GSTN issued advisory on “RCM Liability/ITC Statement”

Table of Contents

GSTN advisory on Introduction of RCM Liability/ITC Statement

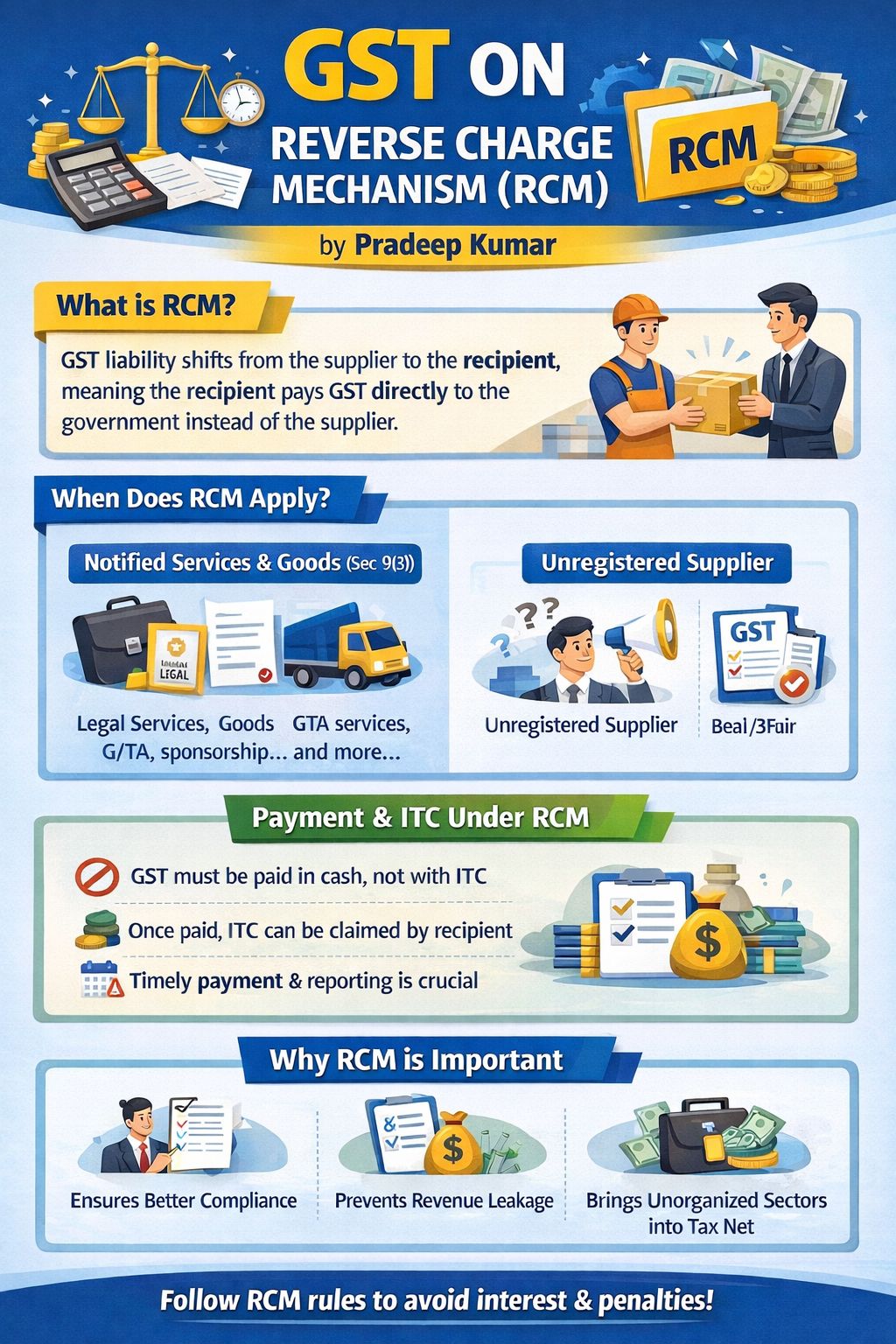

The recent advisory by Goods and Services Tax Network introduces a new “RCM Liability/Input Tax Credit Statement” on the Goods and Services Tax portal, which is designed to help taxpayers accurately report transactions under the Reverse Charge Mechanism. This advisory provides a structured approach to ensure compliance with RCM reporting, helping taxpayers manage their liabilities and Input Tax Credit more effectively. New Ledger on GST Portal. Here’s a summary of the key points on “RCM Liability/ITC Statement”:

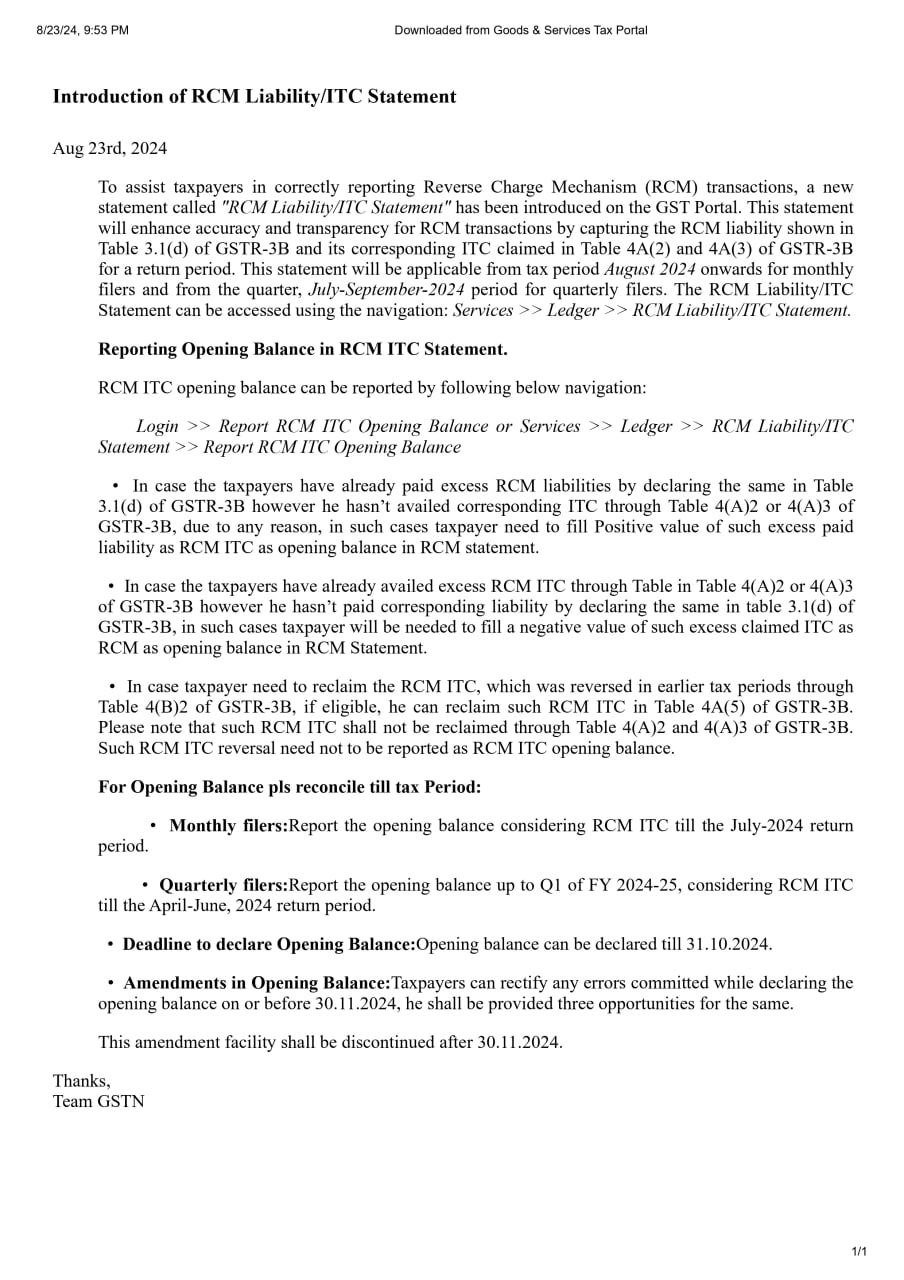

Introduction of RCM Liability/ITC Statement

- Purpose: To assist taxpayers in accurately reporting Reverse Charge Mechanism transactions and enhancing transparency by capturing the RCM liability in Table 3.1(d) of GSTR-3B and the corresponding Input Tax Credit claimed in Tables 4A(2) and 4A(3) of GSTR-3B.

- Applicability:

- From August 2024 for monthly filers.

- From the July-September 2024 quarter for quarterly filers.

- Access: Navigate through Services >> Ledger >> RCM Liability/Input Tax Credit Statement on the GST portal.

Reporting Opening Balance in RCM ITC Statement

- Steps for Reporting:

- Login >> Report Reverse Charge Mechanism ITC Opening Balance or

- Services >> Ledger >> RCM Liability/Input Tax Credit Statement >> Report Reverse Charge Mechanism Input Tax Credit Opening Balance.

- Cases to Consider:

- Excess RCM Liability Paid but Input Tax Credit Not Claimed: If the taxpayer has paid excess RCM liabilities but hasn’t claimed the corresponding ITC, they need to report this as a positive opening balance in the RCM statement.

- Excess Input Tax Credit Claimed but RCM Liability Not Paid: If the taxpayer has claimed excess Reverse Charge Mechanism ITC but hasn’t paid the corresponding liability, they need to report this as a negative opening balance in the RCM statement.

- Reclaiming Reversed RCM Input Tax Credit : If the taxpayer needs to reclaim Reverse Charge Mechanism Input Tax Credit that was reversed in previous periods, they should reclaim it in Table 4A(5) of GSTR-3B and not in Tables 4A(2) and 4A(3).

Reconciliation and Deadlines

- This timeline is crucial for ensuring accurate reporting and compliance with the new RCM Liability/ITC Statement requirements. The GSTN has set the following deadlines regarding the declaration and amendment of the opening balance in the RCM Liability/ITC Statement:

- Reconciliation:

- Monthly filers: Reconcile Reverse Charge Mechanism ITC up to July 2024.

- Quarterly filers: Reconcile Reverse Charge Mechanism ITC up to Q1 of FY 2024-25.

- Deadlines:

- Deadline for Declaring Opening Balance: Taxpayers must declare the opening balance by October 31, 2024. Declare Opening Balance: By 31st October 2024.

- Opportunity for Amendment: If taxpayers make errors in their declared opening balance, they have the chance to amend these errors until November 30, 2024. They are provided with up to three opportunities for making these corrections. Errors can be rectified by 30th November 2024, with up to three opportunities for amendment. No amendments are allowed after this date.

- Discontinuation of Amendment Facility: After November 30, 2024, the amendment facility will be discontinued, and no further changes to the opening balance can be made.

For more details, you can refer to the official update from GSTN

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.