Tax Notices for Non-Deduction of TDS on Rent >50,000 P.M.

Table of Contents

Tax Dept Sends Tax Notices for Non-Deduction of TDS on Rent >50,000 P.M.

TDS Deduction Responsibility on Rent

Income Tax Dept has issued notices to tenants paying INR 50,000/- or more in monthly rent who failed to deduct and deposit TDS before remitting payments to their landlords. Even salaried employees paying rent from their taxable income must deduct TDS if their rent exceeds INR 50,000/- Per month.

- Tenants must deduct 2% TDS on rent payments exceeding INR 50,000/- per month (effective from October 2024, earlier 5%) and deposit it with the Income Tax Department. TDS must be deposited on time to avoid penalties.

- If tenants failed to deduct TDS on rent, they may need to revise their House Rent Allowance claims as a corrective measure. In cases where landlords have already paid tax on rental income, tenants should obtain Form 26A certification from the landlord to avoid liability.

Why Are Tenants Receiving Notices? Many taxpayers failed to comply with TDS on rent for AY 2023-24 & 2024-25 and are now receiving notices from the Income Tax Dept.

- Some taxpayers might not realize that reducing their HRA claim is a corrective measure.

- The department is increasing scrutiny on high-rent transactions, urging taxpayers to review filings and ensure compliance to avoid penalties.

What Should Tenants Do: The tax notice allows individuals to file an updated ITR and adjust their HRA claims to rectify non-compliance before penalties are imposed. Under “Exception to the Rule,” clarify that if the landlord has already paid taxes on the rental income, the tenant can request a Form 26A certification from the landlord to prove compliance. Consequences of failing to deduct TDS on rent payments and the necessary compliance measures for tenants paying high rent.

Consequences of Non-Compliance

- Non-deduction of TDS can result in:

- Being considered an “assessee in default.”

- Interest penalties ranging from 1-1.5% per month.

- Additional fines imposed by tax authorities.

Exemption from Penalty

- Tenants can avoid penalties if their landlord has already declared rental income in their ITR and paid taxes on it. However, obtaining proof from landlords may be difficult due to privacy concerns.

- ITR-U must be filed within the allowed timeframe (24 months from the end of the relevant AY) to rectify non-compliance before penalties escalate.

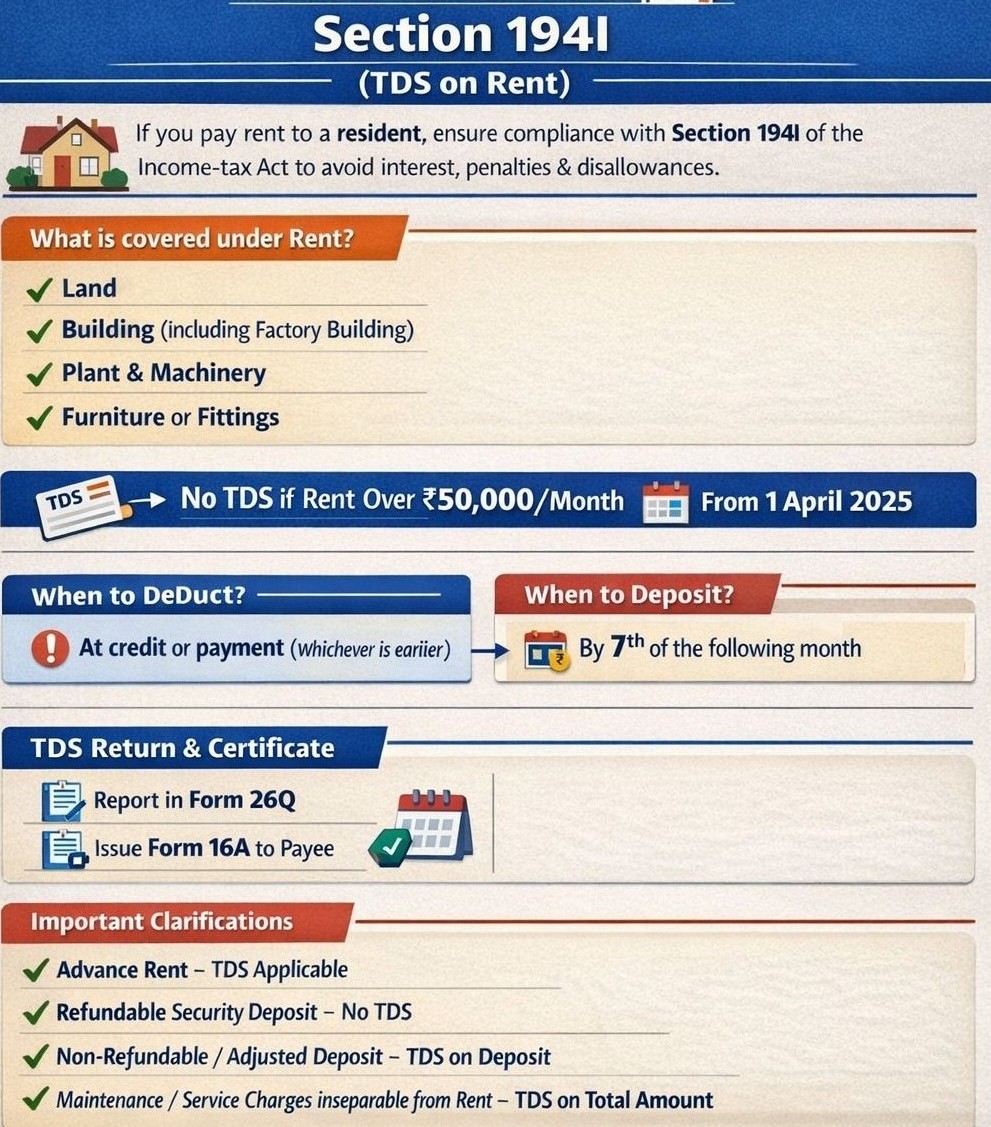

Compliance summary for Section 194I – TDS on Rent

What is the meaning of “rent”?

Payment for use of:

- Land

- Building (including factory building)

- Plant & Machinery

- Furniture or Fittings

Who must deduct TDS?

- Any person paying rent (Company, Firm, LLP, Trust, etc.)

- Individual / HUF only if liable to tax audit u/s 44AB in the preceding FY.

Threshold

- No TDS if total rent ≤ ₹2,40,000 in a financial year. (Note: ₹50,000/month limit applies to 194IB, not 194I.)

Rates

- 2% – Plant, machinery, equipment

- 10% – Land, building, furniture, fittings

- 20% – If PAN not furnished (Sec 206AA)

- Non-resident payee → Sec 195 applies (not 194I).

When to deduct?

- At earlier of credit or payment (including advance rent).

Deposit & Reporting

- Deposit: By 7th of next month

- Return: Form 26Q

- Certificate: Form 16A

Following Important Clarifications related to 194I

- Advance Rent: TDS applicable

- Refundable Security Deposit: No TDS

- Non-refundable / adjusted deposit: TDS applicable

- Maintenance charges inseparable from rent: TDS on total amount

A common mistake normally doing by taxpayers is applying 194IB instead of 194I which create / leads to short deduction notices.

Comparison Chart Section 194I vs Section 194IB – TDS on Rent

| Particulars | Section 194I | Section 194IB |

|---|---|---|

| Applicable to whom? | Any person (Company, Firm, LLP, Trust, Individual, HUF, etc.) | Individual / HUF only |

| Audit requirement (u/s 44AB) | Individual/HUF liable to audit in preceding FY | Individual/HUF NOT liable to audit |

| Nature of payee | Resident only | Resident only |

| Type of asset | Land, Building, Plant & Machinery, Furniture or Fittings | Land or Building only |

| Threshold limit | INR 2,40,000 per financial year | INR 50,000 per month |

| Rate of TDS | 2% – Plant & Machinery 10% – Land/Building/Furniture |

5% |

| Time of deduction | Earlier of credit or payment | Once in a year (March or last month of tenancy) |

| TDS deposit due date | 7th of next month | Within 30 days from end of month of deduction |

| TDS return | Form 26Q (Quarterly) | Form 26QC (Challan-cum-statement) |

| TDS certificate | Form 16A | Form 16C |

| TAN requirement | Mandatory | Not required |

| Section 206AA (No PAN) | 20% | Rate restricted to 5% (not exceeding rent) |

| Advance rent | TDS applicable | TDS applicable |

| Security deposit | Refundable – No TDS | Refundable – No TDS |

Quick Practical Rule- related to TDS on Rent

-

Company / Firm / LLP? → Section 194I

-

Individual / HUF paying >₹50,000 pm rent & not audited? → Section 194IB

-

Non-resident landlord? → Section 195 (not 194I / 194IB)

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.