CAPITAL GAINS TAX RELIEF ON GOLD BONDS : BUDGET

Table of Contents

CAPITAL GAINS TAX RELIEF ON GOLD BONDS IS EXPECTED TO BE TAKEN UP IN THE NEXT BUDGET

Capital gains tax relief on gold bonds is expected to be taken up in the next budget. All coins & bars will be hallmarked as per BIS standards. It is suggested that we all must buy gold coins in a tamper proof packaging.

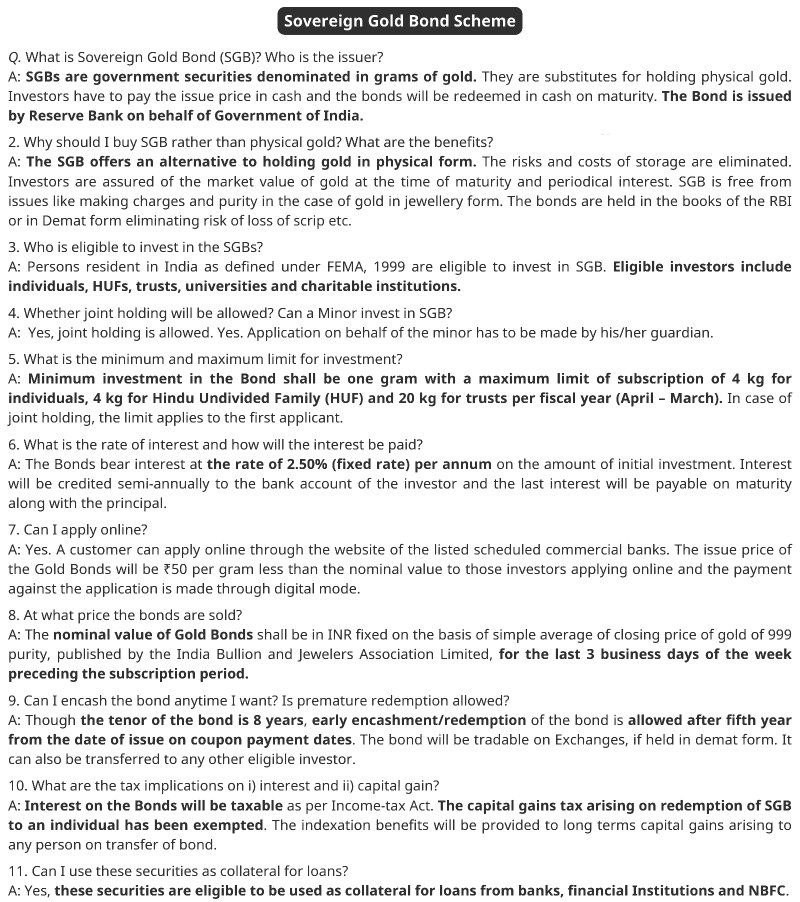

SOVEREIGN GOLD BOND SCHEME

The RBI’s Sovereign Gold Bonds offer a contemporary and practical way to purchase gold with the security and confidence of government-backed assets. With features including tax advantages, set interest rates, and simplicity of investment, Investors in India who are looking for a methodical and well-rounded strategy to building wealth are becoming more and more interested in Sovereign Gold Bonds.

- CBEC has made a custom duty-free allowance of Rs.45000 for passengers of Indian origin and foreigners over 10 years of age residing in India. Notification No. 76/2015.

- The Central Board of Direct Taxes (CBDT) has issued guidelines for compounding of offenses under the Income Tax Act, 1961, and the Wealth Tax Act, 1957, in cases of persons holding undisclosed foreign bank accounts/assets.

- The duty-free limit of Indian Currency that can be brought in India has been increased from Rs.10000 to 25000 in FORM 1. Notification No.76/201.

- Time-barred assessment cannot be reopened for non-satisfaction of conditions for reopening

- The procedure for filing applications under MEIS and SEIS by units located in SEZs and EOUs has been further clarified by DGFT by Public Notice No 30/2015-20 dated 26/07/2015.

- DG- RBI has urged banks to be sensitive towards the lifecycle needs of their MSME clients and develop products that are suitable to their requirements for working capital and for capital expenditure purposes.

- No service tax on the amount received as wharfage charges- [CCE vs M/s Gujarat Maritime Board—Supreme Court].

- Re-insurance service is an input service for providing output service of life insurance

- MCA has notified the amendments in Schedule III to the Companies Act, 2013 to protect the interest of the micro, small, and medium enterprises.

- Schedule-II to the Companies Act 2013 on depreciation is applicable w.e.f. 01.04.2014 (FY 2014-2015), except for the component accounting (w.e.f. 01.04.2015).

- SEBI notifies revised Listing Regulations & Disclosure Requirements on September 2, 2015 vide Notification no. SEBI/LAD-NRO/GN/2015-16/013.

- SEBI has issued circular relating to the Continuous Disclosure Requirements for Listed Entities, under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

- SEBI has amended the delisting guidelines and released the Securities and Exchange Board of India (Delisting of Equity Shares) (Second Amendment) Regulations, 2015.

- RBI is likely to remove a major hurdle that asset reconstruction companies ( ARCs) face while raising funds via initial public offering.

- SEBI has amended the regulations relating to Alternate Investment Fund and the SEBI (Alternative Investment Funds) Reg, 2015 which shall come into force on the date of their publication in the official gazette.

Income tax rate in case of capital Gain regulation in India

Ready Recknor for calculating capital gains tax for all class of Assets.

Hope the information will assist you in your Professional endeavors. For query or help, contact: singh@caindelhiindia.com or call at 9555 555 480

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.