New GST Rates update effective from 18th July 2022

Table of Contents

New GST Rates are effective from 18th July- Let’s take a view of Updated Rates:

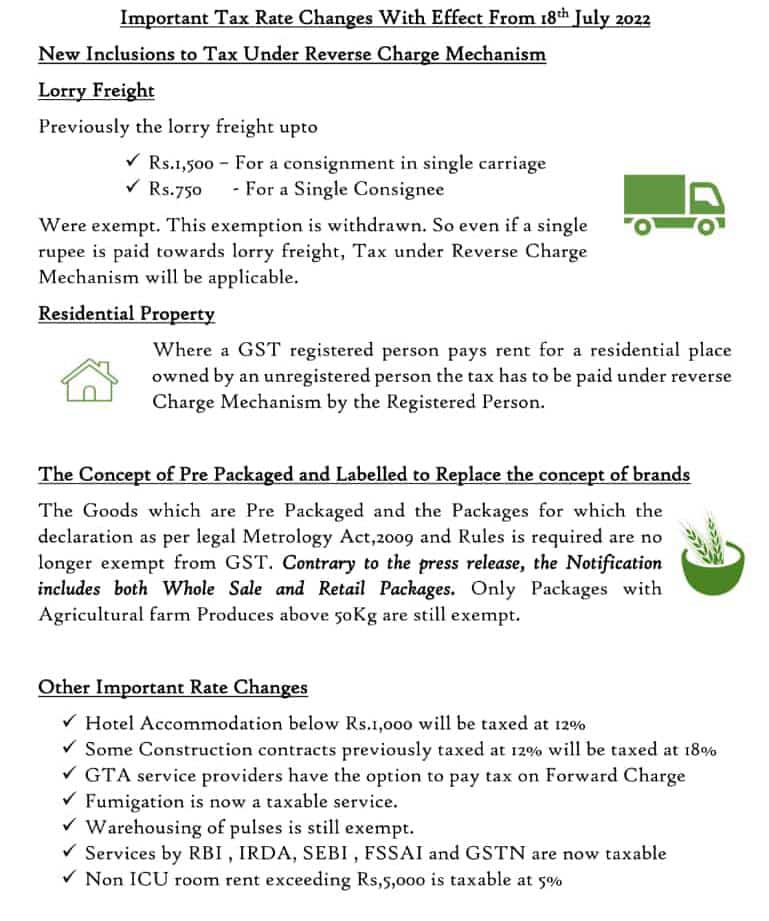

- While the GST council recommend to remove some tax exemptions and adjust some rate structures, many other exemptions were eliminated.

- Beginning from Monday, Customers will pay extra for variety of commodities, including furniture, lodging and banking services as new GST rates go into effect on July 18.

- At the 47th Council Meet, which was held last month in Chandigarh and presided by Union Finance Minister Nirmala Sitharaman, the GST rates were raised on a number of commodities.

- While the GST council planned to abolish some tax exemptions and adjust the rates for others, several exemptions were actually removed. Additionally, the council voted to eliminate duty inversion on commodities whose input taxes were higher than output taxes.

Things getting expensive from July 2022 onwards :

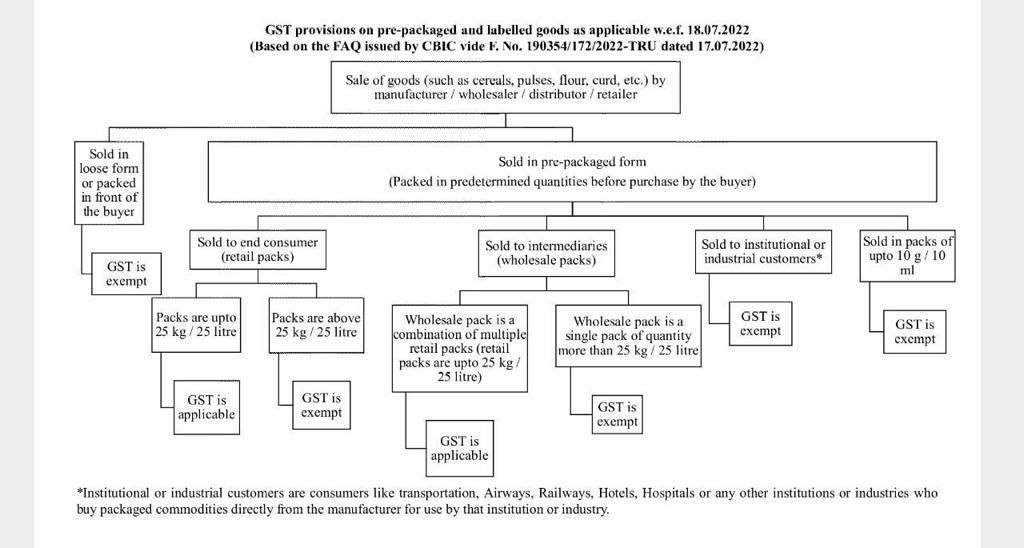

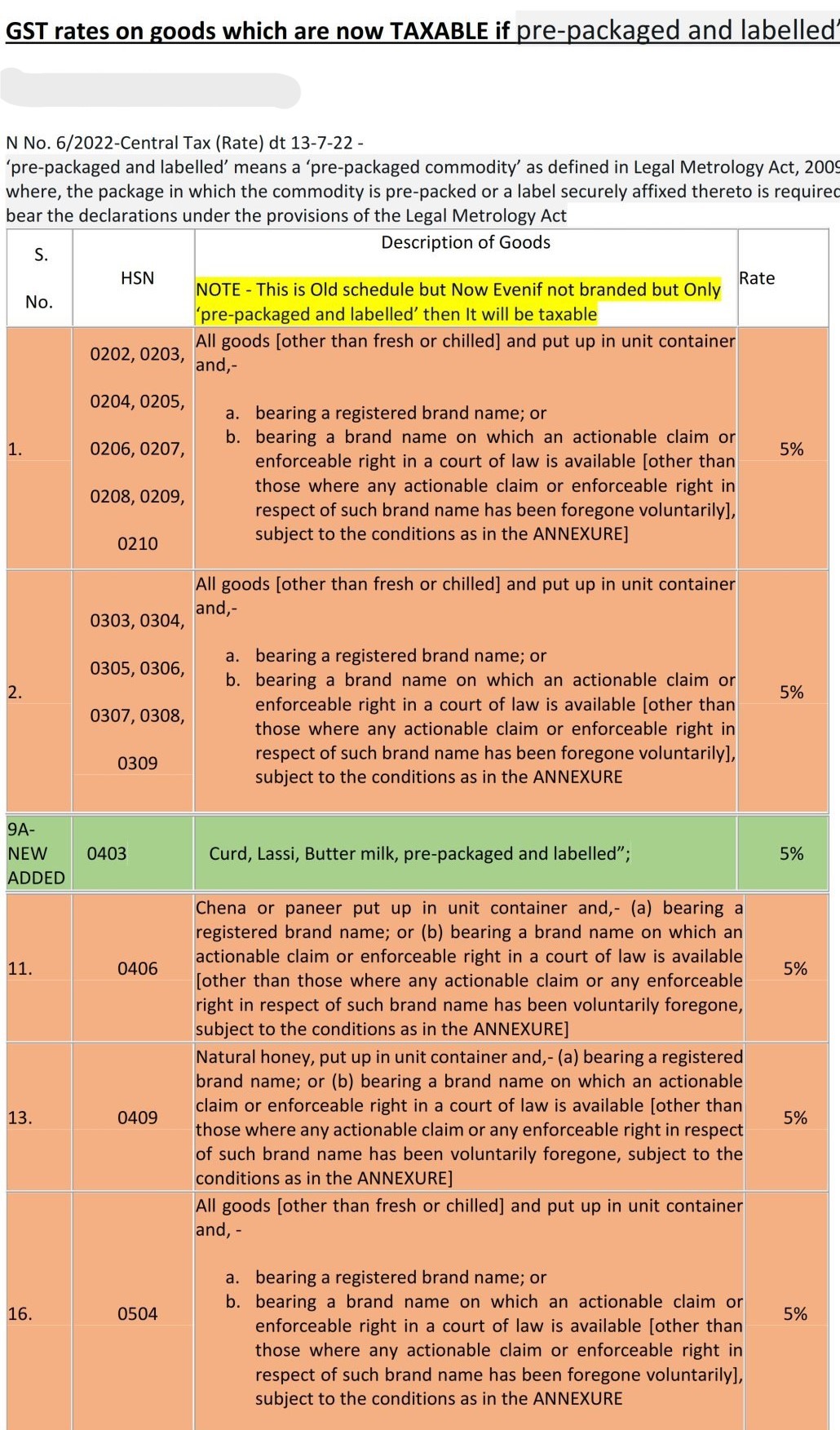

- There is a 5% GST on marked and branded, pre-packaged foods including atta, paneer, and curd.

- A 12 percent GST is charged on hotel rooms with daily rates up to Rs 1,000.

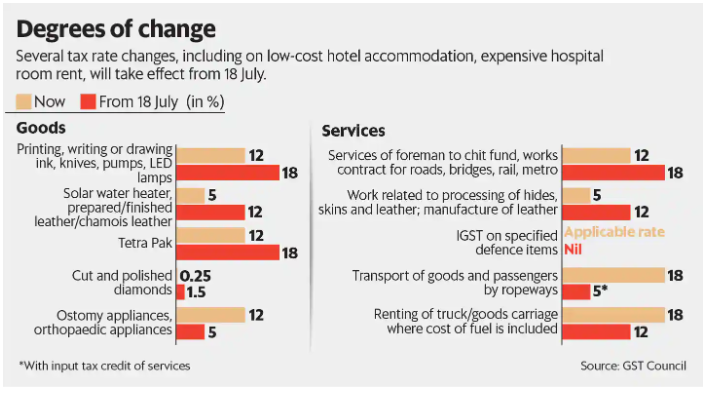

- Tetra packets, check that are lost or in the book form will attract 18% GST.

- 18% on ink, knives, pencil sharpeners, LED lamps, spoons, forks, blades, skimmers, cake servers, ladles, fixtures, and associated metal printed circuit boards

- The GST rate on Solar Water heaters has increased to 12% from 5%

- Work order for a crematorium, effluent treatment facility, metro, and bridges are come under 18% GST slabs.

- 5% GST on rooms at hospitals (apart from ICU) with rent over Rs. 5,000

GST on Pre-packaged

Areas were we can Save money from July 2022 onwards:

- A reduction in the sales tax to 5% from 12% for Ostomy appliances and products and persons transported by ropeways.

- The tax rate for renting trucks and goods carriage that includes the cost of fuel, has been reduced to 12% from the previous 18%.

- Only economy class flights are exempts from the GST when travelling to and from north eastern states and Bagdogra.

- Electric vehicle, whether or not they are equipped with a battery subject to a 5% GST.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.