Credit Guarantee Fund Trust for Micro and Small Enterprises

Credit Guarantee Fund Trust for Micro and Small Enterprises Scheme

To the first generation of entrepreneurs, the availability of bank loans without the hassles of collateral or third-party guarantees would be a vital source of support in realising their dream of founding a Micro and Small Enterprise. (MSE). In order to strengthen the credit delivery system and facilitate the flow of credit to the MSE sector, the Ministry of Micro, Small & Medium Enterprises (MSME), Government of India, developed the Credit Guarantee Scheme (CGS) with this goal in mind. The Credit Guarantee Fund Trust for Micro and Small Enterprises was established by the Government of India and SIDBI to make the programme operational. (CGTMSE).

Ministry of Micro, Small & Medium Enterprises (MSME), Government of India has enhanced the ceiling of coverage from Rs 200 lakh to Rs 500 lakh per borrower for availing credit guarantee for Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) Scheme for Micro, Small & Medium Enterprises (MSME) on 31 March 2023. The extent of coverage is for Micro, Small & Medium Enterprises (MSME) including trading activity.

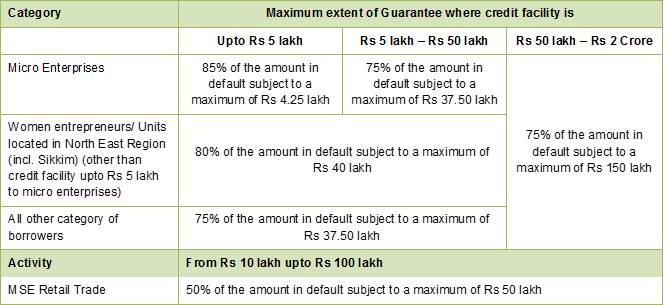

- In case of SC/ST entrepreneurs or Women entrepreneurs or MSE promoted by Agniveers / MSEs situated in Aspirational District or Person with Disability (PwD) or ZED certified MSEs: 85 percentage (upto INR 500 lakh), All other category of borrowers 75 percentage (upto INR 500 lakh),

- In case of Micro Enterprise: Maximum extent of Guarantee Coverage: 85 percentage (upto INR 5 lakh), 75 percentage (INR 5 lakh to INR 500 lakh),

- In case of MSEs located in NER 75% (incl. Sikkim, UT of Jammu & Kashmir & UT of Ladakh) : 80 percentage (upto INR 50 lakh), 75 percentage (INR 50 lakh to INR 500 lakh),

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) Scheme Charges (in addition to the interest by the bank)

Slab Standard Rate *

0-10 lakh 0.37 Per annum

10-50 lakh 0.55 Per annum

Above 50-1 crore 0.60 Per annum

Above 1-2 crore 1.20 Per annum

Above 2-5 crore 1.35 Per annum

All Private sector banks or Public Sector banks provide Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) Scheme as Member lending Institutions (MLIs).

As soon as the credit facilities are approved, the lender should pay for them. When working capital facilities alone are provided to borrowers, the guarantee will begin on the date the guarantee fee is paid and continue for the duration of the term credit, or for such longer period as the Guarantee Trust may specify in this regard, up to 5 years in the case of term loans or composite loans

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.