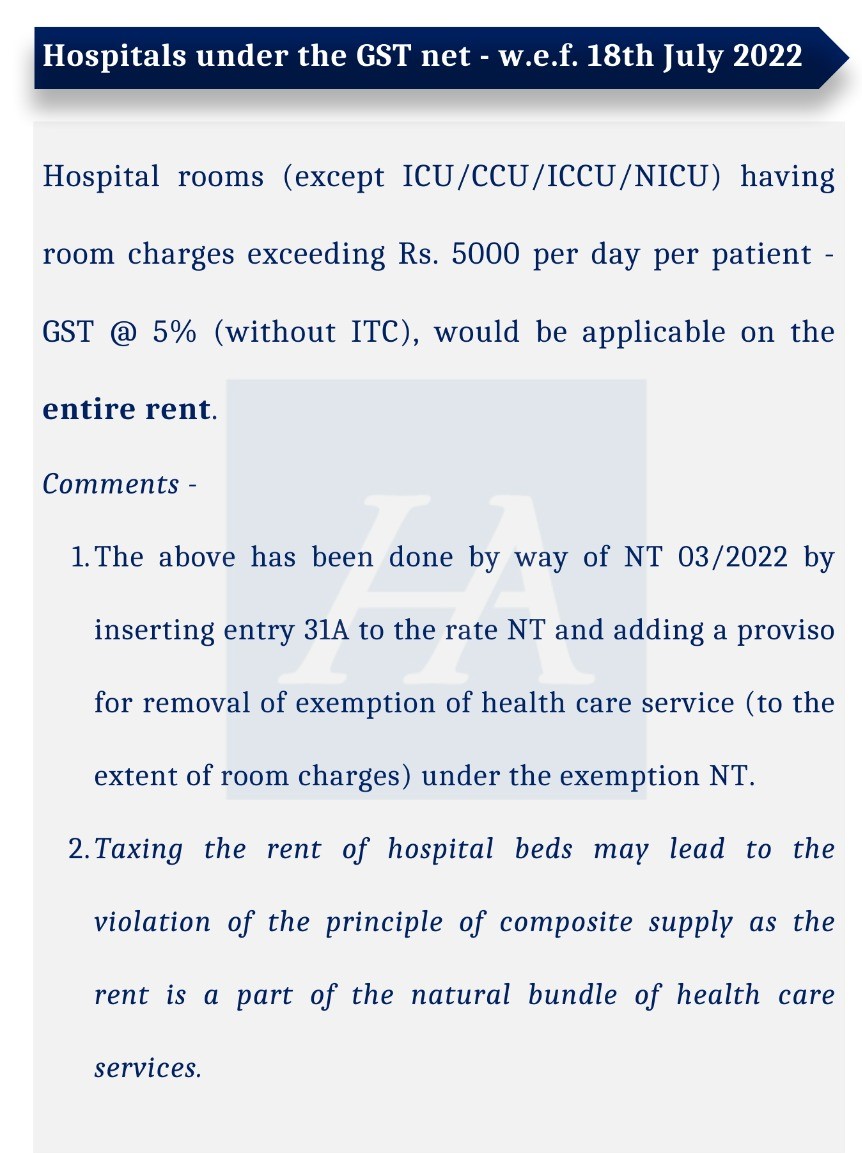

Hospital Rooms/Beds

- Charges of Hospital beds/rooms (excluding ICU) More than INR 5000 per day shall be taxed up to 5 % without Input tax Credit.

LED Lights, Lamps

- There will be a price hike on LED Lamps LED Lights, & fixtures as now these are taxed from 12 % to 18 %

Bank Cheques

- GST council has decided to levy an 18 percent of GST tax on fees charged by banks for the issuance of cheques.

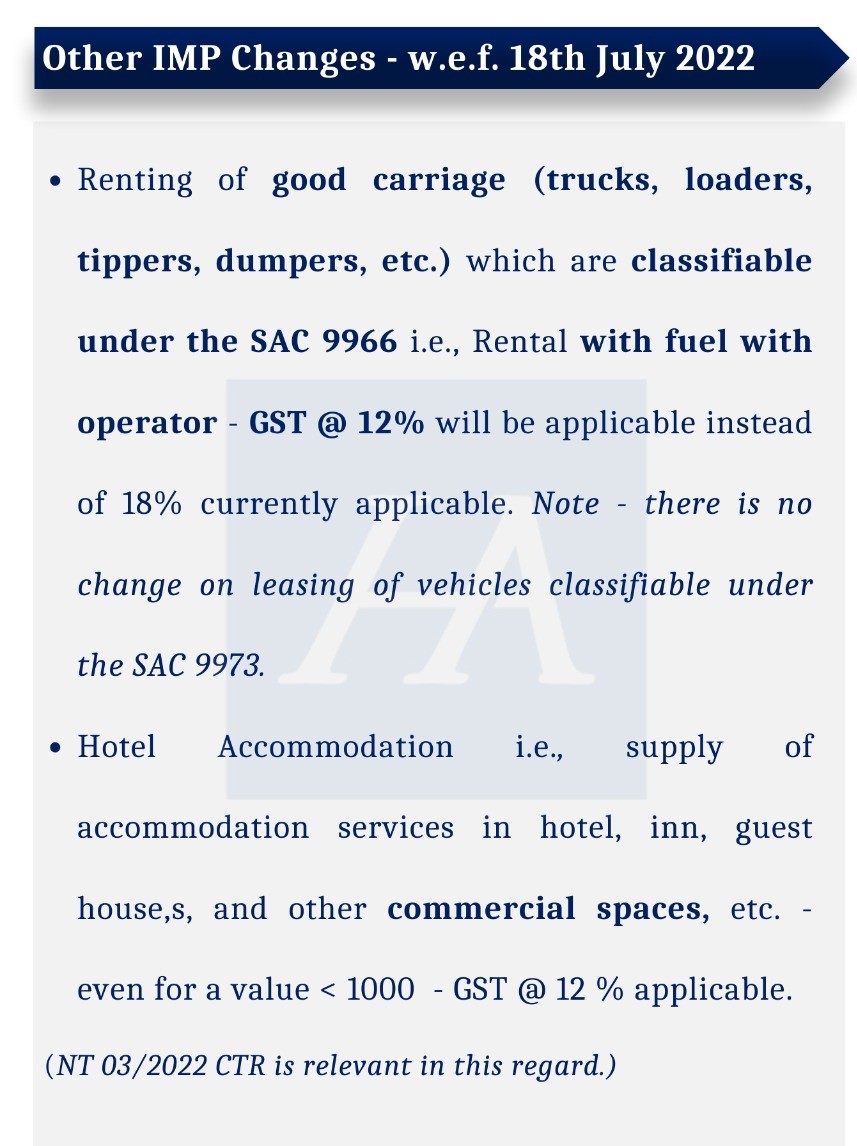

Hotel Rooms

- Charges on Hotel rooms under 1,000 per day have come under 12 percent of GST slabs, decided by the GST council.

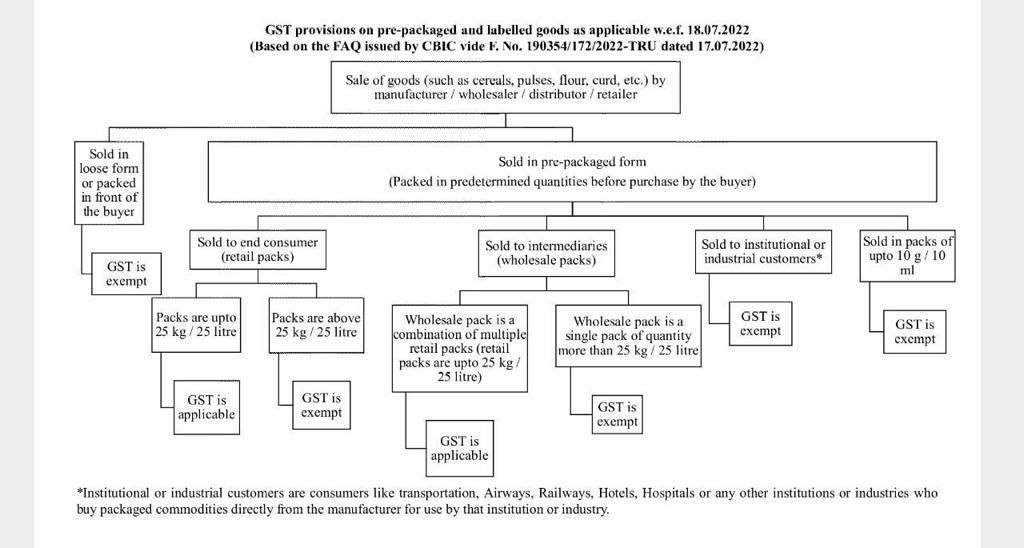

Packaged Food

- GST council has considered the recommendation to bring packaged food items under the GST ambit. Branded items like pre-packaged and pre-labelled retail packed items are excluded from the exemption.

Accessories

- Accessories such as cutting blades, knives, Pencil sharpeners and blades, Spoons, cake-servers, forks, ladles, Spoons, forks, skimmers, etc. have now been placed under the 18 % of GST slab from the 12 % Slab earlier..

Now Revised GST Rates Cheaper in below Case

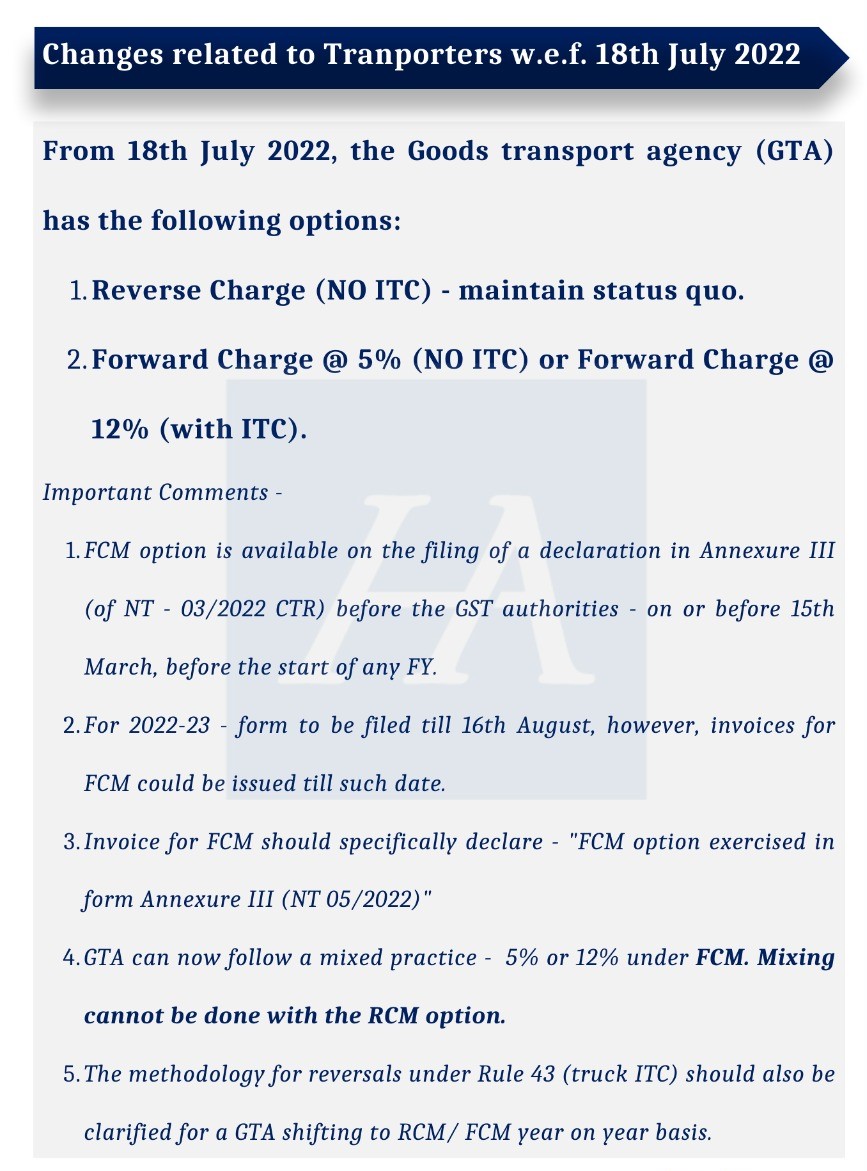

Renting of Goods Carriage

- GSTN has brought down the GST tax rates from 18 % to 12 % on renting of goods carriage with operators.

Frights/Transport

- GST tax rates on the transport of goods and passengers through ropeways have been slashed down from 18 % to 5 %.

Orthopedic Appliances

- GST taxes on artificial parts of the body, appliances that are worn and intraocular lenses, carried etc. have been slashed down to 5 % from 12%.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.