TDS on Rent Payment u/s 194-I, 194-IC, 194IB & 195

Table of Contents

All about TDS on Rent Payments u/s 194-I, 194-IC, 194IB & 195

Tax Deducted at Source (TDS) on rent involves deducting a certain percentage of tax from the rent payments made to landlords. This mechanism ensures tax collection at the source of income, aiding in timely tax payment and compliance.

Section 194-I: TDS on Rent Payments to Resident Landlords

- Applicability: Section 194-I applies when the annual rent paid or payable exceeds Rs. 2,40,000. Applicable to individuals or Hindu Undivided Families (HUFs) not liable to tax audit under Section 44AB.

- Any person other than an individual or HUF (not subject to audit) making rent payments to resident Indians. Individuals or HUFs covered under Section 44AB during the preceding financial year are liable to deduct TDS. TDS is required if the annual rent exceeds Rs. 2,40,000.

- TDS Rates: 2% for the use of any plant, machinery, or equipment. 10% for the use of any land, building (including factory buildings), furniture, or fittings.

- TDS must be deducted either at the time of crediting the rent to the landlord’s account or during the actual payment, whichever is earlier.

- Security deposits are not subject to TDS if refundable. However, if adjusted against rent, they become liable to TDS. Payments for warehousing charges, renting business centers, and regular hotel accommodations under agreements attract TDS under Section 194-I.

Section 194-IC: TDS on Payments under Joint Development Agreements

- Applicability: Section 194-IC applies to payments made under Joint Development Agreements (JDAs).

- Who Must Deduct TDS: Any person paying consideration (not in kind) to a resident under a JDA.

- TDS Rate: 10% on the consideration paid. 20% if the recipient does not provide PAN.

- Time of Tax Deduction: TDS is deducted either at the time of crediting the payment to the payee’s account or at the time of actual payment.

Section 194IB: TDS on Rent Paid to Resident Landlords by Individuals/HUFs

- Applicability: Section 194-IB applies when the rent paid by individuals or HUFs (not liable to audit under Section 44AB) exceeds Rs. 50,000 per month. The responsibility to deduct and pay TDS lies with the tenant.

- TDS Rate & deposit: 5% if the recipient provides their PAN. 20% if the recipient does not provide PAN (under Section 206AA). TDS is deposited at the end of the financial year or at the end of the tenancy, whichever is earlier.

- Payment and Filing Process: The tenant deposits the deducted TDS using a Challan-cum-statement in Form 26QC. A TDS certificate is issued to the landlord in Form 16C.

- Time of Tax Deduction: TDS is deducted at the time of credit or payment, whichever is earlier. For the last month of the tenancy or the financial year, TDS is deducted at the time of credit or payment.

- No Requirement for TAN: Unlike other sections, individuals or HUFs do not need a Tax Deduction and Collection Account Number (TAN) to deduct TDS under Section 194-IB.

TDS on Rent Payments Under Section 195: For Non-Resident Indian (NRI) Landlords

When making rent payments to Non-Resident Indian (NRI) landlords, tenants must adhere to the TDS requirements under Section 195 of the Income Tax Act. This ensures that tax is collected from the source of income.

- Applicability: This section applies to rent payments made to non-resident landlords (NRIs). There is no minimum threshold for the rent amount. The responsibility to deduct and pay TDS lies with the tenant.

- TDS Rate: The TDS rate depends on the applicable tax rate for NRIs, which is usually 30% plus Education Cess (4%). Alternatively, a beneficial tax treaty rate between India and the NRI’s country of residence may apply.

- NRI landlord should provide a Tax Residency Certificate (TRC) from their country of residence to avail any beneficial DTAA rates. A beneficial tax treaty rate between India and the NRI’s country of residence may apply if the NRI provides a valid Tax Residency Certificate (TRC).

- The tenant must deposit the deducted TDS on a monthly basis as per the general TDS provisions. The tenant is required to file a quarterly TDS return using Form 27Q. The tenant issues a TDS certificate to the NRI landlord in Form 16A. The quarterly TDS return must be filed by the following dates:

- Quarter-1: 31st July

- Quarter-2: 31st October

- Quarter-3: 31st January

- Quarter-4: 31st May of the next financial year.

- Both tenant and landlord should keep records of rent payments and TDS certificates for tax filing purposes. Failure to deduct or deposit TDS can attract penalties under the Income Tax Act.

Summary of TDS Process Under Section 195 : For Non-Resident Indian (NRI) Landlords

| Aspect | Details |

| Applicability | Rent payments to NRI landlords, no minimum threshold |

| TDS Rate | 30% plus Education Cess (4%) or beneficial DTAA rate |

| Form for TDS Deposit | Monthly deposit |

| Form for TDS Return | Quarterly TDS return using Form 27Q |

| Form for TDS Certificate | Form 16A |

| Frequency of TDS Deposit | Monthly |

| Frequency of Return Filing | Quarterly (due dates: 31st July, 31st October, 31st January, 31st May) |

| Responsibility | Tenant |

| Penalties for Non-Compliance | Penalties for failure to deduct/deposit TDS |

| Record Keeping | Both tenant and landlord must maintain records |

Differences between Section 194I & Section 194IB:

| Aspect | Section 194I | Section 194IB |

| Person responsible for TDS deduction | (Individual and HUF) who are covered under Section 44AB (a) and (b) For other Assessee – no condition | (Individual and HUF) who are not covered under Section 44AB (a) and (b) For other Assessee – Section not applicable |

| Monetary Limit | Rs. 2,40,000/- per annum | INR 50,000/- per month |

| Applicable on which asset | Land, Building, Plant and machinery, furniture and fitting | Land and building only |

| TDS Rate | 2% for plant and machinery <br> 10% for land, building, furniture and fitting | 5% on land and building |

| Time Limit of TDS deduction | At the time of credit or payment, whichever is earlier | At the time of credit for the rent of the last month or the last month of tenancy, or at the time of payment, whichever is earlier |

| Time Limit for payment of TDS | Within 7 days from the end of the month in which it was deducted. <br>(For March – 30th April instead of 7th April) | 30 days from the end of the month in which TDS is deducted |

| TAN required | Yes | No |

| Form to be filed | 26Q | 26QC |

Difference Between Section 194IB & 195 with reference to Rent Payments

Understanding the differences between Section 194IB and Section 195 of the Income Tax Act is crucial for tenants making rent payments, as the requirements for TDS vary significantly depending on whether the landlord is a resident or a non-resident. The primary distinctions between Section 194IB and Section 195 revolve around the residency status of the landlord, the applicable TDS rates, the forms used for TDS deposits and certificates, and the frequency of TDS deposit and filing. Tenants have different TDS requirements with regard to rent payments to resident and non-resident landlords under Sections 194IB and 195 of the Income Tax Act, respectively.

| Aspect | Section 194IB (Resident Landlords) | Section 195 (NRI Landlords) |

| Applicability | Rent to resident landlords, exceeding Rs. 50,000 per month | Rent to non-resident landlords, no minimum threshold |

| TDS Rate | 5% (20% if PAN not provided) | 30% plus Education Cess 4% (or as per applicable DTAA) |

| Form for TDS Deposit | Form 26QC | Monthly deposit; Form 27Q for quarterly TDS return |

| TDS Certificate Form | Income Tax Form 16C | Income Tax Form 16A |

| Frequency of TDS Deposit | Within 30 days from the end of the month in which TDS is deducted | Monthly |

| Frequency of Return Filing | Annually or at the end of the tenancy | Quarterly |

| Onus of Deduction and Payment | Tenant | Tenant |

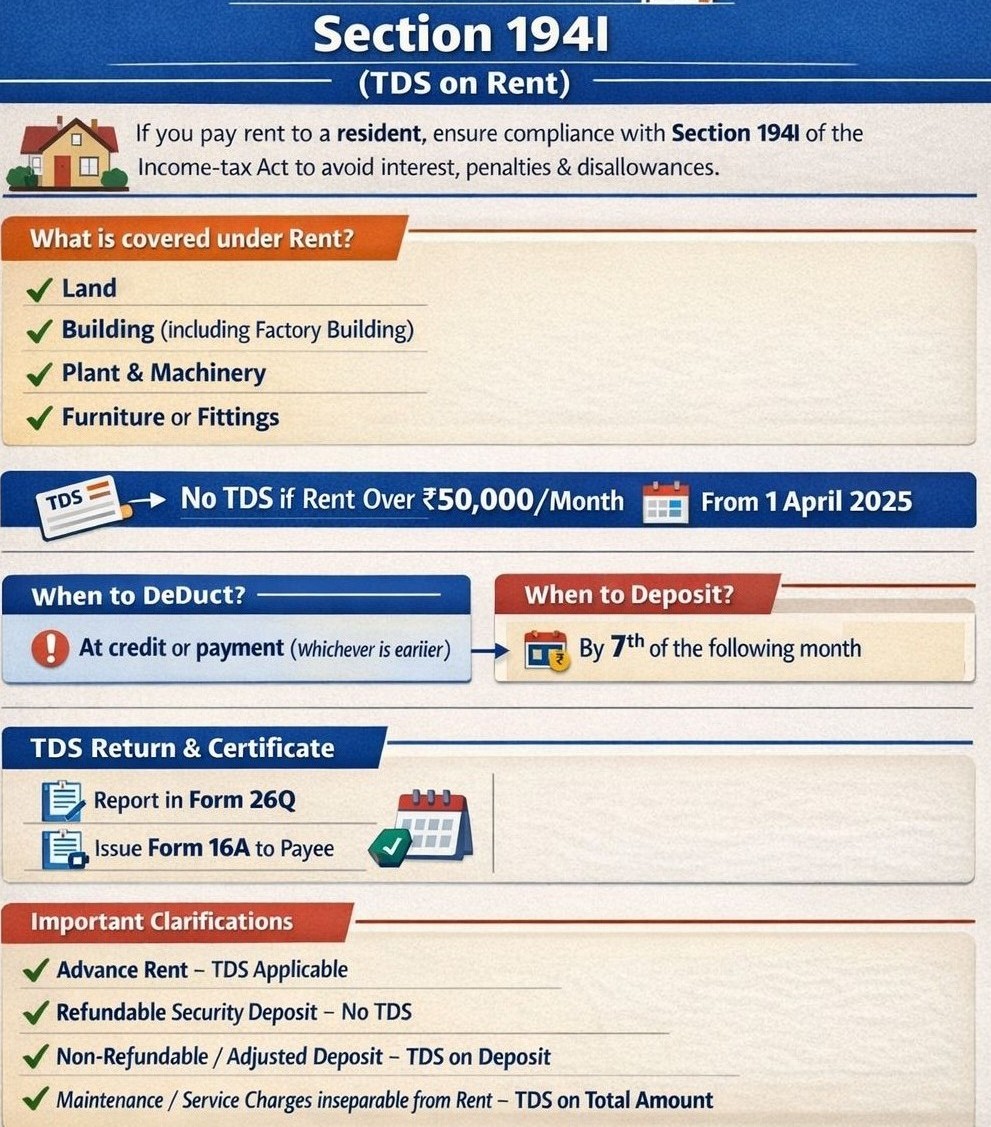

Tax Deducted at Source (TDS) on rent payments from April 1, 2025

As of February 14, 2025, a significant amendment has been proposed to Section 194-I of the Income Tax Act concerning Tax Deducted at Source (TDS) on rent payments.

- Increased Threshold for Tax Deducted at Source Deduction: Previously, Tax Deducted at Source was required to be deducted if the annual rent exceeded INR 2,40,000. Effective April 1, 2025, this threshold is proposed to be revised to INR 50,000 per month. Entities / person paying rent should review their rental agreements and implement necessary changes to their accounting processes to ensure compliance with the updated TDS provisions starting from April 1, 2025.

- Implications: Tax Deducted at Source will now be applicable if the monthly rent exceeds ₹50,000, shifting from an annual to a monthly assessment. This change primarily affects entities such as companies, firms, and individuals or Hindu Undivided Families (HUFs) subject to tax audit u/s 44AB.

- Tax Deducted at Source Rates:

- Land, Building, Furniture, or Fittings: 10% of the rent amount.

- Plant, machinery, or equipment: 2% of the rent amount.

Penalties for Non-Compliance of TDS Provisions :

- Section 201(1A): Interest for late deduction or late payment (1% per month for late deduction, 1.5% per month for late payment). The penalty is calculated for each day the failure continues, starting from the due date until the date of actual filing.

- Under Section 234E: Late fees of Rs. 200 per day for delayed return filing, capped at the TDS amount. The total amount of penalty cannot exceed the amount of TDS or TCS payable for the respective period for which the return is to be filed. The late fee is mandatory and is automatically levied for delays in filing TDS/TCS statements.

- Section 271H: Penalty ranging from Rs. 10,000 to Rs. 1,00,000 for non-filing or incorrect information.

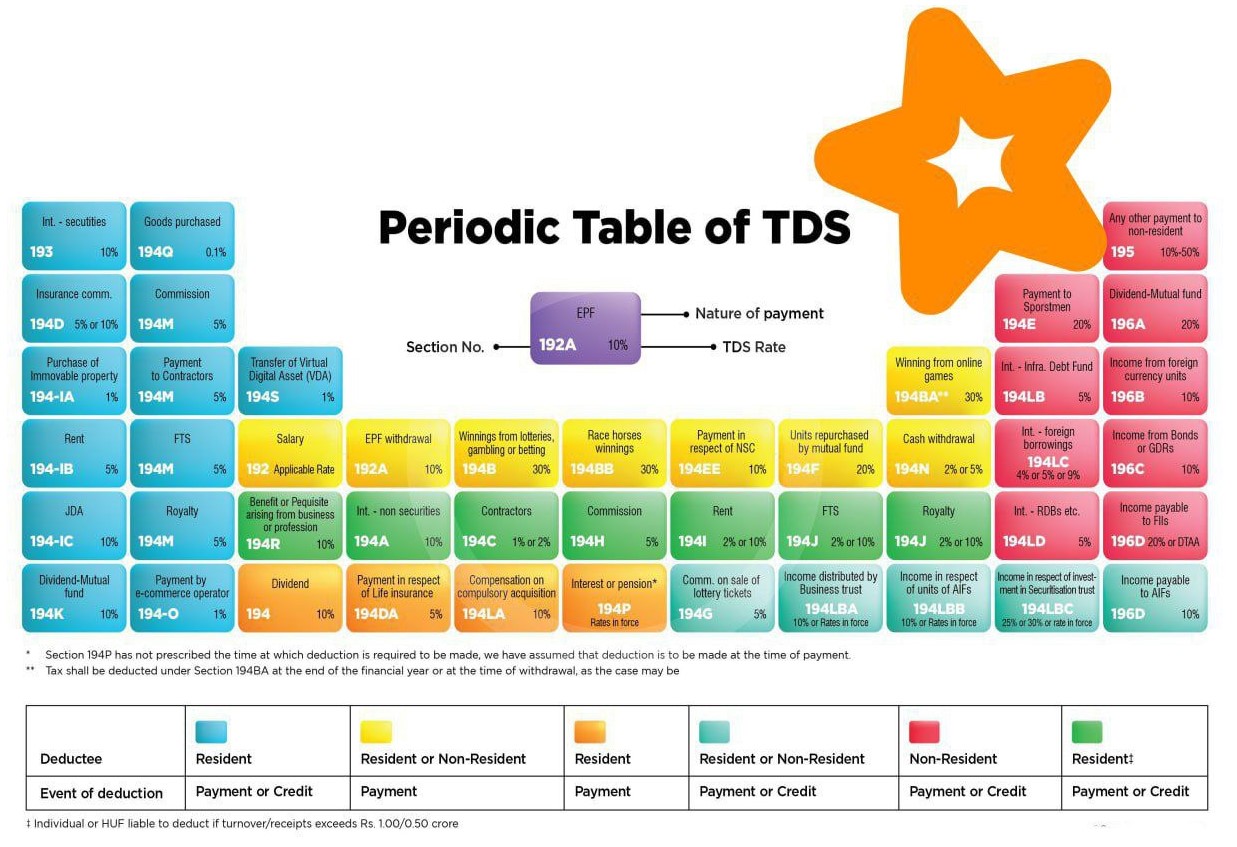

TDS & TCS Rate chart for FY 2024-25

Comprehensive study about TDS & TCS chapter

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.