Why is belated ITR is different from regular ITR?

Table of Contents

Why belated ITR is different from a regular income tax return?

- The best option way to file an income tax return is always before 31st July, we clarify further what comes after missing the deadline for filing an Income tax return.

- The due date for filing an income tax return is 31st July 2022 declared by the income tax department it is compulsory for every taxpayer with a yearly income more than Rs 2.5 lakh. Still some taxpayer might face difficulty in filing an ITR and not able file ITR in within the time period of 31st July.

How is a belated return different from a revised return?

- A belated return must be filed if the taxpayer’s income tax return was not filed by the due date required or within the given timeframe stated in a notification issued by an assessing officer. A revised return may be filed if the assessee finds any errors, mistakes, or false statements or any omission, fault or wrong statement

- While a belated income tax return is submitted after the due date. In that situation, they have timeline 31st Dec 2022, to submit a late income tax return. But a normal Return is submitted before to the due date.

Can we file income tax returns for the last three years now?

- No, we cannot file an income tax return for the last 3 years together, only one year ITR file, and from current financial one more older year ITR can be file after.

What happens in case you have missed the deadline of income tax return filing ?

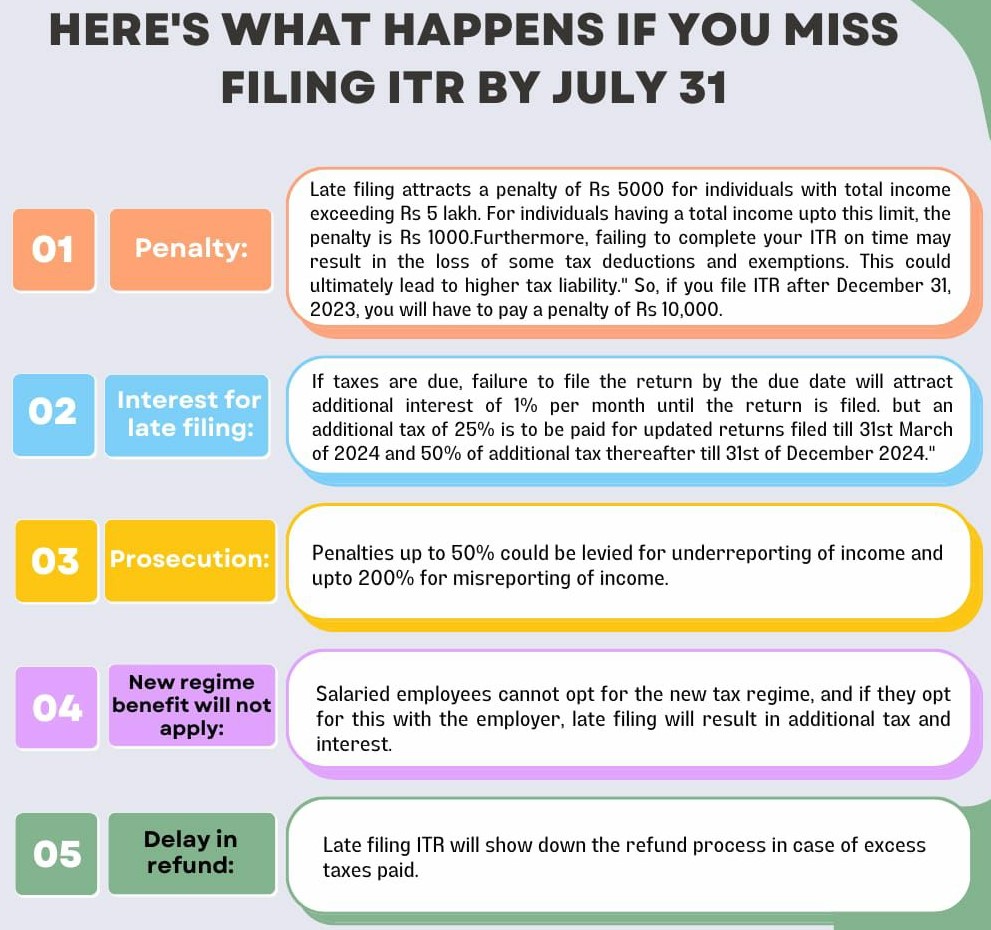

If a taxpayer files their ITR after the deadline, they may be liable to a penalty of up to Rs 5,000. For individuals whose annual total income does not exceed Rs. 5 lakh, the maximum fine for filing a belated ITR is Rs 1,000.

What is the penalty for filing a belated return?

- As per the changed income tax rules notified under Section 234F of the Income Tax Act, filing our Income tax return post the timeline, can make you liable to pay a maximum penalty of INR 5,000. We needed to pay penalties/Fee if you file a belated income tax return:

As follows:

- INR 1000, if the yearly income is less than INR 5 lakhs.

- INR 5000, if the annual income crosses INR 5 lakhs.

If you are filing the belated income tax return, some other fee/charges/interest will be assessed along with penalties.

Interest is applicable on outstanding tax liability payable.

- In case there is an outstanding income tax liability after July 31st, 2022, there is a 1% interest rate that will be applied to any unpaid/ outstanding amount. Whether or not the tax amount was accidentally filed wrong by mistake or not.

- The outstanding tax, including interest on the outstanding tax, is required to be deposited by the taxpayer on or before 31st July.

- Moreover, a full month’s interest must be paid for the whole month if the payment is made on the any date of the month. For example, if the payment of tax is made on the 6th day of any particular month, the full month is included for the tax calculation.

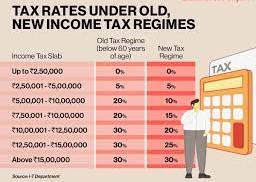

Tax to be paid as per tax slab applicability:

Implication of Carry forward the losses

- Taxpayers can minimize their tax liability by balancing or Carry forward the losses from the business operation activities or sale of the property against other incomes, tax payer can lower their tax outstanding dues, Losses may be Carry forward the losses over to the succeeding years.

- However, the carried forward/offsetting or Carry forward the losses are not available in the in belated ITR. The dues can only be Carry forward the losses if the return filing is made within 31st July.

What are transactions that are compulsory to be mentioned in the Income Tax return for FY 2022-23?

The below-mentioned transactions are compulsory to be stated in the income tax return:

- The actual cost of the house property: The index cost of the property sold/purchased was needed to be filled in on the income tax return. In FY2022-2023, assessors were required to state the actual cost of the house property.

- Provident fund (Provident Fund account): If you earn an interest higher than INR 2,50,000/- per annum on the Provident Fund account, it needs to be mentioned in the income tax return.

- House Property in a Foreign Country: If you own a house in any foreign land, its details are also necessary to be mentioned in the income tax return. Moreover, Tax dept may may ask you for information or details with respect to your foreign income.

- Sale/purchase of house property: If you have sold house property between April 1, 2022, & March 31, 2023, its details must also be state in the ‘Capital gains’ column.

- House property renovation: If you have made renovated your house property in the previous FY (2022-23), complete information/details about it shall be stated in the ‘capital gains’ column in the income tax return.

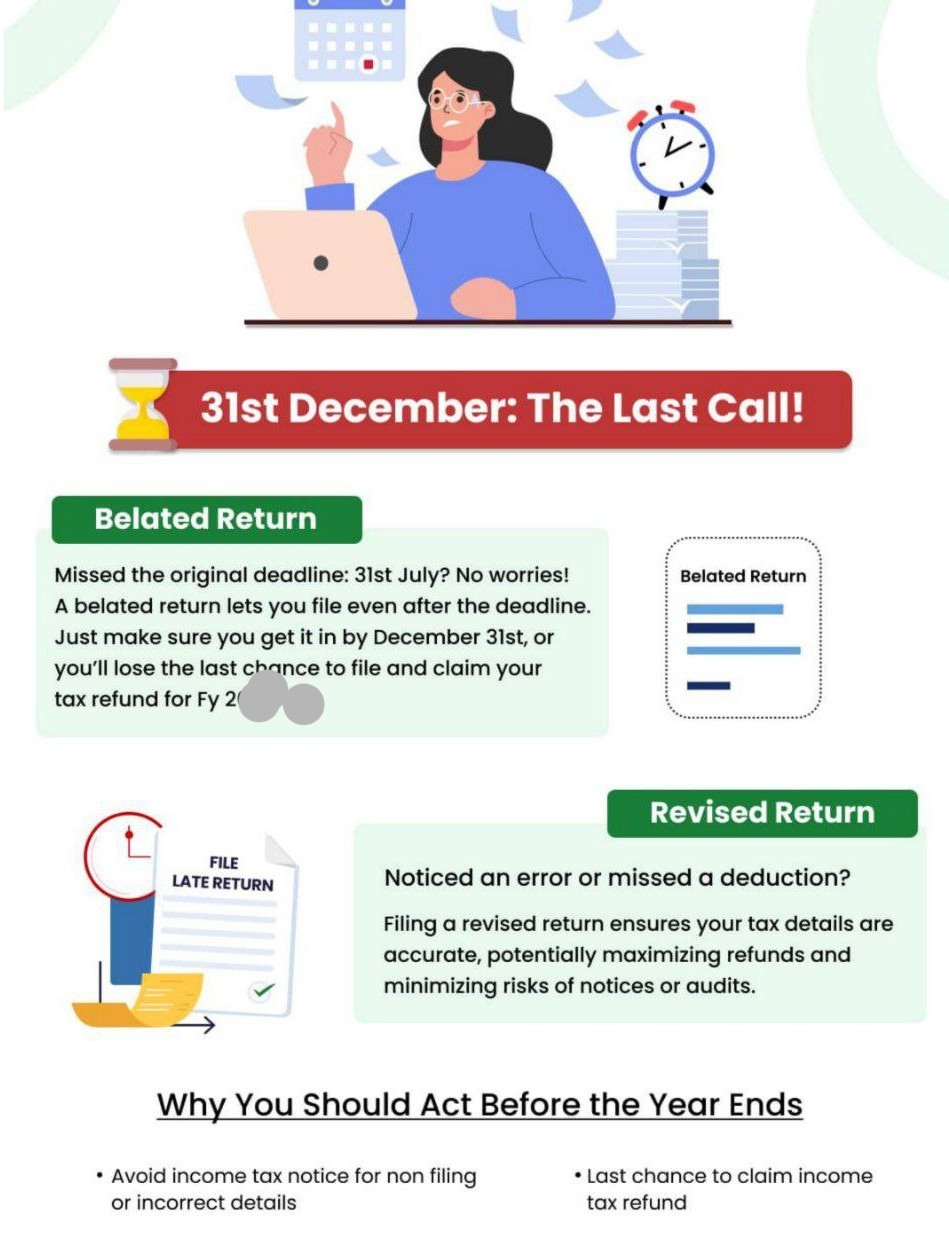

Last Chance Alert!: ITR Filing & Refund Claim Deadline 31 Dec 2025.

31 Dec 2025 is the FINAL date to file ITR & claim a refund for AY 2025-26.

Income Tax Return Filing: Taxpayers must file their belated or revised ITR by 31 December 2025 to remain eligible for refunds and avoid permanent loss of claims for AY 2025-26. File Your ITR & Claim Refund by 31st December 2025 (AY 2025-26) Miss the deadline, lose the opportunity.

Consequences of Missing the Deadline

- Loss of Refunds: TDS on salary, FD interest, professional income, & Excess advance/self-assessment tax

- No Revision of Errors

- Loss of Carry-Forward of Losses : Business, speculative, capital losses

- Penalties & Compliance Risks : Late fee u/s 234F; Interest u/s 234A/B/C; AIS/TIS mismatch alerts

Who Must File Before 31 Dec 2025

- Anyone expecting a refund

- Salaried individuals with excess TDS

- Freelancers, professionals, business owners

- Senior citizens with FD interest subject to TDS

- Students/interns earning taxable income

Condonation of Delay (u/s 119(2)(b)) :

Possible but uncertain & Updated ITR (ITR-U) :

- Can be filed later, but refund cannot be claimed

- File ITR before 31 Dec 2025 if any refund is due

- Reconcile Annual Information Statement and Taxpayer Information Summary Form 26AS, and bank interest

- Revise incorrect returns before the deadline

- Educate family members to avoid losing refunds

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.