Zero Rated Supply under GST

Table of Contents

Zero Rated Supply under GST

Under the Goods and Services Tax (GST) law, a Zero Rated Supply refers to supplies on which GST is charged at 0%, but the supplier can still claim input tax credit for taxes paid on inputs and input services. This ensures that exports remain tax-free but without blocking the credit chain. As per Section 16 of the IGST Act, 2017, Zero Rated Supply includes:

- Export of goods or services or both (out of India)

- Supply of goods or services to a Special Economic Zone developer or SEZ unit

Section 16 – Zero Rated Supply

Definition: Zero rated supply means any of the following:

a) Export of goods or services or both

b) Supply of goods or services or both to a Special Economic Zone (SEZ) developer or SEZ unit

Entitlement to Input Tax Credit: A registered person making zero rated supply is eligible to claim input tax credit on inputs, input services, and capital goods used in making such supplies, even if the supply is exempt.

Options for Supply: A registered person making zero rated supply can choose either of the following:

Option 1:

- Supply with payment of IGST

- Claim refund of the IGST paid

Option 2:

- Supply without payment of IGST

- Furnish a Letter of Undertaking or a bond before making supply

- Claim refund of unutilised input tax credit

Key Points:

- It is different from exempt supply — in exempt supply, input tax credit cannot be claimed.

- A zero-rated supply can be made:

- With payment of IGST and then claim refund of IGST paid, or

- Without payment of IGST under a Letter of Undertaking /bond and claim refund of unutilised ITC.

- The aim is to promote exports and SEZ supplies by ensuring they are free from domestic taxes.

- Zero rated supply is different from exempt supply: input tax credit is available here. GST Refund claims must follow the procedure under the CGST Rules (Rule 89). Letter of Undertaking is generally available to all exporters except those prosecuted for tax evasion above INR 250 lakh.

Rule 89 of the CGST Rules, 2017 which deals with Application for Refund(Rule 89)

Filing the application: A person claiming refund (including unutilised ITC for zero-rated supplies, excess tax paid, or other eligible refunds) must file Form GST RFD-01 electronically on the GST portal. The application must be accompanied by supporting documents/evidences as prescribed.

Refund of unutilised ITC for Zero Rated Supply:

- Applies to exports and supplies to SEZ without payment of IGST under LUT/Bond.

- Refund amount is calculated using this formula

Refund Amount=Turnover of Zero Rated Supply×Net ITCAdjusted Total Turnover\text{Refund Amount} = \frac{\text{Turnover of Zero Rated Supply} \times \{Net ITC}}{\{Adjusted Total Turnover}}Refund Amount=Adjusted Total TurnoverTurnover of Zero Rated Supply×Net ITC

Where:

- Turnover of zero rated supply = value of export of goods/services and supplies to SEZ (as per GST law)

- Net ITC = ITC availed on inputs and input services during the period

- Adjusted total turnover = total turnover in a State/UT excluding exempt supplies (except zero-rated) during the period

Refund in case of SEZ supplies:

- For supply to an SEZ unit/developer, the refund application must be accompanied by:

- Endorsement from the SEZ officer that goods/services have been received for authorised operations

- Proof of payment by the recipient in case of supply of services

Other refund scenarios under Rule 89:

- Refund of tax paid on deemed exports

- Refund in case of excess payment of tax

- Refund of tax paid by specialised agencies like UN bodies, embassies, etc.

Time limit: Refund application to be filed within 2 years from the relevant date as defined in Section 54 of the CGST Act.

Important Exclusions: No refund of unutilised ITC is allowed if the export duty is payable or where ITC is on restricted goods/services under Rule 54.

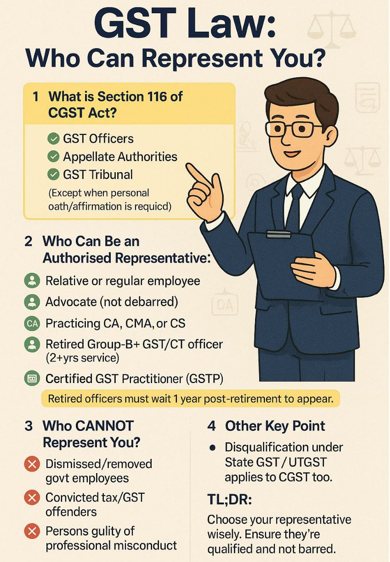

GST Law: Who Can Represent You?

What is Section 116 of CGST Act?

Covers representation before:

- GST Officers

- Appellate Authorities

- GST Tribunal

(Except when personal oath/affirmation is required)

Who Can Be an Authorised Representative under GST ?

- Relative or regular employee

- Advocate (not debarred)

- Practicing CA, CMA, or CS

- Retired Group-B+ GST/CT officer (with ≥ 2 years’ service)

- Certified GST Practitioner (GSTP)

Note: Retired officers must wait 1 year post-retirement before appearing.

Who CANNOT Represent You?

- Dismissed/removed government employees

- Convicted tax/GST offenders

- Persons guilty of professional misconduct

Other Key Points

- Disqualification under State GST/UTGST also applies to CGST.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.