Commissions to own subsidiaries makes mis-selling by banks

Table of Contents

Commissions to own subsidiaries, which makes mis-selling by banks

The numbers from FY24 commissions show a massive reliance by banks on distribution income especially from their own subsidiaries, which makes the “mis-selling” concern very real. Let’s break it down:

1. HDFC Bank alone earned nearly 30% of the total commissions (INR 6,467 cr out of INR 21,773 cr).

2. SBI + Axis Bank + HDFC Bank together account for ~63% of the pie.

3. Subsidiary-dependence is glaring:

o Kotak Mahindra Bank: 100% from Kotak Life Insurance.

o Canara Bank: 99.1% from Canara Robeco MF. This raises direct conflict of interest concerns.

4. Public sector banks (PNB, BOB, Canara, Union, Indian Bank) earn less compared to private giants, but still show patterns of in-house bias.

5. Smaller private banks (Yes, Federal, IDFC First) are aggressively building this stream, despite weaker balance sheets.

The Core Issue

Banks are supposed to advise and protect customers’ financial interests.

But if employees are incentivized to push in-house products with high commissions, then:

Customer needs may be ignored.

Products with poor suitability (e.g., expensive ULIPs, long lock-in insurance) may be pushed.

Trust in the banking system could erode.

Possible regulatory responses could include:

1. Disclosure mandates – Banks must declare % of commissions from group entities.

2. Cap on related-party distribution – Limit how much a bank can sell of its subsidiary’s products.

3. Suitability norms – RBI/IRDAI/SEBI could enforce stronger “customer-first” checks (like fiduciary responsibility).

4. Commission transparency – Customers should know exactly what commission the bank earns from the product they’re sold.

5. Incentive reform – Shift from commission-based to advisory fee-based distribution.

The numbers highlight that commissions are not small “side income” they are a structural revenue stream. But if left unchecked, this model risks mis-selling, loss of customer trust, and systemic reputational damage for Indian banks.

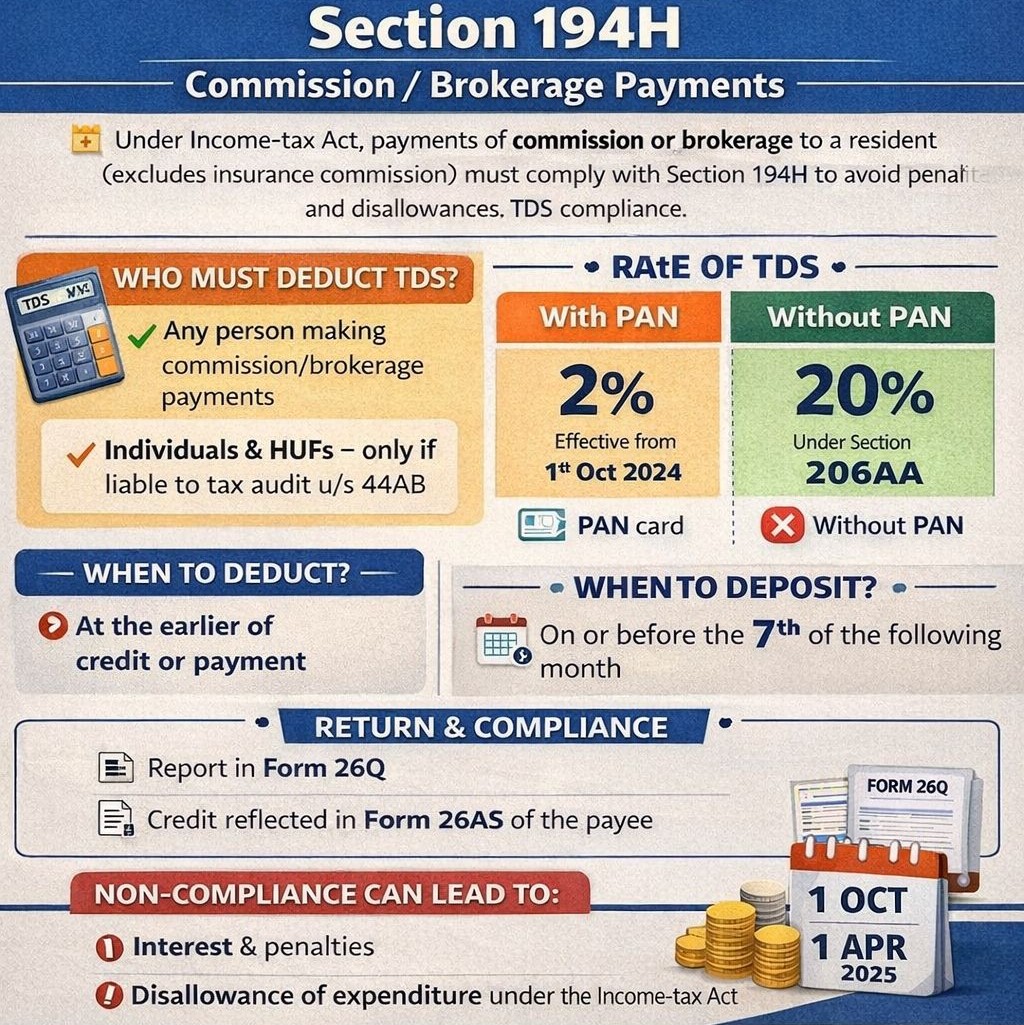

Compliance summary for Section 194H – TDS on Commission/Brokerage:

- Applies to payments for:

- Services rendered (other than professional services)

- Acting on behalf of another for buying/selling goods

- Transactions relating to assets, valuable articles, or securities

(Insurance commission excluded – covered under Sec 194D)

Who Must Deduct?

- Any person paying commission/brokerage.

- Individuals/HUFs only if liable to tax audit u/s 44AB in preceding FY.

Threshold

- No TDS if total commission/brokerage ≤ ₹20,000 in a financial year, (Applicable from 1 April 2025)

Rate

- 2% – if PAN furnished (effective 1 Oct 2024)

- 20% – if PAN not furnished (Sec 206AA)

Timing

- Deduct at earlier of credit or payment, including year-end provisions.

Deposit & Reporting

- Deposit: By 7th of next month

- Return: Form 26Q

- Certificate: Form 16A

- Credit reflected in Form 26AS / AIS of payee.

Non-Compliance Risks

- Interest u/s 201(1A)

- Late fee & penalties

- Disallowance of expenditure u/s 40(a)(ia)

Practical Points

- Trade discounts upfront: not commission.

- Incentives/performance-linked payouts: May attract 194H depending on arrangement.

- Commission credited to suspense/payable account: TDS still applicable.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.