New Capital Gains Taxation regime to optimize tax planning

Table of Contents

Provisions of the Amendment- Choice of Taxation of Capital Gain Scheme

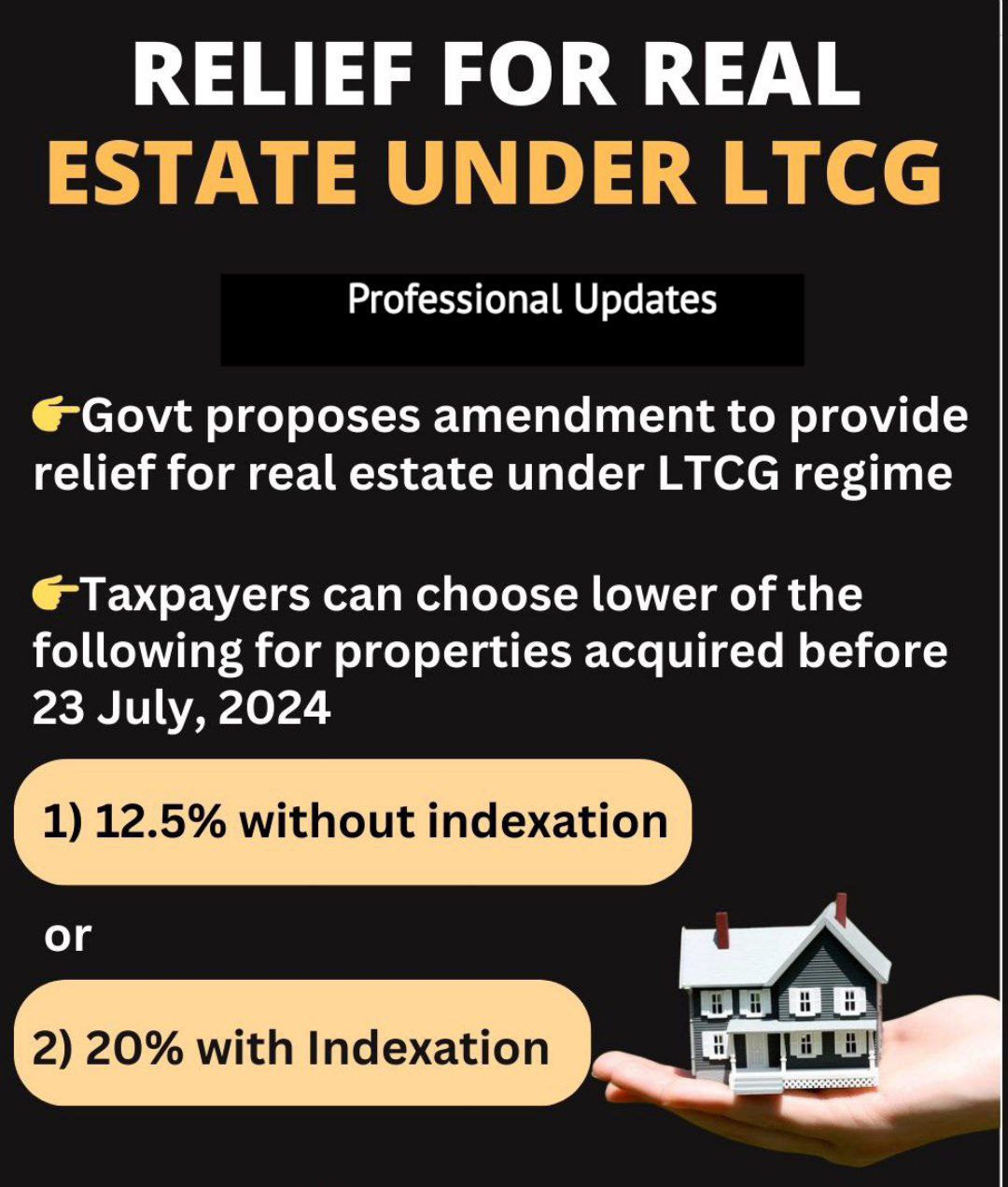

Budget 2024 provide relief applies to individuals and Hindu Undivided Families (HUF) who transfer long-term capital assets, specifically land or buildings or both. Following Choice of Taxation of Capital Gain Scheme :

– Taxpayers can opt to compute their taxes under either the new scheme (12.5% without indexation) or the old scheme (20% with indexation).

– The Taxpayers will pay the lower of the two calculated tax amounts.

By allowing taxpayers the flexibility to choose between the two schemes, this amendment aims to provide substantial relief and potentially reduce the tax burden for those dealing with long-term capital gains from immovable property.

Calculation of the Cost of Acquisition – Regarding New Capital Gains Taxation regime

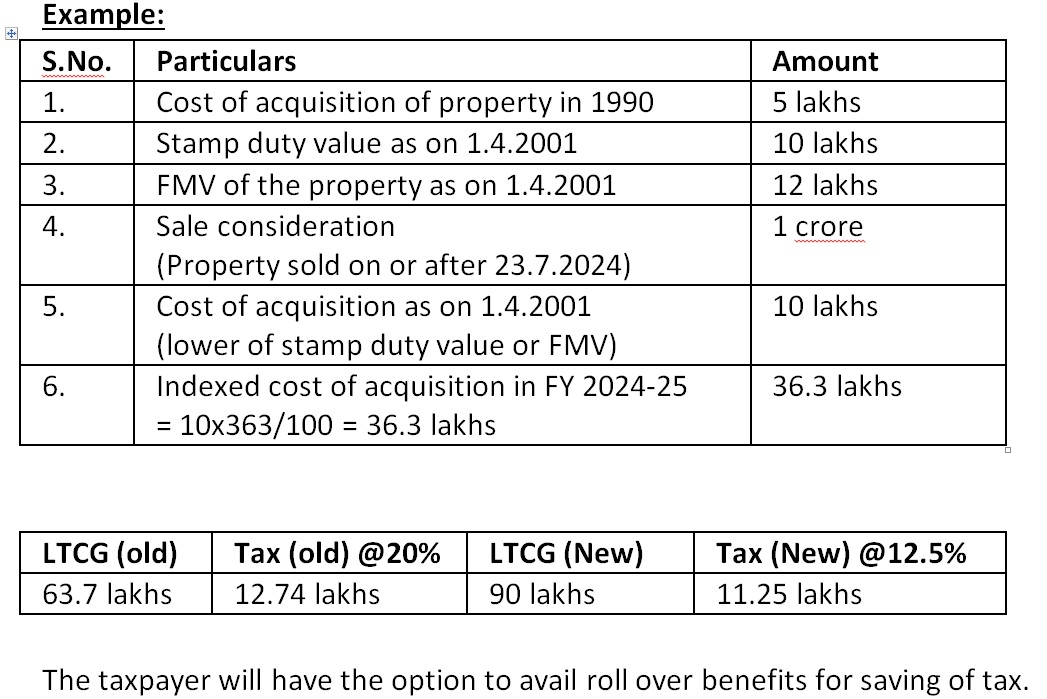

The recent clarification by Income Tax India regarding the New Capital Gains Taxation regime for properties bought before 2001 addresses an important issue related to the calculation of the Cost of Acquisition (COA).

Capital Gains Taxation Regime Changes (Effective from July 23, 2024): A significant concern was how to determine the Cost of Acquisition for properties purchased before April 1, 2001, under the new regime.

Clarification by Income Tax Dept: This clarification provides much-needed guidance and helps in addressing uncertainties regarding the tax implications for properties purchased before 2001 under the revised capital gains taxation rules effective from July 23, 2024.

For properties (land, building, or both) acquired before April 1, 2001: The COA for the purpose of capital gains calculation as of April 1, 2001, can be the higher of the following:

- Actual Cost of Acquisition: The original purchase price of the property.

- Fair Market Value: The market value of the property as on April 1, 2001, but not exceeding the stamp duty value where such value is available.

Implications of This Clarification: If the FMV as of April 1, 2001, is higher than the actual cost of acquisition and does not exceed the stamp duty value, it can be used as the COA, which could lower the taxable capital gains. The FMV used as the COA cannot exceed the stamp duty value as on April 1, 2001, ensuring that the COA is not inflated beyond what would be acceptable under stamp duty considerations.

Taxpayers with Properties Purchased Before 2001: When selling such properties under the new regime, the seller can opt for the more favorable of the two COA options, potentially reducing their capital gains tax liability.

Let’s break down the example you provided to better understand the impact of the new capital gains tax provisions and how they interact with exemptions under Sections 54, 54EC, and 54F.

New Tax Provisions and the available exemptions to optimize tax planning.

The new provisions require the entire capital gain amount (₹3 Crore in this case) to be reinvested to achieve full exemption under Section 54, 54EC, or 54F. Partial reinvestment, such as ₹1 Crore or ₹2 Crore, will not provide any additional tax benefit due to the restriction imposed by the amendment. The taxpayer needs to carefully plan their reinvestment strategy to fully leverage the exemptions and minimize tax liability.

Scenario:

- Sale of Land on 1st August 2024: ₹4 Crore

- Purchase in 2001: ₹1 Crore

- Indexed Cost (Old Regime): ₹3.48 Crore

- Capital Gain (New Provision without Indexation): ₹3 Crore

- Capital Gain (Old Provision with Indexation): ₹52 Lakhs

Tax Calculation Under Both Provisions:

- New Provision (Without Indexation):

- Capital Gain: ₹3 Crore

- Tax Rate: 12.5%

- Tax Payable: ₹3 Crore * 12.5% = ₹37.50 Lakhs

- Old Provision (With Indexation):

- Capital Gain: ₹52 Lakhs (₹4 Crore – ₹3.48 Crore)

- Tax Rate: 20%

- Tax Payable: ₹52 Lakhs * 20% = ₹10.40 Lakhs

Amendment Impact:

- As per the amendment in the Finance Bill, the tax payable under the new provisions should not exceed the tax under the old provisions.

- Tax Payable (After Adjustment): ₹10.40 Lakhs (as per old provision).

Section 54 Exemption Scenarios:

- If Only ₹1 Crore is Invested:

- Capital Gain: ₹3 Crore

- Unutilized Capital Gain: ₹2 Crore (since only ₹1 Crore is reinvested).

- Taxable Amount: ₹2 Crore.

- Tax on ₹2 Crore: ₹2 Crore * 12.5% = ₹25 Lakhs.

- But Restricted to: ₹10.40 Lakhs (due to the amendment).

Result: No tax benefit from investing only ₹1 Crore.

- If ₹2 Crore is Invested:

- Capital Gain: ₹3 Crore

- Unutilized Capital Gain: ₹1 Crore.

- Taxable Amount: ₹1 Crore.

- Tax on ₹1 Crore: ₹1 Crore * 12.5% = ₹12.5 Lakhs.

- But Restricted to: ₹10.40 Lakhs (due to the amendment).

Result: No tax benefit from investing ₹2 Crore.

- If ₹2.5 Crore is Invested:

- Capital Gain: ₹3 Crore

- Unutilized Capital Gain: ₹50 Lakhs.

- Taxable Amount: ₹50 Lakhs.

- Tax on ₹50 Lakhs: ₹50 Lakhs * 12.5% = ₹6.25 Lakhs.

Result: Benefit Achieved, as tax reduces to ₹6.25 Lakhs.

Section 54EC Exemption:

- Works similarly to Section 54. The same principle applies where the amount to be reinvested for full exemption is now based on the entire capital gain of ₹3 Crore, not the indexed gain.

Section 54F Exemption Scenarios:

- If Full Consideration (₹4 Crore) is Invested:

- Exemption: Entire ₹3 Crore capital gain is exempt.

- Taxable Amount: Nil.

- If ₹2 Crore is Invested:

- Exempt Capital Gain: (₹3 Crore * ₹2 Crore / ₹4 Crore) = ₹1.5 Crore.

- Taxable Capital Gain: ₹1.5 Crore.

- Tax on ₹1.5 Crore: ₹1.5 Crore * 12.5% = ₹18.75 Lakhs.

- But Restricted to: ₹10.40 Lakhs (due to the amendment).

Result: No tax benefit from investing ₹2 Crore.

Gift deed can be quashed if children don’t serve parents

Income tax rate in case of capital Gain regulation in India

Ready Recknor for calculating capital gains tax for all class of Assets.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.