56th GST Council made recommendation relating to GST Change

Table of Contents

56th GST Council Meeting chaired by Union Finance Minister Smt. Nirmala Sitharaman held on 3rd September 2025, New Delhi.

The 56th meeting of the GST Council was held on 3rdSeptember, 2025 at Sushma Swaraj Bhavan, New Delhi under the chairpersonship of the Union Finance & Corporate Affairs Minister Smt. Nirmala Sitharaman. The GST Council inter-alia made the recommendations relating to changes in GST tax rates, provide relief to individuals, common man, aspirational middle class and measures for facilitation of trade in GST.

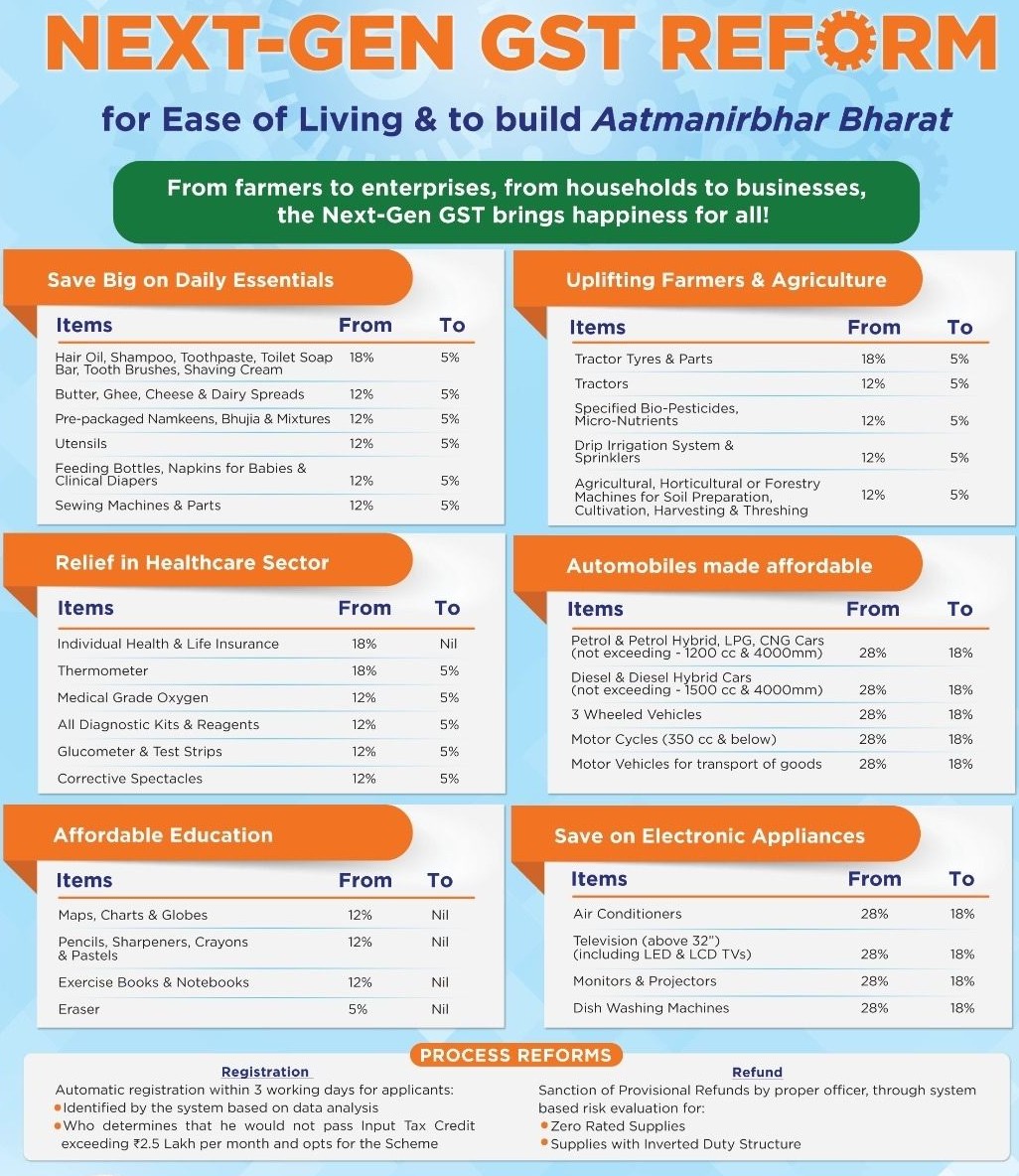

Next-Gen GST Reform: Ease of Living & Aatmanirbhar Bharat

The Government of India has launched the Simplified GST Registration Scheme and Next-Gen GST Refund System, marking a historic reform under GST 2.0. Endorsed unanimously by the 56th GST Council, these reforms bring significant relief to farmers, MSMEs, women, youth, small traders, and the middle class, while advancing the twin visions of Ease of Living and Aatmanirbhar Bharat. The recommendations made by the 56th GST Council are as below:

Changes in GST Rates of Goods & Services

Goods

- Rate Changes : Detailed HSN-wise changes (Annexure I) and sector-wise changes (Annexure II).

- Other Changes

- GST to be levied on Retail Sale Price (RSP) instead of transaction value for pan masala, gutkha, cigarettes, unmanufactured tobacco, chewing tobacco (like zarda).

- Ad hoc IGST & compensation cess exemption granted on a new armoured sedan car imported by the President’s Secretariat for the President of India.

Save Big on Daily Essentials

-

-

- Hair oil, shampoo, soap, toothpaste, shaving cream – 18% → 5%

- Butter, ghee, cheese, dairy spreads – 12% → 5%

- Packaged namkeens, bhujia, mixtures – 12% → 5%

- Utensils – 12% → 5%

- Baby feeding bottles, napkins, diapers – 12% → 5%

- Sewing machines & parts – 12% → 5%

-

Automobiles Made Affordable

-

-

- Petrol/LPG/CNG hybrid cars (≤1200cc & ≤4000mm) – 28% → 18%

- Diesel hybrids (≤1500cc & ≤4000mm) – 28% → 18%

- 3-wheeled vehicles – 28% → 18%

- Motorcycles (≤350cc) – 28% → 18%

- Goods transport vehicles – 28% → 18%

-

Save on Electronic Appliances

-

-

- Air conditioners – 28% → 18%

- TVs (above 32″, including LED & LCD) – 28% → 18%

- Monitors & projectors – 28% → 18%

- Dishwashers – 28% → 18%

-

Relief in Healthcare Sector

-

-

- Health & life insurance – 18% → Nil

- Thermometers – 12% → 5%

- Medical oxygen – 12% → 5%

- Diagnostic kits, reagents – 12% → 5%

- Glucometers & test strips – 12% → 5%

- Corrective spectacles – 12% → 5%

-

Uplifting Farmers & Agriculture

-

-

-

- Tractor tyres & parts – 18% → 5%

- Tractors – 12% → 5%

- Bio-pesticides, micro-nutrients – 12% → 5%

- Drip irrigation & sprinklers – 12% → 5%

- Agricultural & forestry machinery – 12% → 5%

-

-

Affordable Education

-

-

- Maps, charts, globes – 12% → Nil

- Pencils, sharpeners, crayons, pastels – 12% → Nil

- Exercise books, notebooks – 12% → Nil

- Erasers – 5% → Nil

-

Services

- Rate Changes : Detailed HSN-wise (Annexure III) and sector-wise (Annexure IV) changes.

- Other Changes

- Clarification: stand-alone restaurants cannot classify themselves as ‘specified premises’; hence, they cannot opt for GST @ 18% with ITC.

- GST valuation rules amended to align with changes in tax rate on lottery tickets.

III. Implementation Timeline

- 22nd September 2025

a) GST rate changes on services.

b) GST rate changes on goods (except tobacco & related products). - Pan masala, gutkha, cigarettes, zarda, unmanufactured tobacco, bidi

- To continue at existing GST & cess rates until all compensation cess loan obligations are cleared.

- Transition date to revised rates will be decided later by the Finance Minister.

- Refund Reforms

- CBIC to start 90% provisional refunds for inverted duty structure (risk-based, like zero-rated supplies), pending amendments in the CGST Act, 2017.

IV Measures for Facilitation of Trade

- Process Reforms

- Several GST law & procedure simplifications (Annexure V).

- Implementation dates to be notified separately.

- Operationalisation of GSTAT

- Goods & Services Tax Appellate Tribunal (GSTAT) to start accepting appeals before end of September 2025.

- Hearings to commence before December 2025.

- Limitation date for backlog appeals: 30th June 2026.

- Principal Bench will also act as National Appellate Authority for Advance Ruling (NAAAR).

FAQs are also being issued for clarification of doubts. Expected outcome: Strengthened dispute resolution mechanism, consistency in advance rulings, improved taxpayer certainty, and ease of doing business. This landmark reform reflects the visionary leadership of Hon’ble PM Shri Narendra Modi Ji and Hon’ble FM Smt. Nirmala Sitharaman Ji, ensuring that GST 2.0 is not just about taxation but about nation-building, citizen empowerment, and economic strengthening.

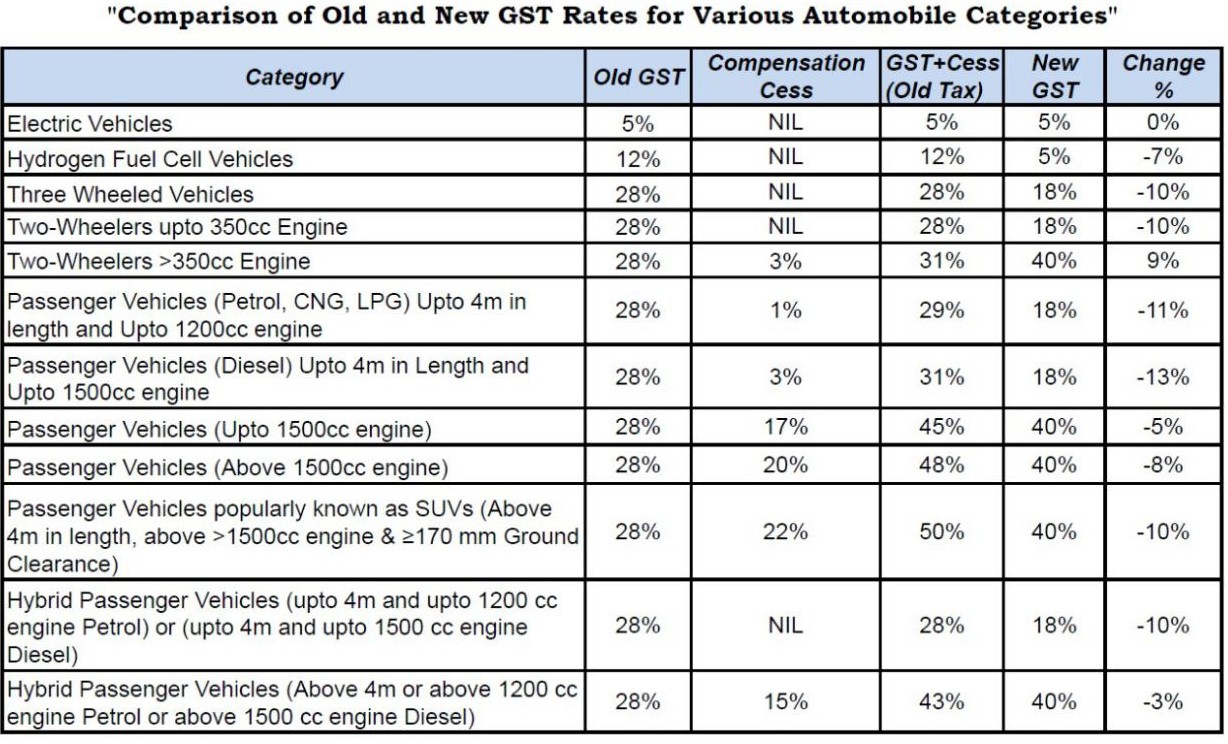

Comparison of Old and New GST Rates for Automobile Categories (2025 Update)

| Category | Old GST + Cess | New GST | Change |

|---|---|---|---|

| Electric Vehicles | 5% → 5% | No change | |

| Hydrogen Fuel Cell Vehicles | 12% → 5% | Reduced by 7% | |

| Three-Wheeled Vehicles | 28% → 18% | Reduced by 10% | |

| Two-Wheelers up to 350 cc | 28% → 18% | Reduced by 10% | |

| Two-Wheelers above 350 cc | 31% → 40% | Increased by 9% | |

| Passenger Cars (Petrol/CNG/LPG ≤ 1200 cc, ≤ 4 m) | 29% → 18% | Reduced by 11% | |

| Passenger Cars (Diesel ≤ 1500 cc, ≤ 4 m) | 31% → 18% | Reduced by 13% | |

| Passenger Cars (≤ 1500 cc, > 4 m) | 45% → 40% | Reduced by 5% | |

| Passenger Cars (> 1500 cc) | 48% → 40% | Reduced by 8% | |

| SUVs (≥ 4 m, > 1500 cc, ≥ 170 mm clearance) | 50% → 40% | Reduced by 10% | |

| Hybrid Passenger Cars (≤ 1200 cc petrol / ≤ 1500 cc diesel) | 28% → 18% | Reduced by 10% | |

| Hybrid Passenger Cars (> 1200 cc petrol / > 1500 cc diesel) | 43% → 40% | Reduced by 3% |

- Strong relief for mass-market vehicles : Small petrol, diesel, and hybrid cars now taxed at 18%, down from 28–31%. This directly benefits hatchbacks, compact sedans, and entry-level hybrids.

- Two-wheelers benefit moderately, except premium bikes (> 350 cc) which now attract a higher 40% GST.

- Luxury and SUV segments see meaningful relief — total tax cut by ~10 percentage points, simplifying structure by removing compensation cess.

- Green mobility promotion continues EVs retain the concessional 5% rate. & Hydrogen fuel cell vehicles reduced from 12% → 5%.

- Cess removal simplifies compliance — now only one clear GST rate per category instead of a dual rate system.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.