Bank Account Frozen in GST for Over 1 Year?

Table of Contents

Bank Account Frozen in GST for Over 1 Year?

Under the Goods and Services Tax law, the authorities have powers under Section 83 of the CGST Act, 2017 to provisionally attach the bank accounts of taxpayers to protect government revenue during ongoing proceedings.

However, such provisional attachment is valid only for 1 year from the date of the order. After this period, the order automatically ceases to have effect. Section 83(2), CGST Act, 2017: “Every such provisional attachment shall cease to have effect after the expiry of a period of one year from the date of the order made under sub-section (1).”

This means if your bank account remains frozen beyond 1 year, without a fresh order, the action is illegal and liable to be set aside.

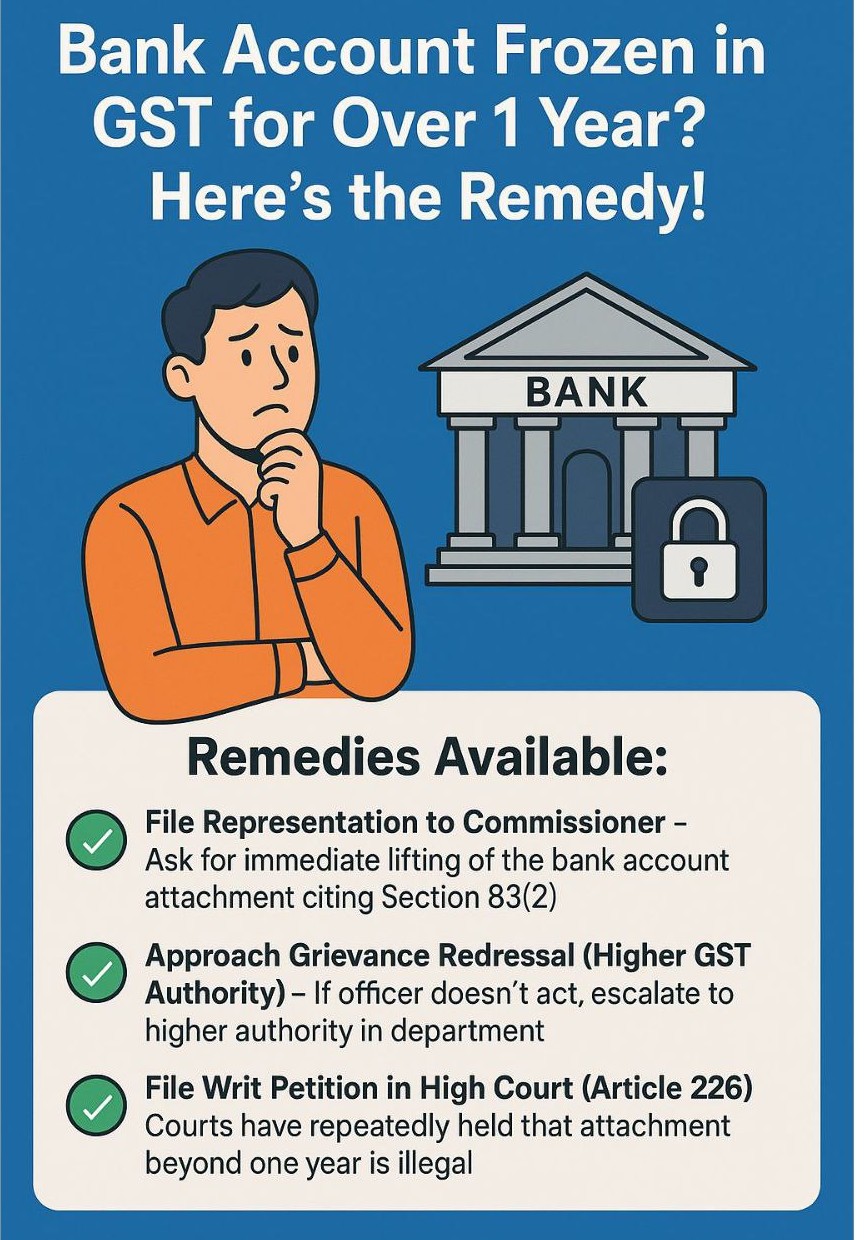

What is Remedy in case a bank account is frozen in GST for over 1 year?

Under Section 83(2) of the CGST Act, 2017, any provisional attachment of a bank account automatically lapses after 1 year. If your account is still frozen beyond this period, the action is illegal. What you can do:

- File Representation to Commissioner – seek lifting of the attachment citing Sec 83(2).

- Approach Grievance Redressal (Higher GST Authority) – escalate if the officer doesn’t act.

- File Writ Petition in High Court (Article 226) – courts have repeatedly held attachments beyond 1 year as invalid.

- Businesses need not suffer indefinitely—timely legal recourse is available.

Practical Implications Bank Account Frozen in GST for Over 1 Year :

- Taxpayers often face severe hardship when bank accounts remain frozen, affecting working capital, vendor payments, and employee salaries.

- Several High Courts (e.g., Gujarat HC in Valerius Industries v. UOI, Delhi HC in Proex Fashion Pvt Ltd v. UOI) have ruled against prolonged or unjustified bank account attachments.

Courts have clearly ruled: Bank account attachment beyond 1 year is unlawful! Our firm can assist you in Reviewing the legality of the attachment order, Filing representation before GST authorities, and Pursuing relief before the High Court where necessary.

Preventive Measures for Bank Account Frozen in GST : Taxpayer must maintain proper GST compliance and timely filings to avoid exposure to provisional attachments. Regularly track any notices or orders uploaded on the GST portal.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.