All about the Director KYC -DIR 3 KYC Filing

Table of Contents

All about the Director KYC DIR- 3 KYC Filing

DIR- 3 KYC Filing- File DIR-3 KYC Before 30th September

A director identification number (DIN) is a unique number assigned to a person who wishes to become a director or who is already a director of a corporation. In this digital age, submitting an eForm DIR-3 application was sufficient to receive DIN. This was a one-time process for anyone interested in becoming a director of one or more businesses. All directors with a DIN will now be required to submit their KYC details annually in eForm DIR-3 KYC, thanks to the Ministry of Corporate Affairs’ (MCA) decision to update its registration.

Any individual who has been assigned a Director Identification Number (DIN) as of March 31st of the previous fiscal year must submit e-form DIR-3-KYC to the Central Government by September 30th of the following fiscal year. Every Director should file the form using his or her own DSC and have it officially certified by a competent expert. The MCA21 platform will designate all approved DINs against which a DIR-3 KYC form has not been filed as ‘Deactivated’ with the rationale ‘Non-submission of DIR-3 KYC’ when the due period for filing the KYC form has passed. The filing of DIR-3 KYC in respect of such deactivated DINs after the required date would be permitted for a cost of Rs 5k.

When an individual submits web-form DIR-3 KYC-WEB using the web service in connection to a future financial year after submitting e-form DIR-3 KYC in relation to a prior financial year, it is deemed to be compliance with the provisions for that financial year.

If an individual wishes to file KYC for the first time or to change his or her personal mobile number or e-mail address, he or she must do so by completing and submitting e-form DIR-3 KYC.

Q.: What is Step-by-step Process to File DIR 3 KYC Form- Director Identification Number ?

Step 1: Download the form DIR-3 KYC from the MCA website

- First and foremost step is to download the DIR-3 KYC form from the MCA website

Step 2: Fill in the DIN details

Step 3: Furnish the Required Details in the DIR- 3 KYC Form

Step 4: Permanent Account Number Verification

Step 5: Update Contact Details and Verify OTP

Attachments to be made

The following documents must be uploaded by the applicant. Before uploading, be sure to acquire these forms certified as well:

-

- Proof of Permanent address Copy .

- Conditional attachments Copy

- Aadhaar Card copy.

- Passport scan .

- Proof of present address.

Note: The applicant should digitally sign any other optional attachments.

Step 6: Authentication of e-Form- Procedure after e-form submission

Step 7: e-Form DIR-3 KYC is submitted successfully SRN Generation – and allotted to the user for the future use

Step 8: Email communication- acknowledges the receipt on his personal email ID.

Q.: What is Checkpoints for Filling of the DIR-3 KYC eForm with MCA

- When filling out the eForm, each Director must provide their own personal cell phone number and email address. An OTP will be used to verify this phone number and email address (one-time password).

- The second precaution is that the director must use his own digital signature when submitting this eForm.

- The MCA DIR -3 eForm should also be approved by a practising Chartered Accountant, Company Secretary, or Cost and Management Accountant as the third test to guarantee that complete and accurate information is submitted.

Q.: Who Should File a File DIR -3 ?

- Approved/Disqualified DIN Status

- Every Director who has been assigned a DIN by the end of the financial year or before.

Q.: What Documents is required to file it?

- passport-size Photos

- Passport (Compulsory if a foreign national is holding a DIN).

- self-attested Electricity bill/bank statement with current address

- Director’s DSC

- Aadhaar card , Voters Identity card. with self-attestation (with Mobile number updated)

- Email Address and Phone Number

- Self-Attestation Permanent Account Number

- Details of Nationality and Citizenship details like gender, and date of birth.

Q.: Is there a cost to file it with the government?

- There are no government fees associated with submitting DIR3 KYC.

Q.: I working with an Indian company as a foreign director. I am not in possession of an Aadhar Card. Is the DIR 3 KYC Procedure still necessary?

- It is required that you file your DIR3 KYC if you have a DIN. The document list will be the same as before (except Aadhar).

Q.: What consequences if the DIR -3 form isn’t submitted on or before the deadline?

- If the application is submitted beyond the deadline, the Ministry will impose a penalty of Rs. 5,000/-. This is a legal requirement that cannot be avoided.

- The DIN must be deactivated. As a result, you are disqualified to act/ serve as a director of any corporation.

Note:

| E-Form | Timeline | Purpose of Form | Last Date to File | Remark |

| DIR-3 KYC Web | Annual Compliance | KYC of Directors | 30th September 2021 | Every individual who have previously filed form Director Identification Number DIR-3 KYC & there is no change in Mobile No. & email id. |

| DIR-3 KYC | Annual Compliance | KYC of Directors | 30th September 2021 | Every individual who holds Director Identification Number (DIN) as on 31st March 2021 and who has not filed DIR 3 KYC form previously or there is a change in Mobile No. & email id |

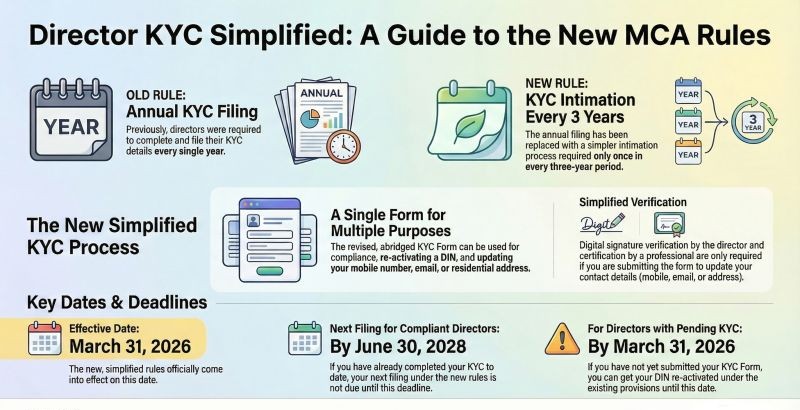

MCA Update

W.e.f 01.08.2024

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.