Significantly improve ‘Ease of Doing Business in India

Table of Contents

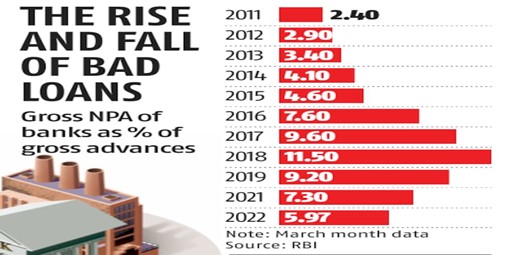

Non-Performing Assets (NPAs) of Banks

The Gross Non-performing assets (GNPAs) of banks are expected to Cross ₹10 lakh Crore by March 2022, an ASSOCHAM-CRISIL Joint Study.

“NPAs are expected to rise to 8.5-9 percent by March 2022, driven by slippages in Retail, Micro, Small and Medium Enterprise (MSME) Accounts, besides some Restructured Assets,”

Bank Loans are to be recovered through:

- Earlier –Filing of Cases in Civil Courts.

- Compromise – Bank, and Borrower.

- SARFEASI, 2002.

- DRT / DRAT.

- Through Lok Adalat.

- Write-Off the Loans.

- Sale to ARCs.

- IBC 2016

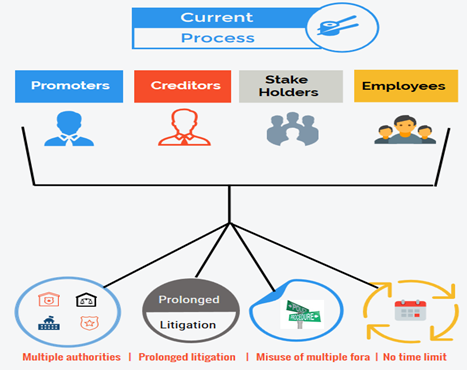

Why the new code is required to resolve business failures

Limitations under the current process

Why and How It Happens?

- Liquidity Problem

- Delay in Operations

- Disruption in Operation

- Delay in Payment

- Operational Loss

Kingfisher Airlines – Case Study

- Kingfisher launched in 2005

- Nov-2005 : Ordered 30 Airbus Planes

- Year-2006 – Despite Losses – KFA ordered more 5 Airbus

- Year-2011 – Bankers agreed to lend another Rs.8000 crores to restructure loans.

- Year-2009 – Despite Losses – Launched International Routes

- Year-2007 – Despite Losses – Buys 26% stake in Deccan Airlines.

- Dec-2011 – Chairman CBEC considering legal Action against KFA.

- Year-2012 – Kingfisher starts cancelling flights and Service Tax Dept frozen around 40 Bank A/Cs of KFA. And delay in salary to employees of KFA.

Group Insolvency

- Group Insolvency is a framework where if multiple entities of a single corporate group go insolvent, their resolutions can be consolidated in one court so that firstly, the group can be restructured as a whole, and secondly, its combined assets can be utilized in the best interest of both the group corporate and the debtor.

- This structure allows substantive consolidation which enables the clubbing of assets and liabilities of the group members in a way that they can be treated as a single economic organism.

- The Insolvency and Bankruptcy Code (‘Code’) provides detailed provisions to deal with the insolvency of a corporate debtor on a standalone basis, it does not envisage a framework to either synchronize insolvency proceedings of different corporate debtors in a group or resolve their insolvencies together.

- Consequently, the insolvency of different corporate debtors belonging to the same group is dealt with through separate insolvency proceedings for each corporate debtor.

- However, in the insolvency resolution of some corporate debtors, special issues arose from their interconnections with other group companies. While the Code is silent about group insolvency, the courts are trying to fill in this lacuna through judicial pronouncements.

- Group Insolvency can be tackled by either Procedural Co-ordination or Substantive Consolidation. The process of procedural co-ordination is what the Indian courts have adopted in most group insolvency cases that have been tackled.

- The Insolvency and Bankruptcy Board of India (‘IBBI’) constituted a Working Group on Group Insolvency on January 17, 2019, which submitted its recommendations for the framework of the procedure of group companies as ‘Report of the Working Group on Group Insolvency’ on September 23, 2019.

Top 12 Defaulters

| S.no. | Name of CD | Successful Resolution applicant | Amount Admitted

(in cr) |

Amount Realised

(in Rs cr) |

% of Claims Released |

| 1 | Electrosteel Steels Limited | Vedanta Limited | 13175 | 5320 | 40.38 |

| 2 | Bhushan Steel

Limited |

Bamnipal Steel Limited | 56002 | 35571 | 63.50 |

| 3 | Monnet Ispat & Energy

Limited |

Consortium of JSW and

AION Investments Pvt. Lt |

11015 | 2892 | 26.26 |

| 4 | Essar Steel India Limited | Arcelor Mittal India Pvt Limited | 49473 | 41018 | 82.91 |

| 5 | Alok Industries Limited | Reliance Industries Ltd., JM

Financial Asset Reconstruction Company Ltd. |

29523 | 5052 | 17.11 |

| 6 | Jyoti Structures Limited | Group of HNI led by Mr Sharad

Sanghi |

7365 | 3691 | 50.12 |

| 7 | Jaypee Infratech Limited | NBCC (India) Ltd | 23176 | 23223 | 100.20 |

| 8 | Bhushan Power and steel Limited | JSW Ltd. | 47158 | 19350 | 41.03 |

Recovery under IBC v/s Other Forums

| Lok Adalats DRT’s SARFEASI IBC | |

| Recovery %

FY 2018 |

Recovery %

FY 2019

|

| 4% | 5% |

| 5% | 3% |

| 32% | 14% |

| 50% | 43% |

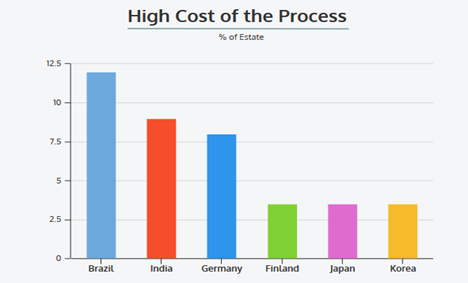

Ease of Doing Business in India

- According to the Ease of Doing Business Report 2020, India’s overall ranking has improved by 67 places to 63rd position among 190 countries since the inception of the Code.

- With this India earned a place among the world’s top ten improvers in ease of doing business, for the third consecutive year

- The Code has improved the India’s ease of doing business’s ranking and also has resulted in better realization of dues by the creditors

Ease of Doing business in India & Role of ‘resolving insolvency’ parameters

| Particulars | 2016 | 2017 | 2018 | 2019 | 2020 |

| Rank in

Resolving Insolvency |

136 | 136 | 103 | 108 | 52 |

| Time (yrs) | 4.3 | 4.3 | 4.3 | 4.3 | 1.6 |

| Recovery Rate (Cents in dollar) | 25.7 | 26 | 26.4 | 26.5

|

71.6 |

Objectives of the Code IBC, 2016 – Timeline

| 2014 | 2015 | 2016 | 2016 |

| August 2014 Bankruptcy Law Recovery Committee was formed.

|

Nov 2015 – Draft bill submitted by BLRC

Dec 2015 – IBC Bill was introduced in Lok Sabha

|

05 May 2016 – Passed by Lok Sabha.

11 May 2016- Passed by Rajya Sabha

|

28 May 2016-Received President’s accent.

01 Dec 2016 – IBC came in to effect.

|

- The Insolvency and Bankruptcy Code, 2016 (“Code”) which seeks to streamline and consolidate bankruptcy, insolvency, and liquidation laws in India were introduced in Lok Sabha on December 21, 2015, by Finance Minister, Late Shri. Arun Jaitley.

- Subsequently, after the incorporation of several comments given by the Joint Committee of Parliament the Code was finally passed by Lok Sabha and Rajya Sabha on May 5, 2016, and May 11, 2016, respectively.

- Finally, the Code received the assent of the President on the 28th of May 2016.

Preamble States of IBC Code :

- “Consolidate and amend the laws relating to reorganization and insolvency resolution of corporate persons, partnership firms, and individuals in a time-bound manner for maximization of value of assets of such persons, to promote entrepreneurship, availability of credit, and balance the interests of all the stakeholders including alteration in the order of priority of payment of Government dues and to establish an Insolvency and Bankruptcy Board of India, and for matters connected therewith or incidental thereto”.

Introduction to IBC and Regulatory Framework :-

- Restructuring laws in India prior to IBC, 2016.

- Objectives of the Code.

- Scheme of the Code.

- Four Pillars of IBC, Insolvency Professionals.

- Insolvency Professionals Agencies (IPAs).

- The Insolvency and Bankruptcy Board of India.

- Adjudicating Authorities: NCLT, NCLAT, and the Supreme Court of India.

- Insolvency Professional Entities.

- Legal and Regulatory Framework of the Code.

- Bankruptcy Law Reforms Committee.

Key Highlights of Insolvency & Bankruptcy Code, 2016

Objective behind the Code:

- This code seeks to consolidate and amend laws relating to reorganization / revival and insolvency resolution of Corporate Persons, Partnership Firms and Individuals in a time bound manner.

The IBC code seeks to amend the following 11 laws:

- Indian Partnership Act, 1932.

- Central Excise Act, 1944.

- Income Tax Act, 1962.

- Recovery of Debts due to banks and financial Institutions Act, 1993.

- Finance Act, 1994.

- Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002.

- Sick Industrial Companies (Special Provisions) Repeal Act, 2003.

- Payment and settlement System Act, 2007.

- Limited Liability Partnership Act, 2008.

- Companies Act, 2013.

Repeal 2 Laws

- Presidency Towns Insolvency Act, 1909.

- Provincial Insolvency Act, 1920

Benefits of Insolvency & Bankruptcy Code, 2016

- Time bound settlement of Insolvency.

- The Insolvency and Bankruptcy Board of India will keep watch.

- Banks and Asset reconstruction companies immediate gainers.

- Locked-up assets will be freed.

- Comprehensive Coverage – Companies, Partnerships, LLP, Individuals and more can be added.

- Faster turnaround of Businesses

- Database of serial Defaulters.

- Shift from Equity to Debt.

- Creation of Bankruptcy Regulator.

- Protect workers

- New Class of Insolvency Professionals.

- Lift lender comfort.

- Significantly improve ‘EASE OF DOING BUSINESS’.

IFCCL Services

India Financial Consultancy Corporations Pvt Ltd offer a range of services as per your needs : –

- Risk Management and Internal Audit: Review of Operations, Illustrative Coverage in Business Processes, Management Issues tailored as per your needs.

- Taxation: Transactional advice and tax planning relating to Corporate, Non-Corporate Entities etc.

- Advisory Services: Business Strategy, Corporate Restructuring, Corporate Finance, Shareholder Wealth Management, Corporate Governance, Building Accounting Manuals, Global Accounting Services.

- Valuations: Business Valuation, Real Estate, Brands, Intangible Assets, Securitization etc.

- Financial Reporting & Compliances: Setting Up, Running and Supervising Financial Accounting, Tax Payments (Direct, Indirect and Employee Related), including MIS, Interim Financial Statements, Data Analytics and More…

- Regulatory Filings: Filings with MCA (ROC), RBI, FEMA, FCRA, Municipal Corporation, Sub Registrar

- Legal Advisory & Support: We support in managing your litigations by coordinating with lawyers on our panel or as identified by client to offer support and systematic approach.

- IBC Services : We offer solutions related to IBC related services, like handling matters relating to Resolution Plan and related compliances under Corporate Insolvency Resolution Process (CIRP) and Pre-packaged Insolvency Resolution Process (PP-IRP).

- Family Office Service: Overall taxation impact minimization.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.