FAQ on GST E-Way Bills

Table of Contents

Frequently Asked Questions on GST E-Way Bills

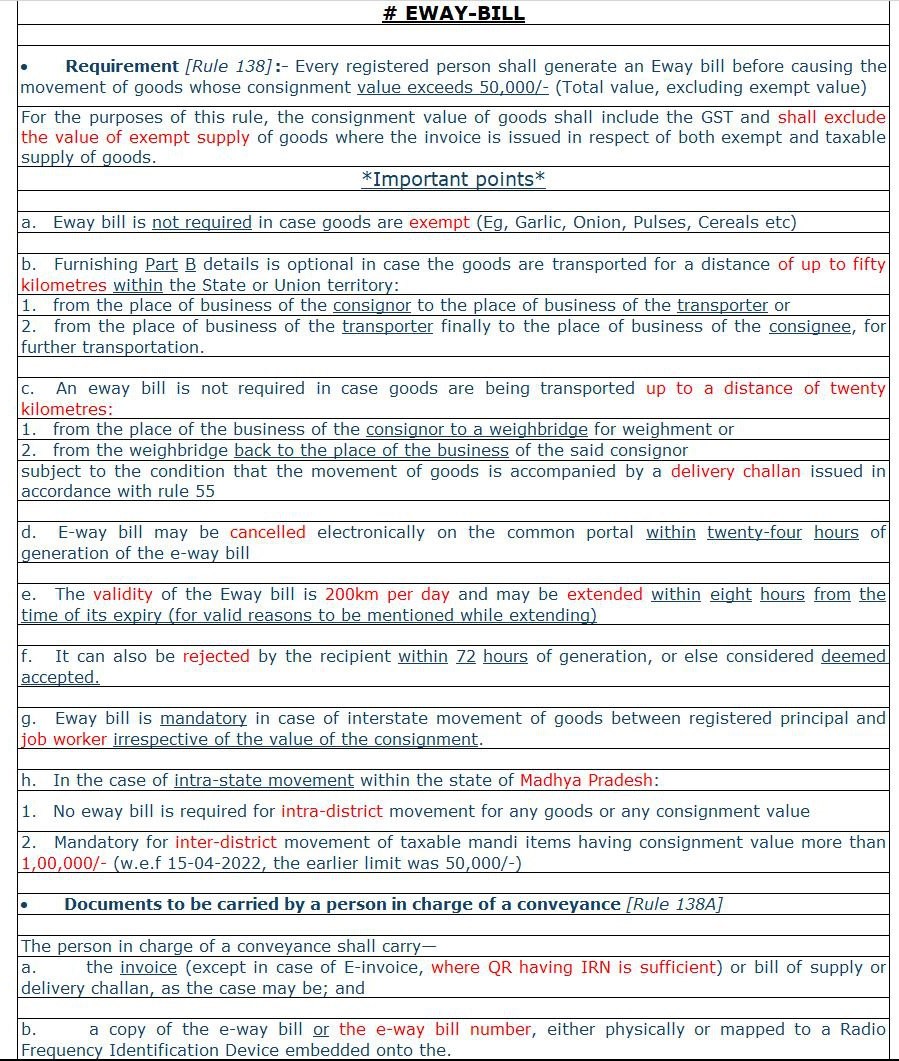

Q.: What exactly are e-Way Bills?

- e-Way Bills are invoice supporting documents that are generated based on invoices. It includes invoice information, item information, and transporter information.

- E-Way Bills are required documents to be carried by transporters of goods worth Rs. 50,000 and/or more when transporting such goods both inter- and intra-state.

- e-Way Bills are invoice supporting documents that are generated based on invoices. It includes invoice information, item information, and transporter information.

Q.: Who requires an eWay bill?

- E-way bills are required for all forms of transactions involving the transportation of commodities, including external supply whether within the state or interstate, inward supply whether within the state or interstate, including from unregistered persons, and transportation for reasons other than supply.

GSTN Advisory on verification of transporter Id (TRANSIN) in e-Waybills

Q.: What is the purpose of a way bill?

- In the shipping industry, a waybill is a document that contains accurate information about a goods shipment, such as origin, destination, transit route, and contact information for the shipper and receiver.

Q.: If unregister party goods send to another unregister party but goods amount exceed 50,000 than e way bill will make.

- Yes, This applies even if both the sender and receiver are unregistered. In cases where both parties to the transaction are unregistered, either of the parties needs to register with GSTN or the transporter needs to generate the e-way bill. If the goods are transported by a consumer’s own vehicle, the consumer can fill in the vehicle number in Part B of Form GST EWB-01.

Q.: Is eWay bill have any KM limit ?

- the e-way bill km limit in GST depends on the type of conveyance and the nature of the goods being transported. The general rule is that for every 200 km of travel, the e-way bill is valid for one day, except for over dimensional cargo or multimodal shipment in which at least one leg involves transport by ship, where the validity is one day for every 20 km of travel. However, there are some exceptions and variations in different states and union territories. For example, in some cases, the e-way bill is mandatory even if the value of the goods is less than Rs. 50,000 or the distance is less than 50 km.Less Than 200 Kms Validity of EWB is 1 Day. I hope this helps.

- If unregister party goods send to another unregister party but goods amount exceed 50,000 than e way bill will make

- Yes, This applies even if both the sender and receiver are unregistered. In cases where both parties to the transaction are unregistered, either of the parties needs to register with GSTN or the transporter needs to generate the e-way bill. If the goods are transported by a consumer’s own vehicle, the consumer can fill in the vehicle number in Part B of Form GST EWB-01.

NEW E WAY BILL PORTAL 2.0

NEW E WAY BILL PORTAL 2.0 outlines the key updates and features of the E-Way Bill 2.0 portal, which will be launched on 1st July 2025. Here’s a concise summary of the important points:

Objective of NEW E WAY BILL PORTAL 2.0

To provide seamless inter-operability between:

-

E-Way Bill 1.0 portal (https://ewaybillgst.gov.in)

-

E-Way Bill 2.0 portal (https://ewaybill2.gst.gov.in)

Ensures business continuity during exigencies or portal downtimes.

New Inter-Operable Services on E-Way Bill 2.0:

Available for E-Way Bills generated from either portal:

-

Generation based on Part-A details

-

Consolidated E-Way Bill generation

-

Validity extension of E-Way Bills

-

Transporter details update

-

Retrieval of consolidated E-Way Bills

Also includes already supported services like:

-

Generation, vehicle update, and printing of E-Way Bills

System Integration in NEW E WAY BILL PORTAL 2.0

-

Real-time sync between both portals (mirror data within seconds), If E-Way Bill 1.0 is down, you can operate fully via 2.0 (and vice versa), Dual-system architecture ensures uninterrupted compliance

-

API Access: All services are also available via API for integration by taxpayers and logistics operators, Currently accessible in the sandbox environment for testing

Key Benefits:

-

Redundancy: No dependency on a single portal

-

Cross-portal functionality: Update/print data across portals

-

Business continuity during portal outages

-

Encouraged use of API integration for logistics automation

Action Points for Users:

-

Visit the new portal: ewaybill2.gst.gov.in, Test and integrate APIs if applicable & Refer to manuals or contact the GST Helpdesk for support

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.