Cashless Convenience option for Foreign Tourists in India

Table of Contents

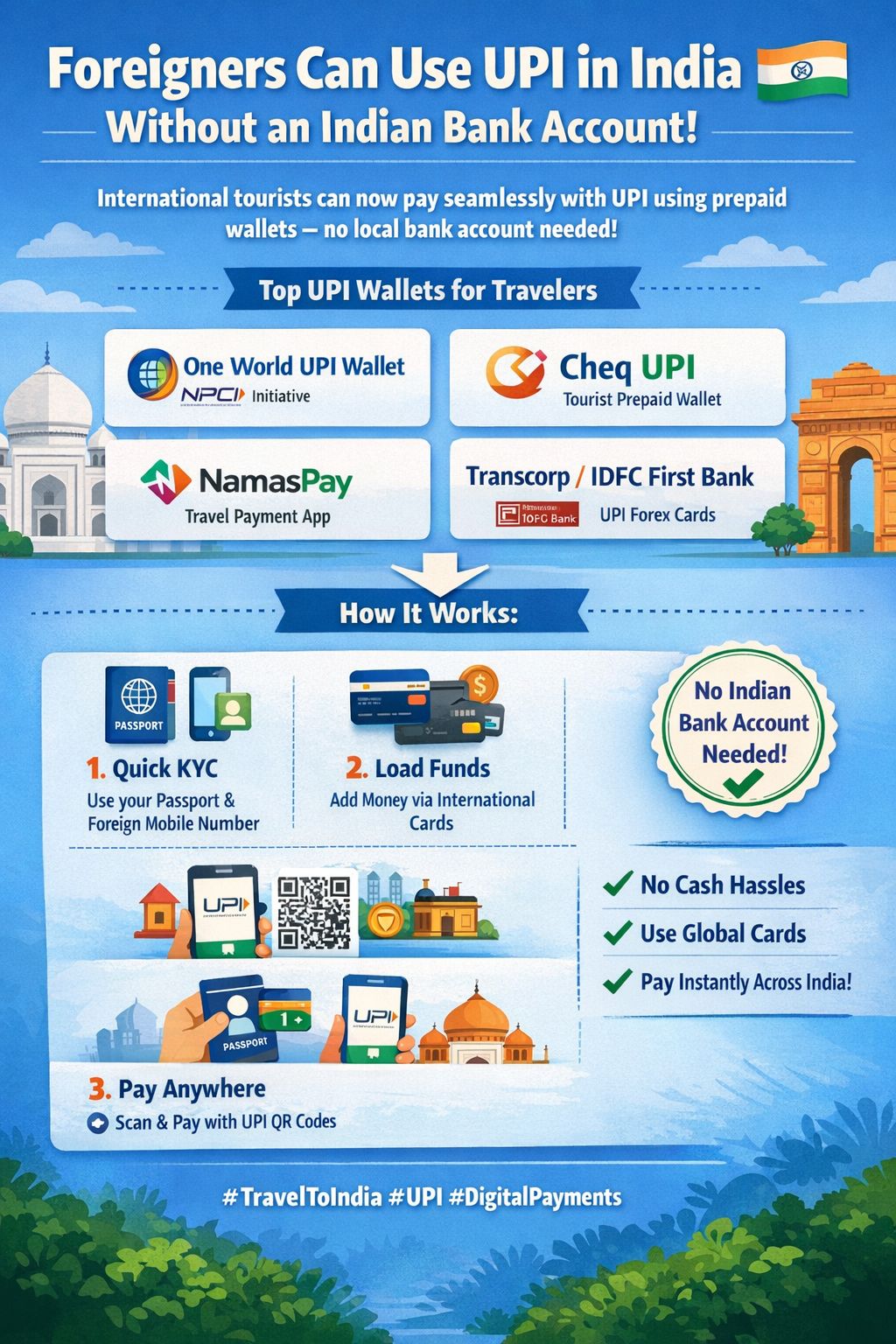

Foreigners Visiting India Can Now Use India’s digital payments ecosystem Without an Indian Bank Account

India’s digital payments ecosystem just became truly global. Foreign tourists and visitors can now make UPI payments in India without opening an Indian bank account, marking a major step in making India a cash-light, tourist-friendly economy. What’s Changed?

- Earlier, UPI required An Indian bank account & Indian mobile number. Now, eligible foreign visitors can Use UPI via prepaid wallets / authorised apps, Fund wallets through international cards or overseas accounts. Pay across India by scanning any UPI QR code

- Who Can Use It : Foreign tourists visiting India, Overseas students, Business travellers & NRIs / OCIs (as per eligibility). Access is subject to KYC and regulatory verification.

Companies Already Enabling UPI for Foreigners

Several fintech and payment players are live or onboarding users for UPI without an Indian bank account, including:

- NamasPay – UPI wallet for international travelers, NRIs, and overseas students.

- Cheq UPI – UPI-based solution for NRIs and foreign nationals.

- Pine Labs – Merchant-side enablement for accepting UPI payments from foreign wallets.

- Other RBI-authorised PPI / fintech partners – Access varies by nationality, KYC level, and app

1. UPI One World – Cashless Convenience for Foreign Tourists in India

- A prepaid wallet designed for foreign tourists in India to make cashless transactions using UPI (Unified Payments Interface). Developed by NPCI in collaboration with a private sector bank and Transcorp International Ltd, under RBI guidance.

- Purpose of UPI(Unified Payments Interface): Simplifies payments for international visitors, eliminating the need for cash. Tourists can pay at merchant locations by scanning QR codes via the Unified Payments Interface One World app.

- Unified Payments Interface Access Points is airports, hotels, money exchange counters, and other designated touchpoints.

- UPI required KYC Requirement: Full KYC based on passport and valid visa. Any unused balance can be transferred back to the original payment source, following Forex regulations. Initially launched during the G20 Summit for select countries. Now available to all foreign tourists visiting India.

2. Cheq UPI – Key Highlights

Cheq UPI is a UPI-based payment solution for NRIs, OCIs, foreign nationals, and eligible Indian residents to make seamless digital payments in India without an Indian bank account.

Cheq UPI Eligibility : Non-Resident Indians, Overseas Citizens of India (OCI), Foreign nationals visiting or residing in India. Indian residents (where permitted). This is subject to KYC and verification norms.

Cheq UPI Cost : Cheq UPI does not have any joining fee. The Cheq UPI App is free to download from Google Play Store and Apple App Store.

Cheq UPI Registration & Verification : Download app then Enter mobile number thereafter OTP verification then Submit KYC then In-person verification (if required). Following Documents required like Passport, Visa/OCI/PIO card, address proof, photo. And this Verification time: 24–72 hours

Cheq UPI SIM & Mobile Verification can be done via following like

-

- OTP-based SIM verification

- Registered SIM must remain active

- Dual SIM phones supported

Cheq UPI In-Person Verification: At Cheq-authorized locations or via scheduled partners. Person must Carry original passport, visa/OCI, and requested documents

Cheq UPI Wallet & Payments : People can add money via international cards, overseas bank transfers, or other supported channels. Person can Pay by scanning any UPI QR code or entering merchant UPI ID.. Cheq UPI Charges are nominal FX/processing fees (shown before confirmation)

Cheq UPI Limits & Withdrawals: Cheq UPI Payment and funding limits as per RBI guidelines, KYC level, and Cheq policy moreover that Unused balance can be withdrawn to original funding source

How do I add money to my Cheq UPI wallet?

-

- You can add money via international cards, Overseas bank transfers, Other supported funding channels shown in the app

- Wallet loading may attract nominal processing or FX charges, depending on the funding method and Exact charges are transparently displayed before confirmation

- Wallet funding limits depend on User verification status, Regulatory caps and Source of funds. Daily and monthly limits are displayed in-app.

Cheq UPI Refunds & Account Changes

-

- Failed transactions auto refunded

- Phone number changes require re-verification

- Account closure after zero balance and identity checks

Cheq UPI Support & Security

-

- Person can used Cheq UPI via contact via in-app support or official email and RBI-compliant security, encrypted transactions, multi-factor authentication. Cheq UPI ensure Data privacy is ensured under applicable laws

- Cheq UPI Uses encrypted data storage, Does not share data without consent and Complies with applicable data protection laws

- To close your account, Ensure wallet balance is zero, Submit an account closure request via support and Complete identity verification. Account closure is processed after regulatory checks.

3. NamasPay – Key Highlights

Who can use NamasPay?

-

- NamasPay Eligibility is International travelers visiting India, NRIs (Non-Resident Indians), Foreign nationals with valid travel documents. Overseas students and business visitors. Subject to KYC and regulatory guidelines.

NamasPay Country Coverage:

-

- European Union: Citizens/residents of any of the 27 EU member countries (e.g., Germany, France, Italy, Spain, Netherlands, Sweden, etc.). If you are a citizen or resident of any of the 27 European Union (EU) member countries, your country falls under the EU category.

- African Union: Supports AU member countries (e.g., Nigeria, Kenya, South Africa, Ghana, Egypt, Ethiopia, etc.). Final eligibility confirmed during onboarding.

- NamasPay Security: Bank-grade encryption, Secure OTP authentication, RBI-compliant processes, and Continuous fraud monitoring.

- NamasPay uses Bank-grade encryption, Secure OTP and authentication systems and RBI-compliant processes (where applicable) along with Continuous monitoring to prevent fraud. Your money and personal data are protected at all times.

- NamasPay Required Documents required Passport, Valid visa/residence permit, Photograph, Proof of identity (as per regulations)

- Where can you spend via NamasPay : Any merchant accepting UPI in India, Online platforms supporting UPI, Retail, transport, food, hotels, and daily expenses. No. Cash deposits are not allowed. Funds can only be added through digital and traceable channels to comply with regulations.

- NamasPay Charges: Wallet creation: Free however FX conversion/processing charges may apply (shown before confirmation) and In NamasPay No hidden fees applicable.

- NamasPay Adding Money: International debit/credit cards, Overseas bank transfers and Other supported digital channels (Cash deposits not allowed)

- How to Pay via NamasPay:

- Scan & Pay: Open app → Scan QR → Enter amount → Confirm

- Pay via UPI ID: Open app → Enter UPI ID → Enter amount → Confirm

4. Pine Labs Secures All Three Payment Licences from RBI

A major regulatory milestone in India’s fintech ecosystem. Pine Labs has successfully obtained all three key payment licences from the Reserve Bank of India, placing it among a small, elite group of fully licensed payment companies in India.

What Licences Has Pine Labs Secured?

- The approvals cover the entire payment stack Pine Labs Offline Payments Licence Enables in-store and device-based digital payments and Strengthens Pine Labs’ dominance in POS and merchant hardware

- Pine Labs Online Merchant Payments Licence Supports payment aggregation for online merchants and all Enables seamless digital checkout across platforms

- Pine Labs Cross-Border Payment Licence Allows international payment processing, Supports inbound and outbound cross-border transactions and Critical for global merchants and international commerce

- Pine Labs Full regulatory compliance across offline, online, and cross-border payments, Positions Pine Labs as a one-stop payment infrastructure provider, Enhances trust with banks, merchants, and regulators and Enables faster product launches without licensing bottlenecks

Comparison chart for UPI One World vs Cheq UPI vs NamasPay:

| Feature | UPI One World | Cheq UPI | NamasPay |

|---|---|---|---|

| Target Users | Foreign tourists visiting India | NRIs, OCIs, foreign nationals | International travelers, NRIs, overseas students |

| Indian Bank Account Required? | No | No | No |

| Developer | NPCI (under RBI guidance) | Cheq Fintech | NamasPay Fintech |

| KYC Requirement | Passport + Visa | Passport + Visa/OCI + Address proof | Passport + Visa/residence permit |

| Funding Options | International cards, Forex conversion | International cards, overseas bank transfers | International cards, overseas bank transfers |

| Refund of Unused Balance | Yes (to original source) | Yes (to original source) | Yes (to original source) |

| Where to Use | Any UPI merchant in India | Any UPI merchant in India | Any UPI merchant in India |

| Charges | Nominal FX charges | Nominal FX/processing charges | Nominal FX/processing charges |

| Special Features | Official RBI-backed initiative | Designed for NRIs & global users | Supports AU & EU travelers |

Why This Is a Big Deal

- For India – Boosts tourism convenience, reduces dependency on cash & forex cards and Strengthens India’s position as a global digital payments leader

- For Merchants – No new hardware, No forex handling, and Faster settlements

- For Visitors, No bank visits & No currency exchange hassles

- This move Expands UPI beyond borders, Supports India’s Digital Public Infrastructure (DPI) vision, and Lays groundwork for global UPI interoperability. India isn’t just exporting goods anymore. it’s exporting payment rails.

**********************************************************

If this article has helped you in any way, i would appreciate if you could share/like it or leave a comment. Thank you for visiting my blog.

Legal Disclaimer:

The information / articles & any relies to the comments on this blog are provided purely for informational and educational purposes only & are purely based on my understanding / knowledge. They do noy constitute legal advice or legal opinions. The information / articles and any replies to the comments are intended but not promised or guaranteed to be current, complete, or up-to-date and should in no way be taken as a legal advice or an indication of future results. Therefore, i can not take any responsibility for the results or consequences of any attempt to use or adopt any of the information presented on this blog. You are advised not to act or rely on any information / articles contained without first seeking the advice of a practicing professional.