Is a return mandatory if turnover is NIL under GST?

Table of Contents

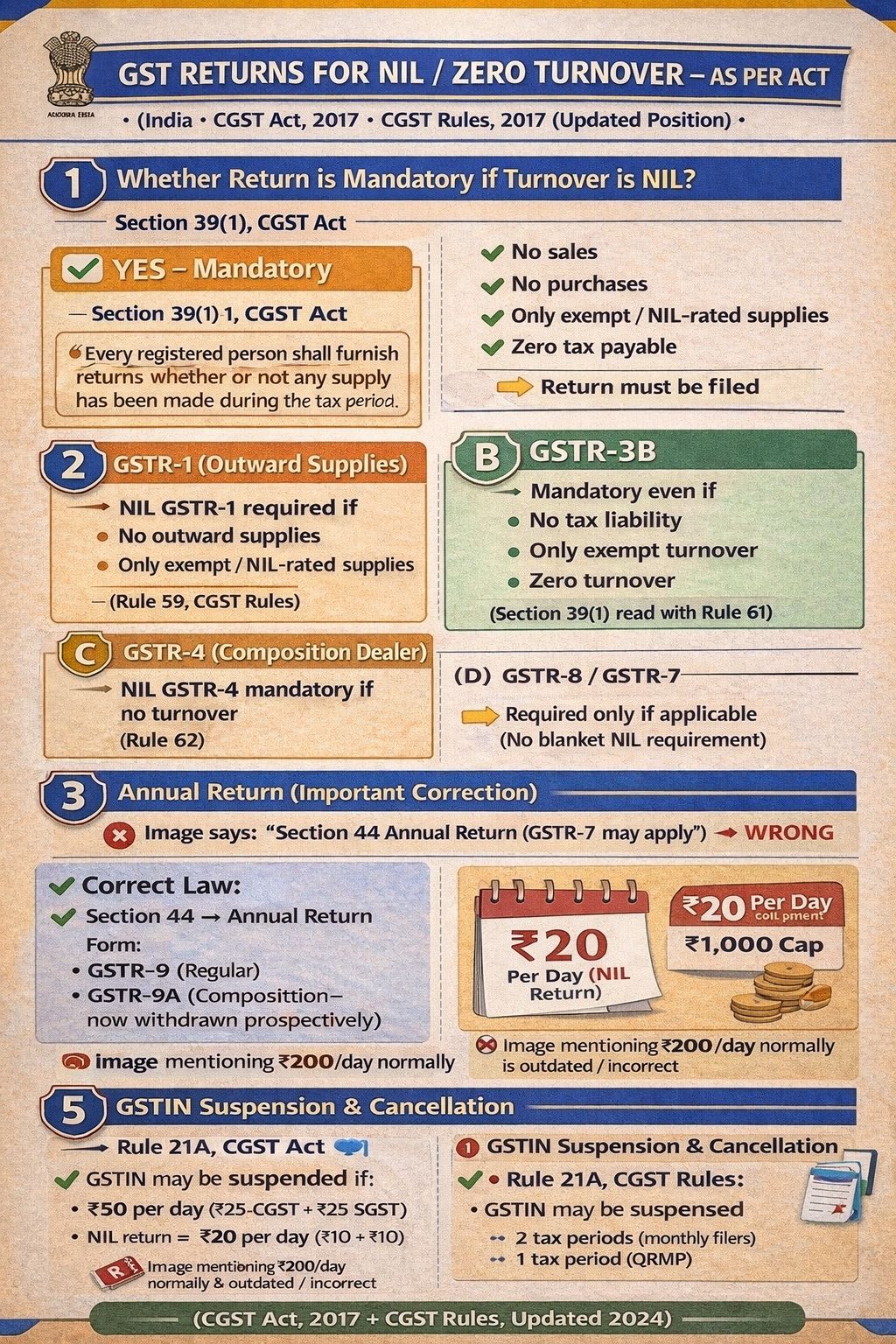

GST RETURNS FOR NIL/ZERO TURNOVER—AS PER CGST Act, 2017

Is a return mandatory if turnover is NIL under GST?

YES – Filing of Return is Mandatory. Legal provision is given in Section 39(1) of the CGST Act, 2017. Every registered person shall, for each tax period, furnish a return, whether or not any supplies of goods or services or both have been made during such tax period. Hence, return filing is compulsory even when turnover is NIL.

Applicability – NIL Turnover Scenarios: Return filing is mandatory even if no sales and no purchases, only exempt/NIL-rated supplies, zero outward and inward supplies, no tax payable, and the business is temporarily inactive.

Types of GST Returns – NIL Filing Requirement

GSTR-1 – Outward Supplies : NIL. GSTR-1 is mandatory if no outward supplies or only exempt/NIL-rated supplies. Legal Reference: Rule 59, CGST Rules, 2017

GSTR-3B – Summary Return: Mandatory even if no tax liability, only exempt turnover & zero turnover. Legal Reference from Section 39(1), CGST Act & Rule 61, CGST Rules, 2017

GSTR-4 – Composition Dealers : NIL GSTR-4 must be filed if there is no turnover. Legal Reference: Rule 62, CGST Rules, 2017

GSTR-7 / GSTR-8 : Required only if applicable

-

- GSTR-7 → Only if liable to deduct TDS

- GSTR-8 → Only if liable to collect TCS

- No blanket NIL filing requirement

Section 44 Annual Return:

Section 44 applies to the Annual Return, GSTR-9 (Regular), and the Annual Return INR 200/day penalty normally in case of noncompliance, but the correct amount is INR 20 per day (NIL return) & INR 1,000 cap.

GSTIN Suspension & Cancellation

Grounds for GSTIN Suspension:

GSTIN Suspension & Cancellation Statutory Provision provided under Rule 21A of the CGST Rules, 2017. It is to be noted that suspension is governed by rules, not the CGST Act, 2017. GSTIN may be suspended by the Proper Officer in the following cases:

- In case non-filing of GST returns, i.e., continuous non-filing for 6 months (Regular taxpayers). Continuous non-filing for 3 tax periods (Composition taxpayers)

- In case Continuous NIL GST Returns: Filing NIL returns for a prolonged period indicating no business activity. NIL returns for 2 consecutive years → treated as inactive / non-operational.

- No Business Activity: No outward or inward supplies. No tax liability, No operational indicators for 6 months or more

- Risk Parameters / Fraud Triggers: Registration obtained by fraud, willful misstatement, or suppression of facts. Risk flagged under RMMP (Risk Management & Monitoring Programme). Mismatch in returns, fake ITC patterns, suspicious transactions

- Consequences of Suspension : GSTIN becomes inactive, No tax invoices can be issued, and e-way bill generation is blocked. Refunds and ITC utilisation restricted

- Cancellation of GSTIN : If discrepancies are not rectified during suspension: Registration may be cancelled under Rule 21, Cancellation may be retrospective. Revival requires revocation application + pending return filings + penalties

- There is no separate provision in the CGST Act specifying “25 sections” or “10 sections” for NIL returns. Suspension and cancellation are procedure-driven, not automatic. Filing regular NIL returns alone does not trigger cancellation, but combined with inactivity and risk flags, it may.

GST Compliance Alert – NIL Returns & Zero Turnover

Even if a business has zero turnover, GST compliance does not stop.

- NIL Return Filing—Mandatory: NIL GSTR-1 & GSTR-3B must be filed even when there are no outward supplies, no inward supplies, and no tax liability. Non-filing is treated as non-compliance, regardless of turnover. NIL turnover ≠ NIL compliance. Every registered person must file applicable GST returns on time, even with zero business activity.

- Late Fee for NIL Returns: Consequences of Non-Filing NIL Returns: Late fee: INR 20 per day (NIL returns). Blocking of subsequent returns, GSTIN suspension under Rule 21A & Possible cancellation of registration, INR 20 per day (₹10 CGST + ₹10 SGST) & Maximum cap: ₹1,000

- Risk of GSTIN Suspension/Cancellation: Continuous non-filing of NIL returns can lead to GSTIN suspension & cancellation of registration. Once cancelled, revocation involves additional time, cost, and scrutiny.

- Annual Return – Important Clarification: GSTR-9 is applicable only to regular taxpayers. Composition dealers, ISDs, and TDS/TCS deductors are not required to file GSTR-9. & The filing requirement applies even if annual turnover is NIL, where applicable.

- Zero turnover does NOT mean zero compliance. : Timely filing of NIL returns protects the GSTIN and avoids penalties, notices, and operational disruption.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.