RBI & ROC Compliance Tracker for October–November 2025

Table of Contents

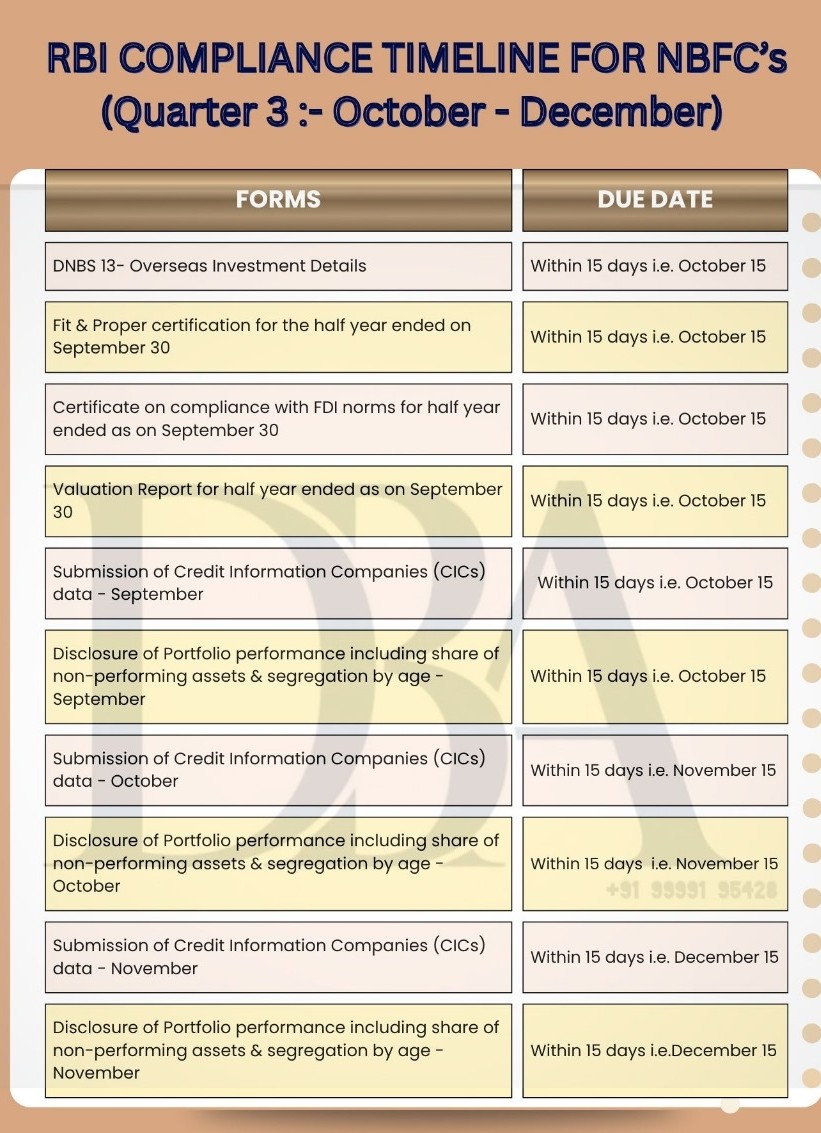

RBI Compliance Timeline for NBFCs – Q3 (October to December 2025)

NBFC Compliance Tracker – Q3 (Oct–Dec 2025)

| Form / Requirement | Due Date |

|---|---|

| DNBS 13 – Overseas Investment Details | 15 October 2025 |

| Fit & Proper Certification (Half-year ended 30 Sept) | 15 October 2025 |

| Certificate on Compliance with FDI Norms (Half-year ended 30 Sept) | 15 October 2025 |

| Valuation Report (Half-year ended 30 Sept) | 15 October 2025 |

| Submission of CICs Data – September | 15 October 2025 |

| Disclosure of Portfolio Performance incl. NPAs (Age-wise) – September | 15 October 2025 |

| Submission of CICs Data – October | 15 November 2025 |

| Disclosure of Portfolio Performance incl. NPAs (Age-wise) – October | 15 November 2025 |

| Submission of CICs Data – November | 15 December 2025 |

| Disclosure of Portfolio Performance incl. NPAs (Age-wise) – November | 15 December 2025 |

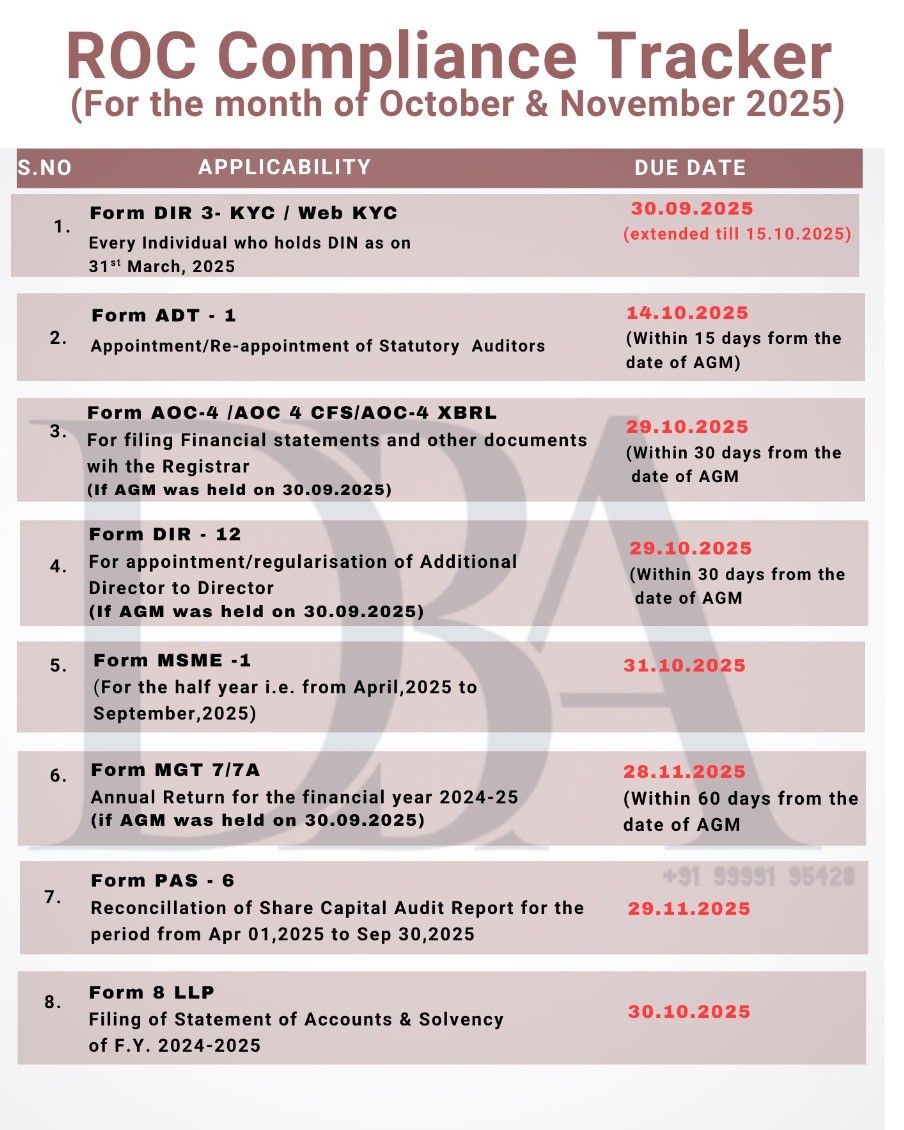

ROC Compliance Tracker – Oct & Nov 2025

|

Form |

Applicability |

Due Date |

|

DIR-3 KYC / Web KYC |

Individuals holding DIN as on 31st March 2025 |

15.10.2025 (extended) |

|

ADT-1 |

Appointment/Re-appointment of Statutory Auditors |

14.10.2025 (within 15 days of AGM) |

|

AOC-4 / CFS / XBRL |

Filing financial statements (if AGM held on 30.09.2025) |

29.10.2025 (within 30 days of AGM) |

|

DIR-12 |

Appointment/regularisation of Additional Director (if AGM held on 30.09.2025) |

29.10.2025 (within 30 days of AGM) |

|

MSME-1 |

Half-yearly return (April–Sept 2025) |

31.10.2025 |

|

MGT-7 / 7A |

Annual Return for FY |

28.11.2025 |

|

PAS-6 |

Reconciliation of share capital audit report (April–Sept 2025) |

29.11.2025 |

|

LLP Form 8 |

Statement of Accounts & Solvency for FY |

30.11.2025 |

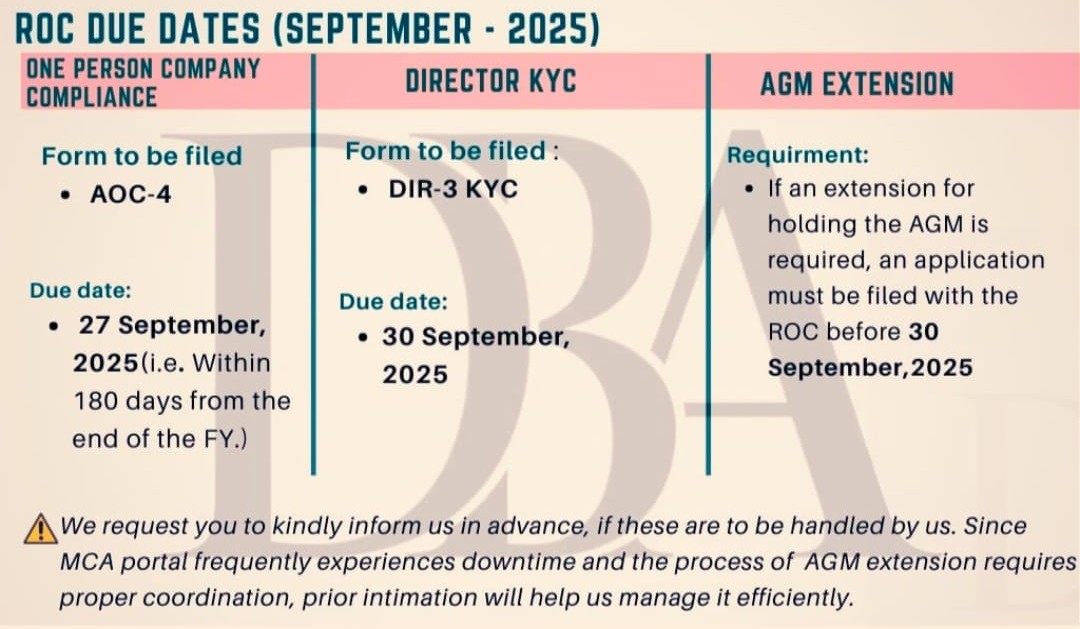

ROC Compliance – September 2025

- One Person Company (OPC) Compliance : Form: AOC-4 – Due Date: 27 September 2025 (Within 180 days from the end of the financial year)

- Director KYC : Form: DIR-3 KYC : Due Date: 30 September 2025

- AGM Extension : Requirement: If an extension for holding the AGM is needed, an application must be filed with ROC before 30 September 2025.

If you wish to delegate these filings, it’s advised to inform your compliance team or service provider in advance, especially for AGM extension, due to frequent MCA portal downtimes and coordination requirements.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.