Consequences of CPE Non-Compliance for CA from 2024 Onwards

Table of Contents

Understanding the Consequences of CPE Non-Compliance for Chartered Accountants from 2024 Onwards

Continuing professional Education is essential for Chartered Accountants, serving as a cornerstone for maintaining the integrity and competence of the profession. The Institute of Chartered Accountants of India has underscored the significance of CPE by introducing structured consequences for non-compliance, starting from the calendar year 2024. Here’s a detailed breakdown of what you need to know:

What Are CPE Hours for ICAI Members?

CPE hours represent a CA’s commitment to ongoing education and skill enhancement, ensuring they remain updated with the latest developments in the financial and regulatory landscape. ICAI mandates a specific number of hours per year, highlighting the importance of continuous learning in delivering professional excellence.

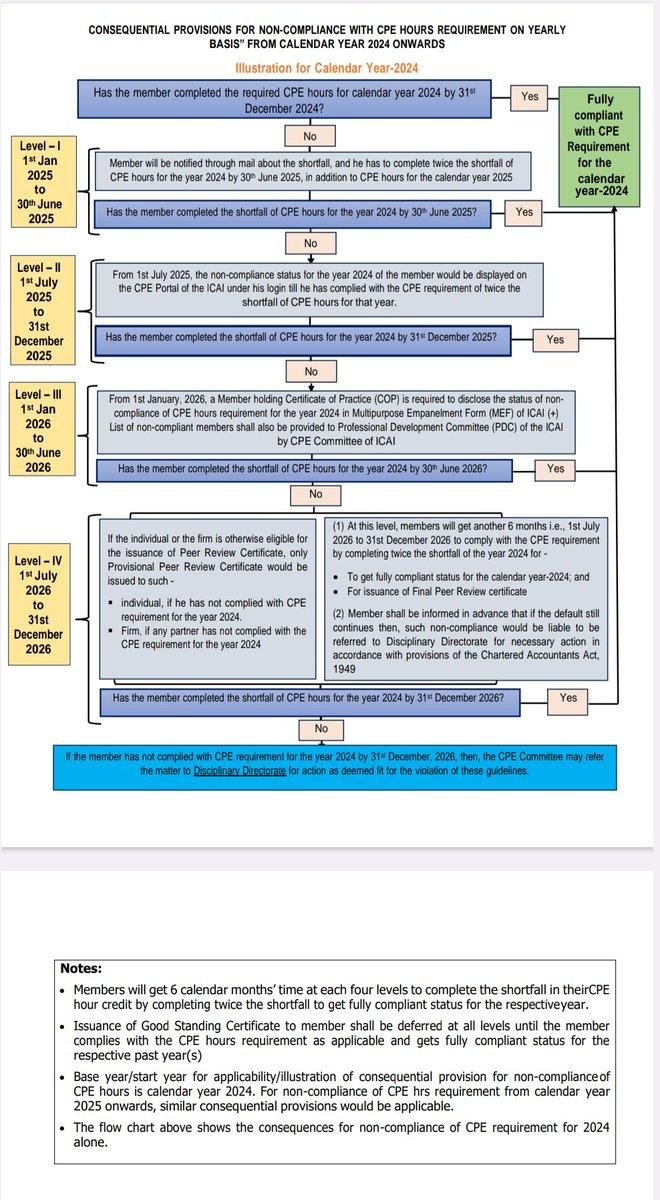

Consequential Provisions for Non-Compliance of ICAI Members

Level I (1st January to 30th June 2025):

- If the required CPE hours are not completed by 31st December 2024, the CA will receive a notification highlighting the shortfall.

- The CA will then have until 30th June 2025 to complete twice the deficit to regain compliance status.

Level II (1st July to 31st December 2025):

- A continued shortfall will result in the CA’s non-compliance status being publicly displayed on the ICAI e-Portal.

Level III (1st January to 30th June 2026):

- If non-compliance persists, it will need to be disclosed in the Multilayered Empanelment Form, impacting empanelment opportunities.

- This status will also be reported to the Professional Development Committee by the CPE Committee.

Level IV (1st July to 31st December 2026):

- At this final stage, unresolved non-compliance will lead to withholding of the Peer Review Certificate.

- Additionally, the matter may be referred to the Disciplinary Directorate for further action.

What is the Bottom Line for ICAI Members?

Compliance with CPE requirements is not optional—it is vital for upholding the reputation and integrity of the profession. By fulfilling these requirements, Chartered Accountants ensure they remain at the forefront of the ever-evolving financial ecosystem.

ICAI Members Planning Ahead

To avoid the consequences of non-compliance:

- Plan Early: Map out your CPE activities at the start of the year.

- Leverage ICAI Resources: Utilize workshops, webinars, and peer learning opportunities offered by ICAI.

- Stay Proactive: Address any challenges in completing CPE hours by seeking support from ICAI or engaging with peer networks.

- Non-compliance in 2024 will trigger provisions effective 1st January 2025, requiring members to address deficits or face escalation across four levels. Completion of ICAI’s certificate/diploma courses (virtual or physical) will contribute to structured CPE hours.CPE hours are credited in the calendar year the event concludes.

Remember, CPE is not just about meeting a mandated quota of hours; it is an opportunity to enhance your knowledge, skills, and value to clients and the economy. By embracing the spirit of continuous improvement, you contribute to the profession’s excellence and your personal growth.

Peer review mandate due date extended: Phase III – 1 July 25 & Phase IV – 1 Jan 2026

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.