India’s GST Overhaul: A Major Reset by Diwali

Diwali gift by PM Narendra Modi- India’s Goods & Services Tax Overhaul

A significant Goods and services Tax reform is underway, set to simplify India’s indirect tax system with a 2 slab structure (5% and 18%), replacing the current four-tier framework. A special 40% “sin/luxury” rate will continue to apply to a select few high-end or demerit goods. This is being positioned as a “Diwali gift” by Prime Minister Narendra Modi, who announced the revamp in his Independence Day address. What are the effect come after this announcement :

- Boost to consumption: Lower Goods and services Tax on essentials and aspirational goods is expected to inject fresh momentum into the economy—especially households, which account for 60% of GDP.

- Market surge: Stock markets responded positively, with auto, cement, consumer goods, and insurance stocks rallying in anticipation of higher demand.

- Fiscal considerations: The reform could reduce government revenue by an estimated $20 billion annually, balanced by anticipated consumption gains and streamlined tax administration.

- 40+ stocks expected to benefit from GST Reforms 2.0 span across auto, cement, FMCG, banking, and consumer durable sectors.

Table of Contents

What Will Change – as Prime Minister Narendra Modi announces as Diwali gift?

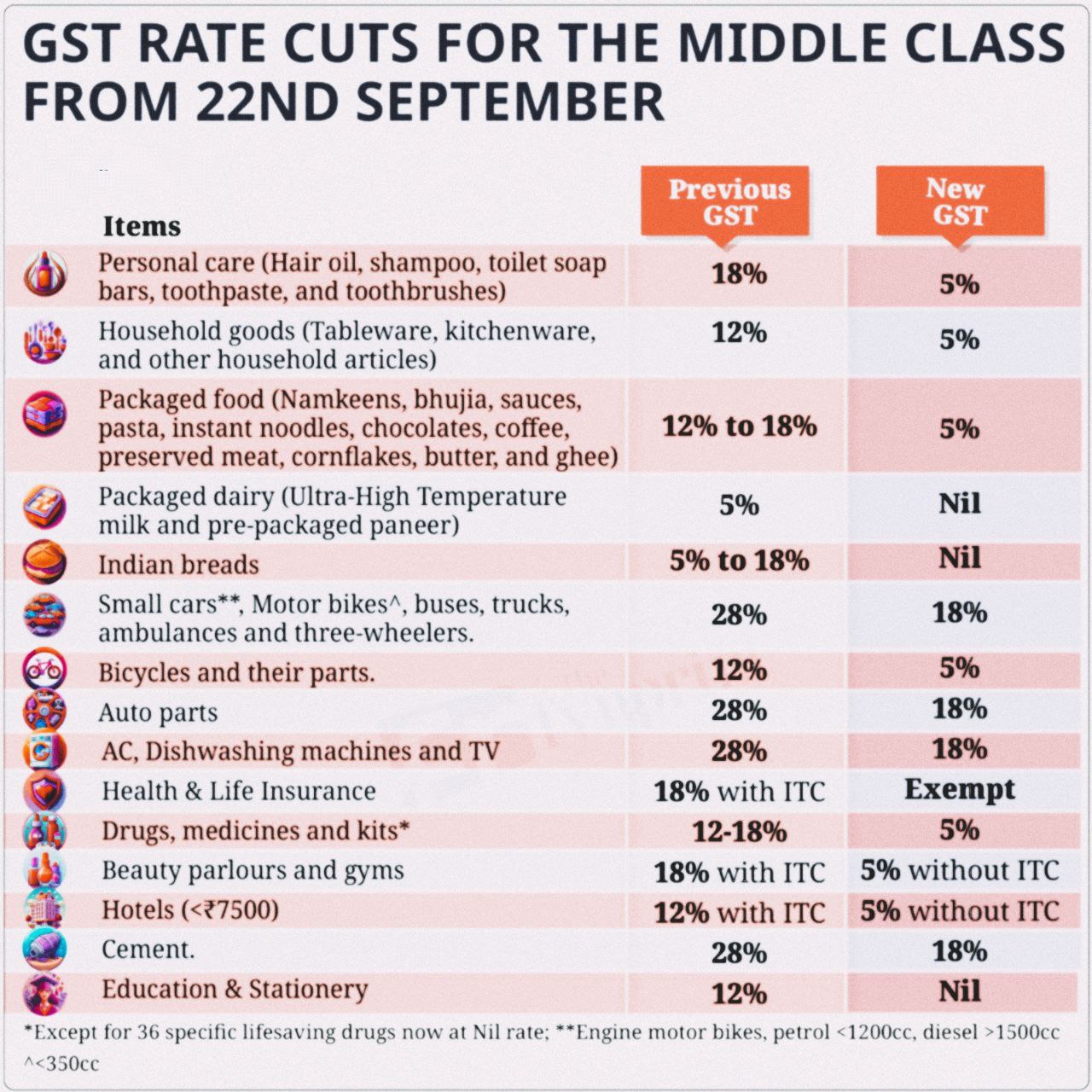

- Nearly 99% of items currently under the 12% Goods and services Tax slab are set to drop to 5%.

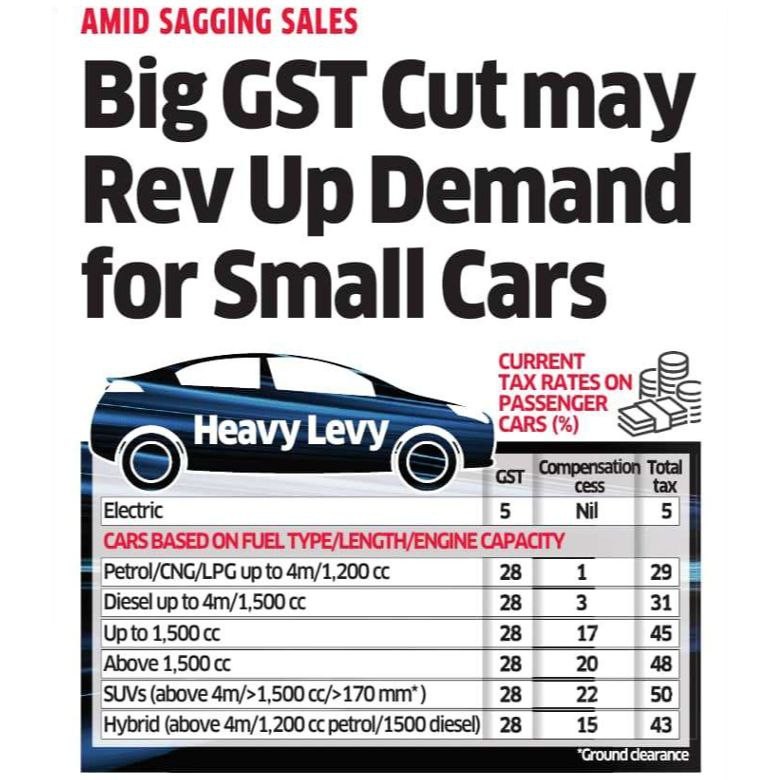

- Around 90% of items from the 28% slab may move to 18%, including small cars, cement, ACs, TVs, and other electronics.

Key beneficiaries are mentioned here under:

- Key consumer segments—snacks, packaged food, daily-use electronics, cement, and small cars are likely to become significantly cheaper,

- From 28% → 18% Slab: If implemented, GST on air-conditioners, large TVs, and dishwashers will move into the lower slab.

- Insurance premiums (health and life) could see Goods and services Tax reduced to 5% or zero, making coverage more affordable.

- Auto & Two-Wheelers (lower GST on small cars & 2-wheelers) – Maruti Suzuki, Tata Motors, Mahindra & Mahindra, Hero MotoCorp, Bajaj Auto, TVS Motor.

- Cement (rate cut from 28% → 18%) like UltraTech Cement, Shree Cement, ACC, Ambuja Cements, Dalmia Bharat, Ramco Cement.

- FMCG (reduced GST on packaged food & essentials) like Hindustan Unilever (HUL), ITC, Nestlé India, Dabur, Britannia, Marico, Colgate-Palmolive

- Consumer Durables (ACs, TVs, electronics moving to lower slab) like Voltas, Blue Star, Whirlpool, Havells, Crompton Greaves, Dixon Technologies,

- Banking & Financials (consumption-led credit growth) like HDFC Bank, ICICI Bank, SBI, Axis Bank, Kotak Mahindra Bank, Bajaj Finance

- Retail & E-commerce like Avenue Supermarts (DMart), Trent, Aditya Birla Fashion & Retail

-

Price Impact: Approx. 7–8% reduction in final prices (depending on base price, dealer margin, and state levies).

-

Demand Boost: Likely to spur festive season sales, particularly in Tier-2 and Tier-3 cities where affordability has been a barrier.

-

Premiumisation: Consumers may shift from entry-level products to mid/high-end models.

-

Industry Push: White goods manufacturers (AC, TV, dishwasher makers) have long lobbied for this cut, citing low penetration in India compared to global averages.

Summary Table

| Aspect | Details |

| New GST Slabs | 5% (everyday goods) & 18% (standard); 40% for select sin/luxury items. |

| Key Savings | Cement, small cars, ACs, electronics, packaged goods, insurance. |

| Expected Impact | Higher consumption, market rally, some revenue trade-offs. |

| Timeline | Rollout by October/Diwali; pending GST Council approval. |

GST Reforms 2.0 span Implementation & Approval

- The formal proposal has been submitted to the Goods and services Tax Council, with the goal of enabling implementation before Diwali (likely in October 2025). Both the Centre and state governments recognize the need for cooperative federalism to balance revenue and reform objective.

- Analysts expect higher consumption demand post-reforms, boosting volumes for autos, cement, FMCG, and consumer goods. Banks & NBFCs stand to gain from increased retail lending. & The move is seen as a short-term consumption booster and a medium-term tax simplification reform

-

Companies may absorb part of the benefit to improve margins instead of fully reducing MRP. Rising raw material costs (steel, semiconductors, freight) may offset some relief. The government will need to balance revenue loss vs. consumption push.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.