New Invoice IMS – Invoice corrections or amendments

Table of Contents

New Invoice Management System (IMS)- Invoice corrections or amendments

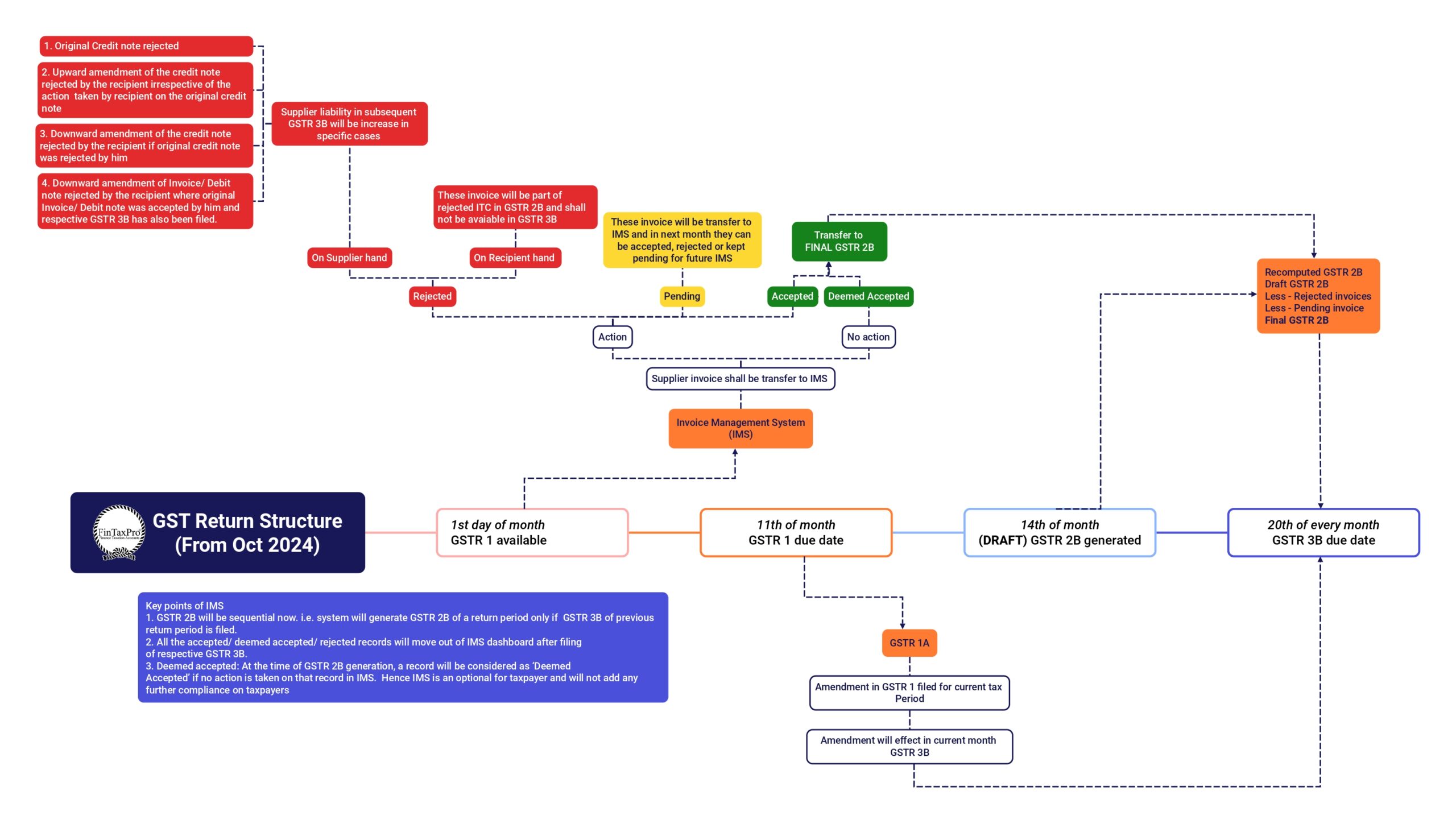

GSTN has introduced a new feature on the GST portal, called the IMS to facilitate easy invoice corrections and accurate Input Tax Credit claims. The new Invoice Management System (IMS) being introduced on the GST portal from 1st October aims to streamline communication between taxpayers and their suppliers for efficient invoice corrections or amendments. IMS will facilitate the reconciliation of invoices between recipients and suppliers, ensuring the correct Input Tax Credit is claimed. Through this system, recipient taxpayers will have the option to:

- Accept the invoice.

- Reject the invoice.

- Keep the invoice pending for future action.

This feature will improve the accuracy of ITC claims and help reduce discrepancies between records. The introduction of IMS will enhance the compliance process and help businesses manage their invoice-related communication seamlessly. this transition may initially challenge software companies, which will need to realign their processes to integrate with the new system. Despite the complexities, it is seen as a necessary step toward adapting to the evolving regulatory landscape.

key advantage of New Invoice Management System (IMS)

A key advantage of IMS is its ability to maintain a detailed audit trail of actions taken on each invoice, which will be useful during GST audits. This feature will simplify scrutiny by providing evidence of a taxpayer’s due diligence in managing ITC claims.

Looking ahead, the IMS could pave the way for automation and AI-driven features, such as:

- Predictive analysis for ITC claims.

- Automated dispute resolution for invoice discrepancies.

- Enhanced fraud detection.

For full implementation, state and central governments will need to amend and reissue the relevant tax rules and forms within their statutory frameworks.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.