Maintenance of Records and Rules of Arrest under PMLA

Table of Contents

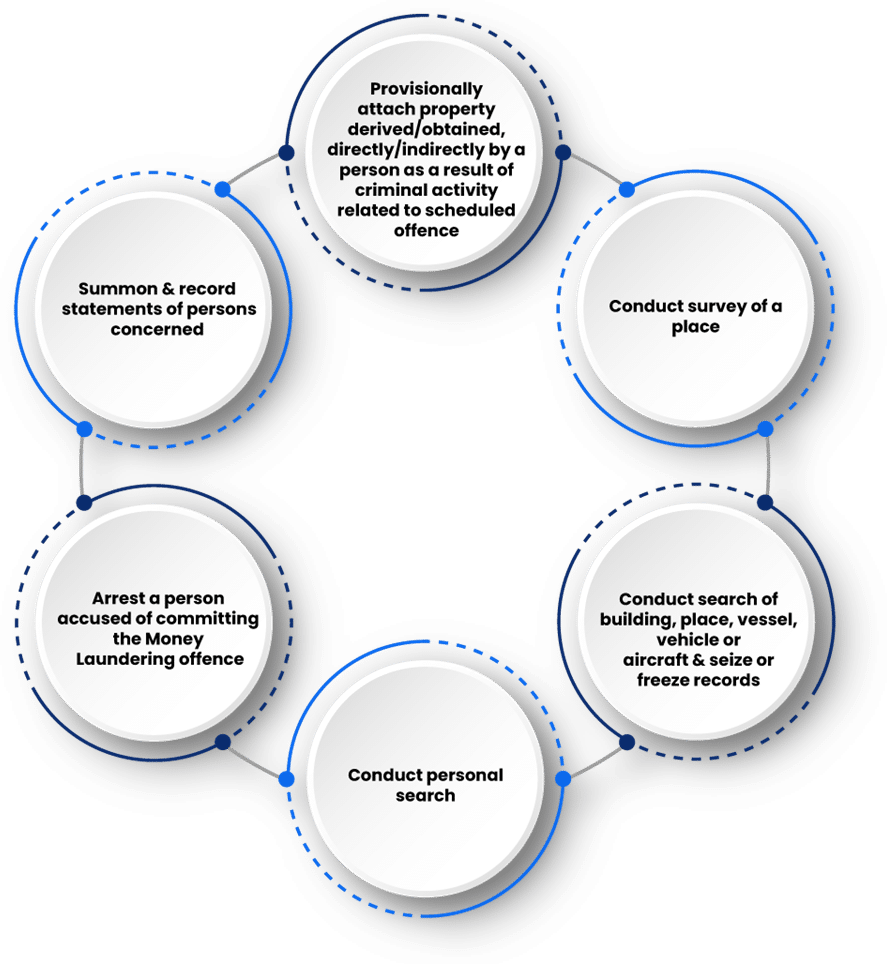

Element under the Prevention of Money Laundering Act

- Prevention of Money Laundering Act, 2002 is an act to prevent money laundering & to provide for confiscation of property derived from, or involved in, money-laundering & for matters connected therewith or incidental thereto.

-

- Punishment for money-laundering.

- Powers of attachment of tainted property.

- Adjudicating Authority.

- Presumption in inter-connected transactions.

- Burden of proof.

- Appellate Tribunal.

- Special Court.

- FIU-IND.

-

- Placement.

- Layering.

- Integration/extraction.

Arrest under the Prevention of Money Laundering Act,

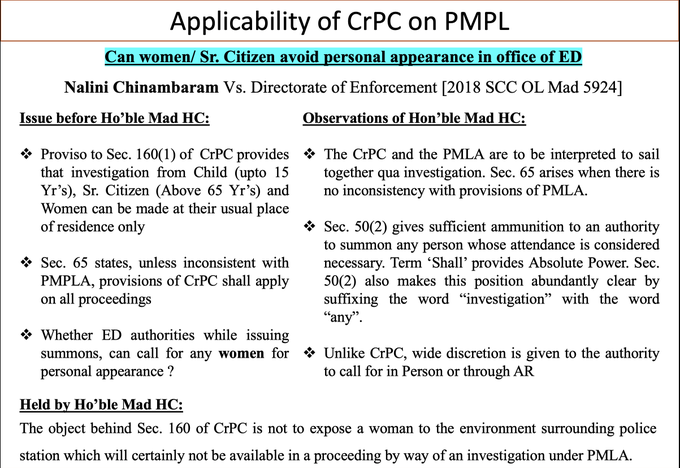

What rules and regulations applicable to arrests under PMLA Act ?

- According to the act, senior authorities authorised by the federal government may detain a person if they have “reason to believe” (to be documented in writing) that they have been responsible for an offence punishable under Prevention of Money Laundering Act, 2002 based on information in their possession.

- PMLA officer who is arresting the accused under Prevention of Money Laundering Act, 2002 needs to compulsory needed to prepare an index of the order copy and all the evidence/material they have in their possession. The officer appointed also required to sign every page of such index of the order copy & Moreover draft along with send a letter to the AA under Prevention of Money Laundering Act, 2002.

- No individual involved in a non-cognizable offence, against whom a complaint has been filed, reliable information has been received, or reasonable suspicion exists that he has been concerned, shall be arrested except under a warrant or order of a Magistrate, subject to the provisions of section 42 under Prevention of Money Laundering Act, 2002.

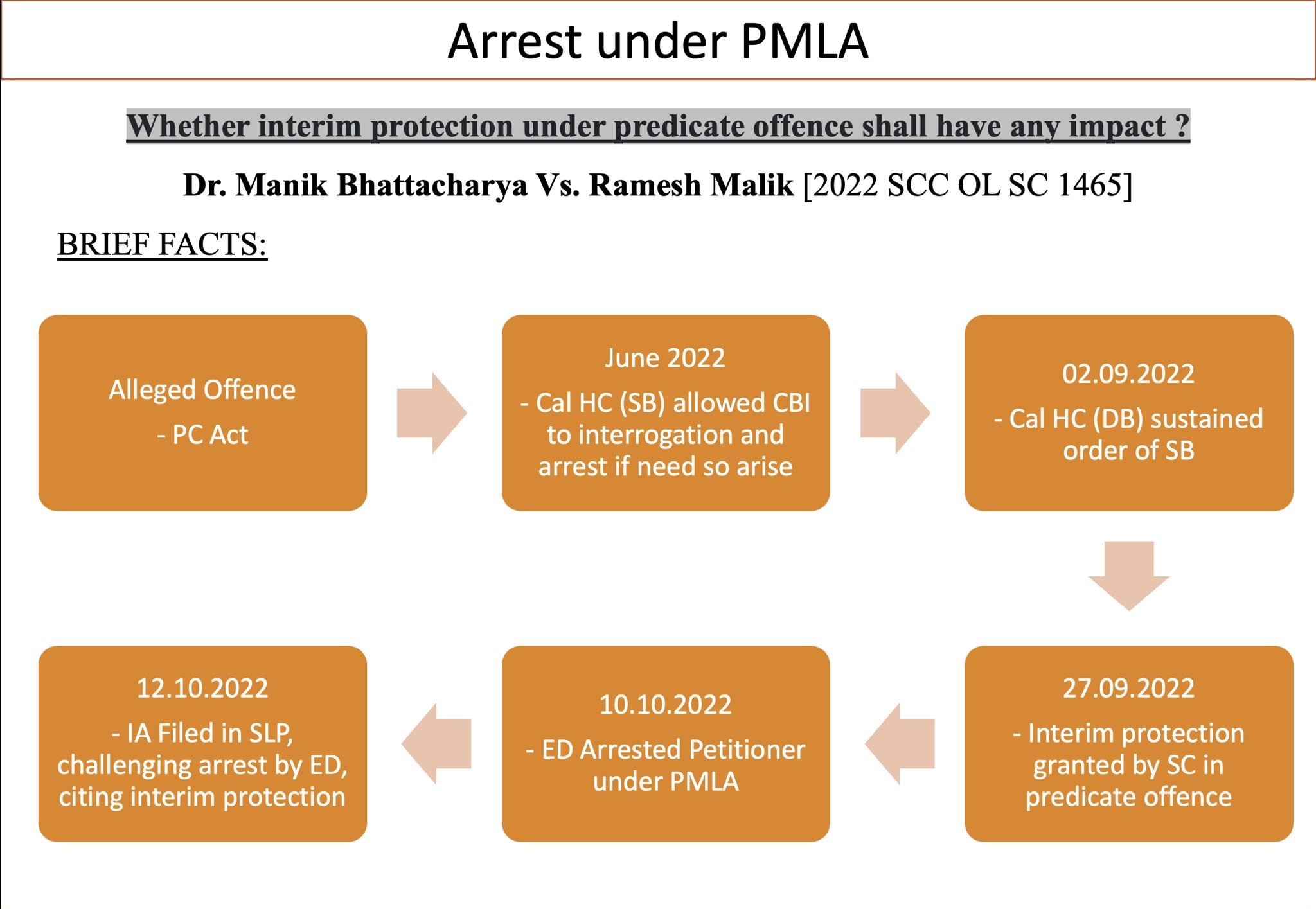

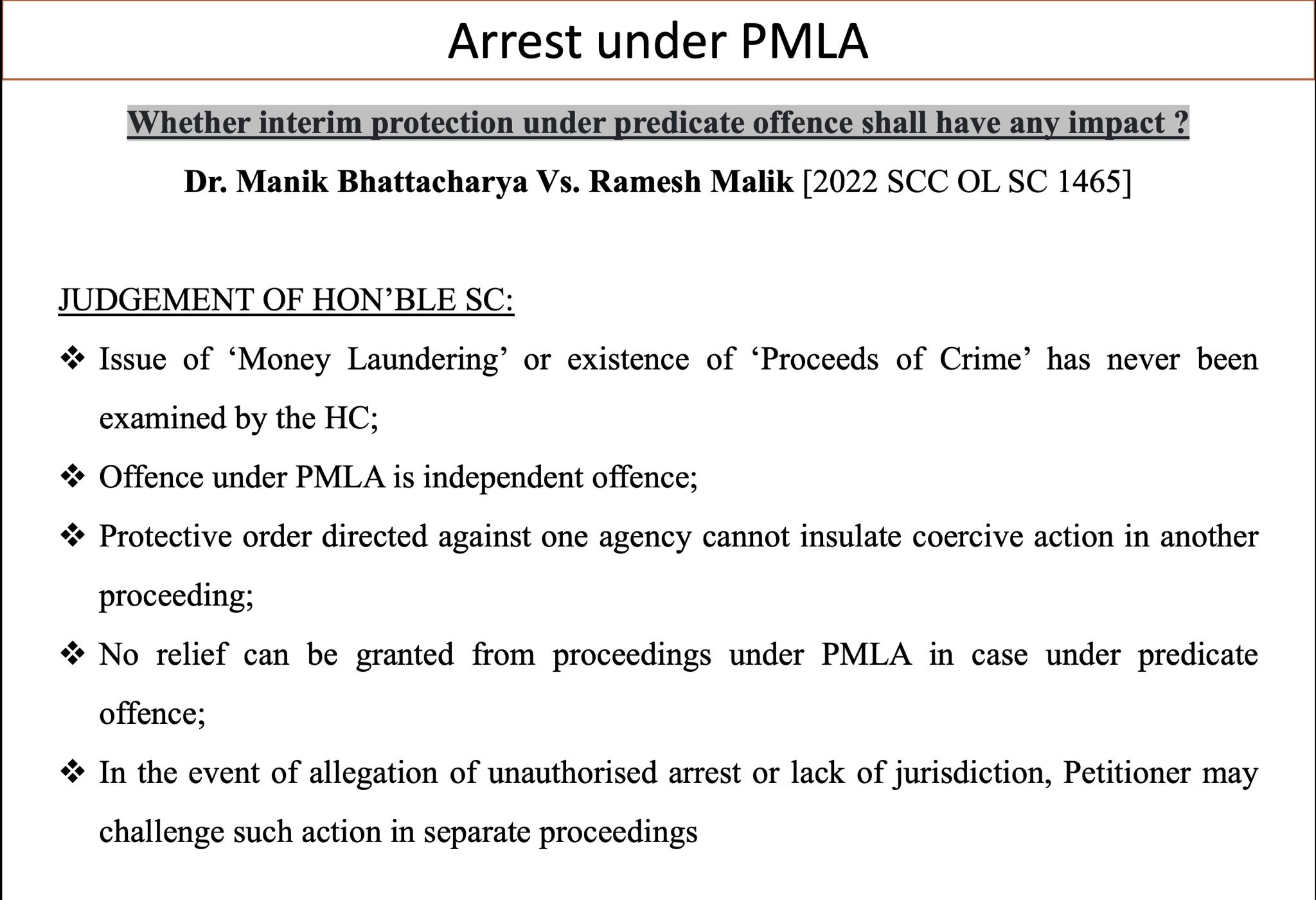

Whether interim protection under predicate offence, insulate accused under PMLA ?

Hon’ble SC answered in negative. in the matter of Dr. Manik Bhattacharya Vs. Ramesh Malik

PMLA (Maintenance of Records) Amendment Rules, 2023:

- The Prevention of Money Laundering Act, 2002 (PMLA) mandates financial institutions, banking companies, and intermediaries to maintain records of their client’s transactions and conduct due diligence to prevent money laundering.

- Prevention of Money Laundering Rules have now been amended with an aim to expand the scope of the Act to cover a wide range of cryptocurrency or virtual digital assets (VDA) transactions under the purview of Prevention of Money Laundering Act, 2002.

- Under the new amendment, activities by a person carrying on designated business or profession under section 2(1)(sa) of the Prevention of Money Laundering Act, 2002, shall also include the activities involving exchange between virtual digital assets and fiat currencies, or exchange between one or more forms of virtual digital assets and transfer of virtual digital assets.

- PMLA (Maintenance of Records) Amendment Rules extends the documentation requirements for client due diligence (CDD) beyond basic KYCs, such as registration certificates and permanent account number copies.

- The clients must now provide more detailed information such as the names of persons holding senior management positions, beneficiaries, trustees, settlers, partners, & authors, depending on the legal form of organization. Clients must also provide details on their registered office address and principal place of business to financial institutions, banking companies, or intermediaries.

NPO under PMLA now includes entities involved in charitable or religious activities

- Maintenance of records have been made more elaborate wherein on the one hand non-profit organisations have been linked to those nonprofit organization (NPO) which are constituted under section 2(15) of the Income tax Act, on the other hand Even a 10% & not 15 percentage of controlling interest in a trust would make a person have beneficial interest in the trust.

- In addition to other details, now if a client is a trust, then documents relating to all trustees have to be submitted by the reporting entity. If the client is a non-profit organization, reporting entities must also register the client’s information on the NITI Aayog’s DARPAN portal.

- Reporting entities are also required to take steps to determine the beneficial owner of a customer.

- Beneficial owner is defined as any natural person who ultimately owns or controls a customer, or any natural person on whose behalf a transaction is conducted. Reporting entities must identify the beneficial owner and take reasonable steps to verify their identity using reliable and independent sources.

Goods and Services Tax Act violations will be booked as Prevention of Money Laundering Act offence

The content of this article is intended to provide a general guide to the subject matter. Hope the information will assist you in your Professional endeavors. For query or help, contact: singh@caindelhiindia.com or call at 9555 555 480

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.