Carry Forward of Losses – Important Points

Table of Contents

Carry Forward of Losses – Important Points

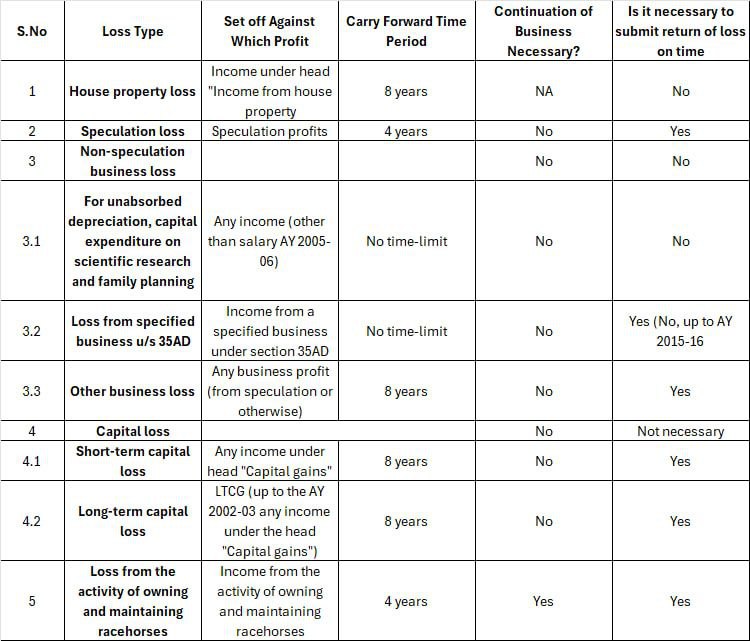

- House Property Loss : Carry forward allowed for 8 years. Can be carried forward even in belated returns (filing on time not mandatory).

- Speculation Loss : Can be carried forward for 4 years. & Filing return on time is mandatory.

- Business Loss (Non-speculative) :

- Normal business loss: 8 years carry forward.

- Specified business loss u/s 35AD: No time limit.

- Unabsorbed depreciation & certain expenses: No time limit.

- Filing return on time is mandatory (except unabsorbed depreciation & specified business u/s 35AD).

- Capital Loss : Both STCG and LTCG losses: 8 years carry forward. Filing return on time is mandatory.

- Owning & Maintaining Racehorses : Loss carry forward for 4 years., Filing return on time is mandatory.

- No Audit Requirement : You do not need to get your accounts audited merely to carry forward losses. & Tax audit and carry forward of losses are independent compliance requirements.

- Link with Return Filing : The carry forward of losses is allowed only if the Income Tax Return is filed within the original due date (generally 31st July / 31st October, depending on the case). If the return is filed after the due date (belated return), certain losses cannot be carried forward.

- Losses Affected

-

- Loss under “Profits and Gains of Business or Profession” (except unabsorbed depreciation).

- Loss under “Capital Gains”.

- Loss from owning and maintaining race horses.

9. Losses Still Allowed in Belated Return

-

- House property loss and unabsorbed depreciation can still be carried forward even if the return is belated.

Simplified Rule of Thumb- Carry Forward of Losses

-

- Filing within the original due date (31st July / 31st October depending on audit applicability) is essential if the assessee wants to preserve carry forward rights for business loss, capital loss, speculation loss, and racehorse loss.

- House property loss and unabsorbed depreciation remain unaffected by the timing.

- Losses that require timely return filing (Original Due Date):

- Business loss (except unabsorbed depreciation)

- Speculation loss

- Capital loss

- Loss from racehorses

- Losses that can be carried forward even in a Belated Return:

- House property loss

- Unabsorbed depreciation

- Loss from specified business (u/s 35AD)

Carry Forward of Losses – Original vs Belated Return

| Type of Loss | If ITR filed within Original Due Date | If ITR filed after Due Date (Belated Return) |

| Business Loss (other than unabsorbed depreciation) | Allowed to carry forward | Not allowed |

| Speculation Loss | Allowed to carry forward | Not allowed |

| Loss under the head “Capital Gains” | Allowed to carry forward | Not allowed |

| Loss from owning & maintaining race horses | Allowed to carry forward | Not allowed |

| House Property Loss | Allowed to carry forward | Allowed (even in belated return) |

| Unabsorbed Depreciation (u/s 32) | Allowed to carry forward | Allowed (even in belated return) |

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.