Hindu Undivided Families (HUF) & its Tax-Saving Potential

Table of Contents

Hindu Undivided Families (HUF)- & its Tax-Saving Potential

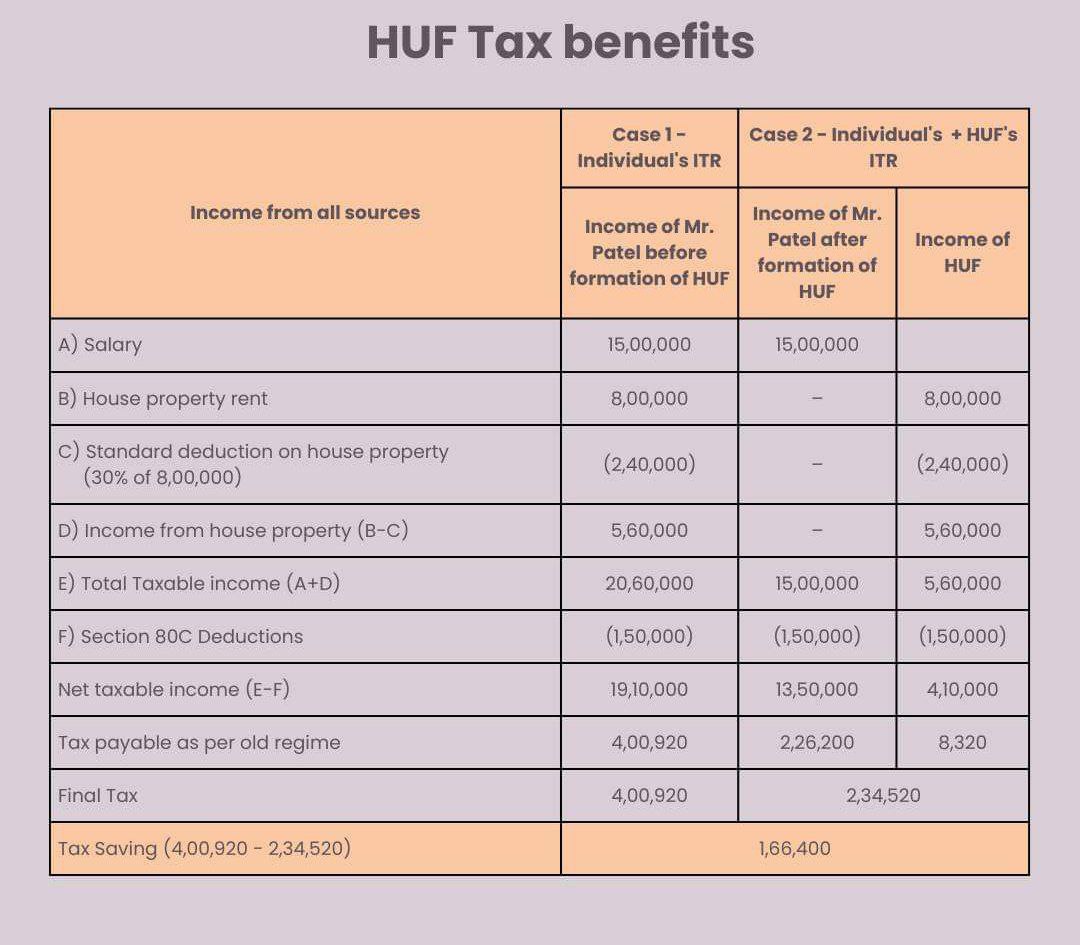

Do you looking to optimize or maximise your savings and improve your tax planning? Take into account looking into the HUF (Hindu Undivided Families) tax-saving potential. Hindu Undivided Families can be a powerful instrument in your financial plan, providing a number of benefits & chances for tax savings. Let’s explore the advantages of Hindu Undivided Families and how they may substantially decrease your income tax burden. how they can help you save substantial income tax.

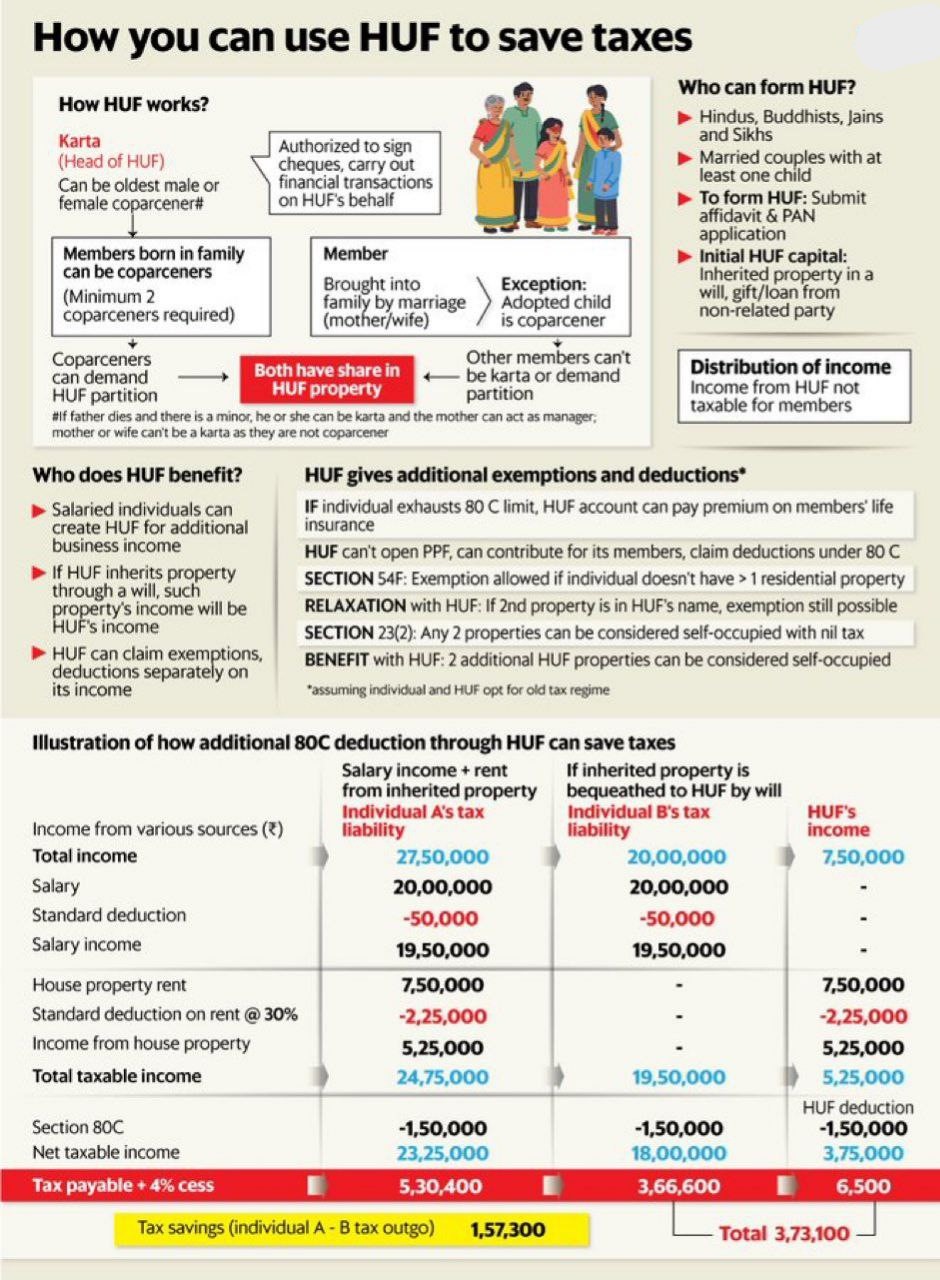

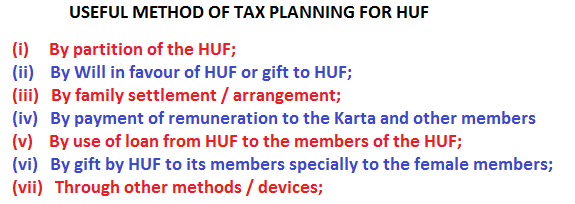

How You Can Use HUF to Save Taxes:

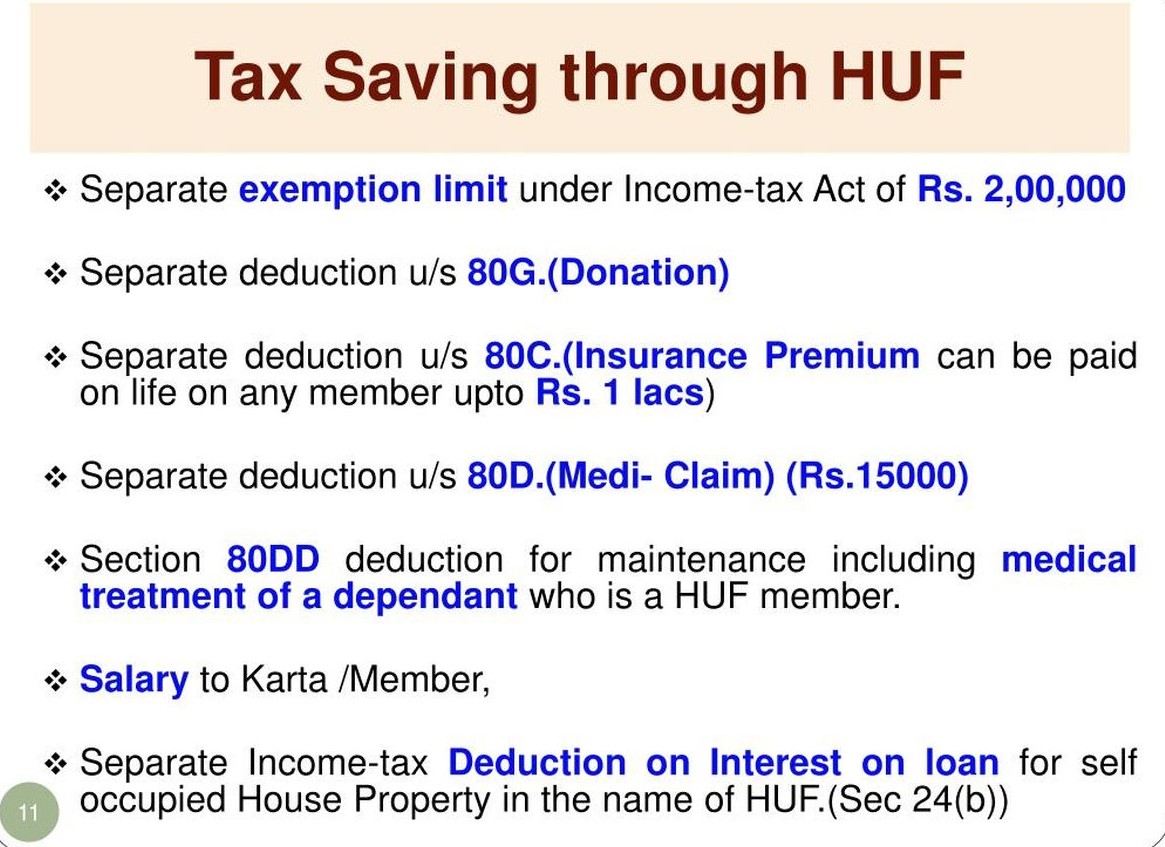

Separate Exemptions & Separate Tax Entity

Hindu Undivided Families are given special tax treatment under the Income Tax Act, which is one of their main benefits. This means that, comparable to individual taxpayers, a Hindu Undivided Family is entitled to a separate basic tax exemption in addition to specific tax exemptions for each of its members. An Hindu Undivided Family can maximise tax savings for the entire family by utilising these distinct exemptions.

Investment Opportunities- Unlocking Options

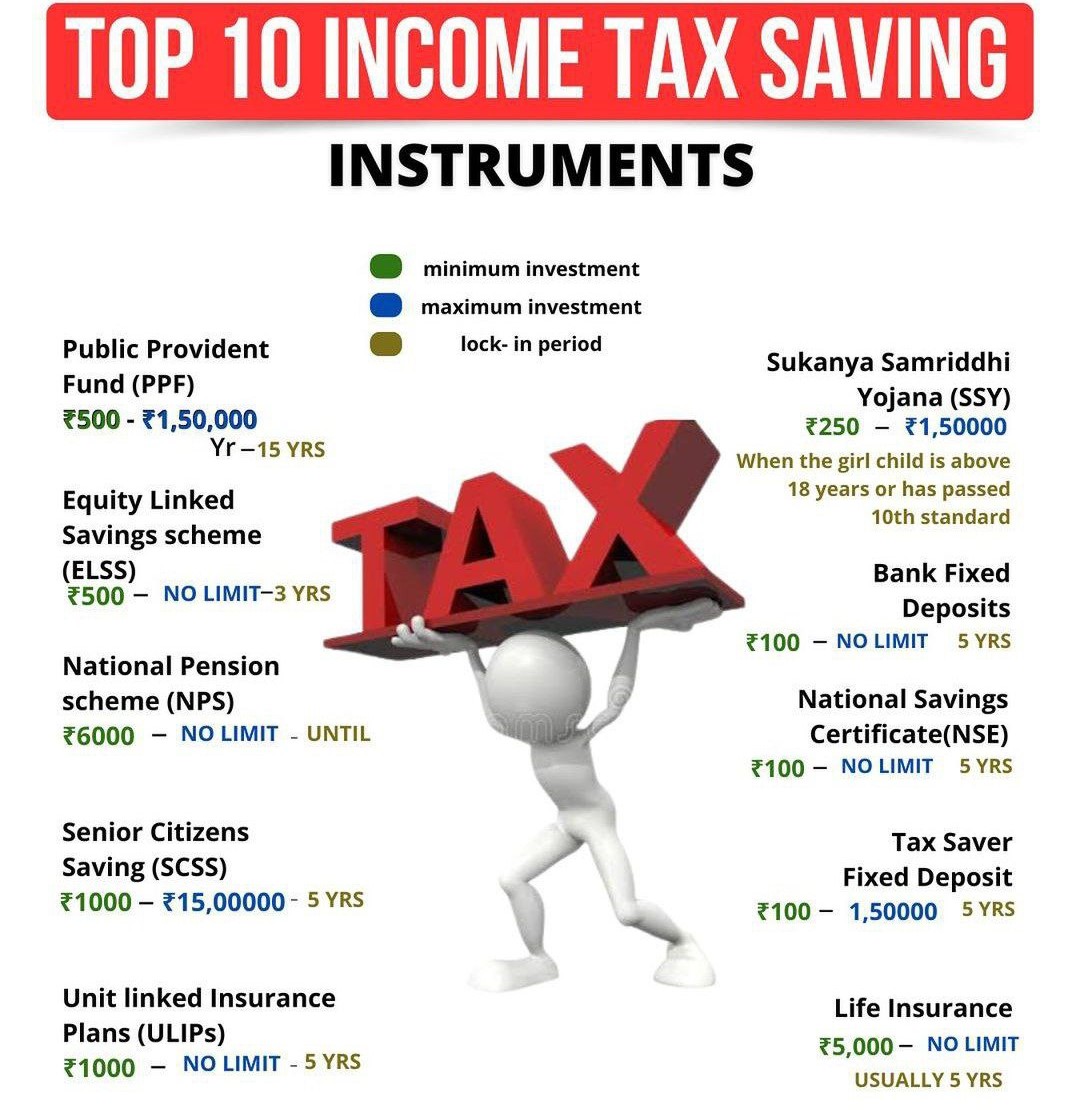

Hindu Undivided Families have the freedom to invest in a variety of assets under their own names. This covers both shares & mutual funds as well as real estate like residential homes. The tax benefits connected with these assets can be exploited by holding investments in the name of Hindu Undivided Families. Hindu Undivided Families, for example, are able to deduct the principal and interest on house loans that they used to buy, build, repair, or renovate their property.

Business can be Running

While a Hindu Undivided Families cannot join a partnership firm as a partner, any of its members may act in its place as a partner. This provides Hindu Undivided Families with the opportunity to operate a business as a proprietor in their own name. The Hindu Undivided Families are able to take advantage of the tax advantages linked with company income & proprietorial deductions by doing this.

Hindu Undivided Families Can Owning Property

Hindu Undivided Families have the right to own homes, and this may have significant tax repercussions.For instance, only two residences may be claimed as being self-occupied by an individual income tax payer; all other properties are considered to be rented out and are subject to notional rent taxation. But extra properties owned by a Hindu Undivided Family might be classified as self-occupied, giving them tax-free status.

Maximizing Benefits & Deductions

Hindu Undivided Families are eligible for a number of perks and deductions under various sections of the Income Tax Act, much like individual taxpayers. This covers premiums for life insurance, health insurance, and medical expenditures for members who are physically incapacitated. An Hindu Undivided Family can maximise tax savings and improve the family’s overall financial situation by carefully using these income tax deductions.

Can HUF earn commission income?

- Yes, A Hindu Undivided Family (HUF) can earn commission income. The income can be earned on its individual capacity. However, it’s important to note that the HUF cannot earn commission based on the holding of Karta but can if the commission is earned solely because of the work of HUF as a separate entity.

- However, there are differing opinions on this matter. Some experts believe that commission income requires personal skills, and therefore, it should not be assessed as HUF’s income.

- In case of scrutiny, the Income Tax Department might assess such income in the hands of the individual (Karta) rather than the HUF.

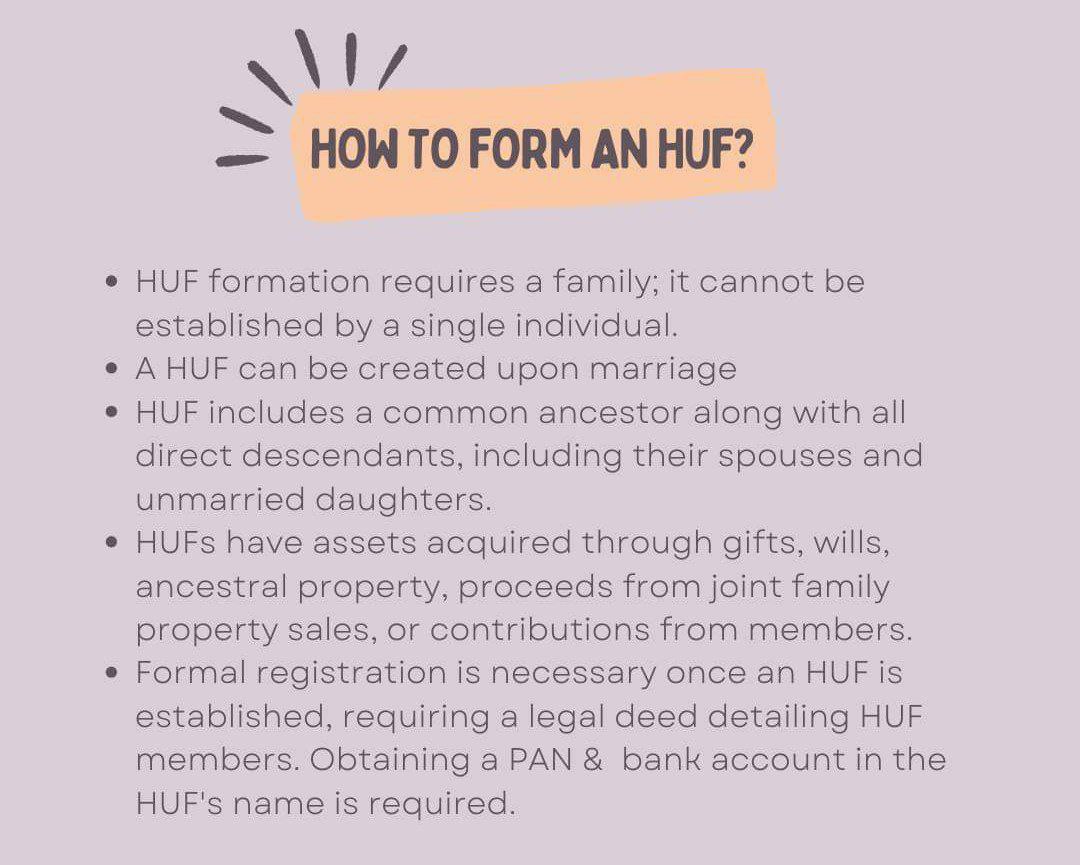

- HUF is a good option for saving taxes. Below is the declaration format for forming an HUF.

HOW HUF CAN HELP SAVE TAX ON MFs

Distribution of Assets on Total Partition of HUF Is Not a Transfer Under the Income-tax Act

Why Distribution on Total Partition Is Not a Transfer

On total partition of a Hindu Undivided Family (HUF)

- Each coparcener receives property in satisfaction of a pre-existing and antecedent right.

- There is no conveyance, no consideration, and no passing of title from one person to another.

- The HUF does not “transfer” assets; it merely breaks up collective ownership into defined individual ownerships.

- Thus, distribution on total partition is not a transfer in the legal sense.

Statutory Backing—Section 47(i)

Section 47(i) of the Income-tax Act, 1961 expressly provides: Any distribution of capital assets on the total partition of a Hindu undivided family shall not be regarded as a transfer. Therefore, such distribution falls outside the scope of capital gains taxation.

Why Section 45 (Capital Gains Charging Section) Fails

Capital gains tax under Section 45 can be levied only if: There is a transfer, and The transfer is by the assessee. In case of total partition:

- Section 47(i) deems that no transfer exists.

- Hence, Section 45 cannot be triggered against the HUF.

Partial Partition—Ignored After 31-12-1978

Section 171(9) provides that:

- Any partial partition effected after 31-12-1978 shall be ignored.

- The HUF shall continue to be assessed as if no such partition had taken place.

- Therefore, only total partition enjoys tax neutrality.

Tax Consequences After Total Partition

- The HUF ceases to exist for tax purposes.

- Assets move to members without triggering capital gains tax.

- Future income is taxable in the hands of individual members.

Important Practical Notes (For Professionals)

- Stamp duty/registration implications may still apply (state-specific).

- The cost of acquisition and holding period carry over to the coparceners.

- Subsequent sale by members may attract capital gains tax.

- Proper partition deed & Section 171 recognition is essential.

Partition is not a transfer. it is the crystallization of rights. Tax neutrality exists because ownership already existed in latent form.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.