GSTN Clarification on Cross Charge vs ISD (Circular 199/2023)

Table of Contents

GSTN Clarification on Cross Charge vs Input Service Distributor (GST Circular 199/2023).

Goods and Services Tax Circular issued recently has given clarification on various issues of Input Service Distributor VS Cross Charge

The Goods and Services Tax Circular can be summarized as under:

- Company Head Office can claim input tax credits which are commonly used by and Branches & Head Office.

- In case of transfer of 𝘪𝘯𝘱𝘶𝘵 𝘵𝘢𝘹 𝘤𝘳𝘦𝘥𝘪𝘵 (Input Service Distributor/ Cross Charge), the credit transfer required to be restricted to Services actually provided to the Company Branch Office – This is to ensure that excess credit is not transferred to a company branch to shift 𝘪𝘯𝘱𝘶𝘵 𝘵𝘢𝘹 𝘤𝘳𝘦𝘥𝘪𝘵 from one location to another location & cash liability minimization.

- Salary Expenses or Cost of manpower is not required to be considered for arriving at cross charge value irrespective of whether Company Branch Office is entitled to full credit of Input Service Distributor or not

- If Cross charge invoice not raised then “value of such service may be deemed to be declared as NIL” & May be deemed as Open Market Value – This effectively provides immunity to goods and Service tax taxpayers where Head Office did not raise cross charge invoice

But, there is few point to be taken care are mention here under in such case :

- Goods and Services Council had recommended prospective amended in Goods and Services Law to make Input Service Distributor compulsory for third party services

– Once the Goods and Services Laws are amended, Company Head Office will have to bifurcate the cost into

– Internally generated services – Issue or Raise invoice on Company Branches

– Third Party Services – Transfer the credit using Input Service Distributor

- Goods and Services Tax Circular only covers transactions between distinct person (Company Branches) and not between related parties

- The Goods and Services Tax Circular specifically states that Salary cost can be excluded for computation of invoice value irrespective of whether Company branch can avail credit or not. But, No reasoning for the same is provided nor has any clarification been provided for any other expenses.

- Based on Q2 in the Goods and Services Circular, it appears that the 𝘪𝘯𝘱𝘶𝘵 𝘵𝘢𝘹 𝘤𝘳𝘦𝘥𝘪𝘵 available needs to be checked on transaction level and not taxpayer level – “Head Office 𝘪𝘴 𝘱𝘳𝘰𝘷𝘪𝘥𝘪𝘯𝘨 𝘤𝘦𝘳𝘵𝘢𝘪𝘯 𝘴𝘦𝘳𝘷𝘪𝘤𝘦𝘴 𝘵𝘰 𝘵𝘩𝘦 𝘉𝘖𝘴 𝘧𝘰𝘳 𝘸𝘩𝘪𝘤𝘩 𝘧𝘶𝘭𝘭 𝘪𝘯𝘱𝘶𝘵 𝘵𝘢𝘹 𝘤𝘳𝘦𝘥𝘪𝘵 𝘪𝘴 𝘢𝘷𝘢𝘪𝘭𝘢𝘣𝘭𝘦”.

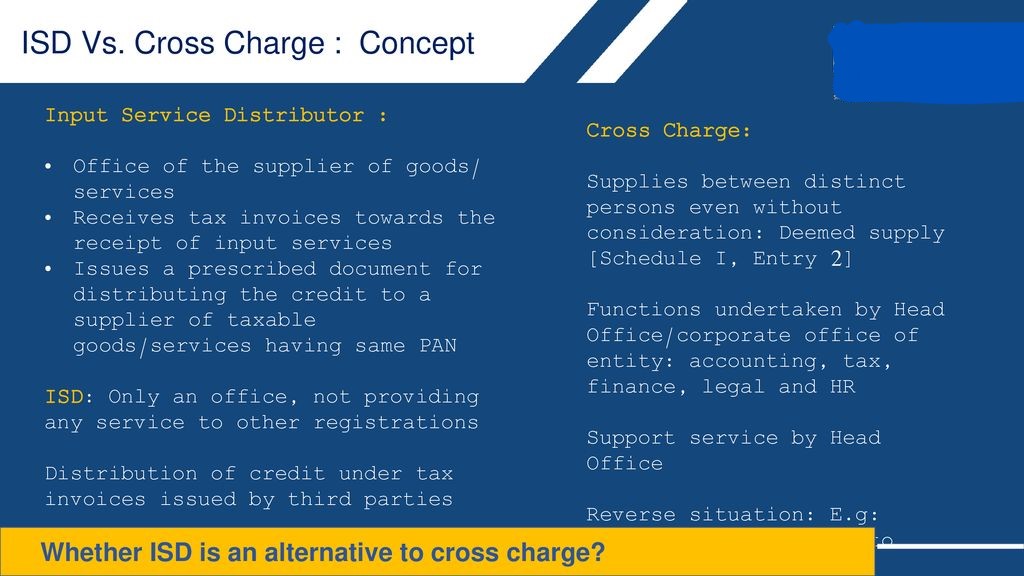

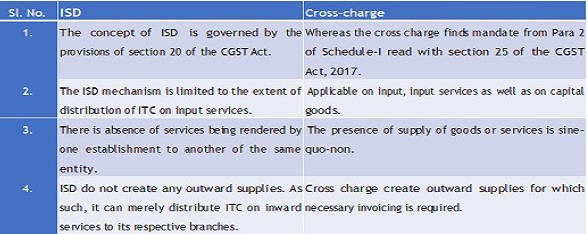

Issue on taxability of supply of services between distinct persons in terms of section 25(4)

Comparative following Table provides clarification on regard to taxability of supply of services between distinct persons in terms of U/s 25(4) of the Central Goods and Services Tax Act: –

| S. No | GSTN Clarification Via Circular no 199/2023 | Issues |

| 1. | It is clarified that in respect of common input services procured by the Head Office from a 3rd Party but attributable to both Head Office and Branch Office’s or exclusively to one or more Branch Office, Head Office has an option to distribute Input Tax credit in respect of such common input services by following Input Service Distributor mechanism laid down in Section 20 of Central Goods and Services Tax Act read with rule 39 of the Central Goods and Services Tax Rules, 2017 (hereinafter referred to as ‘the Central Goods and Services Tax Rules’). Head Office ever, as per the present provisions of the Central Goods and Services Tax Act and Central Goods and Services Tax Rules, it is not mandatory for the Head office to distribute such input tax credit by Input Service Distributor mechanism. Head office can also issue tax invoices under section 31 of Central Goods and Services Tax Act to the concerned Branch Office’s in respect of common input services procured from a third party by Head Office but attributable to the said and the can then avail Input Tax credit on the same subject to the provisions of section 16 and 17 of Central Goods and Services Tax Act.

In case, the Head Office distributes or wishes to distribute Input Tax credit to in respect of such common input services through the Input Service Distributor mechanism as per the provisions of section 20 of Central Goods and Services Tax Act read with rule 39 of the Central Goods and Services Tax Rules, Head Office is required to get itself registered mandatorily as an Input Service Distributor in accordance with Section 24(viii) of the Central Goods and Services Tax Act. Further, such distribution of the Input Tax credit respect a common input services procured from a third party can be made by the Head Office to a BO through Input Service Distributor mechanism only if the said input services are attributable to the said BO or have actually been provided to the said BO. Similarly, the HEAD OFFICE can issue tax invoices under section 31 of CGST Act to the concerned , in respect of any input services, procured by HEAD OFFICE from a third party for on or behalf of a BO, only if the said services have actually been provided to the concerned . |

Whether Head office can avail the input tax credit (hereinafter referred to as ‘Input Tax credit ’) in respect of common input services procured from a third party but attributable to both Head office and or exclusively to one or more , issue tax invoices under section 31 to the said for the said input services and the can then avail the ITC for the same or whether is it mandatory for the HEAD OFFICE to follow the Input Service Distributor (hereinafter referred to as ‘ISD’) mechanism for distribution of ITC in respect of common input services procured by them from a third party but attributable to both Head Office and Branch Offices or exclusively to one or more ? |

| 2. | The value of supply of services made by a registered person to a distinct person needs to be determined as per rule 28 of Central Goods and Services Tax Rules, read with sub-section (4) of section 15 of Central Goods and Services Tax Act. As per clause (a) of rule 28, the value of supply of goods or services or both between distinct persons shall be the open market value of such supply. The second proviso to rule 28 of Central Goods and Services Tax Rules provides that where the recipient is eligible for full input tax credit, the value declared in the invoice shall be deemed to be the open market value of the goods or services.

Accordingly, in respect of supply of services by Head Office to , the value of the said supply of services declared in the invoice by Head Office shall be deemed to be open market value of such services, if the recipient BO is eligible for full input tax credit. Accordingly, in cases where full input tax credit is available to a BO, the value declared on the invoice by Head office to the said BO in respect of a supply of services shall be deemed to be the open market value of such services, irrespective of the fact whether cost of any particular component of such services, like employee cost etc., has been included or not in the value of the services in the invoice. Further, in such cases where full input tax credit is available to the recipient, if Head office has not issued a tax invoice to the BO in respect of any particular services being rendered by Head Office to the said BO, the value of such services may be deemed to be declared as Nil by Head Office to BO, and may be deemed as open market value in terms of second proviso to rule 28 of Central Goods and Services Tax Rules. |

In respect of internally generated services, there may be cases where Head office is providing certain services to the for which full input tax credit is available to the concerned . But, Head office may not be issuing tax invoice to the concerned with respect to such services, or the Head office may not be including the cost of a particular component such as salary cost of employees involved in providing said services while issuing tax invoice to for the services provided by Head Office to . Whether the Head Office is compulsory required to issue invoice to under section 31 of CGST Act for such internally generated services, and/ or whether the cost of all components including salary cost of Head Office employees involved in providing the said services has to be included in the computation of value of services provided by Head Office to when full input tax credit is available to the concerned . |

| 3. | In respect of internally generated services provided by the Head Office to , the cost of salary of employees of the Head Office, involved in providing the said services to the , is not mandatorily required to be included while computing the taxable value of the supply of such services, even in cases where full input tax credit is not available to the concerned BO. | In respect of internally generated services provided by the Head Office to , in cases where full input tax credit is not available to the concerned , whether the cost of salary of employees of the Head Office involved in providing said services to the , is mandatorily required to be included while computing the taxable value of the said supply of services provided by Head Office to . |

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.