Guide to the Updated Income Tax Return (ITR-U)

Table of Contents

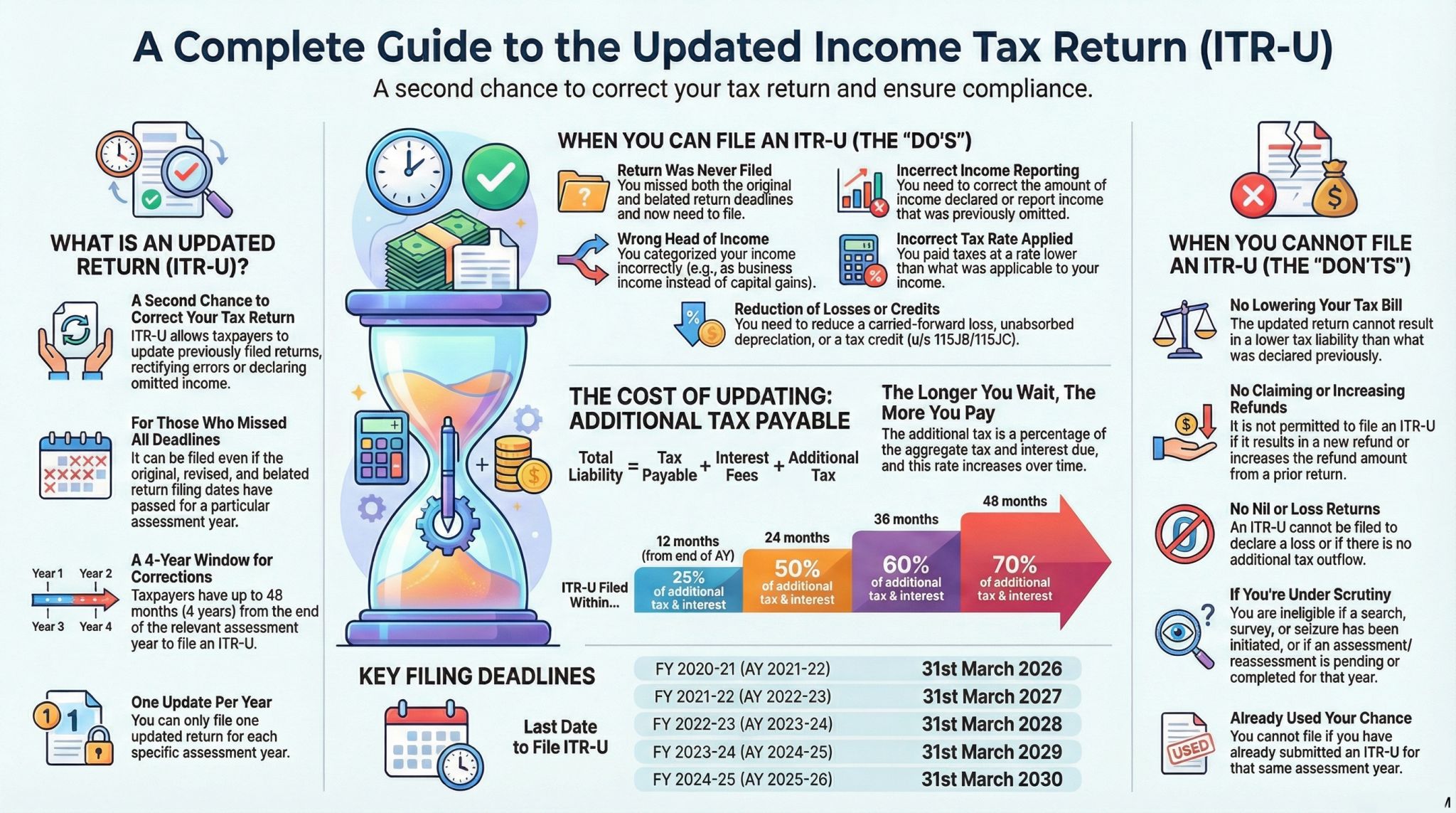

Missed Your Tax Deadline? You have Second Chance to Stay Compliant

Missed your tax deadline? Don’t panic, there’s still a way to make things right! : Updated Income Tax Return (TR-U) introduced u/s 139(8A) of the Income Tax Act, allowing taxpayers to voluntarily correct errors or omissions in previously filed returns or even file a return that was never filed. It is a powerful compliance mechanism, but it comes with strict conditions and additional tax costs. An updated income tax return enables a taxpayer to:

- Correct mistakes or omissions in income

- Disclose missed income

- Rectify incorrect heads of income or tax computation

Discovered an error in your tax return after the deadline? Or missed filing altogether, then the updated income tax return offers a structured way to get back on track but with clear rules and rising costs. Think of the updated income tax return as a bridge back to compliance, not a reset button.

When Should You Use ITR-U

Any taxpayer who has filed an original, belated, or revised return, or not filed any return at all. Valid Reasons to File Updated Income Tax Return

- Missed original and belated filing deadlines

- Income not declared or under-reported

- Wrong head of income selected

- Tax paid at an incorrect rate

- Reduction of Carried-forward losses, Unabsorbed depreciation, MAT/AMT credit (u/s 115JB / 115JC)

- Only one ITR-U is allowed per assessment year.

You can file ITR-U if you:

- Missed both original and belated filing deadlines

- Reported income under the wrong head (e.g., business vs. capital gains)

- Omitted income that was later discovered through the Annual Information Statement/Taxpayer Information Summary or records.

- If filing ITR-U reduces carried-forward losses or credits, an updated Income Tax Return (ITR-U) must also be filed for all affected subsequent years.

For FY 2021-22 (AY 2022-23), the ITR-U window closes on 31 March 2026. If you haven’t reviewed your Annual Information Statement/Taxpayer Information Summary, now is the time. Early correction means lower cost and peace of mind. An updated income tax return can be filed within 48 months (4 years) from the end of the relevant assessment year.

CBDT has enabled ITR-U filing for ITR-3 and ITR-4 for AY 2021-22 and AY 2022-23. ITR-U is a compliance tool, not a refund mechanism. Costs rise sharply with delay; only one opportunity per assessment year. Early correction = lower additional tax + peace of mind

ITR-U cannot be filed if:

- An updated return has already been filed for that assessment year.

- It is a Nil or Loss return

- It results in lower tax liability or higher refund

- Search (u/s 132), survey (u/s 133A), or seizure (u/s 132A) proceedings apply

- Assessment/reassessment/revision is pending or completed

How to Verify ITR-U

ITR-U can be verified using:

- Aadhaar OTP

- EVC

- DSC (mandatory for tax audit cases)

ITR-U is only for increasing tax compliance. You cannot use it to:

- Claim a new or higher refund

- Reduce your total tax liability

- File a Nil or Loss return

- Update a year already under scrutiny, search, or survey by the Department

Additional Tax Payable Under Updated Income Tax Return :

The Cost of Delay The longer you wait, the higher the additional tax on total tax + interest: filing an updated income tax return involves additional tax on total tax + interest.

Tax Calculation Summary

Computation of Updated Income Includes Additional income under each head: tax, interest, late fee, taxes already paid, additional tax (25%–70%), and net tax payable u/s 140B. Self-assessment tax must be paid before filing, and challan details must be entered.

- Total Tax Liability = Tax on additional income + Interest + Late fee + Additional tax

- Net Payable = Total liability – Tax Deducted at Source and Tax Collected at Source/Advance tax/Relief

- ITR-U must be filed along with the applicable ITR form (ITR-1 to ITR-7).

| Filing Period | Additional Tax |

| Within 12 months | 25% |

| Within 24 months | 50% |

| Within 36 months | 60% |

| Within 48 months | 70% |

Time Limit to File Updated Income Tax Return

| Financial Year | Assessment Year | Last Date |

| FY 2020-21 | AY 2021-22 | 31 March 2026 |

| FY 2021-22 | AY 2022-23 | 31 March 2027 |

| FY 2022-23 | AY 2023-24 | 31 March 2028 |

| FY 2023-24 | AY 2024-25 | 31 March 2029 |

| FY 2024-25 | AY 2025-26 | 31 March 2030 |

For FY 2021-22 (Assessment Year 2022-23), the window closes 31st March 2026. Review your Annual Information Statement/Taxpayer Information Summary today and take corrective action before the window narrows further. Your second chance won’t last forever!

About IFCCL

Businesses and professionals seeking reliable tax advisory can trust IFCCL for comprehensive corporate taxation support tailored to evolving regulatory requirements. The firm provides end-to-end Tax return preparation services, ensuring accuracy, compliance, and timely filing for companies and individuals.

With strong expertise in income tax scrutiny handling, the team effectively manages complex assessment proceedings and departmental queries. Their specialized Notice Handling & Scrutiny services help clients respond confidently to income tax notices, minimizing risks and ensuring proper representation before tax authorities.

Recognized for professional excellence in Delhi tax notices and scrutiny handling, Rajput Jain and Associates offers structured documentation, drafting of replies, and representation services. Many clients regard the firm as the best CA for tax notice and scrutiny cases, thanks to their practical approach, in-depth technical knowledge, and consistent success in handling income tax scrutiny matters. Their commitment is simple: safeguard client interests, ensure compliance, and deliver reliable tax solutions with precision and integrity. Contact us at 9555 555 480 or Singh@carajput.com/singh@caindelhindia.com

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.