Which Foreign Asset are to be Declared in Schedule FA of ITR

Table of Contents

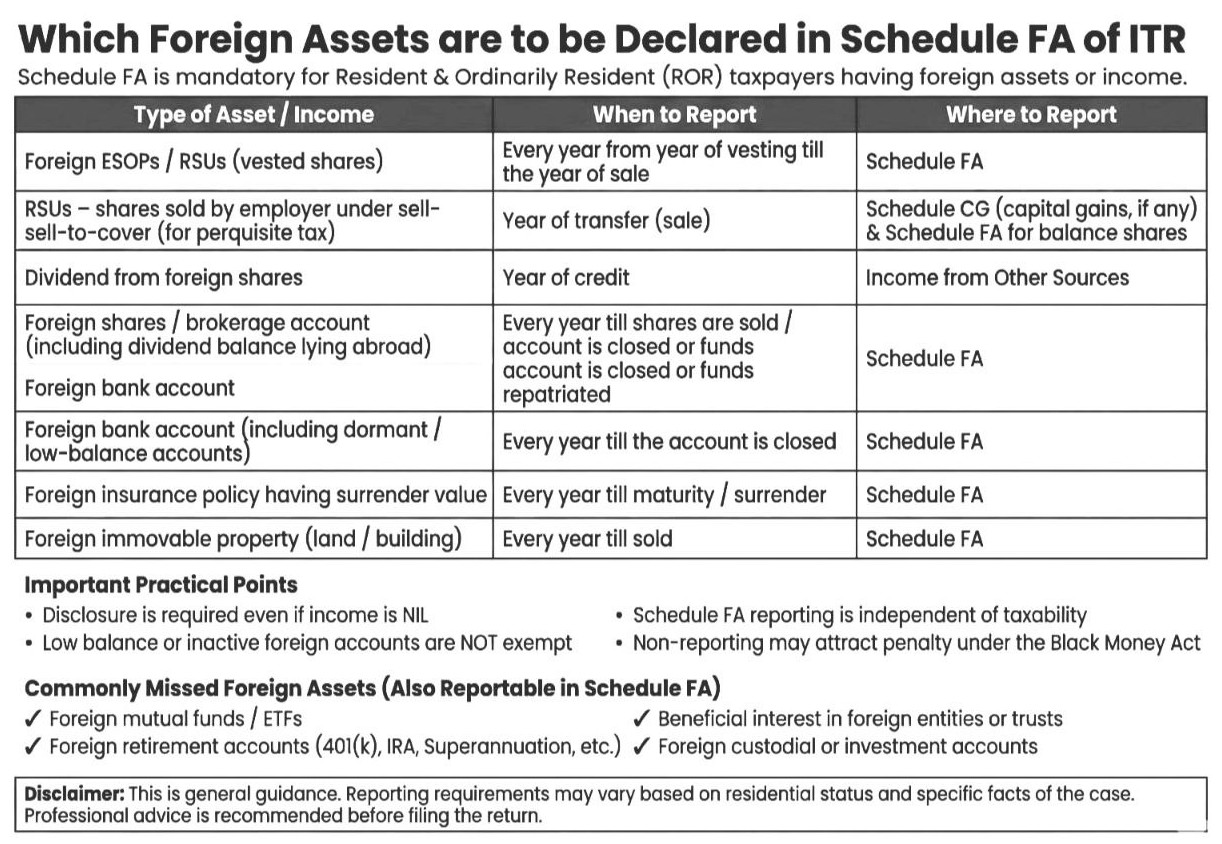

Which Foreign Assets are to be Declared in Schedule FA of ITR

It explains the reporting requirements for resident & ordinarily resident taxpayers who hold foreign assets or income. This is general guidance. Reporting requirements may vary based on residential status and specific facts of the case. Professional advice is recommended before filing the return. Here’s a detailed breakdown:

Types of Asset / Income & Reporting Details

-

Foreign ESOPs/RSUs (vested shares)

- When to Report: Every year from year of vesting till the year of sale

- Where to Report: Schedule FA

-

RSUs—shares sold by employer under sell-to-cover (for perquisite tax)

- When to Report: Year of transfer (sale)

- Where to Report: Schedule CG (capital gains, if any) & Schedule FA for balance shares

-

Dividend from foreign shares

- When to Report: Year of credit

- Where to Report: Income from Other Sources

-

Foreign shares/brokerage account (including dividend balance lying abroad)

- When to Report: Every year till shares are sold / account is closed or funds repatriated

- Where to Report: Schedule FA

-

Foreign bank account

- When to Report: Every year till the account is closed

- Where to Report: Schedule FA

-

Foreign insurance policy having surrender value

- When to Report: Every year till maturity/surrender

- Where to Report: Schedule FA

-

Foreign immovable property (land/building)

- When to Report: Every year till sold

- Where to Report: Schedule FA

- We should also keep in mind the following important practical points in this reference :

- Disclosure is required even if income is NIL.

- Low balance or inactive foreign accounts are NOT exempt.

- Schedule FA reporting is independent of taxability.

- Non-reporting may attract a penalty under the Black Money Act.

9. Commonly Missed Foreign Assets (Also Reportable in Schedule FA)

- Foreign mutual funds / ETFs

- Foreign-retirement accounts (401(k), IRA, Superannuation, etc.)

- Beneficial interest in foreign entities or trusts

- Foreign custodial or investment accounts

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.