What Happens After Grant of GST Registration

Table of Contents

What Happens After Grant of GST Registration –(Rule 10A – Furnishing of Bank Account Details)

What happens after the grant of GST registration

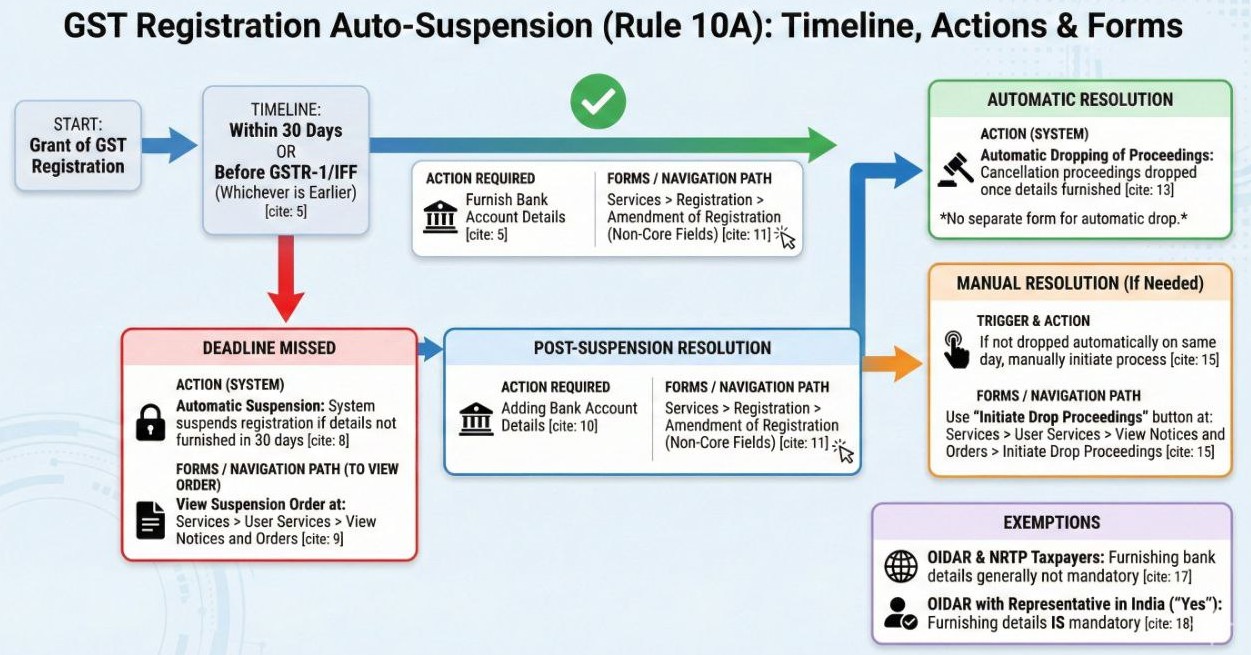

What happens after the grant of GST registration, focusing on compliance with Rule 10A regarding furnishing bank account details. It shows timelines, consequences of missing deadlines, and resolution paths. Grant of GST Registration → triggers compliance requirements.

Grant of GST registration is not the end of compliance. It immediately triggers post- registration obligations, the most critical being furnishing bank account details under Rule 10A of the CGST Rules. Then Immediate Compliance Trigger to Grant of GST Registration under the Rule 10A, CGST Rules which objective to Linking a valid bank account with GSTIN for monitoring of transactions and refunds.

GST registration is provisional unless Rule 10A is complied with: A simple omission like not furnishing bank details can lead to automatic suspension without hearing, though restoration is straightforward once corrected.

Timeline for Furnishing Bank Account Details :

GST Linking a valid bank account with GSTIN deadline in this case is within 30 days from the date of grant of registration OR Before filing GSTR-1/IFF, whichever is earlier. Then GST taxpayers must file GSTR-1 or IFF is blocked until bank details are furnished. Thereafter, action is required by the GST taxpayer.

Furnish Bank Account Details :

GST taxpayer must navigate the path (GST Portal): Services → Registration → Amendment of Registration (Non-Core Fields) and Details to be provided Bank Account Number, IFSC, Upload of supporting document (cancelled cheque / bank statement)

Consequence of Missing the Deadline:

Automatic Suspension of GST Registration: If bank account details are not furnished within 30 days, the system will automatically suspend GST registration, block filing of returns, or block generation of e-way bills. No separate notice or hearing is required for suspension.

Where to view suspension notice: Services → User Services → View Notices and Orders

If Deadline Missed

- Action (System): Automatic suspension of GST registration if details are not furnished in 30 days.

- Forms / Navigation Path: Services > User Services > View Notices and Orders

Post-Suspension—How to Resolve and Then Furnish Bank Account Details :

Even after suspension, the taxpayer can still file an amendment for bank details. then Navigation Path: Services → Registration → Amendment of Registration (Non-Core Fields).

Automatic Resolution (System Driven) : Once bank account details are successfully furnished:

- Suspension proceedings are automatically dropped

- GST registration is restored

- No separate application required

In most cases, this happens on the same day.

Manual Resolution (If Auto-Drop Does Not Happen) : When Required? If suspension is not revoked automatically after updating bank details.

Action Required: Initiate Drop Proceedings Manually : Navigation Path: Services → User Services → View Notices and Orders → Initiate Drop Proceedings

Rule 21A read with system advisory provide the exemptions under Rule 10A : Bank Details Not Mandatory For OIDAR (Online Information Database Access and Retrieval) suppliers & NRTP (Non-Resident Taxable Persons), and an important exception in this case is OIDAR supplier having a representative in India (Answer = “Yes”) ➝ Bank account details become mandatory

Exemptions

- OIDAR & NRTP taxpayers: Furnishing bank details is generally not mandatory.

- And OIDAR with representative in India (“Yes”): Furnishing details is mandatory.

Compliance Summary Table

| Stage | Requirement | Impact |

| After GST registration | Furnish bank details | Mandatory |

| Deadline | 30 days / before GSTR-1 | Strict |

| Non-compliance | Auto suspension | Severe |

| Resolution | Add bank details | Simple |

| Auto restoration | Yes | System driven |

| Manual intervention | Rare | Available |

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.