GSTR Return under Goods & Services Tax regime in India

Kind of GSTR Return under Goods and Services Tax regime in India

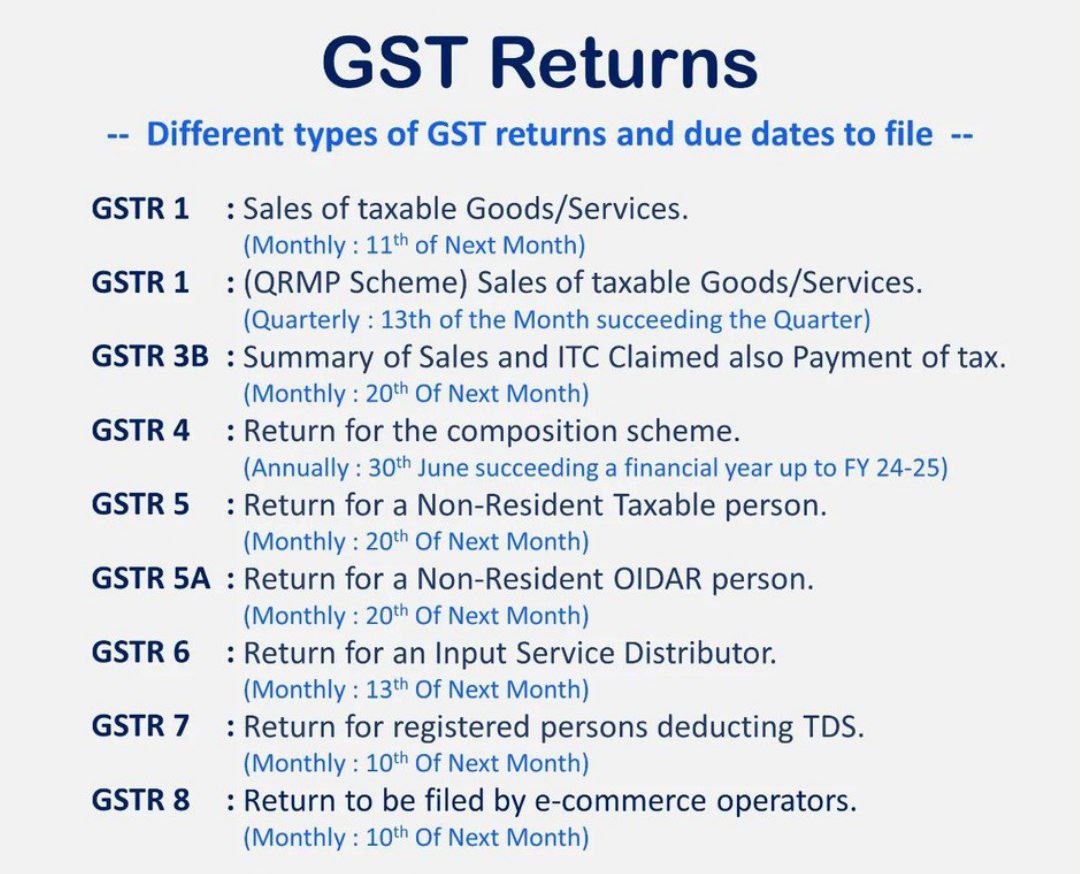

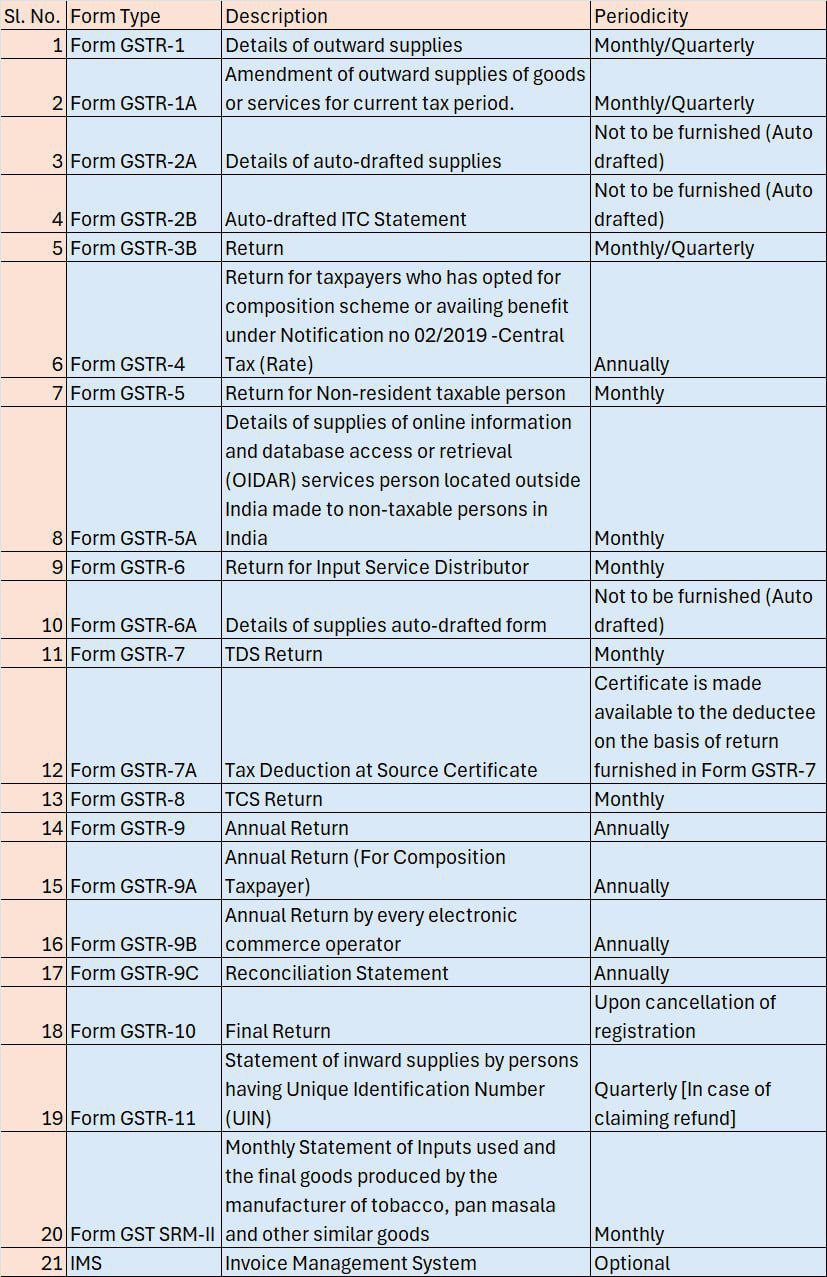

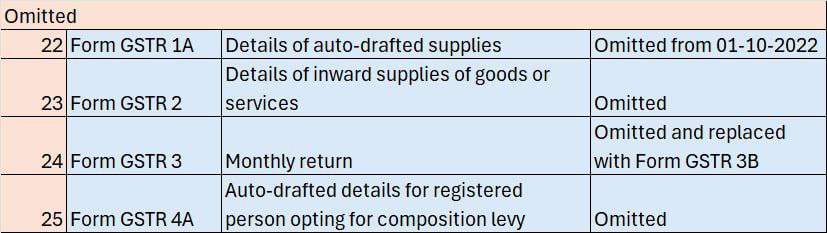

The Goods and Services Tax regime in India, there are various returns that need to be filed, depending on the type of taxpayer and the nature of their business. Under GST, there are thirteen returns. GSTR-1, GSTR-4, GSTR-3B, GSTR-5, GSTR-5A, GSTR-6, GSTR-7, GSTR-8, GSTR-9, GSTR-10, GSTR-11, CMP-08, and ITC-04 are the documents in concern. All taxpayers do not, however, apply to all returns. Depending on the type of taxpayer and the type of registration they obtained, taxpayers file returns. Each return has a specific purpose, and the requirement to file a particular return depends on the taxpayer’s registration type, the nature of their business, and the transactions they engage in. Not all returns are applicable to every taxpayer, and understanding which returns apply is crucial for compliance under GST.

Brief overview of GSTR Return under GST Regime

Here’s a brief overview of these returns and the types of taxpayers they apply to:

- GSTR-1: Filed by regular taxpayers to report outward supplies of goods and services. This return details all the sales transactions of a business.

- GSTR-3B: A summary return filed by regular taxpayers to report the summary of outward supplies along with input tax credit (ITC) claimed, and payment of tax.

- GSTR-4: Filed by composition scheme taxpayers. It’s an annual return (previously filed quarterly) that includes details of outward supplies and tax payable under the composition scheme.

- GSTR-5: Filed by non-resident taxable persons to report the details of outward and inward supplies, ITC availed, and tax paid.

- GSTR-5A: Filed by non-resident Online Information and Database Access or Retrieval service providers to report the details of services provided to non-taxable persons in India.

- GSTR-6: Filed by Input Service Distributors to distribute the input tax credit among its branches or units.

- GSTR-7: Filed by taxpayers required to deduct tax at source under GST to report the details of TDS and TDS liabilities.

- GSTR-8: Filed by e-commerce operators to report the details of supplies made through their platform and the amount of tax collected at source.

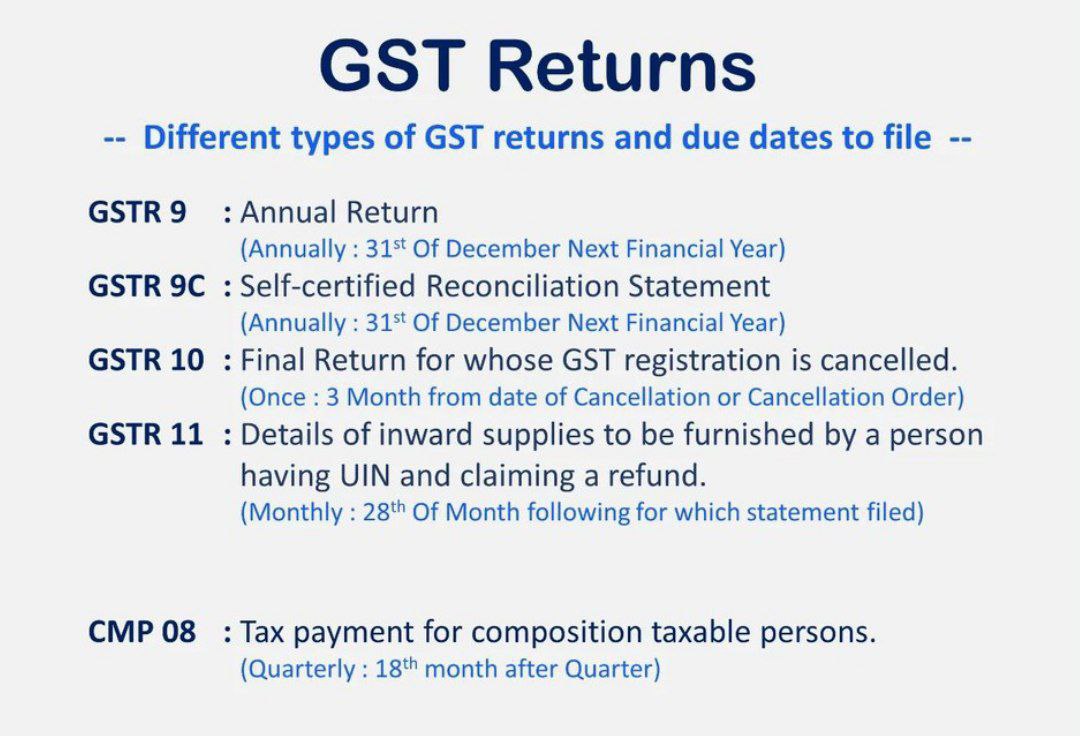

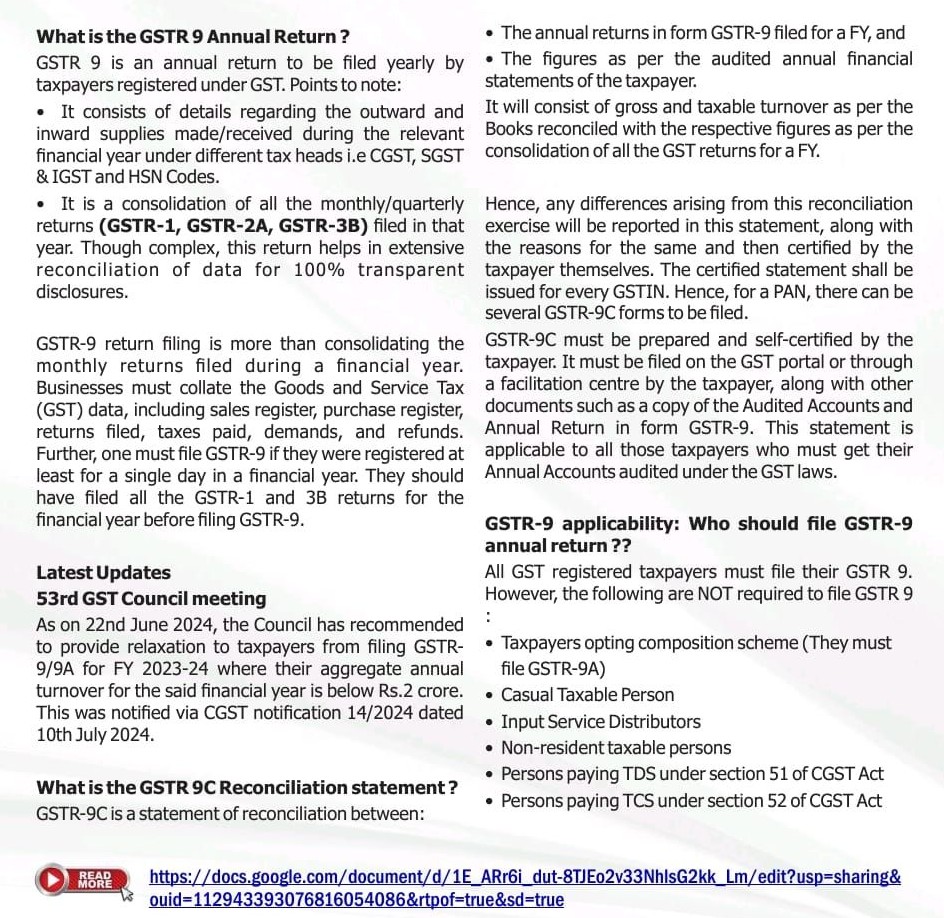

- GSTR-9: An annual return filed by regular taxpayers to provide a summary of the outward and inward supplies made or received during the financial year under different tax heads Center Goods and Services Tax, State Goods and Services Tax, SGST, Integrated Goods and Services Tax, and Harmonized System of Nomenclature codes.

- GSTR-10: A final return filed by taxpayers whose Goods and Services Tax regime Registration has been canceled or surrendered, providing details of inputs, capital goods held, and liabilities.

- GSTR-11: Filed by taxpayers who have been issued a Unique Identity Number to claim a refund of taxes paid on inward supplies.

- CMP-08: A quarterly return-cum-challan filed by composition taxpayers to pay tax and provide a summary of outward supplies.

- ITC-04: Filed by manufacturers or principal businesses who send goods to a job worker and need to report the details of goods sent and received back.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.