New Facility for taxpayer to quickly remove GST Suspension

New GST Facility for a taxpayer to easily & quickly remove a GST Suspension via GST Portal

- GST Taxpayer can now undo the GST Suspension thanks to a new feature introduced by GSTN By using a single click on his own.

- The GST platform now allows taxpayers to commence Drop Proceedings for registration suspension and remove the suspension on their own.

- GST website has created a new utility that can be used to evaluate whether to suspend the processes for suspending registration on the GST portal and to lift the suspension.

- According to @Infosys GSTN (GST Tech on Twitter), GST taxpayer may now initiate the Drop the GST Registration cancellation proceedings.

- Assessees who used to submit their required returns after receiving the show cause notice sent via the GST system are still in operation.

- Prior to this new GST functionality, even if the returns are given, the registration of the assessors who submit their required returns but fail to respond to the SCN will be suspended.

- However, certain assessments have the capability of executing drop proceedings after the required returns have been provided.

How the GST Portal Facilitates drop of Proceedings for GST Registration suspension

- Such taxpayers can now independently access drop proceedings thanks to the new feature. If the all GST returns have been submitted with in the time, they can easily revoke their suspension with the press of a button.

- When Assessee submits the required returns but the suspension of their GST Registration status remains, they are able to remove the suspension with a single click by completing the drop procedure.

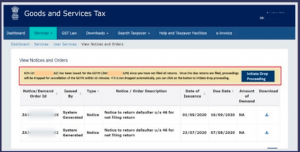

- GST Taxpayer is enabled to log on to the GST portal > Services > User Services> View Notices and Orders> Click on‘Initiate Drop Proceeding’, to use the facility.

- The measure may be significant since it limits court litigation. Since the assesses were dissatisfied with the GST department’s decision to suspend enrolment, several writ petitions were sent to the High courts.

- Moreover, GST Tribunal has not yet been established, there was no legal remedy available.

- GST taxpayers normally discover that the cancelled GST registration has been restored after completion of filling GSTR Return appx time is 15 minutes. But if the revocation does not occur automatically, they can use the “Initiate Drop Proceedings” facility.

Popular Articles :

- Complete Guidance on TDS applicable on Goods and Services Tax

- Analysis of Provisions of issue of Summon Under GST

- TDS & GST on Google or FB Ad words advertisements

- What is the process of applying instant free pan through aadhaar e-kyc

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.