IFSC AML framework for entities operating within GIFT City

Table of Contents

IFSC AML framework for entities operating within GIFT City.

In the context of the International Financial Services Centres Authority AML framework, particularly for entities operating within GIFT City, it is critical to safeguard against Money Laundering, Terrorist Financing, and Proliferation Financing. When performing a Customer Risk Assessment, an International Financial Services Centres Authority entity must give due consideration to several critical risk factors. The framework emphasizes a Risk-Based Approach, where the Customer Risk Assessment plays a pivotal role in identifying, evaluating, and mitigating these risks. Key Money Laundering or Terrorist Financing Risk Factors for Customer Risk Assessment under the International Financial Services Centres Authority Anti-Money Laundering Framework

-

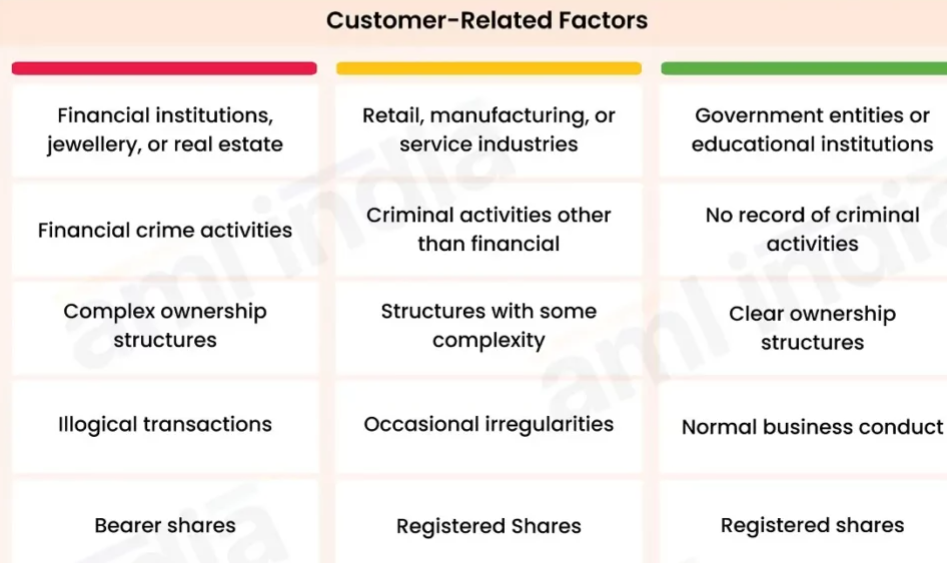

Customer-Specific Risk Factors:

- Customer Identity: Assessing the background, nature, and type of the customer, including their legal status, occupation, and ownership structure.

- Type of Customer: Different entities such as individuals, corporates, trusts, or non-profit organizations may carry varying levels of risk.

- Customer’s Financial Behavior: Monitoring transaction patterns, income levels, and any anomalies that could suggest higher Money Laundering or Terrorist Financing Risk. Evaluating whether the customer’s behavior aligns with the expected transaction profile.

- Nature of Business: The customer’s industry or sector might influence risk levels, especially those prone to money laundering or terrorist financing. Noting any significant changes in how the customer manages their account or interacts with the entity.

- Reputation and Past Conduct: Considering any negative media coverage, previous legal issues, or involvement in suspicious activities.

-

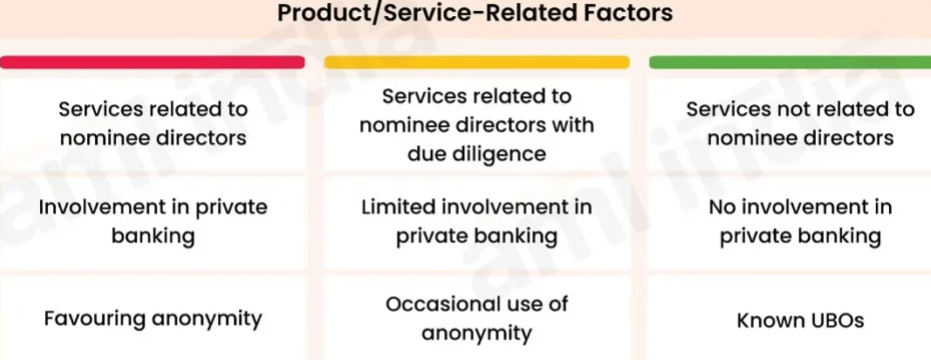

Product/Service/Transaction-Related Risk Factors:

- Type & Complexity of Product/Service: Higher risk associated with complex financial products, high-value transactions, or services prone to abuse for Money Laundering or Terrorist Financing purposes. Products or services that are complex or have high-value transactions may pose higher risks.

- Transaction Patterns: Analyzing the nature, frequency, and value of transactions to detect unusual or suspicious activity.

- Frequency and Volume of Transactions: High-frequency or high-value transactions may indicate higher risk, especially if inconsistent with the customer profile.

- Payment Methods: Risks associated with the use of cash, cryptocurrencies, or other anonymous payment methods.

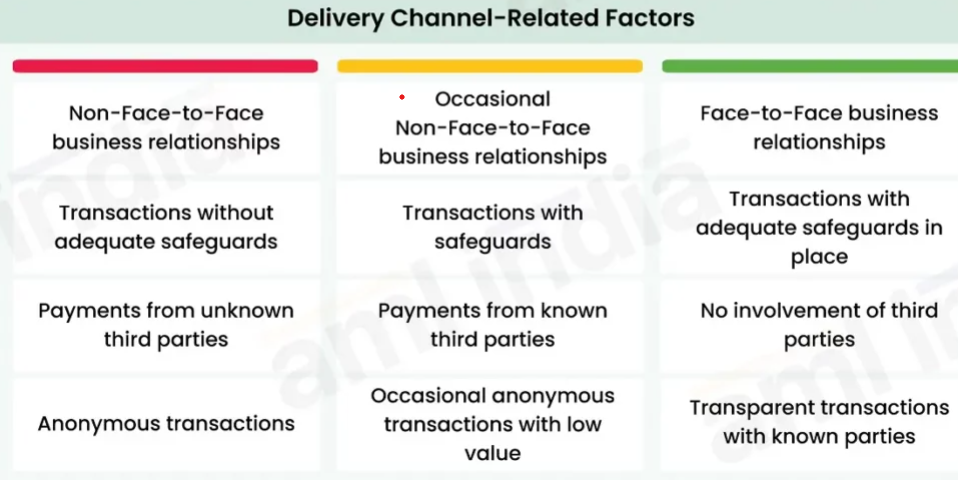

- Delivery Channels: Risk assessment based on whether the customer interacts in person, remotely, or through intermediaries.

-

Delivery Channel-Related Risk Factors:

- Interaction Method: Risk levels differ based on whether the customer interacts face-to-face, through digital channels, or via intermediaries.

- Channel Security: Evaluating the security of the delivery channel, especially in online or remote transactions, which may carry higher risk.

-

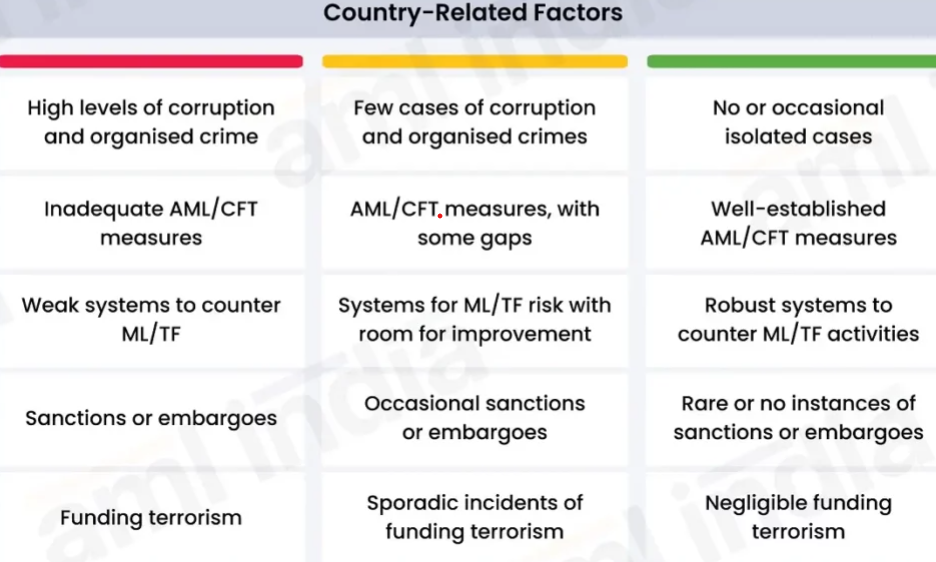

Geography-Related Risk Factors:

- Customer Location: Higher risk for customers located in jurisdictions with weak Anti-Money Laundering/ Counter Financing of Terrorism controls, or those identified as high-risk by international bodies like the Financial Action Task Force. Assess the risk based on the customer’s country or region, considering factors like the level of regulation, financial transparency, and geopolitical stability.

- Cross-Border Transactions: Increased risk when dealing with customers or transactions involving high-risk regions or countries subject to international sanctions. Increased risk if the customer is involved in cross-border activities, especially with high-risk jurisdictions.

-

Jurisdictional Risk Factors:

- Compliance with Local Regulations: Ensuring adherence to local laws and regulations, including Anti-Money Laundering and Counter Financing of Terrorism standards.

- International Sanctions and PEPs: Assessing risk related to politically exposed persons and entities or individuals subject to international sanctions.

-

Other Relevant Risk Factors:

- PEPs and Sanctions Lists: Assessing the risk of customers who are Politically Exposed Persons or are on sanctions lists.

- Business Activities: Certain industries or business activities may inherently carry higher risks of Money Laundering or Terrorist Financing Risk and PF.

- Unusual or Suspicious Transactions: Monitoring for patterns that deviate from normal behavior, such as large cash transactions, round-number transfers, or rapid movements of funds.

- Source of Funds: Understanding the origin of funds to assess the legitimacy and potential risk.

Anti-Money Laundering – Risk Assessment Process

- Data Collection: Gather comprehensive data on customers, including identity, financial transactions, and geographic connections.

- Risk Analysis: Evaluate the collected data against the risk factors to determine the potential level of Money Laundering or Terrorist Financing Risk/TF and PF risk.

- Risk Rating: Assign a final risk rating to each customer—High, Medium, or Low—based on the assessment.

- Mitigation Controls: Implement appropriate controls and monitoring mechanisms tailored to the risk rating. This may include enhanced due diligence for high-risk customers.

IFCCL Role in AML Consultancy Services

At International Financial Services Centres Authority, we understand the critical nature of Customer Risk Assessment in fortifying defenses against Money Laundering or Terrorist Financing and PF risks. Our comprehensive AML Consultancy services include:

- Designing Customer Risk Profiling Processes: Tailoring the risk assessment framework to the specific needs of the entity.

- Managed Customer Due Diligence Support: Offering end-to-end support in conducting thorough due diligence and ongoing monitoring.

By adopting a robust customer risk assessment process, regulated entities can significantly mitigate Money Laundering or Terrorist Financing and PF risks, ensuring compliance with the International Financial Services Centres Authority Anti-Money Laundering framework while safeguarding their operations in GIFT City.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.