Overview of GST Appeal

Table of Contents

Overview of Goods and service Tax (GST) Appeal

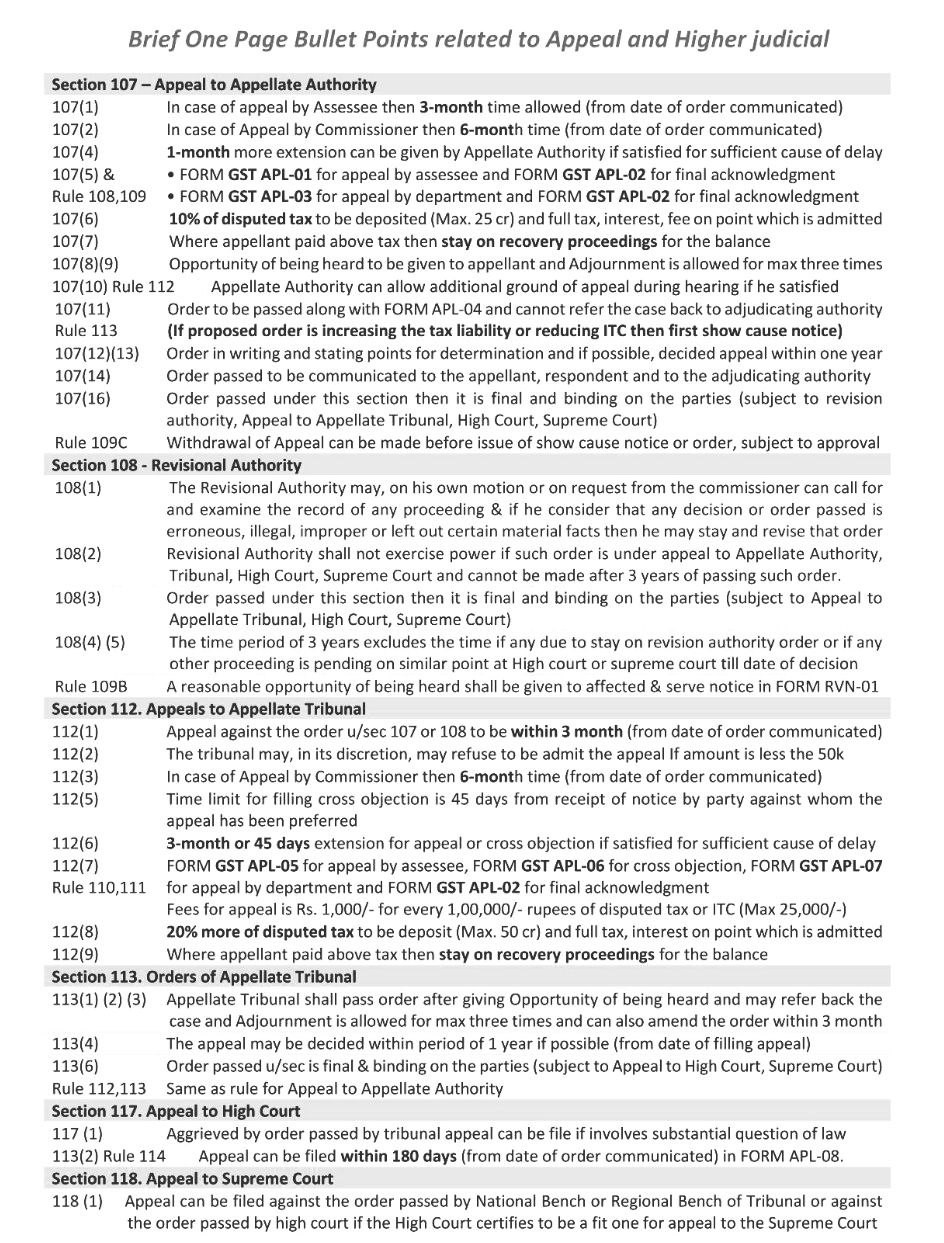

Within three months of the date the judgement or order is informed to them, any taxpayer or unregistered individual who feels wronged by a decision or order rendered against them may file an appeal with the Appellate Authority.

What are the steps of GST appeals Filling?

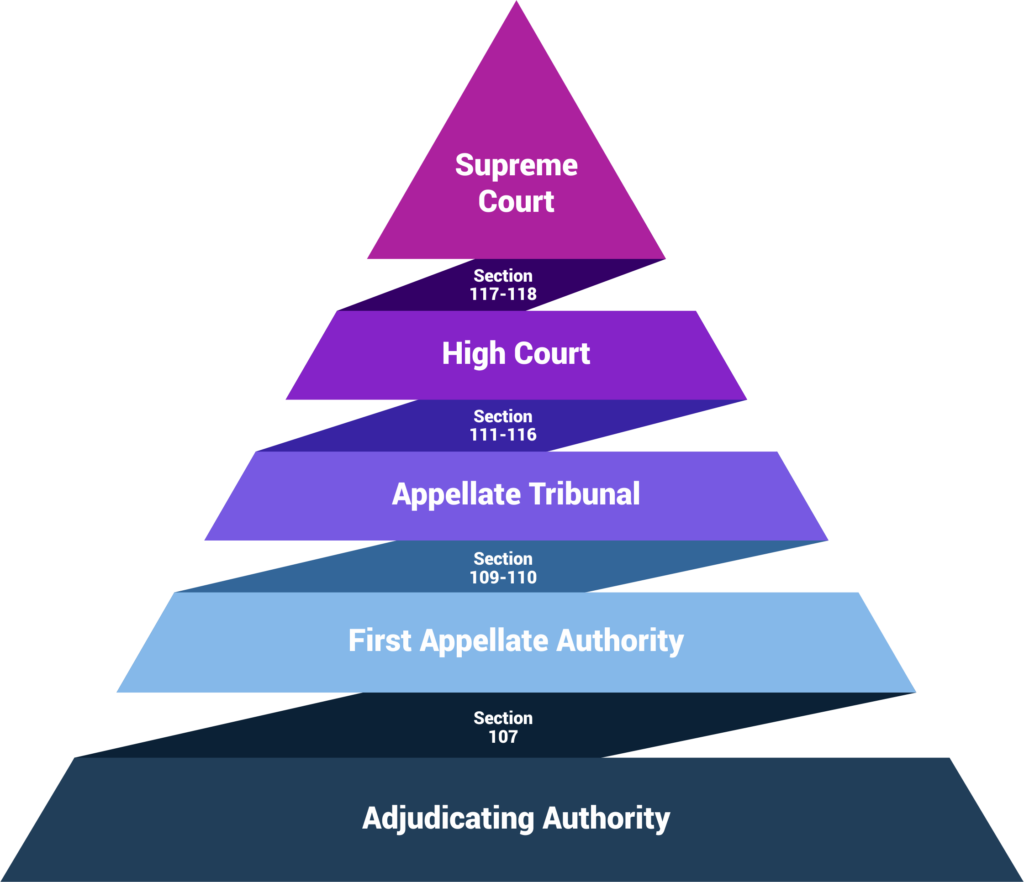

| Appeal level | Orders passed by | Appeal to | Sections of Act |

| First | Adjudicating Authority | 1st Appellate Authority | 107 |

| Second | First Appellate Authority | Appellate Tribunal | 109,110 |

| Third | Appellate Tribunal | High Court | 111-116 |

| Fourth | High Court | Supreme Court | 117-118 |

Is all GST appeal be made to State Goods and service Tax & Central Goods and service Tax both authorities?

- As per the Goods and service Tax Act, Central Goods and service Tax & State Goods and service Tax or UTGST officers are both empowered to pass orders. As per the GST Act, an order passed under Central Goods and service Tax will also be deemed to apply to State Goods and service Tax.

- But in case the GST Officer under Central Goods and service Tax has passed an order, any appeal/review/ revision/rectification against the order will lie only with the officers of Central Goods and service Tax. In the Similar manner, for State Goods and service Tax, for any order passed by the State Goods and service Tax officer the appeal/review/revision/rectification will lie with the proper officer of State Goods and service Tax only.

Submitting of Goods and service Tax Appeal

- To submit an GST appeal to the respective GST Appellate Authority, Taxpayer can follow the procedure detailed as per attached charted steps.

- A person may file an appeal with the First Appellate Authority if they are dissatisfied with any ruling or order made under Goods and service Tax law against them by an adjudicating authority. They have the right to appeal to the National Appellate Tribunal, the High Court, and ultimately the Supreme Court if they are unhappy with the ruling made by the First Appellate Authority.

Question: Is there need require to file any hardcopy to the GST Department after filing GST Appeal online.. I received provisional acknowledgement after filing online GST Appeal. It was filed on 14/1/202X, but still no notice for hearing is received. What to do?

Ans: It is mandatory to submit all the related docs in the form of hard copy after that they can be considered an appeal submitted and GST Dept will issue APL 02.

Is withdrawal of a GST appeal is possible ?

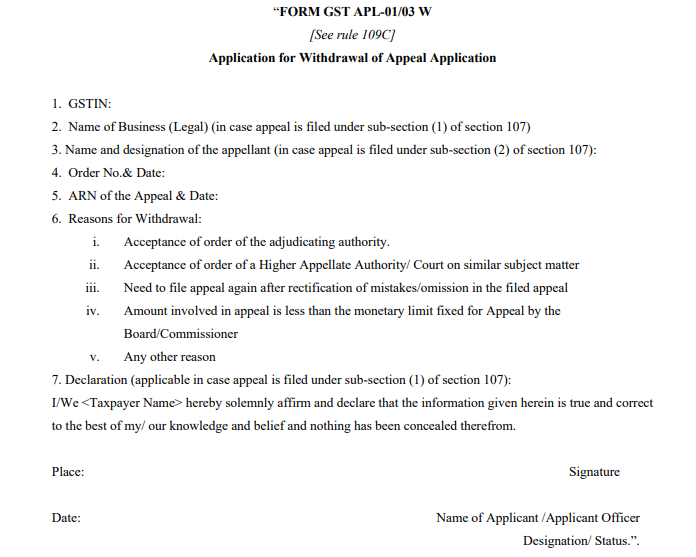

In the 48th GST Council meeting, It was determined for offering the opportunity to withdraw a previously submitted GST appeal. The goal of the move was to lessen the volume of litigation that the appellate authorities must handle. In this context, Notification No. 26/2022-Central Tax introduced a new Rule 109C into the CGST Rules.

According to Rule 109C, the petitioner may submit a withdrawal of appeal application at any point up to the issuance of the show-cause notice or the order under Section 107(11), whichever comes first. This relates to any appeal that has been submitted using Form GST APL-01 or Form GST APL-03. The new Form GST APL-01/03W must be used to file the appeal withdrawal application.

It is significant to note that the appellate authority’s consent will be needed to withdraw the aforementioned appeal in cases where the final acknowledgment in Form GST APL-02 has been issued. After the petitioner files the application for withdrawal of the appeal, the appellate authority has seven days to rule on it. An appellant can file a new appeal within the time limits outlined in Section 107 after such withdrawal.

Draft of appeal against order under section 73 for GST on royalty payment

To,

The Appellate Authority,

(Name and address of the jurisdictional office)

Subject: Appeal against order u/s 73 for GST on royalty payment

Sir/Madam,

I, (name of the appellant), having GSTIN (number), hereby file this appeal against the order no. (number) dated (date) passed by the (designation and name of the officer) under section 73 of the CGST Act 2017.

The facts of the case, the show cause notice and the order appealed against are as follows:

(Here, give a brief summary of the facts of the case, the show cause notice issued by the officer, the allegations imposed therein, and the order passed by the officer. Mention the amount of tax, interest and penalty demanded by the officer and the basis of the demand.)

The grounds of appeal are as follows:

(Here, state the reasons why you are aggrieved by the order and why you think the order is erroneous, illegal or unjustified. Mention the relevant provisions of the law, the rules, the notifications, the circulars, the case laws or any other authority that support your arguments. Number the grounds of appeal and be concise and clear.)

In view of the above grounds of appeal, I pray that the Appellate Authority may be pleased to:

(Here, state the relief that you are seeking from the Appellate Authority. Mention the amount of tax, interest and penalty that you are contesting and the amount that you have already paid, if any. Request the Appellate Authority to set aside, modify or annul the order appealed against and grant any other relief that you deem fit.)

I declare that the facts stated in this appeal are true and correct to the best of my knowledge and belief.

Date: (date)

Place: (place)

Signature of the appellant or his authorized representative

(Name and designation of the appellant or his authorized representative)

Can GST taxpayer file an GST Appeal After 12 months?

Yes, As per Section 107 of the CGST Act, 2017, the time limit for filing a GST appeal after receiving a DRC-07 form is typically three months from the date of receipt of the GST order. However, the appellate authority has the discretion to allow a delay of up to one additional month (30 days) if a valid reason is provided.

Can You File an Appeal After 12 Months?

-

Legally, No: The prescribed limit (90 days + 30 days = 120 days) is strictly followed. Appeals beyond this period are typically not entertained.

-

Exception in Your Case: If no email or notice was received, you can argue that the order was not “communicated” as required under Section 169 of the CGST Act.

-

Possible Remedies:

-

File a writ petition in the High Court seeking permission to file an appeal, arguing that the order was never communicated.

-

Request a condonation of delay with strong proof that the client was unaware of the demand.

-

Check the GST portal’s Notices & Orders section to confirm if the DRC-07 was uploaded there.

-

Thaerfater Check if the order is visible on the GST portal under Services > User Services > View Notices and Orders. and If the order is not found or was never received, draft a representation letter to the GST Officer seeking clarification. If the officer refuses relief, explore filing a writ petition.

-

Steps to Handle Incorrect GSTR-1 (IFF) Reporting Issue

Since the amendment window for FY 2021-2022 has closed, the taxpayer may face a demand notice under Section 73 or 74 of the CGST Act. Here’s how you can proceed:

File a Written Representation to the GST Officer

-

Explain the clerical mistake: Clearly state that the GSTR-1 (IFF) of one party was mistakenly uploaded under another party’s GSTIN. and Attach supporting documents:

-

Invoices of both parties for that period.

-

Email correspondences or internal records showing the correct transaction.

-

GSTR-3B filings to demonstrate that tax liability was correctly discharged.

-

-

Request rectification or relief: Ask the officer to consider the principle of natural justice and not impose demand unfairly.

Explore Options for Resolution

- If the officer accepts the representation, the officer may drop the demand or issue a lesser penalty under Section 125 (general penalty for procedural lapses).

- In case the officer rejects and raises a demand, file an appeal under Section 107 (GST Act) within 90 days of receiving DRC-07. It is argued that the error was unintentional, and no revenue loss occurred.

If Appeal Fails – Approach High Court (Writ Petition under Article 226)

If the First Appellate Authority does not provide relief, you may approach the Hon’ble High Court through a Writ Petition, citing: Supreme Court rulings on procedural errors not affecting revenue (e.g., cases emphasizing substance over form in tax matters). Lack of opportunity to rectify the mistake, violating principles of natural justice.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.