GSTR-3B Vs GSTR-9 Vs GSTR-1:How do 3 GST business returns

Table of Contents

GSTR-3B Versus GSTR-9 Versus GSTR-1: How do three business returns differ from each other?

- Every GST Identification Number holder is mandated to file a Goods and Services Tax (GST) return. There are approximately 22 different kinds of Goods and Services Tax returns, four of which are suspended and eight of which are view-only in format. The remained 11 must be filed based on the GST Taxpayer category, which includes TDS deductors, e-commerce operators, non-resident taxpayers, ISD, composition taxable persons, regular taxpayers, and others.

- An annual return is GSTR 9. The GST-registered taxpayers are required to submit this GSTR 9 annual return once each year.

- All of your company’s inward supplies (purchases and expenses) and outward supplies (sales and any other services offered) made or received during the relevant financial year are included in GSTR 9. This process is carried out under the several tax heads, including the HSN codes, SGST, CGST, and IGST.

- The GSTR-1, GSTR 2A, and GSTR 3B monthly/quarterly returns are included in this GSTR 9 filing and are submitted for the corresponding financial year.

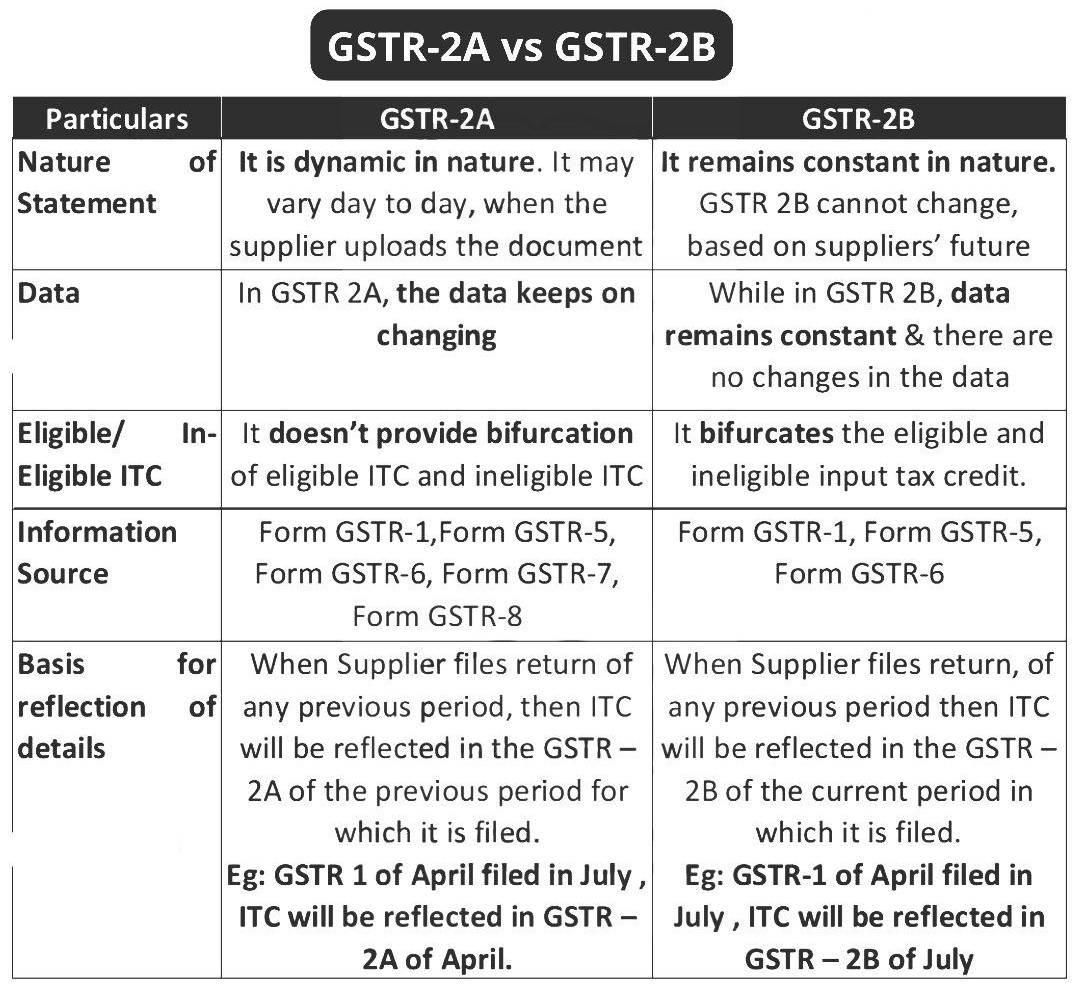

Comparison GSTR-2B and 2A

A normal business must file 3 GST Returns:

- GSTR -3B, GSTR-1 is a monthly return & GSTR-9 is a yearly kind of GST return. What they’re all about is as follows:

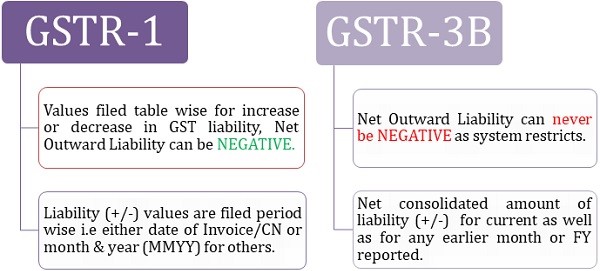

- GSTR-1 is a kind of monthly return statement of outward supplies to be furnished via GST Taxpayers for supplying goods & Services or both via exchange, lease licence, rental, barter, transfer, sale, or other means. Although if your company’s turnover in the Lasy previous financial year was up to INR 5 Crore or is expected to be up to INR 5 crore in the current financial Year, you can use the Quarterly GST Returns with Monthly GST Payment (QRMP) scheme to submit GSTR-1 quarterly while paying tax dues monthly basis via challan.

- To submit the GSTR-1, you must provide invoice information for supplies to registered consumers other than inter-state supplies to unregistered consumers with an invoice value of more than INR 2.5 lakhs.

- Moreover, Details of credit/debit notes issued against invoices, an Harmonized System Nomenclature/ services accounting codes wise summary of outward supplies, summarized state-level details of supplies to unregistered consumers, details of advances received in relation to future supply and their adjustment; nil-rated, exempted, and Non-GST supplies; and details of export of goods and services, including deemed exports (SEZ) are also required.

- On the other hand, GST Taxpayers under the GST Composition scheme are exempt from filing GSTR-1. Businesses with a turnover of less than INR 1.5 Crore can choose for the GST Composition scheme, which allows them to submit only quarterly GSTR-4A return instead of an Annual GSTR Return. Non-resident foreign taxpayers, providers of online information database and access retrieval services, Input Service Distributor, TDS diductors, & e-commerce platforms collecting TCS are also not needed to filing GSTR-1.

- The 11th day of the next month is the deadline for submit GSTR-1 for a given tax period. The 13th day of the month succeeding the end of each quarter is the deadline for those who submission of it quarterly.

Goods and Services Tax Return – 3B

- GSTR Return -3B is simply a summary return of outward supplies & claiming of ITC credits, as well as taxes paid. It could be submitted online via Goods and Services Tax Portal by going to the ‘Services’ tab, then ‘Returns’ & ‘Returns Dashboard’. Form GSTR-3B would be displayed after you select the FY and tax period.

- To avoid data mismatches, sales and input tax credit information should be reconciled with GSTR-1 before submission GSTR-3B.

- The deadline for those submission of it monthly is the Twentieth of the month that follows the tax period, & for those filing it quarterly under the Quarterly Returns with Monthly Payment Scheme, it is the Twenty Second & Twenty Forth of the month that follow the quarter for which the GST return relates. GSTR-3B must be filed, even if No business was conducted during in the specified tax period.

- In the scenario of a delay in submission of GSTR 1, GST taxpayer has to pay INR Fifty per day from the deadline, whereas in the scenario of NIL GST Returns, Late fee is INR 20 per day.

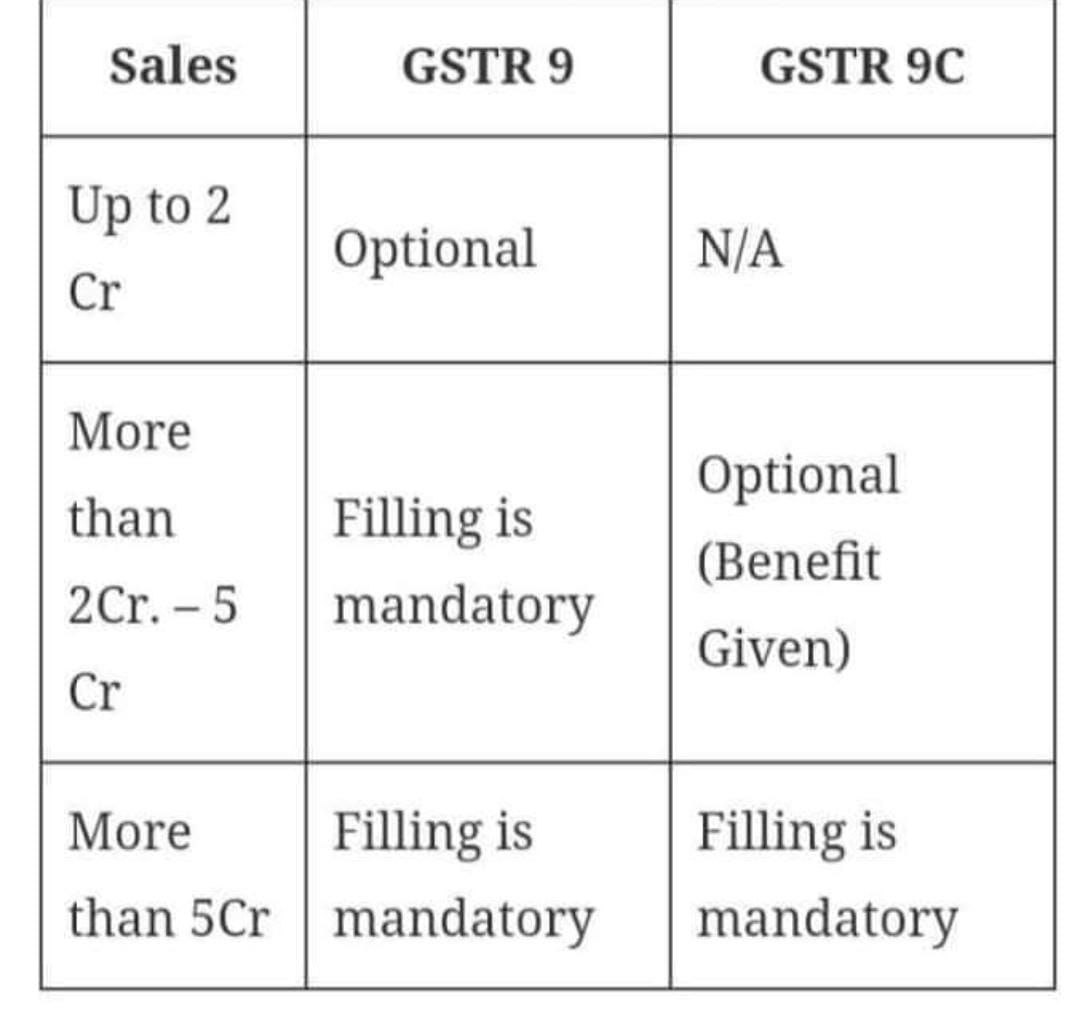

Annual GSTR return -9 & 9C

- Annual Goods and Service Tax Return-9 must be submit annually via all GST-registered taxpayers. This annual Gst Return includes information about Sales, ITC, purchases or refund claimed, or demand created etc under different tax heads like SGST, CGST & IGST.

- It is also a compilation of all quarterly returns and / or monthly filed by GST Taxpayers during the year. Although filing GSTR-9 is reportedly optional for businesses with a turnover of up to INR 2 Crore.

- GST Taxpayer who have chosen the GST composition scheme may file their annual returns in GSTR-9A instead of GSTR-9. Although, GST Taxpayer must file Annual GSTR-9 for the period in which they were registered as a regular taxpayer.

- On the other side, Online Information Database Access & Retrieval Services, GST Normal taxpayers, Input Service Distributor, & non-resident taxable persons Providers are not necessary to submit the GST Annual Return.

- Mandatory if your turnover is less than 5 cr GSTR9 mandatory & if your turnover is more than 5 cr then GSTR9 or GSTR9c both mandatory.

- Online Information Database Access & Retrieval Services (OIDAR) is a kind of service that is delivered over the Internet without any physical interaction with the service provider.

- Significantly, the GST Taxpayer can be filed GSTR-3B & GSTR-1 for the relevant Financial Year in order to file the annual return. The GST Annual Return must be filed by 31st December or Govt’s extended deadline on time to time.

- In case the delays in filing the GST Annual Return by originations with up to INR Five Crore in turnover incur a late fee of INR 50 Per day, which is maximum penalty of 0.04 percentage of sale.

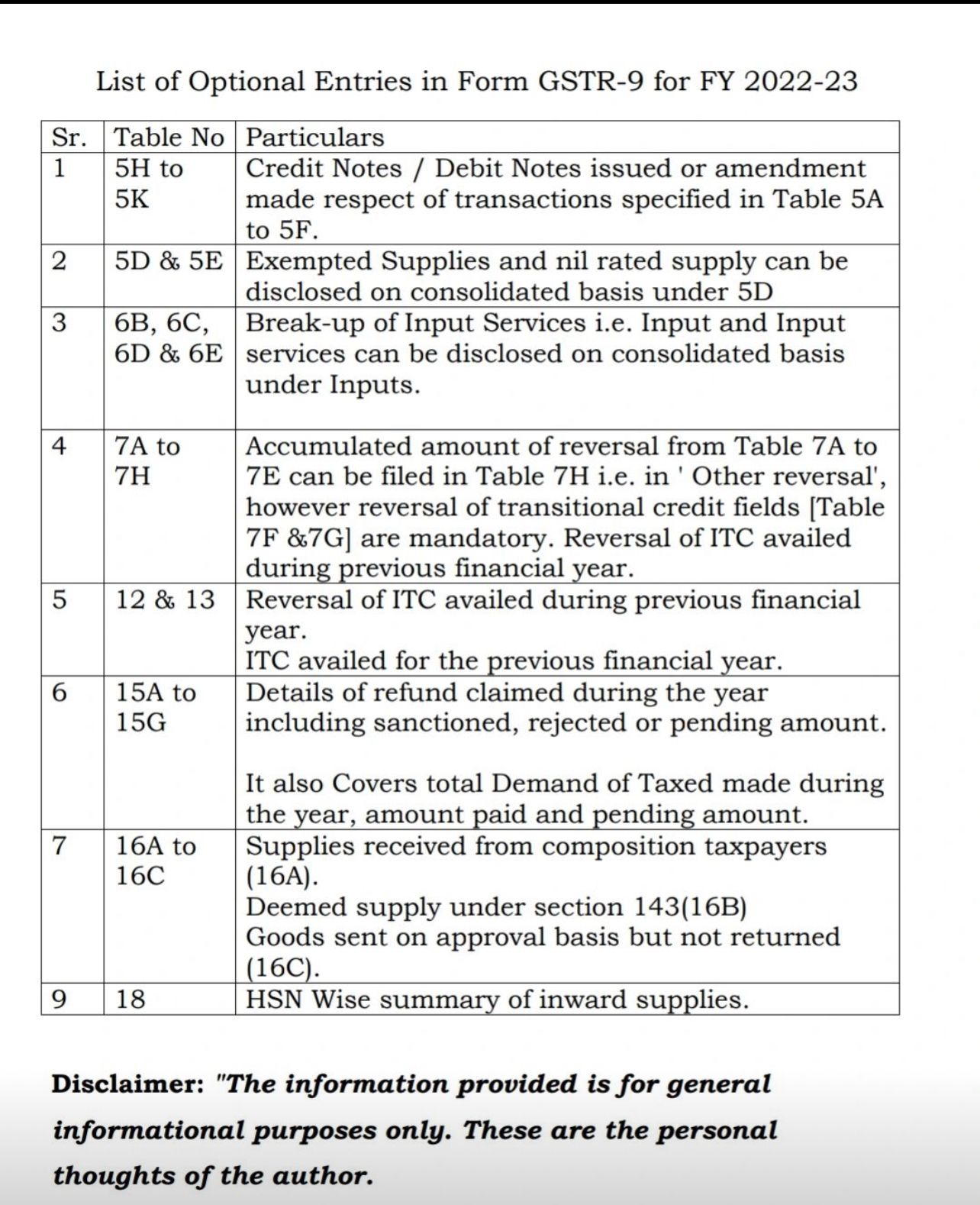

GSTR 9 : List of Optional Entries in Form GSTR -9 for FY 2022-23

Auto-Population of ITC in GSTR-9/9C (Starting FY 2023-24)

Starting from FY 2023-24, eligible Input Tax Credit for domestic supplies (excluding reverse charge and imports) will be auto-populated in GSTR-9 based on the data from GSTR-2B. This automation, which went live on the GST portal on 15th October 2024, aims to simplify the process for taxpayers by eliminating the need for manual input of ITC details.

The auto-population of Input Tax Credit will be available for annual returns GSTR-9 and reconciliation statements GSTR-9C, easing compliance for businesses and reducing errors in reporting. However, taxpayers must still verify the data for accuracy and ensure that any discrepancies are addressed.

Would you like further insights on how this affects the GSTR-9/9C filing process or other GST updates?

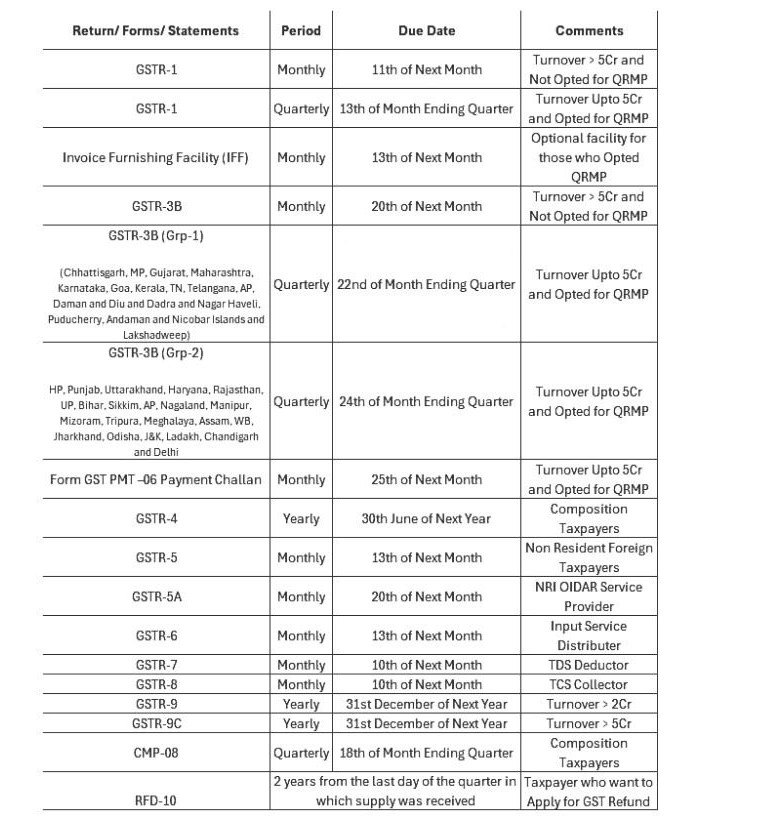

GST RETURN DUE DATES

Popular Articles :

- Complete Guidance on TDS applicable on Goods and Services Tax

- Analysis of Provisions of issue of Summon Under GST

- TDS & GST on Google or FB Ad words advertisements

- What is the process of applying instant free pan through aadhaar e-kyc

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.