All about the Decoding the Business Codes in ITR

Overview: Decoding the Business Codes in ITR

The Income Tax Dept has updated business & profession codes in the ITR forms to reflect the evolving nature of businesses in India. from traditional trades to emerging sectors like social media and online trading. These codes classify specific activities, ensuring taxpayers report their income under the correct head for accurate tax computation. Choosing the right code helps avoid errors, tax notices, and mismatches. Govt of India has updated the business and profession codes in the Income Tax Return system to better reflect today’s diverse business environment, from traditional trades to fast-emerging sectors like social media and online trading. For tax authorities, these codes make it easier to compare industry data, monitor compliance, and detect irregularities. Why It Matters

- Correct classification ensures the right tax rates are applied.

- Reduces scrutiny by aligning ITR details with industry benchmarks.

- Supports automation in tax assessments using AI and analytics.

These 370+ business codes classify specific activities, helping taxpayers correctly report the nature of their work and ensuring accurate tax computation. Choosing the right code reduces the risk of errors, tax notices, and mismatches. For the tax authorities, these codes aid in comparing industry data, tracking compliance, and detecting irregularities.

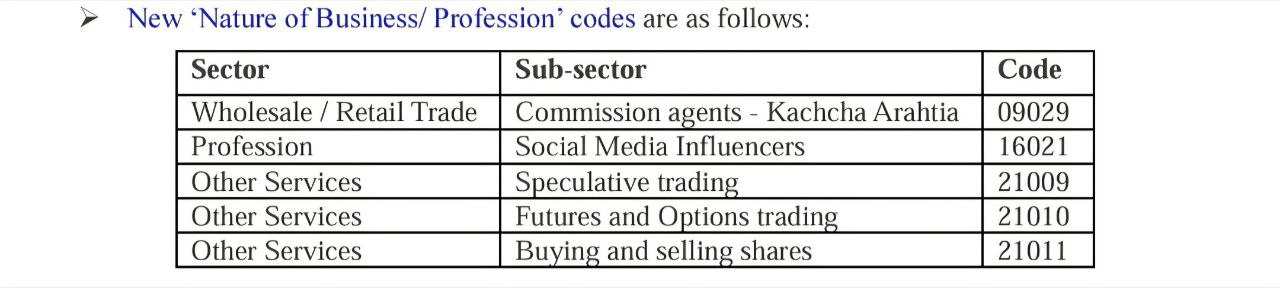

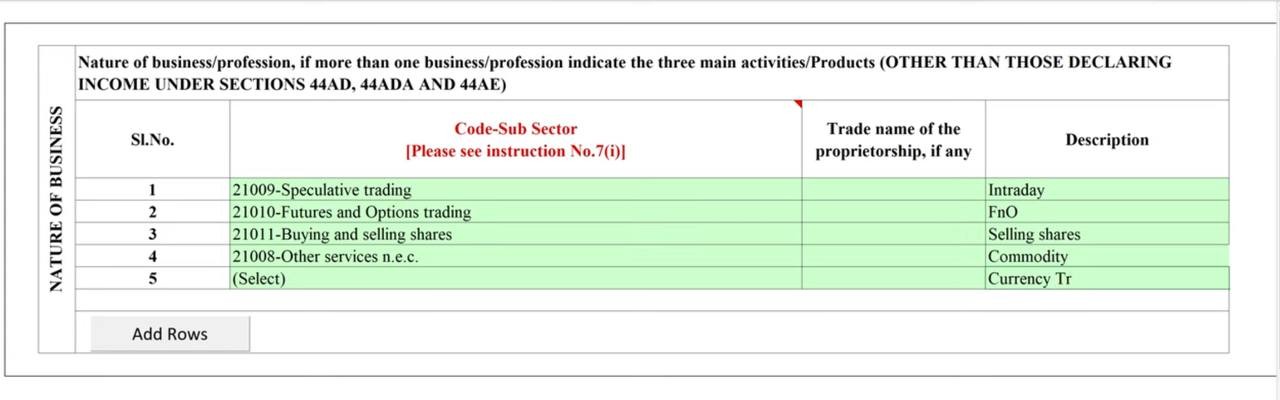

Taxpayers & professionals are advised to select the correct business code while filing ITR for AY 2025-26, as incorrect selection can lead to mismatches, processing delays, or even scrutiny from the Income Tax Department. Accurate coding ensures proper income classification, correct tax computation, and smooth return processing. Key New Business Codes for modern business activities include:

- 9029 – Wholesale & Retail Trade: Commission Agents – Kachcha Arhatia

- 16021 – Professions: Social Media Influencers

- 21009 – Other Services: Speculative Trading

- 21010 – Other Services: Futures & Options (F&O) Trading

- 21011 – Other Services: Buying & Selling Shares

These additions acknowledge industries that have grown rapidly in recent years. The Income Tax Department plans to leverage AI and automation to monitor these activities more effectively. By cross-checking ITR data with sources like SEBI records, it can detect underreporting in areas such as speculative or F&O trading. AI will also track sector-wise trends in real time, making it easier to identify non-compliance.

How the Govt Will Use These Codes

The Income Tax Dept plans to integrate Artificial Intelligence and data cross-verification (e.g., with SEBI records) to Identify underreporting in trading activities, Monitor sector-specific trends in real time, Flag potential non-compliance quickly.

Takeaway for Taxpayers : Select the correct code — it’s the first step to smooth ITR processing, Stay updated with latest business codes to avoid mismatches, With AI-powered monitoring, accuracy in reporting is critical. The right code ensures smooth processing and accurate taxation, while an incorrect one can lead to errors, delays, or scrutiny. With AI-powered monitoring on the rise, precision in reporting has never been more important.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.