How to Update PAN Number Resident Status to NRI / PIO

Table of Contents

How to Update Permanent Account Number Resident Status to NRI / PIO

From 1 July 2023, the Income Tax Department (ITD) deactivated Permanent Account Numbers not linked to Aadhaar — this included many NRIs and PIOs because their PAN residential status was not updated. Impact if not updated Trading blocked on NSE and BSE, Higher TDS deductions as per the Income-tax Act, Difficulty in banking, investments, and tax filing.

Documents Required to Update NRI Status with the Income Tax Department

- Permanent Account Number Card Copy – Proof of identity and Permanent Account Number details.

- Passport Copy – Include visa stamp pages showing non-resident status.

- Proof of Overseas Residency – e.g., foreign bank statements, utility bills, driver’s license.

- Evidence of NRI ITR Filing – Past ITR acknowledgments filed as an NRI.

- Proof of Past Stay in India – Bills, property records, or similar (if previously resident).

Updating these records ensures the Permanent Account Number reflects NRI status and may function without Aadhaar seeding.

Filing ITR with an Inoperative Permanent Account Number:

ITR Filling is allowed but has consequences:

-

- Higher TDS under Sec. 206AA.

- No Refunds or interest on refunds.

- Higher TCS under Sec. 206CC.

How to Update PAN Resident Status to NRI / PIO

Steps to Update Resident Status

Step 1 – Gather Required Documents : You will need to submit to your Jurisdictional Assessing Officer:

- Copy of PAN Card

- Any one of the following proofs of NRI/PIO/OCI status:

- Passport copy showing stay abroad confirming NRI status.

- PIO Card issued by the Government of India.

- OCI Card issued by the Government of India.

- Other national/citizenship ID or taxpayer ID (must be attested — see below).

- Attestation requirement: Citizenship ID or taxpayer ID must be attested by:

- Indian Embassy / High Commission / Consulate in your country of residence, or

- Authorised official of overseas branch of a scheduled bank registered in India.

Step 2 – Find Your Jurisdictional Assessing Officer

- Visit Income Tax Portal – Know Your AO

- Click Know Your AO.

- Enter your PAN and mobile number.

- Click Continue, enter OTP, and click Validate.

- Note down Jurisdictional Assessing Officer name, designation, and contact details.

Step 3 – Submit Documents to Jurisdictional Assessing Officer

- Submit in person, by post, or via authorised representative.

- Clearly mention your request to update Residential Status from “Resident” to “Non-Resident” in ITD records.

- Keep attested copies of all proofs for your records, as the same may be required by your broker, bank, or mutual fund house to update their records too.

Step 4 – Alternative Online Submission

If physical submission is not possible:

- Log in to the Income Tax Portal.

- Go to Grievances section.

- Select Department: AO (Assessing Officer).

- Select Sub-category: Others.

- Attach the required documents (scanned, attested if required).

- Submit and track status online.

Step 5 – Verify Update :

After processing, check on the ITD e-Filing Portal to confirm that your residential status shows as “Non-Resident”. Once updated, your PAN will function without Aadhaar seeding requirements.

How to Track PAN Card Status Online

- Track via Call

- Call the TIN call center at 020-27218080.

- Provide your 15-digit acknowledgement number.

- Track via SMS

- Format: NSDLPAN <15-digit acknowledgement number>

- Send to 57575.

- You’ll get an SMS with the current application status.

- Track via Online Service Providers : Always use the website where you applied:

- NSDL (TIN-NSDL) – Track Here

- UTIITSL – Track Here

- E-Mudhra – Check status on their official portal.

Checking Online via NSDL

- Visit TIN-NSDL portal.

- Select Application Type: “PAN – New / Change Request”.

- Enter Acknowledgement Number.

- Enter Captcha and click Submit.

Without Acknowledgement Number:

- On the same NSDL page, choose the Name & Date of Birth option.

- Enter full name (as in application) and DOB.

- Click Submit.

Checking Online via UTIITSL

- Use Coupon Number given during application, OR

- Use PAN Number if already allotted.

- Enter details on the UTI PAN tracking page and click Submit.

Check PAN–Aadhaar Link Status

Without Logging In (Quick Links):

- Visit the Income Tax e-Filing portal.

- Click Link Aadhaar Status.

- Enter PAN and Aadhaar → Click View Status.

- Possible status messages:

- Linked – “Your PAN is already linked to given Aadhaar.”

- Pending – Linking request sent to UIDAI.

- Not Linked – Need to link.

By Logging In:

- From Dashboard then My Profile then Link Aadhaar Status.

By SMS:

- Format: UIDPAN <12-digit Aadhaar> <10-digit PAN>

- Send to 567678 or 56161.

Track PAN Card Delivery

- Visit India Post Track & Trace.

- Enter the tracking number from NSDL/UTIITSL dispatch message.

- View current location, expected delivery date, and delivery attempts.

Helpline

- UTIITSL PAN Helpline: 033-40802999 (9 AM – 8 PM)

- Email: utiitsl.gsd@utiitsl.com

Consequences of Not Linking PAN with Aadhaar (for Eligible Individuals)

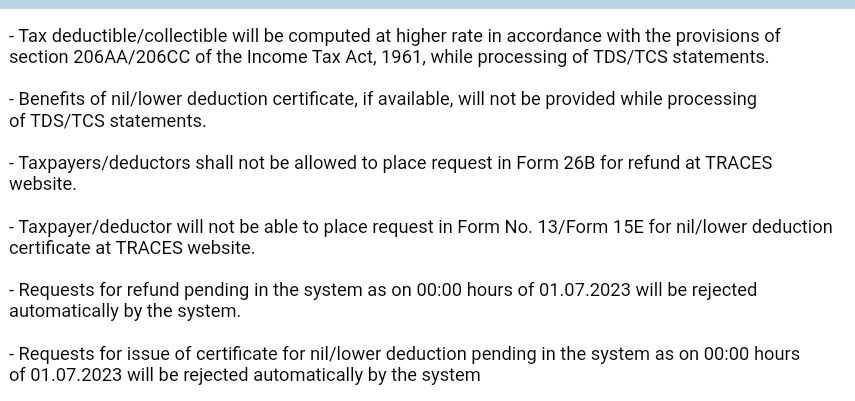

Under the Income-tax Act, 1961, failure to link PAN and Aadhaar by the prescribed deadline leads to the PAN becoming inoperative, with the following consequences:

Higher Tax Deductions/Collections

- Section 206AA – TDS (Tax Deducted at Source) will be deducted at a higher rate.

- Section 206CC – TCS (Tax Collected at Source) will be collected at a higher rate.

Restrictions on Filing and Processing ITR

- Sections 234A, 234B, 234C Taxpayer may not be able to file their ITR effectively. & Delay/interest liabilities under these sections may apply.

- Section 234F – Late filing penalty up to INR10,000.

- Penalty for Late Linking (Section 234H) : PAN can be made operative only after linking with Aadhaar and paying a penalty of up to INR 1,000.

- Penalty for Non-Compliance : Section 272B: Quoting PAN is mandatory for certain financial transactions under Section 139A. If PAN is inoperative, it will be considered non-compliance, attracting a penalty up to INR 10,000.

Practical Impact for NRIs : Even though NRIs are generally exempt from mandatory Aadhaar–PAN linking, those who already have Aadhaar must still link it to avoid PAN inactivation. PAN is essential for Opening NRE/NRO bank accounts, Investing in Indian markets, Property transactions, Other high-value financial dealings.

FAQs related to PAN with Aadhaar

- Is Aadhaar– Permanent Account Number linking mandatory for NRIs?: No, unless you already have Aadhaar, in which case linking is mandatory to avoid PERMANENT ACCOUNT NUMBER becoming inoperative.

- Consequences of not linking Permanent Account Number and Aadhaar? : Permanent Account Number may stop working, affecting tax filing, banking, and investments.

- Exemptions from Linking: NRIs, super-senior citizens (80+), and residents of J&K, Assam, and Meghalaya.

- Difference between NRI Permanent Account Number and Regular PAN : No difference in functionality; NRIs/OCI must apply via Form 49AA.

- Eligibility for Aadhaar: Only if present in India ≥182 days in the last 12 months.

- Mismatch in Permanent Account Number –Aadhaar Details: Correct discrepancies before linking.

- Update Aadhaar to NRI Status First : If applicable, update Aadhaar at an enrollment center before linking.

- Deadlines: Government-notified deadlines apply equally to NRIs holding both Permanent Account Number and Aadhaar.

- Need Aadhaar-linked Mobile for Linking: Yes, OTP authentication is mandatory.

- Fee for Linking Post-Deadline: INR 1,000 late fee currently applies.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.