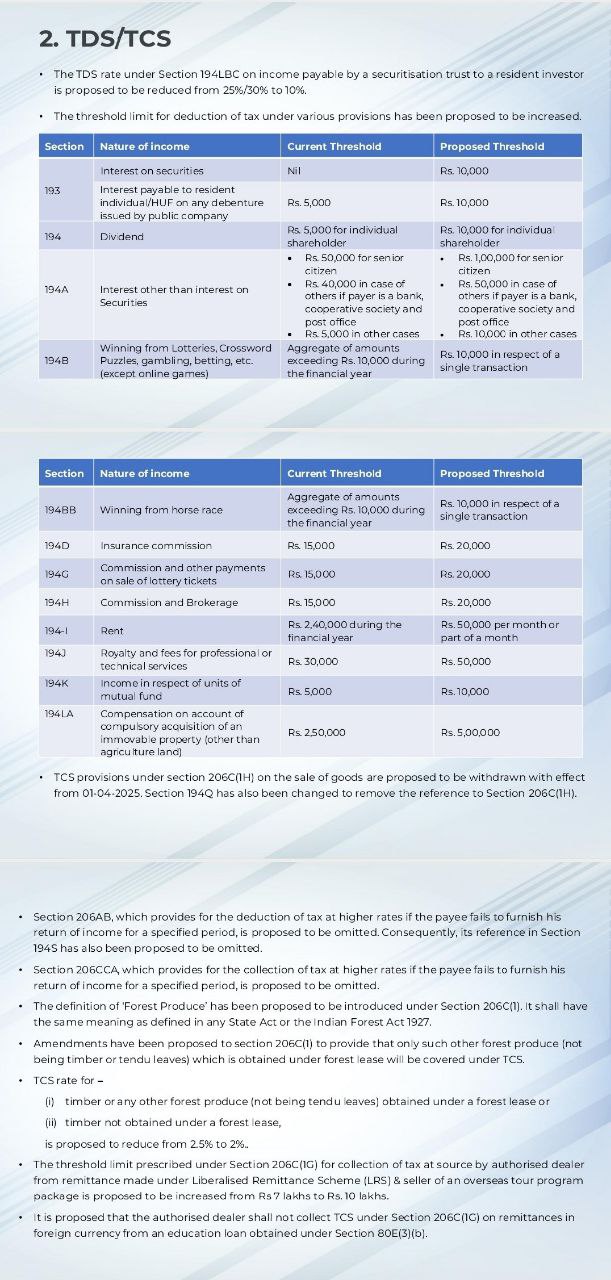

TDS Rates Chart for the FY 2024-25

TDS Rates Chart for the financial year 2024-25

This is the TDS (Tax Deducted at Source) Rates Chart for the financial year 2024-25. Here’s a quick breakdown of the rates and thresholds for various sections:

- Section 192: Payment of Salary – Based on slab rates; Threshold is the basic exemption limit.

- Section 193: Interest on securities – TDS at 10%, with a threshold of ₹10,000.

- Section 194: Payment of Dividends – TDS at 10%, threshold ₹5,000.

- Section 194A: Interest (non-securities) – TDS at 10%, threshold ₹40,000 for banks/co-operative societies.

- Section 194B: Lottery winnings – TDS at 30%, threshold ₹10,000.

- Section 194BA: Income from Online Gaming – TDS at 30%, no threshold.

- Section 194BB: Horse Race Winnings – TDS at 30%, threshold ₹10,000.

- Section 194C: Contractor/Subcontractor payments:

- Individual/HUF: TDS at 1%, threshold ₹30,000 (single transaction) or ₹1,00,000 (annual).

- Others: TDS at 2%.

- Section 194D: Insurance Commission:

- Domestic Companies: TDS at 10%, threshold ₹15,000.

- Others: TDS at 5%.

- Section 194G: Commission on sale of lottery tickets – TDS at 2%, threshold ₹15,000.

- Section 194H: Commission/Brokerage – TDS at 2%, threshold ₹15,000.

- Section 194I: Rent:

- Plant or Machinery: TDS at 2%, threshold ₹2,40,000.

- Land, building, furniture: TDS at 10%, threshold ₹2,40,000.

- Section 194J: Professional Services, Director Remuneration, Technical Services:

- TDS at 10%, threshold ₹30,000.

- For technical services, royalty, call centers: TDS at 2%, threshold ₹30,000.

- Section 194K: Income from mutual fund units – TDS at 10%, no threshold.

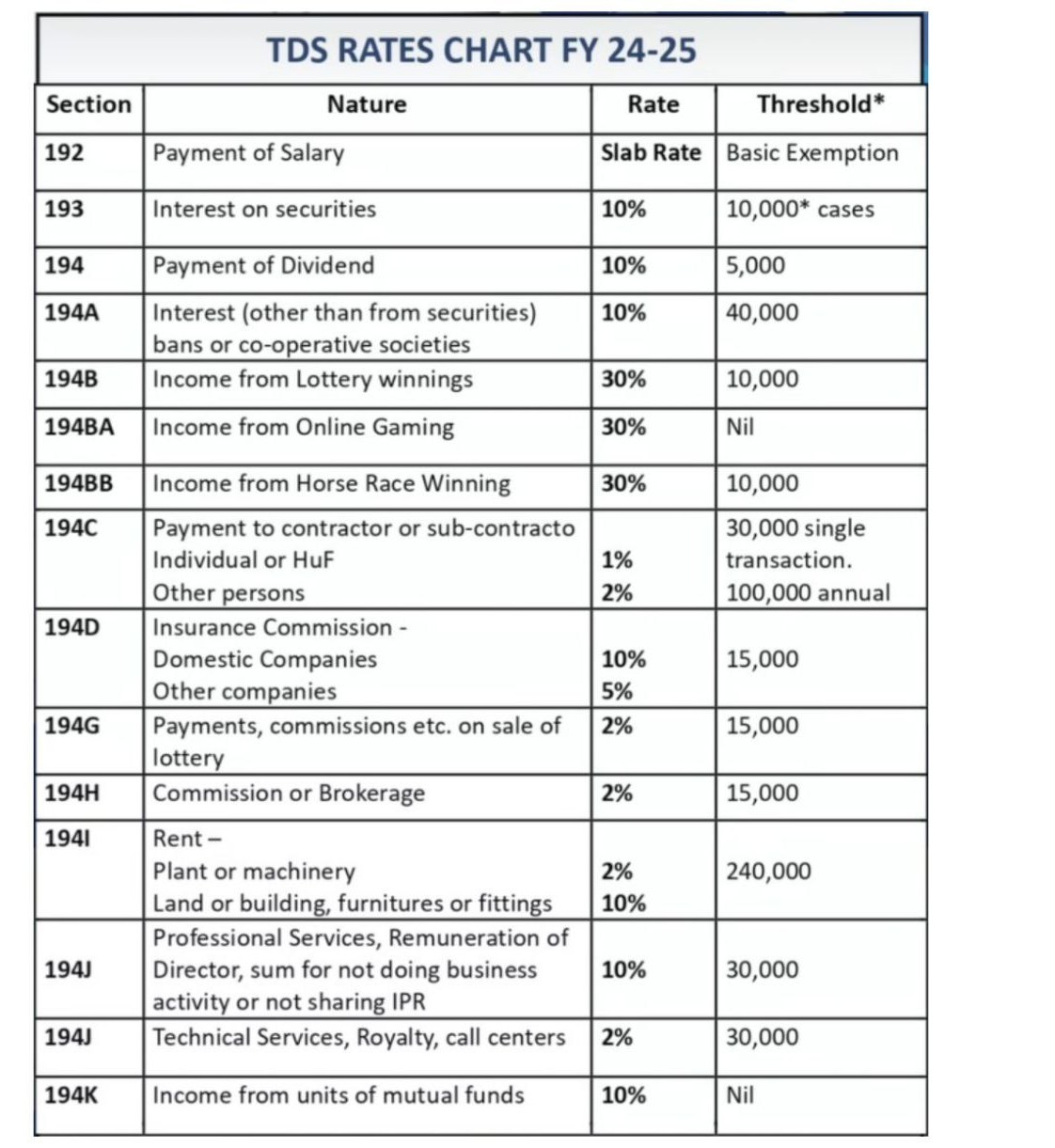

Rationalization of TDS/TCS Provisions: New Updated TDS Rates Chart

Summarizing the rationalization of TDS/TCS provisions with increased threshold limits for various provisions under the Income Tax Act. It may Impact of changes, like Reduces compliance burden by increasing TDS/TCS thresholds. Beneficial for taxpayers, particularly those earning interest, commission, and professional fees. Supports education abroad by removing TCS on certain education-related transactions. Key Changes in TDS/TCS Thresholds

-

Section 194A (Interest other than Interest on Securities)

- Increased from INR 50,000 to INR 1,00,000 for senior citizens.

- Increased from INR 40,000 to INR 50,000 for banks, cooperative societies, and post offices.

- Increased from INR 5,000 to INR 10,000 for others.

-

Section 194-I (Rent): Changed from INR 2,40,000 per year to INR 50,000 per month or part thereof.

-

Section 193 (Interest on Securities): Threshold introduced at INR 10,000 (earlier Nil).

-

Section 194 (Dividend for Individual Shareholder): Increased from INR 5,000 to INR 10,000.

-

Section 194K (Income from Mutual Funds/Specified Companies): Increased from INR 5,000 to INR 10,000.

-

Section 194D (Insurance Commission): Increased from INR 15,000 to INR 20,000.

-

Section 194G (Lottery Commission and Prizes): Increased from INR 15,000 to INR 20,000.

-

Section 194H (Brokerage/Commission): increased from ₹15,000 to ₹20,000.

-

Section 194J (Professional or Technical Fees): Increased from INR 30,000 to INR 50,000.

-

Section 194LA (Enhanced Compensation for Land Acquisition): Increased from INR 2,50,000 to INR 5,00,000.

- Section 206C(1G) (LRS Remittance & Tour Packages): Increased from INR 7,00,000 to INR 10,00,000.

- Additional Relief for Education Remittances like No TCS on education-related remittances where the amount is taken as a loan from a specified financial institution.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.