Strategy to pick dividend-paying stock for passive income

Table of Contents

Strategy of How I pick dividend-paying stocks for passive income.

What Are Dividend Stocks :

- Dividends = Profit Sharing: Companies reward shareholders with a portion of profits.

- Stable Companies: Often large, established firms with consistent performance.

Why Dividend Stocks Work for Passive Income

- Regular Income – Quarterly or monthly payouts.

- No Need to Sell – You earn even if the stock price doesn’t rise.

- Compounding Power – Reinvested dividends grow your portfolio exponentially.

Strategy to pick dividend-paying stocks for passive income. The goal is to build a portfolio that generates stable, growing, and tax-efficient income while preserving capital. Key Strategy for investor, we should Focus on dividend growth, not just high dividend payouts. & The idea is to invest in companies that increase their dividends consistently over time. Why not high dividend-paying companies?

- These companies often don’t reinvest enough in their business.As a result, their share price growth is limited. They may offer high dividends now, but long-term passive income may stagnate.

- Companies with rising dividends year after year. Over time, this leads to higher passive income from your initial investment.

Step 1: Define Your Dividend Investing Goals

- Income vs. Growth : Do you want higher current dividend yield or lower yield but steady growth in dividends?

- Time Horizon : If you’re young, focus on dividend growth; if near retirement, lean toward stable, high yield.

- Target Yield : Aim for 3–6% average portfolio yield (too high often signals risk).

Step 2: Screen for Dividend-Paying Stocks

Use stock screeners (Screener.in, Moneycontrol, TIKR, TradingView, Yahoo Finance) with filters such as:

- Dividend Yield: >2–3%

- Dividend Payout Ratio: <60% (for sustainability; banks/REITs can be exceptions)

- Consistent Dividend History: At least 5–10 years of uninterrupted dividend payments.

Step 3: Analyze Financial Strength

Before buying, check if the company can sustain and grow dividends:

- Earnings Growth – EPS must grow steadily; dividend growth comes from profit growth.

- Free Cash Flow (FCF) – Ensure dividends are backed by real cash, not just accounting profits.

- Debt Levels – Debt/Equity ratio should be reasonable. High debt makes dividends risky.

- ROE & ROCE – Healthy return ratios (>15%) show efficient capital allocation.

Step 4: Look for Dividend Growth, Not Just Yield

- Prefer companies with a track record of increasing dividends (Dividend Growth Investing).

- CAGR of dividend per share over 5–10 years is a good indicator.

- Example: Infosys, HDFC Bank, ITC, Hindustan Unilever.

Step 5: Assess Industry & Business Model

- Pick moat-driven businesses (FMCG, Pharma, Utilities, Financials) with steady demand.

- Avoid companies with highly cyclical earnings (metals, airlines) unless bought at deep value.

- Favor sectors where dividends are part of culture (PSUs, FMCG, IT services, REITs).

Step 6: Diversify

- Sectors – Don’t depend on only PSUs or banks. Mix in FMCG, Pharma, IT, REITs.

- Geography – Consider some global dividend stocks/ETFs (US Dividend Aristocrats, REITs).

- Company Size – Mix large, stable dividend payers with mid-cap dividend growers.

Step 7: Tax Efficiency

- In India, dividends are taxed at your slab rate (post 2020).

- If you’re in higher tax brackets, focus on dividend growth rather than high yield to minimize tax drag.

- Consider REITs/InvITs where income distribution may have partial tax-free components.

Step 8: Build & Monitor Your Portfolio

- Start with 10–15 solid dividend stocks.

- Reinvest dividends if you don’t need income immediately (compounding).

- Review annually – drop companies cutting dividends or showing weak fundamentals.

Example Indian Dividend-Paying Stocks (for study, not a recommendation)

- High Yield Stable: Coal India, Power Grid, ONGC, NTPC

- Dividend Growth + Stability: ITC, Infosys, HDFC Bank, Hindustan Unilever, TCS

- REITs/InvITs: Embassy Office REIT, PowerGrid InvIT

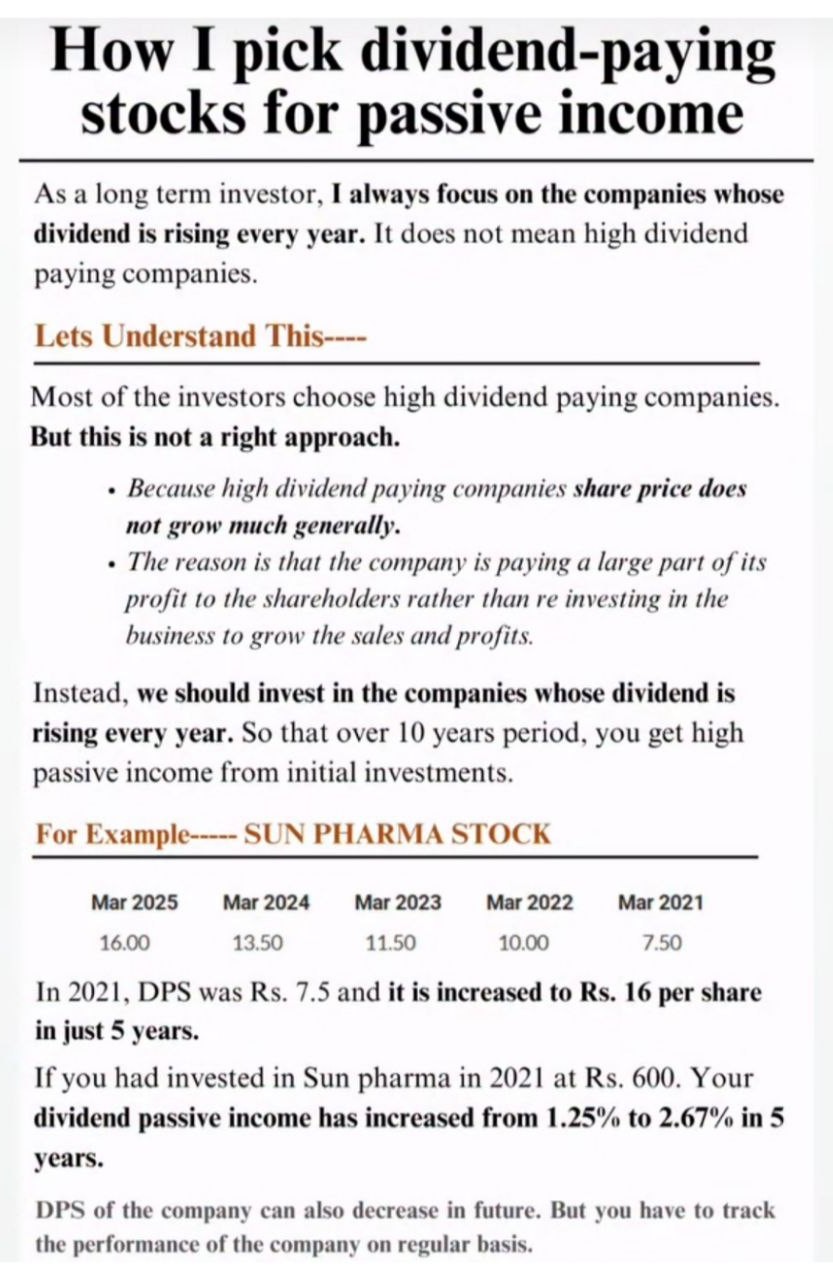

- Like Sun Pharma : Dividend Per Share (DPS) growth over 5 years:

-

- 2021: ₹7.50

- 2022: ₹10.00

- 2023: ₹11.50

- 2024: ₹13.50

- 2025: ₹16.00

If Investor invested in 2021 at ₹600/share Your dividend yield increased from 1.25% to 2.67% in 5 years. Important Note : DPS can decrease too. Regular tracking of company performance is essential. A simple framework to remember:

Yield + Safety + Growth + Diversification = Reliable Dividend Income

How to Get Started

- Open a Brokerage/Demat Account – You mentioned JM Financial Services, which is a solid option.

- Start Small – Focus on quality, not quantity.

- Diversify – Spread across sectors to reduce risk.

- Enable DRIP – Automate reinvestment for compounding.

Investors try to avoid following mistakes:

- Chasing High Yields – Could signal trouble.

- Ignoring Fundamentals – Check debt, earnings, payout ratio.

- Short-Term Thinking – Patience is key.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.