Income Tax, TDS & TCS changes effective from April 1, 2025

Table of Contents

New Income Tax, TDS, and TCS changes effective from April 1, 2025

Key Income Tax, TDS, and TCS changes effective from April 1, 2025, which affect salaried individuals, startups, crypto investors, business entities, and more:

Major Income Tax Changes (From April 1, 2025)

Revised New Tax Regime Slabs

| Income Slab (₹) | Tax Rate |

| Up to 4,00,000 | Nil |

| 4,00,001 – 8,00,000 | 5% |

| 8,00,001 – 12,00,000 | 10% |

| 12,00,001 – 16,00,000 | 15% |

| 16,00,001 – 20,00,000 | 20% |

| 20,00,001 – 24,00,000 | 25% |

| Above 24,00,000 | 30% |

Basic exemption limit increased to ₹4 lakh.

Increased 87A rebate:

Old Regime slabs remain unchanged : Up to INR 60,000 rebate (vs INR 25,000 earlier) → Tax-free income up to INR 12 lakhs under new regime. Section 87A rebate extended to income up to INR 12 lakh (fully tax-free under the new regime).

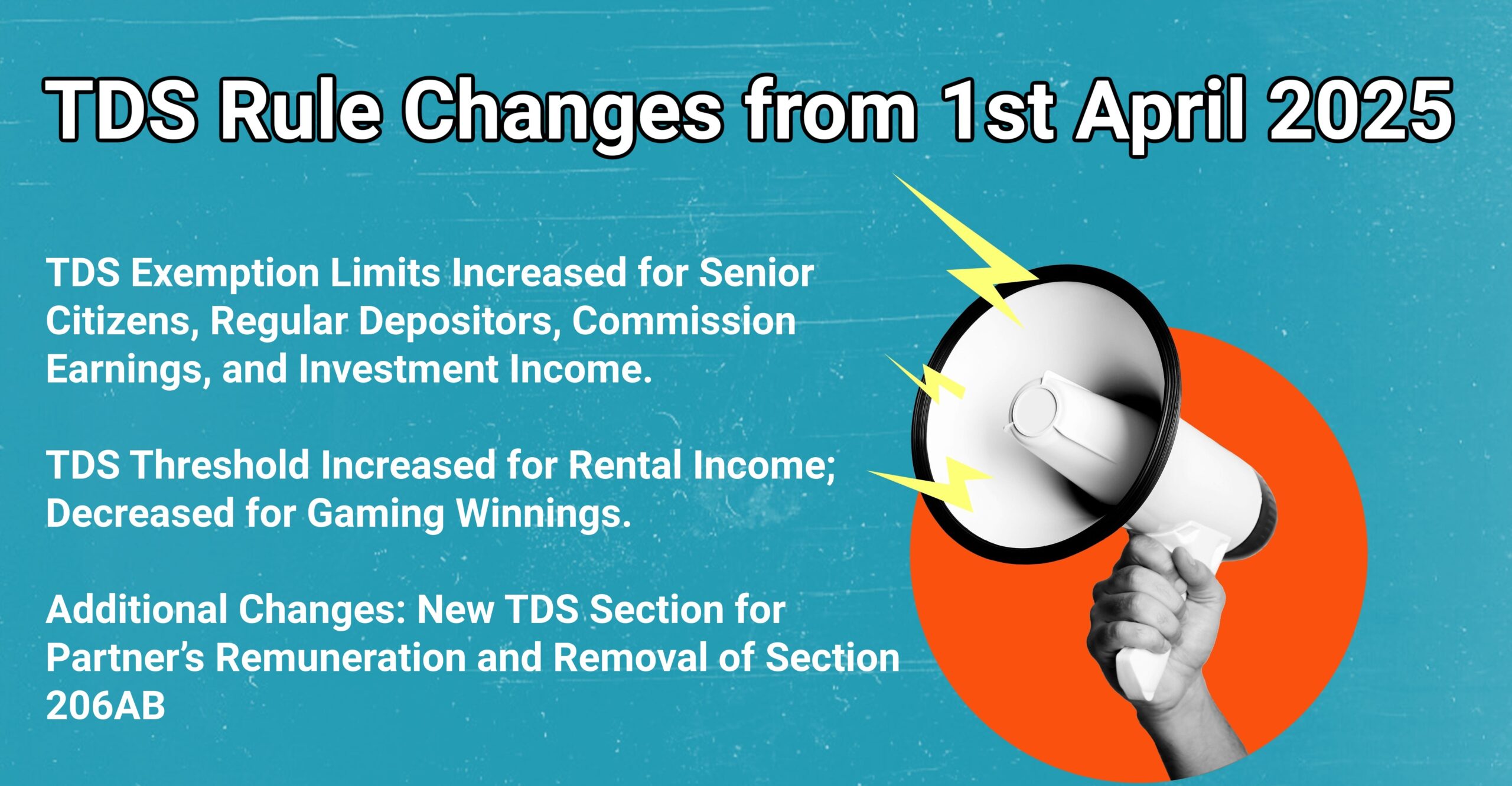

Enhanced TDS Thresholds – TDS Amendments (Effective FY 2025-26)

| Section | Nature of Payment | New Threshold |

| 194J | Professional Fees | ₹50,000 (up from ₹30,000) |

| 194H | Commission/Brokerage | ₹20,000 (up from ₹15,000) |

| 194D | Insurance Commission | ₹20,000 (up from ₹15,000) |

| 194 | Dividends | ₹10,000 (up from ₹5,000) |

| 193, 194A | Interest on Securities/Others | ₹10,000 |

| 194A | Interest (Banks/Post Office) | ₹50,000 (Non-Sr. citizens); ₹1,00,000 (Sr. citizens) |

| 194I | Rent | Monthly rent > ₹50,000 |

| 194R | Business perks/benefits | 10% if > ₹20,000/year |

| 194 | Partners’ Interest/Commission/Remuneration | TDS @10% above ₹20,000 |

- Sections 206AB & 206CCA (higher TDS/TCS for non-filers) now omitted.

TCS Amendments (Effective FY 2025-26)

| Nature | Threshold / Rate |

| Foreign Remittance under LRS | No TCS up to ₹10 lakh (earlier ₹7 lakh) |

| Foreign Education Loans (Sec 80E) | TCS exempted (was 0.5%) |

| Overseas Tour Packages | 5% up to ₹10 lakh; 20% beyond ₹10 lakh |

Return Filing Updates :

Updated Return (ITR-U) Filing Window Extended- Updated return window extended from 24 to 48 months.

| Filing Time | Additional Tax |

| Within 12 months | 25% of tax + interest |

| 12–24 months | 50% |

| 24–36 months | 60% |

| 36–48 months | 70% |

Startup & IFSC Incentives

- Startups (Sec 80-IAC): Tax exemption extended for startups incorporated till 1 April 2030. And 100% deduction for 3 out of 10 years. Section 80-IAC tax holiday for eligible startups extended till March 31, 2030.

- IFSC Units: Tax benefits extended till 31 March 2030. And Full exemption on life insurance premium paid by non-residents for IFSC-issued policies. Section 80LA benefits for IFSC units extended till March 31, 2030.

Relaxation for Deemed Let-Out Properties:

Up to 2 properties can be treated as self-occupied with NIL annual value unconditionally (no employment condition now).

Crypto & VDA Regulations :

Section 285BAA: Exchanges/intermediaries must report crypto transactions. And VDAs can now be treated as “undisclosed income” under Section 158B.

Equalisation Levy Removed:

The 6% levy on digital ad services to non-residents is removed w.e.f. April 1, 2025. Business Trusts (Section 115UA): Capital gains taxed at preferential rates instead of MMR.

Amalgamated entities:

Loss carry-forward period starts from year of loss, not amalgamation.

Deduction on Partners’ Remuneration Revised:

| Book Profit | Deduction |

| First INR 600,000 | INR 3,00,000 or 90%, whichever higher |

| Remaining Book Profit | 60% |

Sections 206AB & 206CCA Removed:

No higher TDS/TCS rates for non-filers from April 2025.

ULIPs Taxed as Capital Gains:

If premium > INR 2.5 lakhs or >10% of sum assured → taxable as CG. And LTCG @12.5%, STCG @20%.

Section 194T—TDS on Partner’s Remuneration & Payments

TDS to be deducted before payment is made to the partner. If aggregate payments exceed INR 20,000 to a partner during the financial year, TDS @10% becomes mandatory. it required to be noted that Firms/LLPs must deposit TDS with the Income Tax Department and file the TDS return under the relevant section. Form 16A should be issued to partners for the TDS deducted. This rules will be Effective From: 1st April 2025 and same is Applicable To: Partnership Firms and LLPs, Section 194T will be applicable on all payments made to partners, including

- Remuneration

- Interest on Capital

- Commission

- Bonuses

- Salary

| Payment Type | TDS Rate | Threshold Limit (FY) |

| Remuneration, Interest, Commission, Bonus, Salary | 10% | INR 20,000 (aggregate/year) |

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.