All about the NBFC (Non-Banking Financial Corporation)

Table of Contents

All about the NBFC (Non-Banking Financial Corporation)

- It is a company known as Non-Banking Financial Corporation incorporated under the Companies Act 1956 or 2013. As per the section 45– I (C) of the Reserve Bank of India Act, a Company which carries on the business of a financial institution will be a Non-Banking Financial Company. Also NBFC must be engaged in the business of Acquisition of stocks, equities, business of advances and loans , debt, etc which is issued by the marketable securities or local authority or Govt.

NON- Banking Financial Corporation (NBFC)

It is a company known as Non Banking Financial Institution/ Company, which has a principal business of receiving deposits. NBFC ( Residuary non banking company) can receive deposits under any scheme or arrangement by any other mode.

Exclusions from the NBFC definition

These are not included in the business of Non Banking Financial company :-

· Sale and Purchase of any goods excluding securities

· Industrial Activity

· Agricultural Activity

· Any immovable property including its sale, purchase and construction – providing of any services.

Meaning of Principal Business:

· Financial activity is the principal business to bring clarity to the business that will be regulated by the Reserve Bank of India. This criterion is also known as the 50-50 test and its as follows:

· The total assets of the company must be 50% to its financial assets.

· According to the guideines given by Ministry of Corporate affairs and Reserve Bank of India the income from financial assets must constitute 50% of the total income. RBI generate the license for the operation of NBFC and it is incorporated under the laws of the land as a company.

· Total income must constitute 50% of its income to financial assets. It is governed by the Reserve Bank of India and also by the Ministry of Corporate Affairs. The License for operation is obtained from the Reserve Bank of India and it is incorporated as a company under applicable laws of the land.

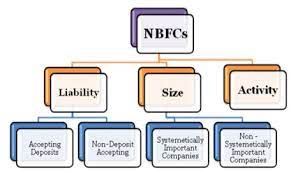

Kind of NBFCs (Non Banking Financial Companies):-

The NBFCs are classified according to their liabilities and activities. NBFCs are classified as follows:

NBFC Company’s which need not to be registered with the Reserve Bank of India. These are the Non-Banking Financial companies which may not be required to obtain any registration with the RBI with an idea that they are regulated by other regulators.

· Core Investment Companies – (Public funds are not taken or assets are less than 100 crore)

· Merchant Banking Companies

· Chit fund company as specified under the section 2 clause (b) of the chit fund Act, 1982

· Insurance Companies holding a certificate of registration issued by Insurance Regulatory and Development Authority

· Nidhi Company as defined under Section 620(A) of the Companies Act 1956

· Housing Finance Companies

· Companies that are engaged in the business of Venture Capital.

· Companies that are occupied in the business stockbrokinging

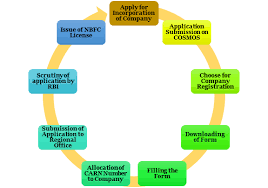

NBFC FORMATION PROCEDURE

· Firstly, a Company should be registered under the Companies Act 1956 or also under the Companies Act 2013 as either a public limited or a private limited company.

· At least INR 2 crore should be owned by the company as its minimum funds.

· Company has to keep its CIBIL record clean.

· At least 1/3 of the directors of a company must posses finance experience.

· A Business plan of five years has to be made by the company for future.

· Company must comply with the requirements for Foreign Exchange Management Act Notification and capital compliances

· After fulfilling all these conditions the online application on the website of Reserve Bank of India should be fulfilled and submitted along with the requisite documents

· A CARN number will be generated

· Also a hard copy of the application has to be sent to The Regional Branch of the RBI

· A license will be given to the company after proper scrutinization of the application

Non-Banking Financial Company needs to follow Following Guidelines:

After getting the license a company has to adhere the following guidelines

· NBFC cannot receive the deposits that are payable on demand

· There is a time limit of minimum period of 12 months and maximum period of 60 months for the public deposit of the company.

· Reserve Bank of India has a prescribed ceiling limit for the chargeability of interest which the company cannot exceed.

· Reserve Bank of India will not take any guarantee for repayment of loan taken by company.

· Company has to furnish all information to the Reserve Bank of India about any changes in the composition of the company.

· Unsecured deposits will be taken by public.

· Apart from this, the said would be required to submit their Audited Balance sheet at the end of every financial year.

· In form NBS – 1 a statutory return on the deposits taken by the company has to be furnished every year.

· The Company has to furnish its quarterly return on the liquid assets

· To shows that the company is in a position to pay back all the money taken from the public and to pay back all the deposits a certificate from auditor is needed.

· Company has to give a half – yearly Asset Liability Management (ALM ) return which shows asset worth Rs. 100 Crore and above and has a public deposit of Rs. 20 Crore and above.

· At the end of every 6 months a credit ratings has to be taken and submitted to the Reserve Bank of India.

· A Company has to maintain a minimum level of 15% of the Public Deposits in its liquid assets.

· In case if the Non Banking Financial Company fails to make payment of any amount taken, than the consumer can go to the Consumer Forum or to the National Company Law Tribunal to file a suit against the Company.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.