PERSONAL LOAN: FUNDING TEMPORARY MONETARY NEEDS

Table of Contents

PERSONAL LOAN: A WAY OF FUNDING TEMPORARY MONETARY NEEDS

Borrowing money becomes essential on several occasions in life be it a medical emergency, buying a home, or a latest brand-new car. Well, to take off our needs and requirements several loans are designed specifically. One such loan which we’ll be discussing during this blog is the personal loan. The loan has been popular for a decade thanks to its offerings and features. a number of its main advantages include collateral free nature and no end-use restrictions.

At the time of utmost monetary crises; many people get stressed about getting financial assistance. Among the various ways to induce assistance, personal loans always lie on top. However, for one who already has an ongoing consumer loan, availing a top-up loan remains the foremost affordable and convenient option. Banks tends to easily approve such a loan, since they are already in receipt of the customer’s documents and credit history.

MEANING

A top-up loan could be a facility provided to the present personal loan holders to increase their borrowing. this is often indeed the most effective option for emergencies because it doesn’t involve any documentation and takes little time for the loan amount to urge disbursed. A top-up consumer loan is availed for any personal need which works in favor of the borrowers.

Eligibility requirement for availing top-up loan facility –

- A clear chronicle for the payment of ongoing personal loans.

- Job stability

- Good CIBIL

- The borrower is required to have paid the minimum number of EMI as per the lender eligibility criteria. Generally, the said number is of 12 EMIs.

ADVANTAGES

- Quick Disbursal– A top informed a private loan gets fast approval and disbursal because the applicant has experienced the same loan process for his first loan. Moreover, the connection between the lender and therefore the borrower isn’t a new one. So it takes less time for the borrower to try to the verification. This makes top-up personal loans best for emergencies where you don’t have time to travel through the paperwork and hassle of latest loan processing.

- Collateral Free – like all other loan, a top-up loan is additionally unsecured and hence, doesn’t require any collateral or guarantor to be secured against the borrowing.

- Multipurpose in Nature– Being an extension to the continued loan, a top-up loan offers the identical facility. And one such facility is not any limitation on the end-use of the loan amount which makes it a multipurpose loan. It is often used for medical emergencies, home renovation, travel, higher education, purchasing gadgets or to fund the short-term requirements of your business.

- Cheaper than Personal Loan– one among the benefits of top-up personal loans is that the lower rate. Generally, the interest rate charged for a top-up loan could be a bit below what it’s charged for a private loan. Getting it even for 1% cheaper rates makes someone save lots during the entire tenure.

SHORTFALLS/DISADVANTAGES

- Applicable Only to the prevailing Customer– A top-up loan personal loan is applicable only to the persons who are already servicing a private loan with the same lender. So if someone wants to alter the lender, then this facility won’t apply to him.

- No Tax Benefits– It doesn’t provide any tax benefits. One can save tax on top-up loans providing the loan amount is employed within the home renovation or educational purpose.

DIFFERENCE BETWEEN PERSONAL LOAN AND TOP UP LOAN

- A loan and a top-up loan both are often used to get funds. If someone is already serving a personal loan than a top up loan is a better choice to them. this is often because it takes very less time to disburse a top loan whereas availing a fresh/new personal loan can take longer.

- If the person encompasses a good repayment history and he contains a good credit score then it’s not difficult for him to urge a top-loan loan. Whereas getting a private loan will be a bit tough because it has some strict eligibility criteria.

- The maximum tenure of a private loan is 5 years, whereas a top-up loan can go up to the top of the private loan, but can only be availed only where the borrower has already made payment of minimum of 12 EMIS.

- When an individual goes for a fresh loan, he should start everything from the beginning. Researching the most effective lender, applying for the loan, submitting documentation then on. Whereas availing a top-up loan only involves a far smaller process, which is signing the loan agreement.

- When considering the value of the borrowing, a private loan is costlier than a top-up loan.

- A person is liberal to apply with any of the lenders for a private loan whereas when availing a top-up loan a borrower is restricted to use with the lender from whom he/she has their loan.

Top up personal loans are indeed as very effective tool to fight monetary crises at the time of emergency. However, to avail of this facility, it’s important to own an ongoing personal loan. it’s highly advisable to analyze your requirements together with the pros and cons of a top-up loan before taking any decision.

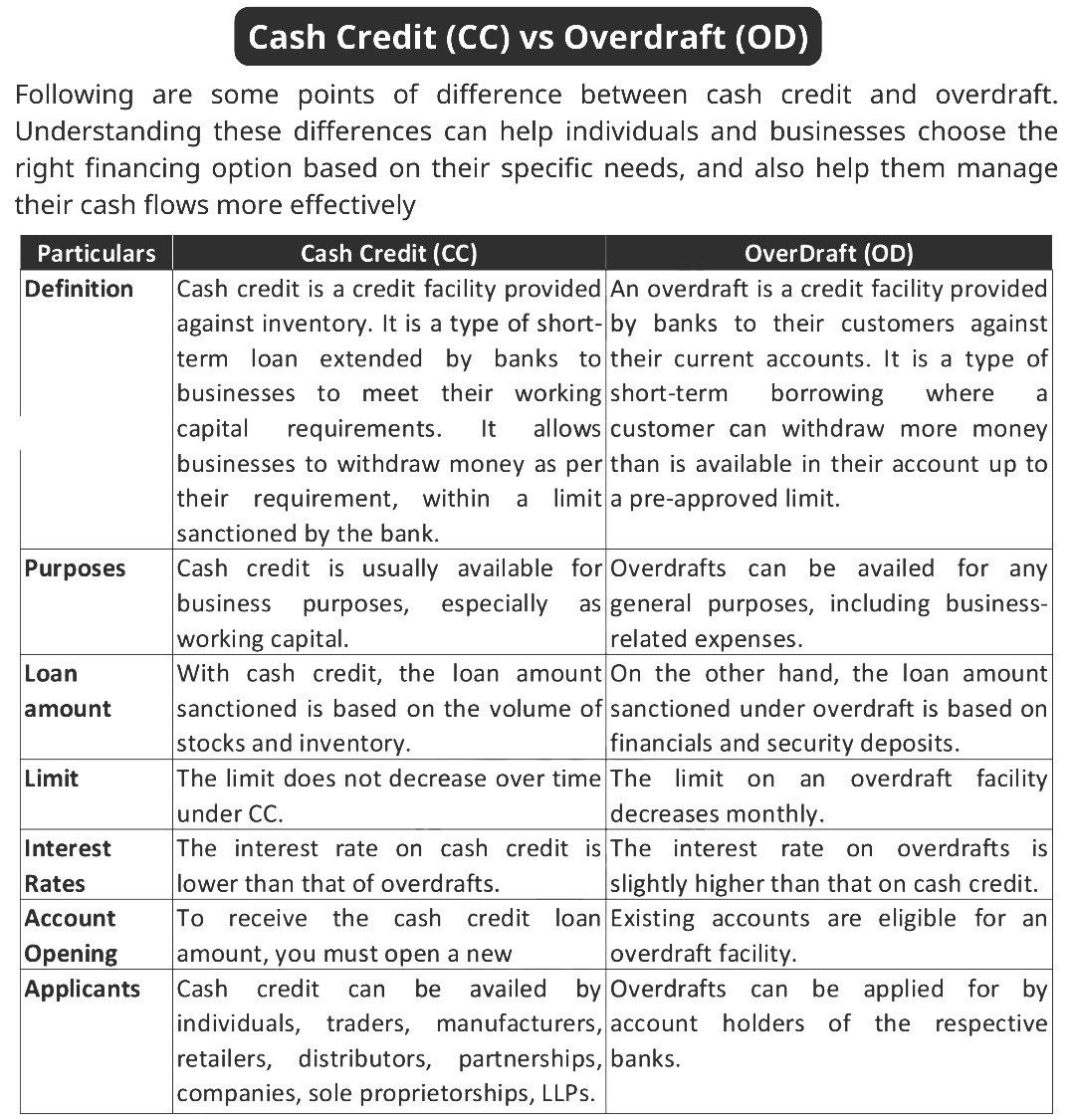

What is the difference Overdraft vs cash credit?

We are supporting the following Services :

- Techno- Commercial DPR For Banks Loans & New Projects

- ¨ T e c h n i c a l A d v i s o r y F o r Productivity Enhancement & Profit Maximization

- ¨ Technical Advisory For Risk Assessment & Loss Minimization

- ¨ Amortization of Tools & Dies Certificate

- ¨ Tool Life Assessment Certificate

- ¨ Fair Valuation of Used/ Second-Hand/ Refurbished Plant & Machinery

- ¨ Fixed Asset Componentization for Claiming Accelerated Depreciation

- ¨ P h y s i c a l V e r i f i c a t i o n o f Inventory

- ¨ Preparation of FAR for Ind AS-16 & IFRS¨ Project Work Assessment

- ¨ Residual Life Assessment for Finance Approvals

- ¨ Manufacturability & Sustainability Assessment

- ¨ Plant Capacity & Utilization Certificate for DRHP Filing

- ¨ Cost Vetting of Plant & M/c

- ¨ Import into SEZ CE Certificate

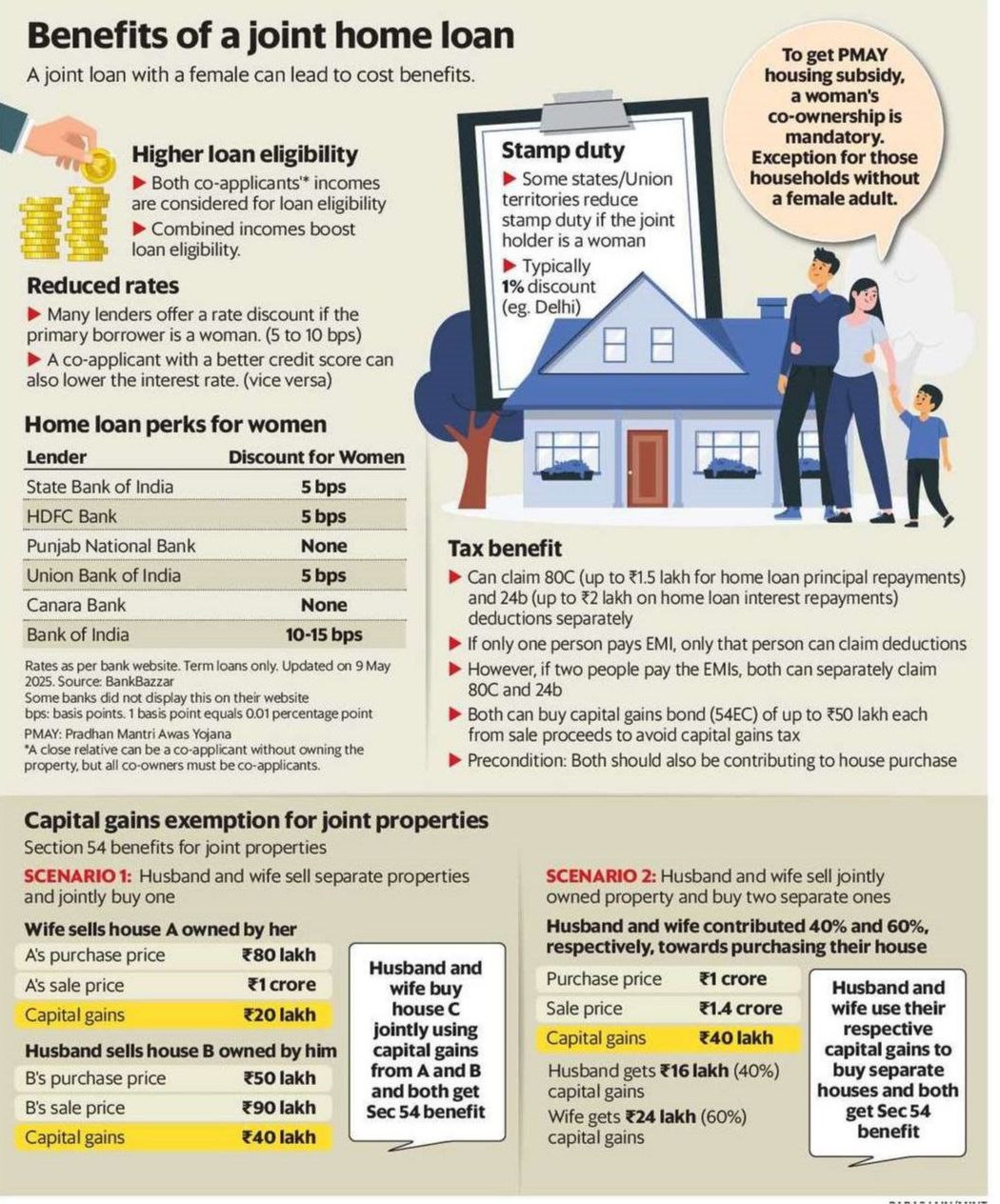

Benefits of taking a joint home loan Particularly when the co-owner is a woman

Higher Loan Eligibility

-

Combined incomes of both co-applicants are considered. Increases the loan amount eligibility.

Reduced Interest Rates

-

Many banks offer interest rate discounts if the primary borrower is a woman.

-

Discounts range from 5 to 15 basis points (bps).

-

Better credit scores of co-applicants can further reduce interest rates.

| Bank | Discount for Women |

|---|---|

| State Bank of India | 5 bps |

| HDFC Bank | 5 bps |

| Punjab National Bank | None |

| Union Bank of India | 5 bps |

| Canara Bank | None |

| Bank of India | 10–15 bps |

(1 bps = 0.01%) — Updated as of 9 May 2025

Stamp Duty Benefits

-

Some states/UTs offer reduced stamp duty (typically 1% lower) if the woman is a joint owner. E.g., Delhi provides this benefit.

PMAY Housing Subsidy Eligibility

-

To avail PMAY subsidy, a woman must be a co-owner, except in households without a female adult.

Tax Benefits

-

Section 80C: Deduction up to ₹1.5 lakh on principal repayment.

-

Section 24(b): Deduction up to ₹2 lakh on interest paid.

-

If both spouses pay EMIs, they can claim deductions separately.

-

Capital Gains Bonds (Section 54EC): Both can invest ₹50 lakh each to avoid capital gains tax.

-

Precondition: Both must be contributing to the purchase.

Capital Gains Exemption (Section 54)

- Scenario 1: Husband and wife sell separate houses and jointly buy one. – Both can claim Sec 54 exemption on capital gains by investing in a jointly owned house.

- Scenario 2: Husband and wife sell one jointly owned house and buy separate houses. – They can split the capital gain based on ownership share and claim Sec 54 exemption individually.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.