Chartered Accountants certified ITR cannot be True copy

Table of Contents

Certified Tax Return cannot be True copy

The CA on a certificate or issue of any document attestation is of immense value since it usually signifies that the Chartered Accountants, in his expert opinion, which is ensured that there is no misrepresentation by the origination filling or issuing such a kind of certificate Chartered Accountants

A important example of this being an all kind of audit report issued by the auditor in respect of the state of affairs of an origination stating the financial statements reflect a true and fair view of the state of affairs of the origination. It is because of this attestation or signature made by the CA that stakeholders including investors can responses on the performance of an origination. One of Significant Certification is Chartered Accountants certified Tax return.

CA Certified Income Tax Return

Tax Return with Chartered Accountants certification are primarily utilized in banks for loan purposes. Any time a loan of any kind is requested, banks demand a valid Tax Return. Bank just wants to confirm the applicant’s ability to repay the loan; therefore, they accept Tax Return that are Chartered Accountants certified for the below reasons:

- Income Proof: A tax return that has been certified by Chartered Accountants is used as proof of income for many different things, including applying for loans, visas, and other financial activities. It gives you a record of your earnings and tax payments, which you can submit as proof of your financial situation.

- A few financial institution lenders may additionally need the borrower to provide their net worth in addition to their tax returns, which are prepared using a chartered accountant’s skills. Any type of loan, including business or personal loans, LAP business loans, vehicle (auto) loans, and mortgage loans, may be aided by completing an income tax return.

- Credibility Prove: A self-submitted income tax return lacks credibility and weight compared to one that has been certified by a chartered accountant. It offers tax authorities assurance that the income tax return was submitted honestly and diligently.

Chartered Accountants certified ITR cannot be True copy

- In a set of frequently asked questions about issuing the Unique Document Identification Number, The Institute of Chartered Accountants of India said that “CA are not authorised to issue a certify Tax Return as True copy. But, they can make an report or opinion or certificate about Income tax return based on its source, authenticity of data and location from which ITR is being prepared & Unique Document Identification Number is needed while doing Chartered Accountants certified Tax Return cannot be True copy.”

- UDIN is a important step in bringing openness to sector & combating malpractice. A Unique Document Identification No is a No that is assigned to any document in order for legal authorities to check its validity and legitimacy. Unique Document Identification Number concept is being implemented with objective of deceased fraud in nation.

- Banks, financial institution, 3rd party stakeholders & regulatory bodies can easily track the Unique Document Identification Number issued by a Chartered Accountants to any information & document proving the veracity of data. Authorities can check UDIN to check Chartered Accountants ensure & credentials that the papers are only certified by them.

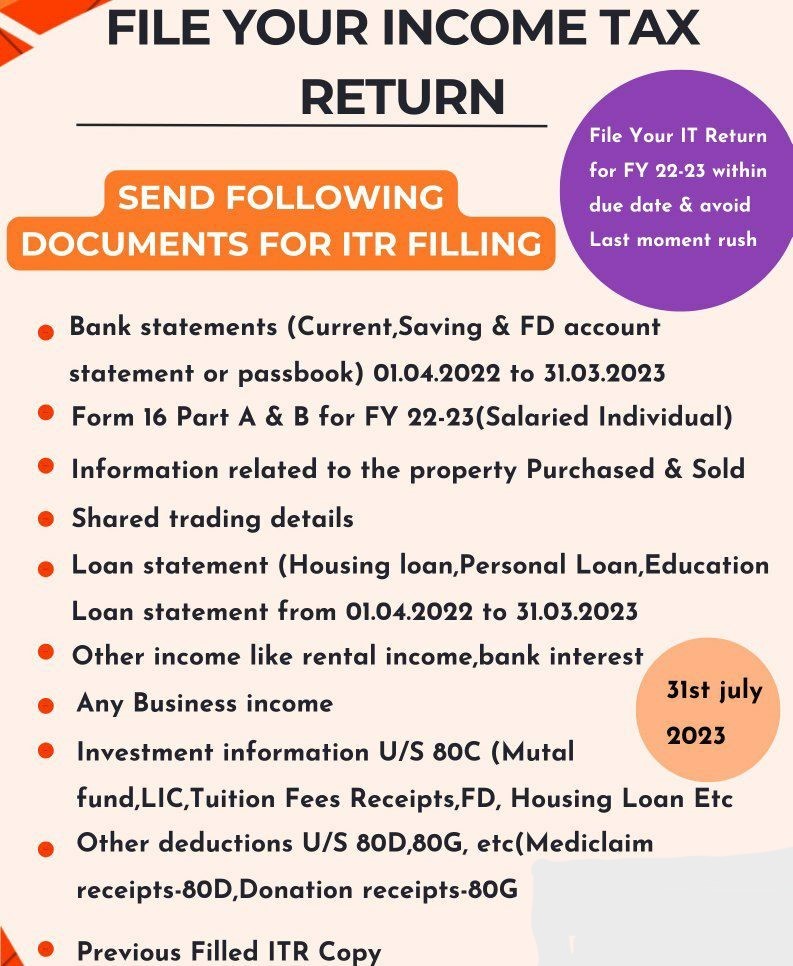

Are you ready to file your income tax returns for the Assessment year 2023-24?

Tax filing season is here! Make sure you don’t miss out on the deadline and get your income tax return filed on time.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.